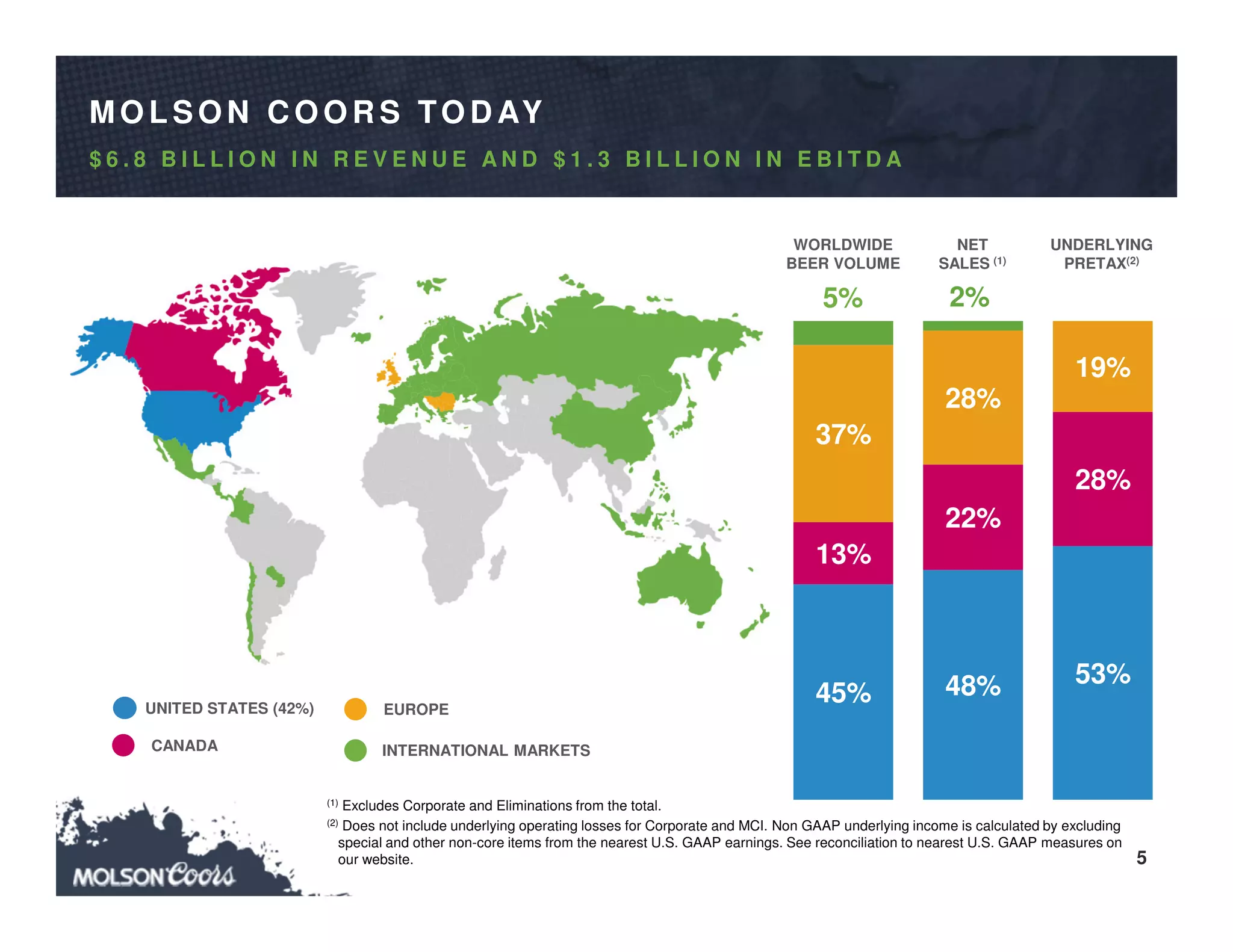

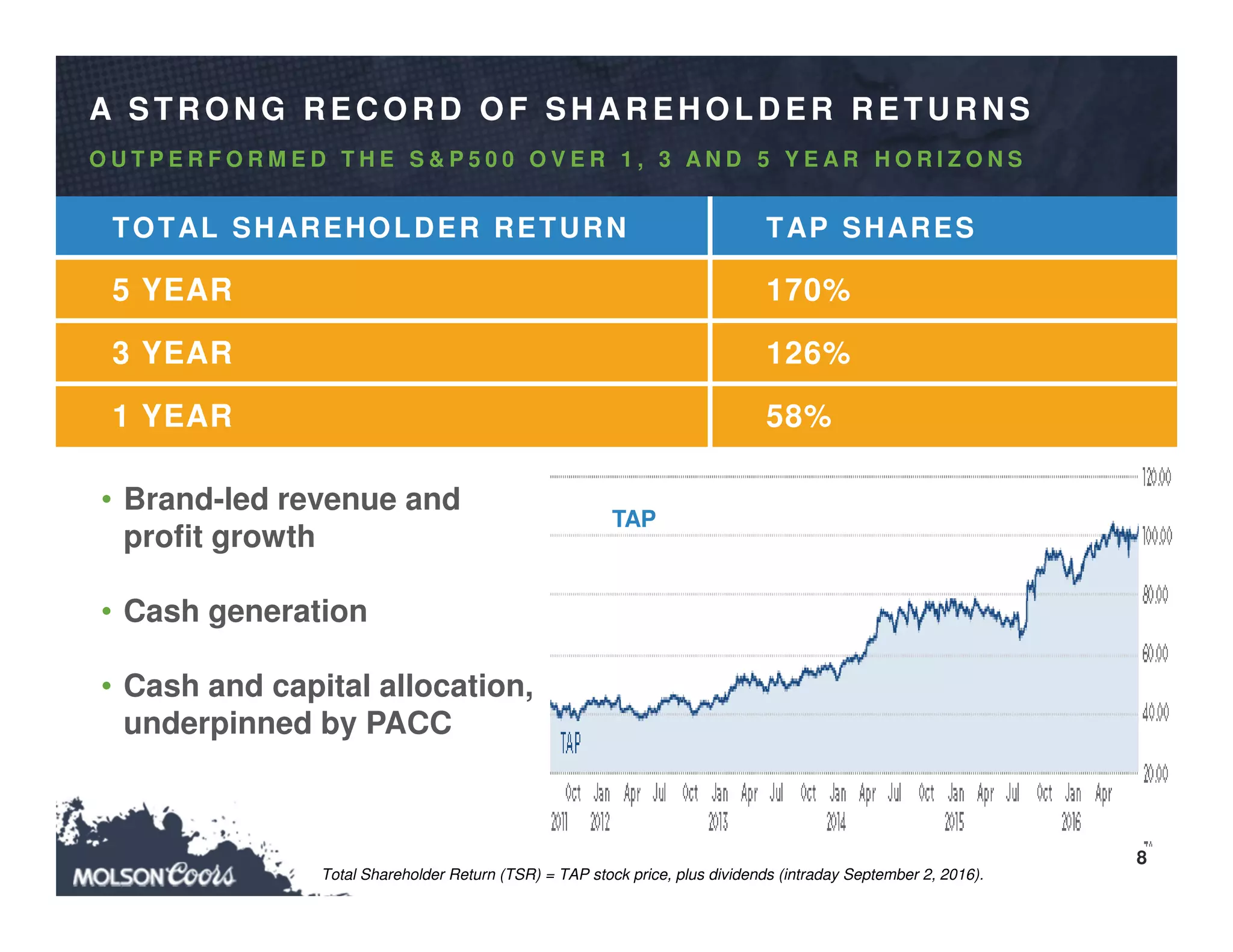

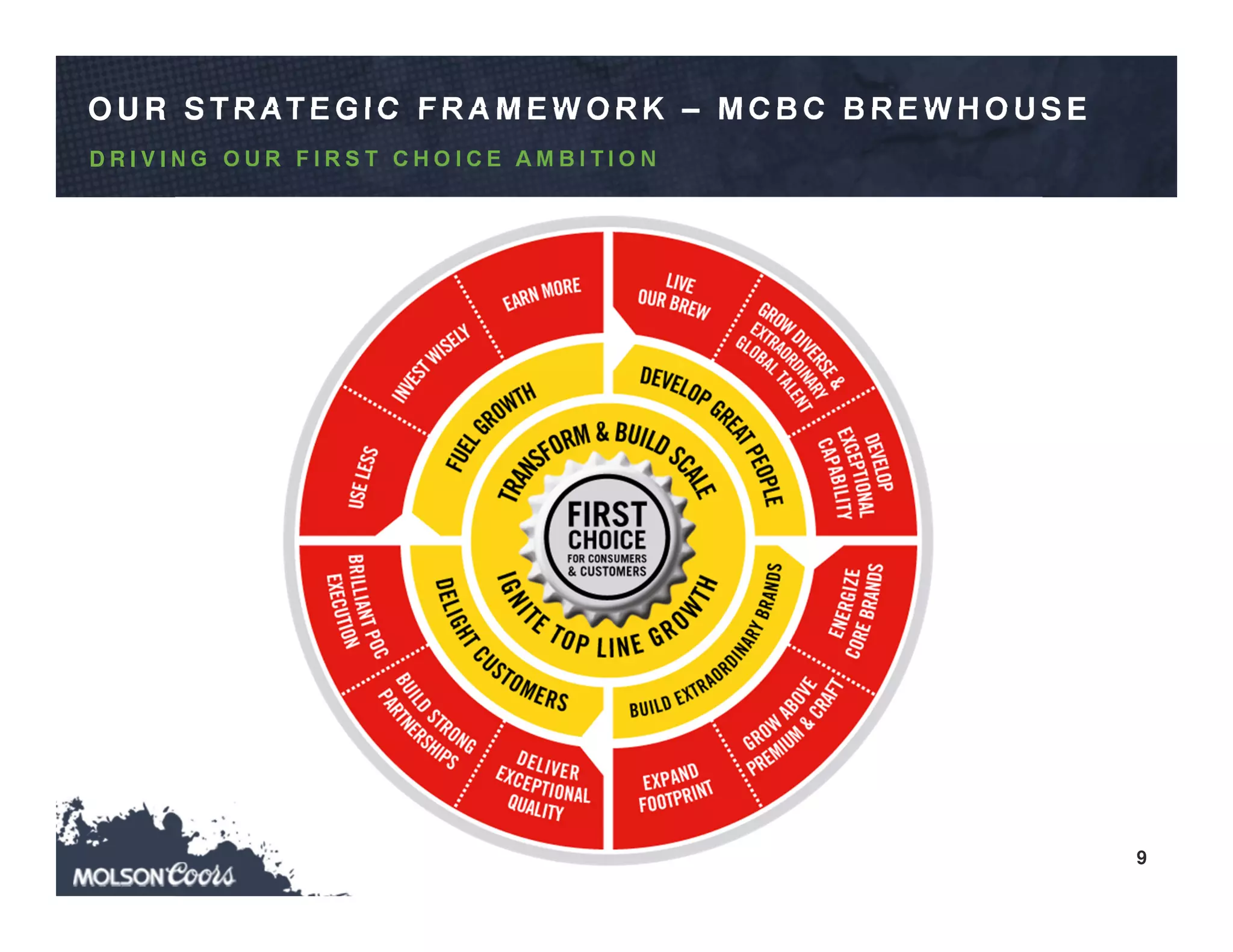

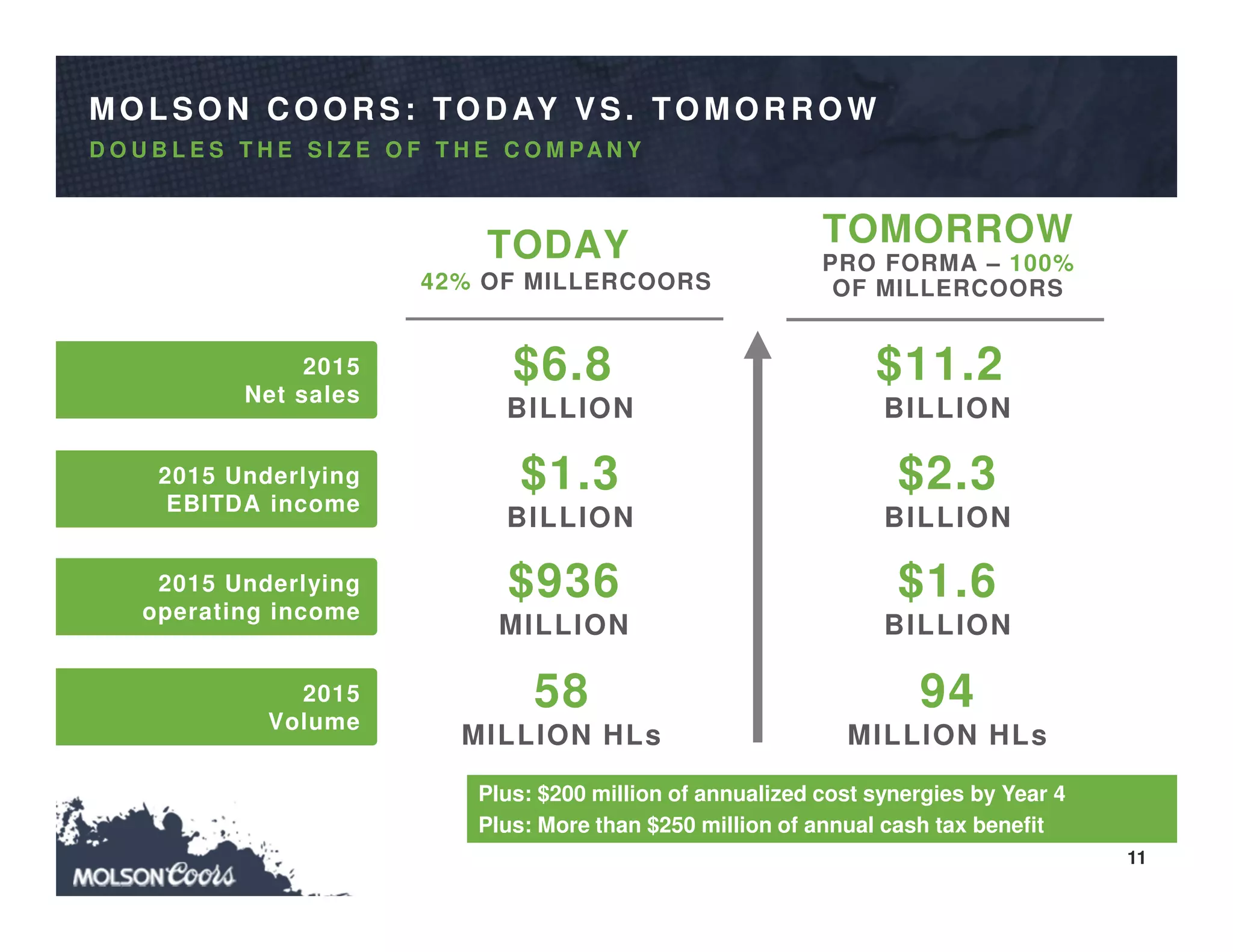

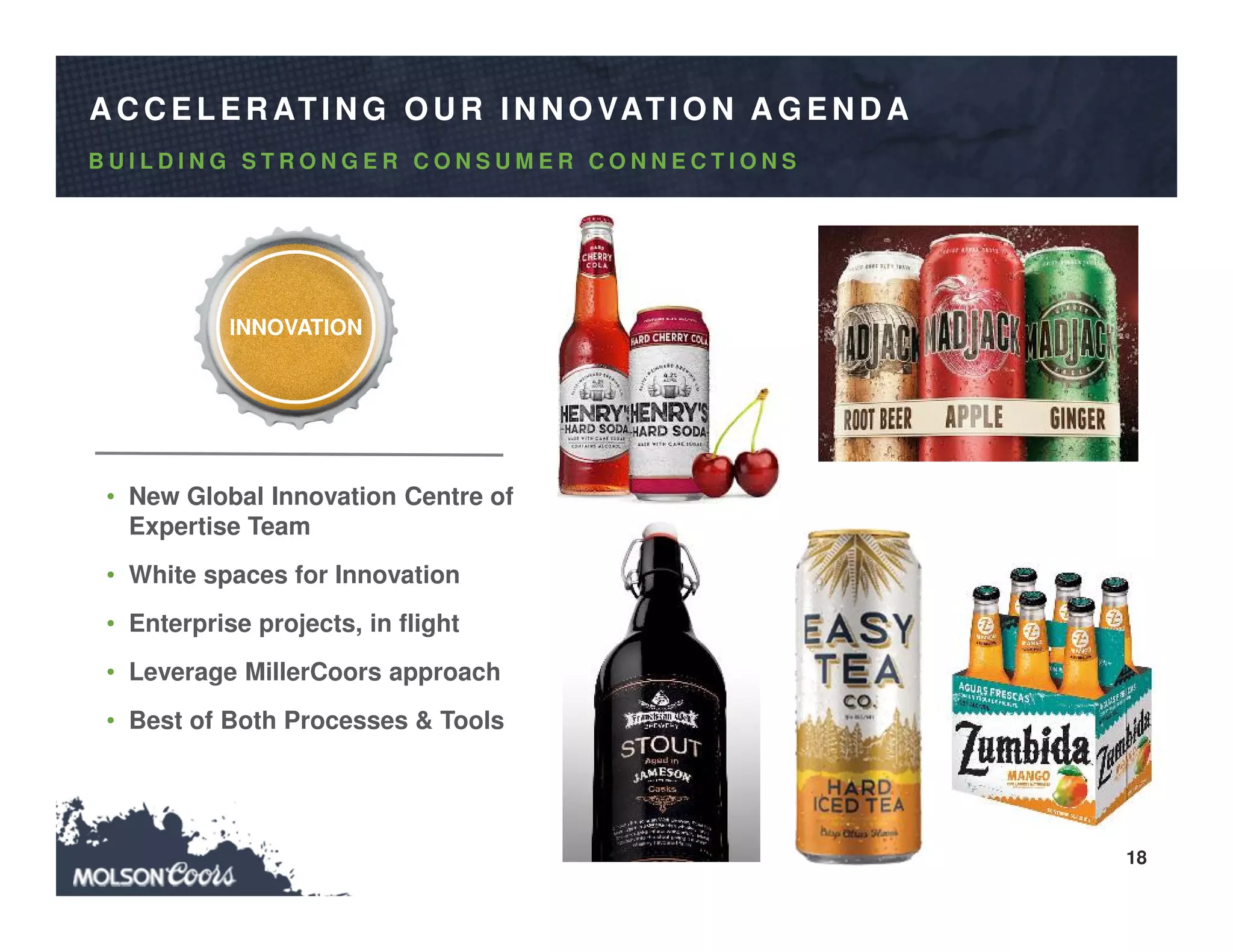

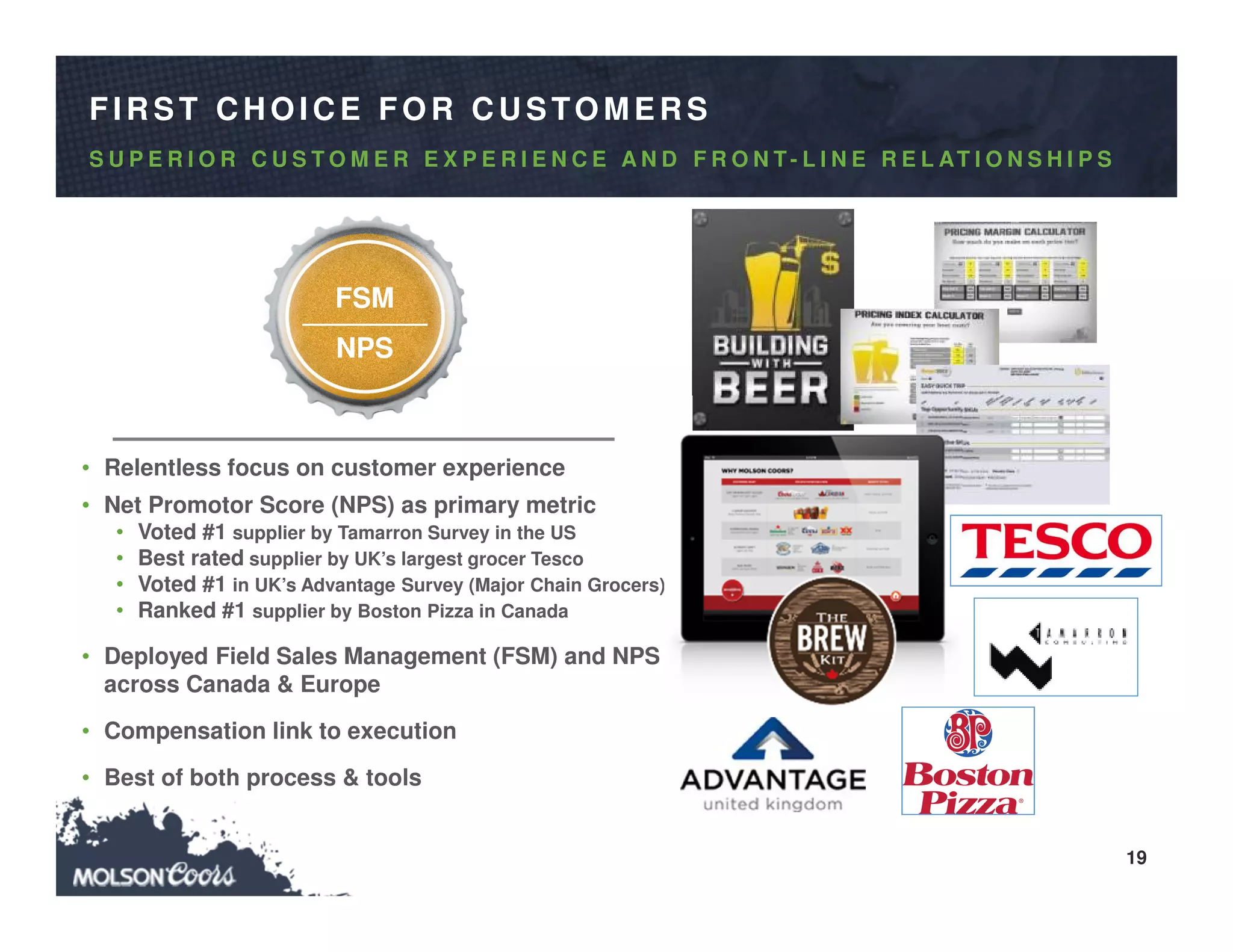

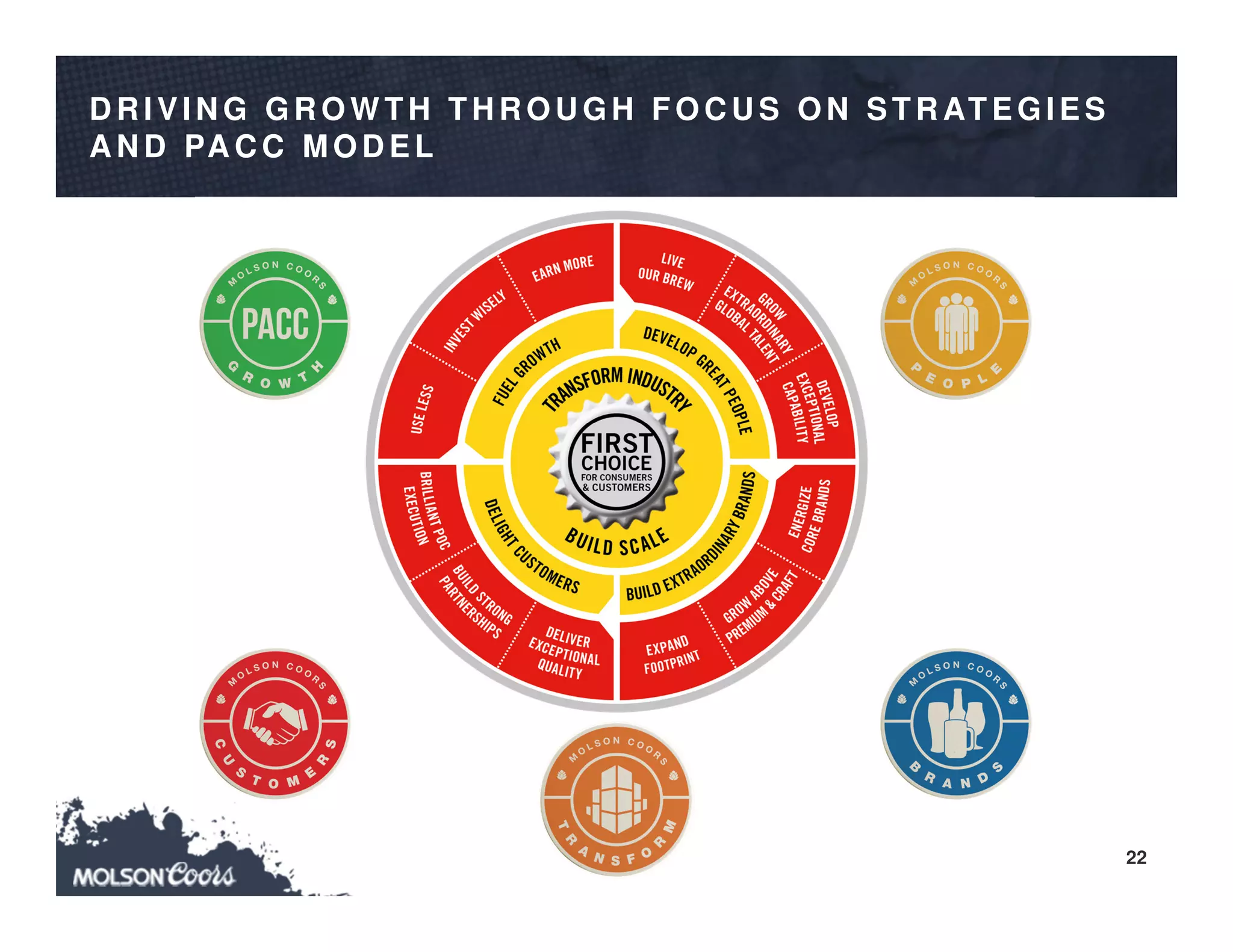

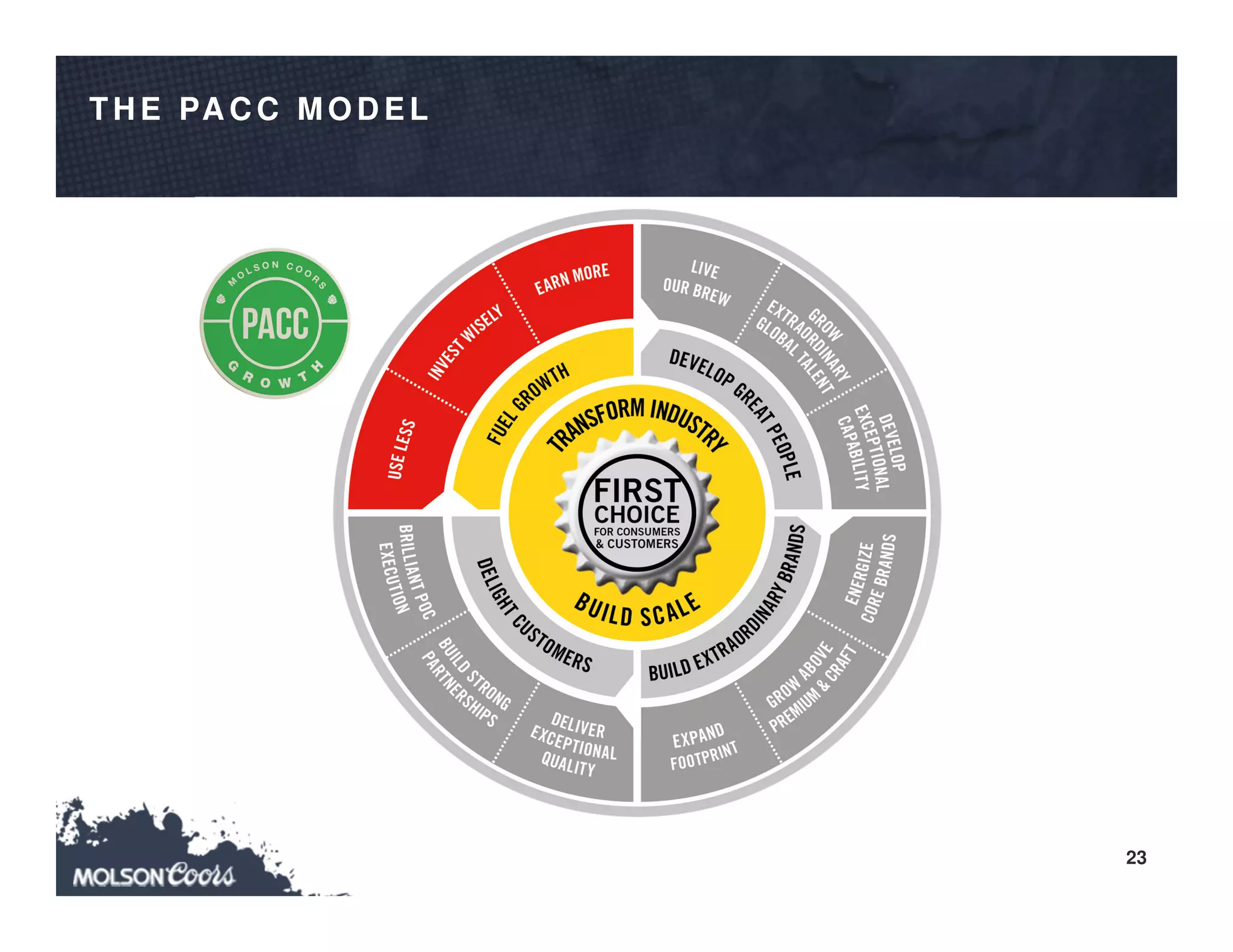

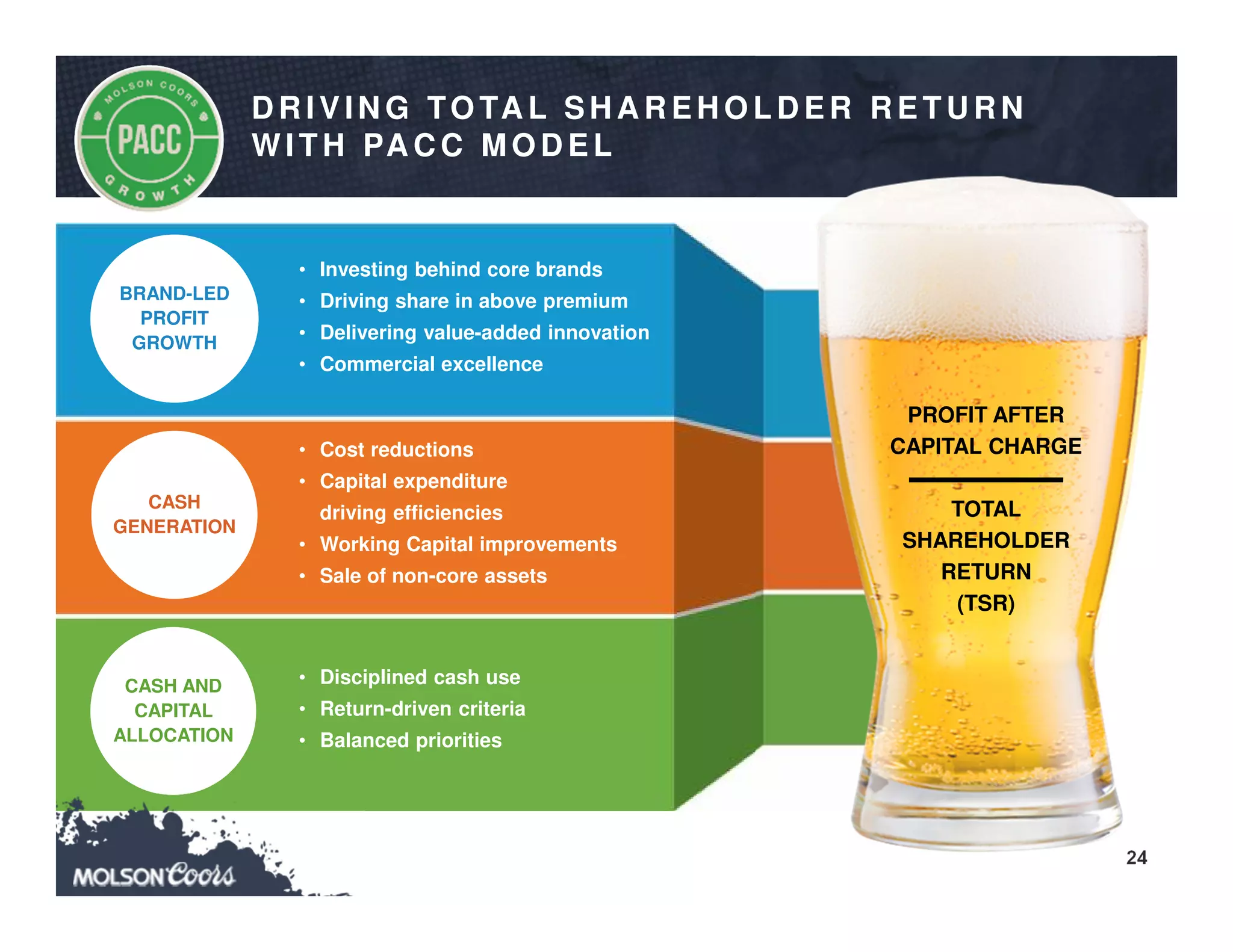

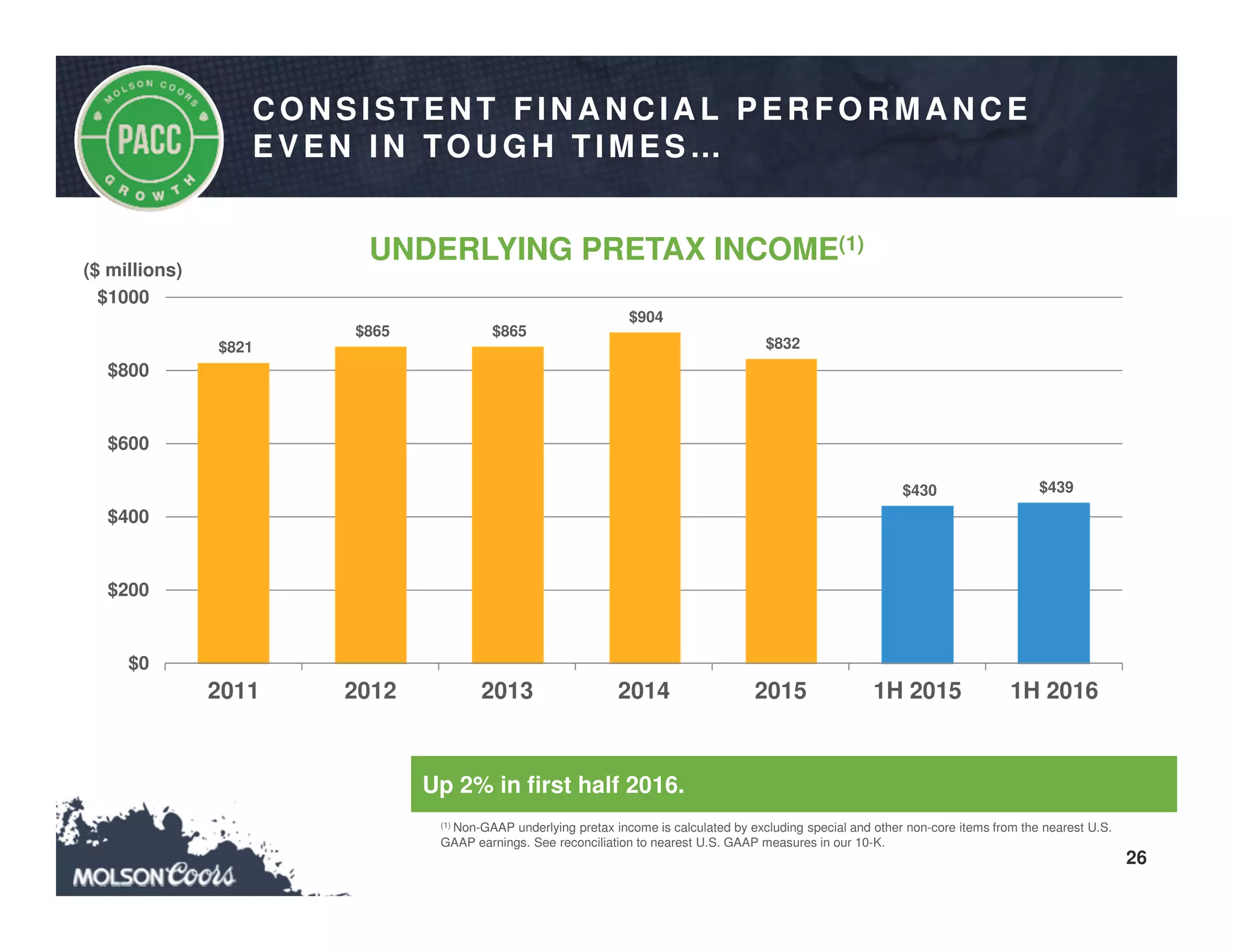

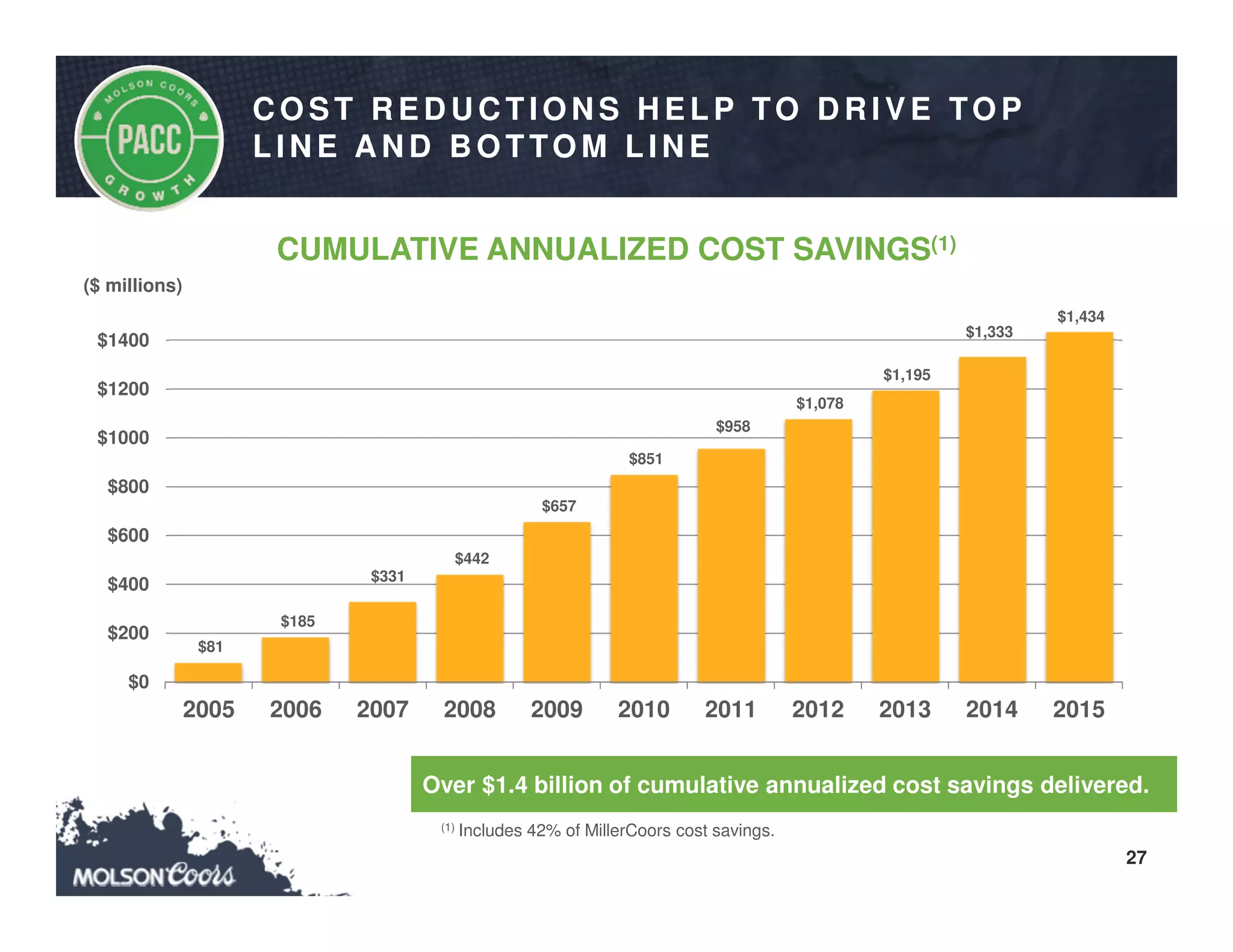

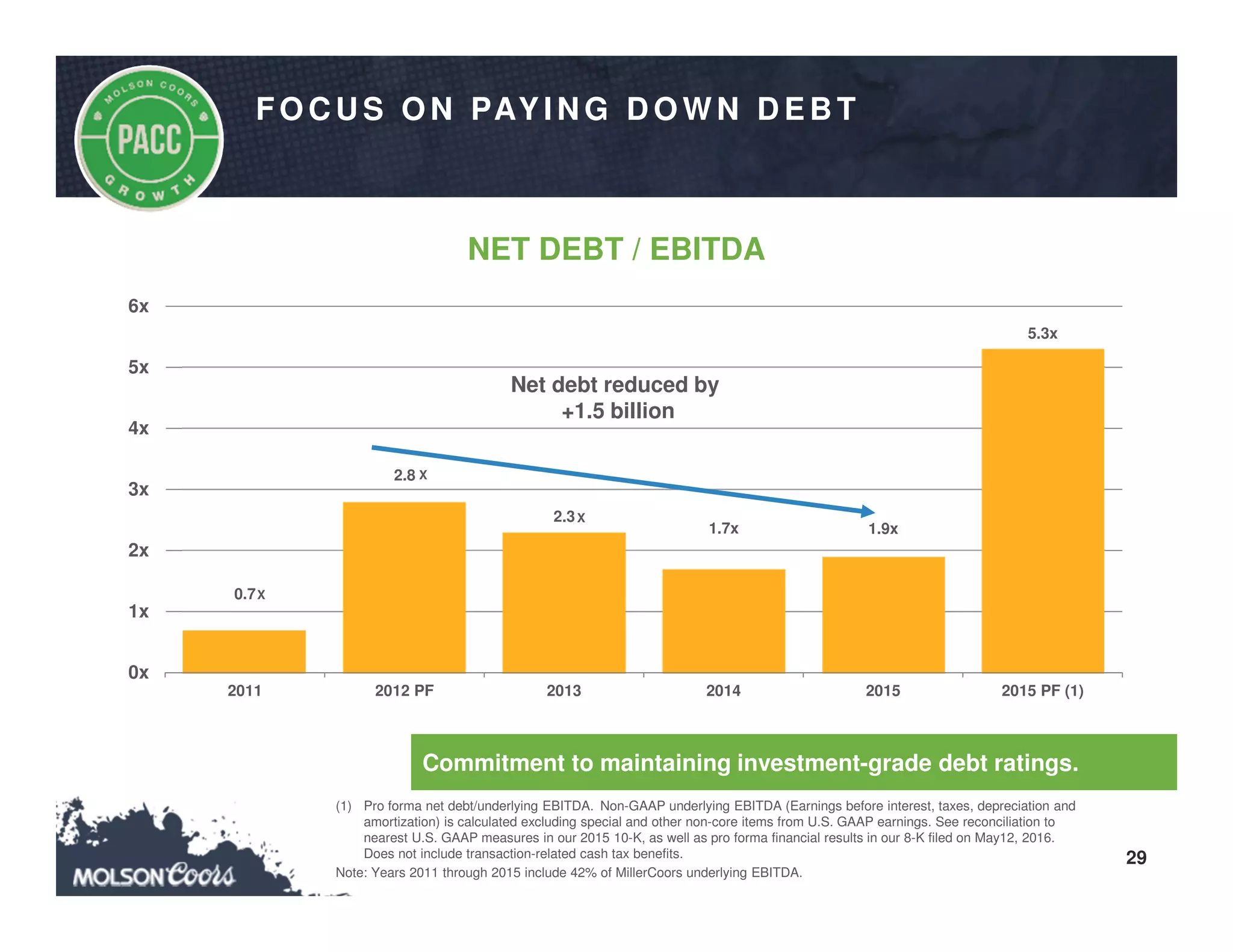

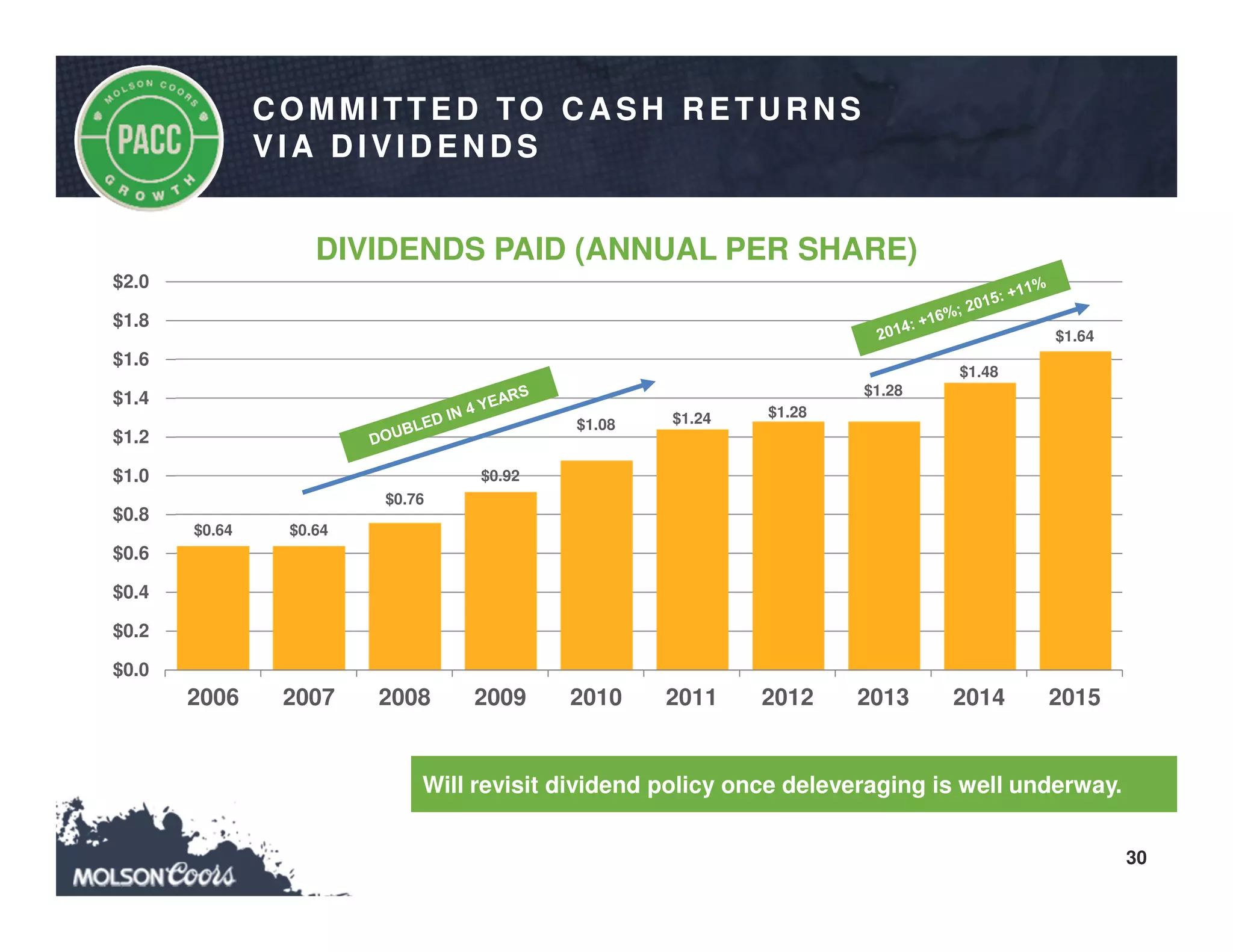

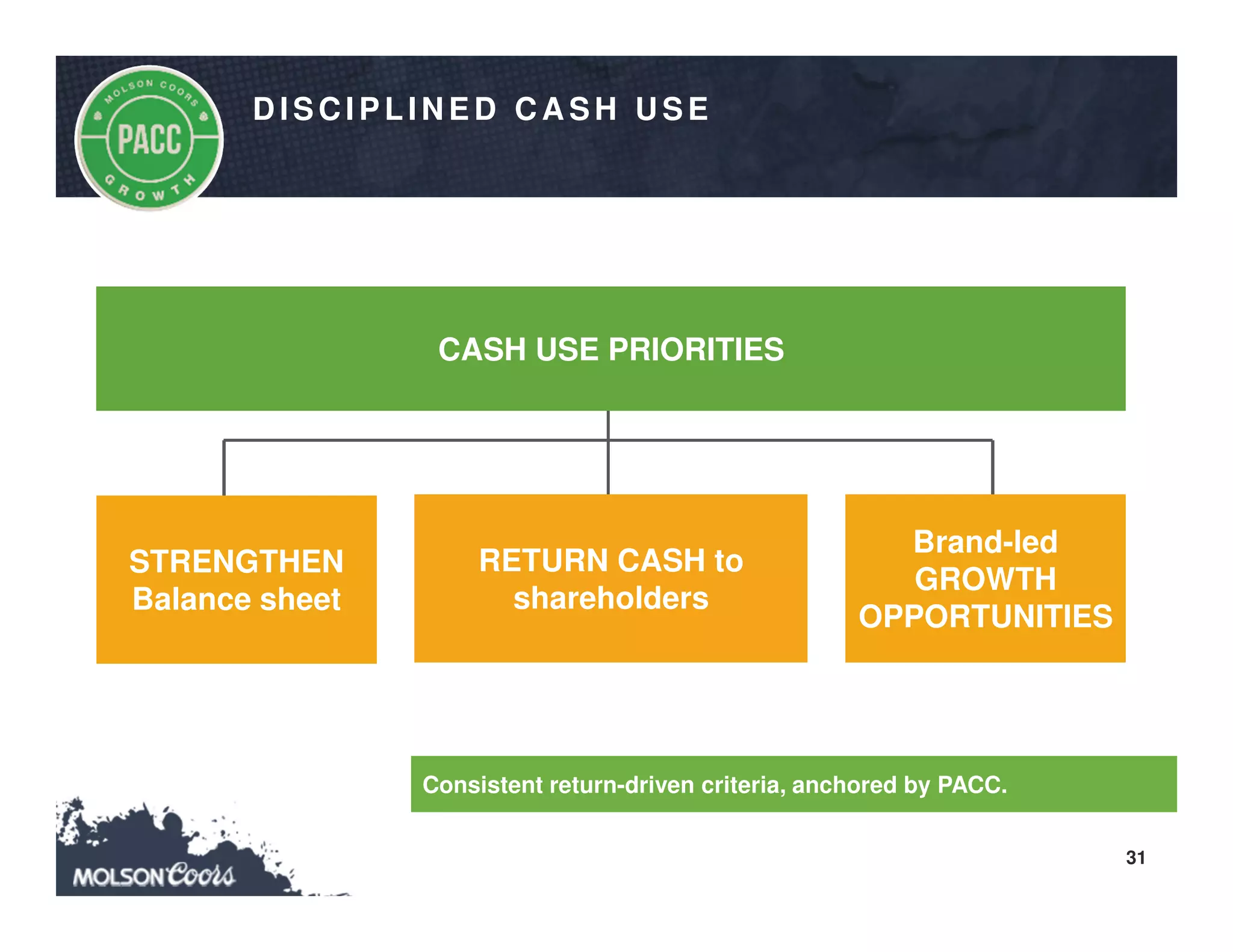

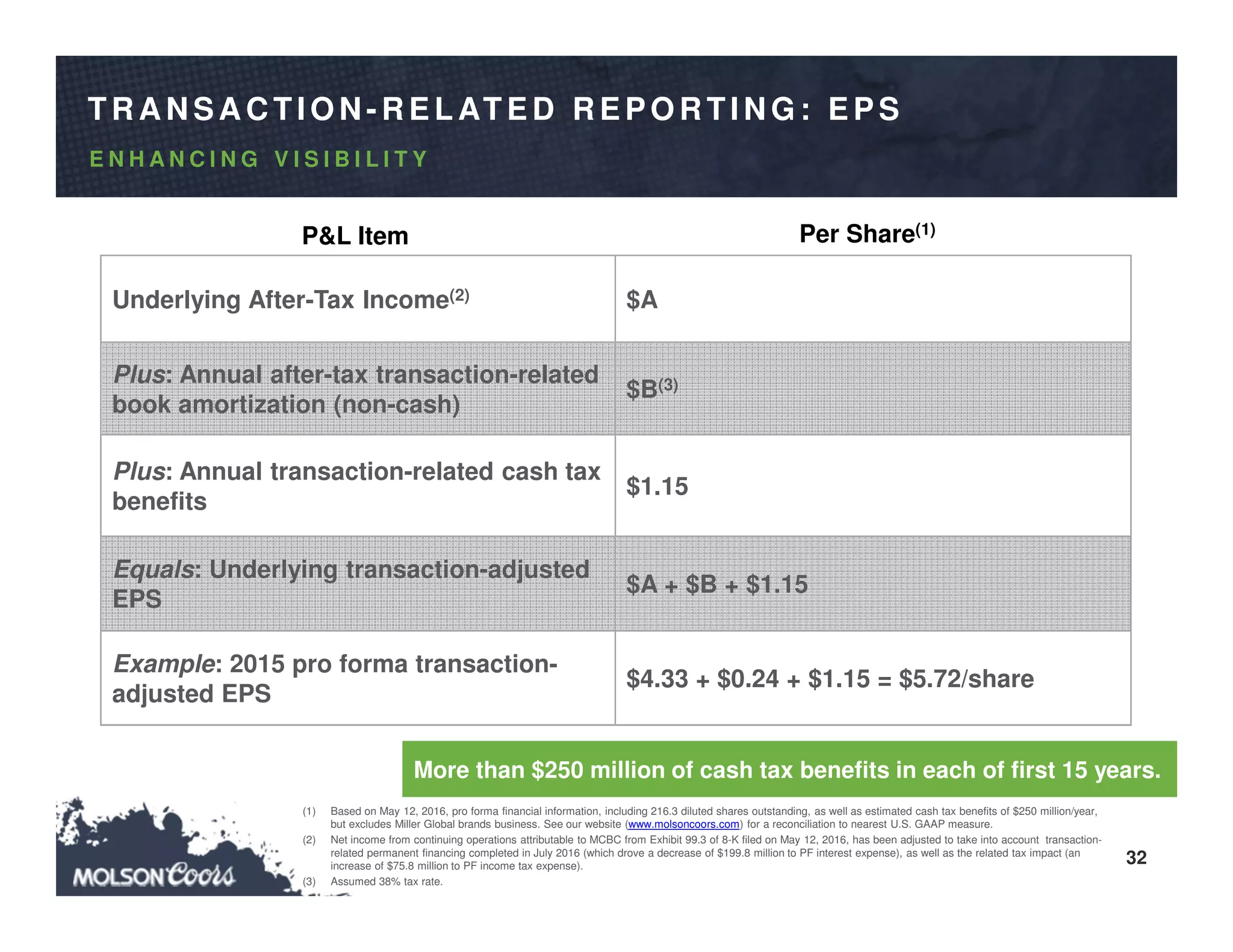

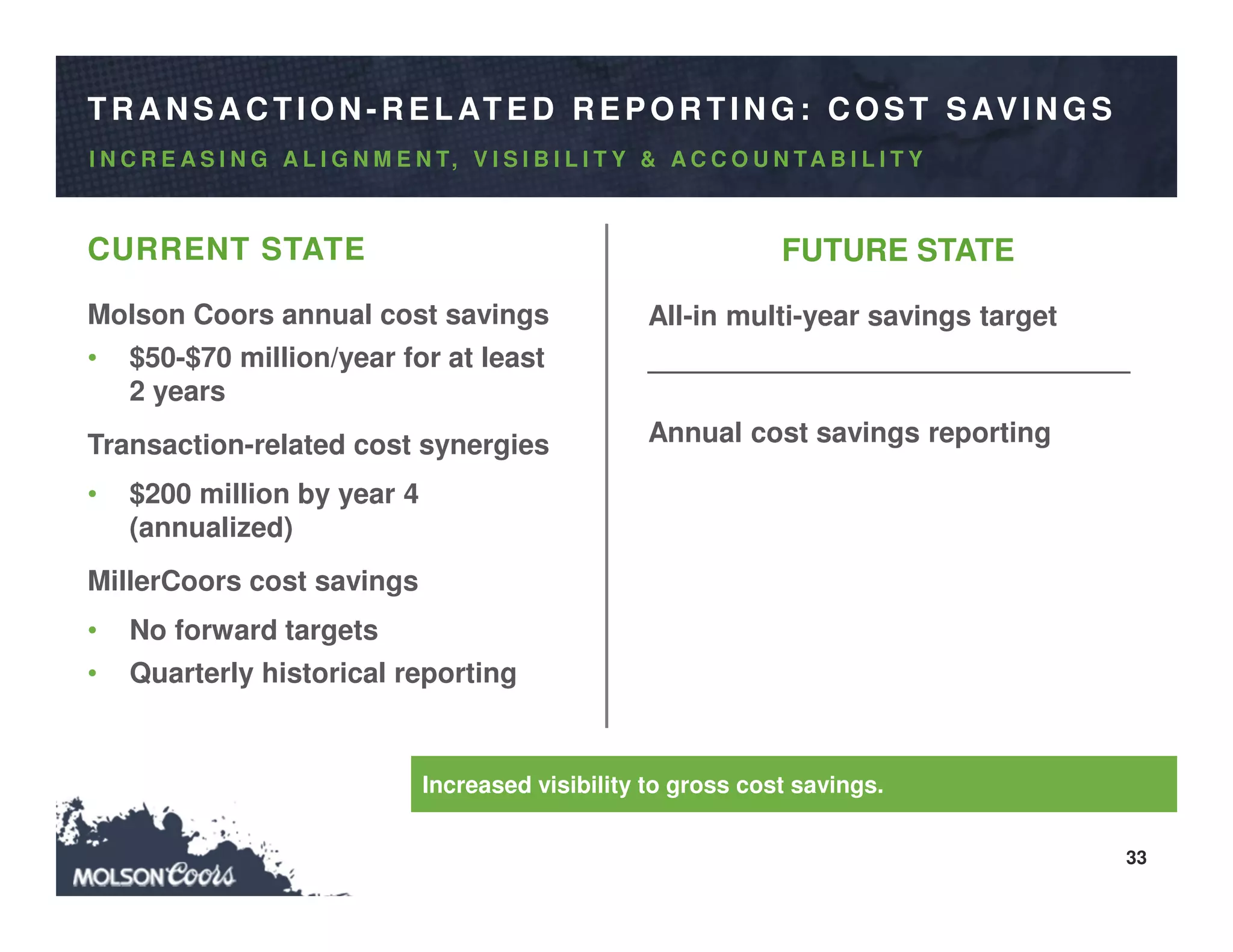

This document summarizes Mark Hunter's presentation at the Barclays Global Consumer Staples Conference on September 7, 2016 as CEO of Molson Coors Brewing Company. The presentation outlines Molson Coors' strategic focus on brand-led growth, cash generation, and capital allocation. It also details how acquiring MillerCoors will double Molson Coors' size, deliver $200M in annual synergies, and over $250M in annual cash tax benefits. The acquisition enhances Molson Coors' commercial capabilities to drive top-line growth through improved insights, innovation, digital capabilities, and customer excellence.