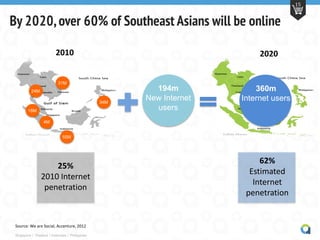

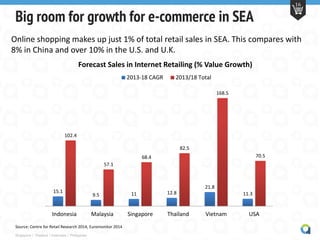

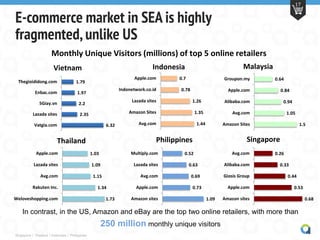

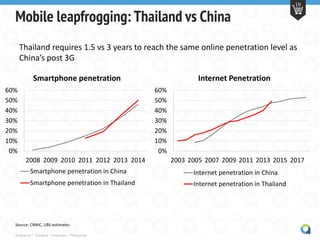

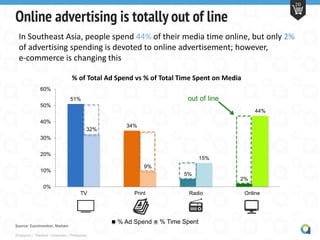

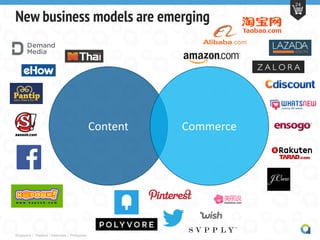

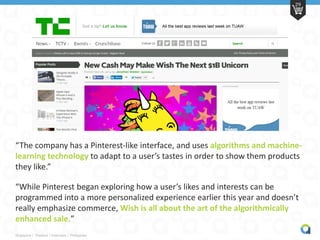

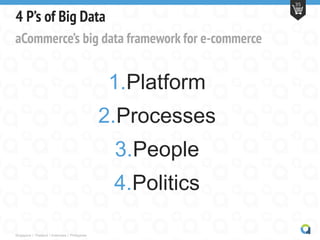

The document discusses the growing trends in e-commerce and retail analytics in Southeast Asia, highlighting the region's potential for online shopping growth compared to more developed markets. It emphasizes the importance of data-driven strategies, mobile penetration, and the shift towards new business models leveraging technology and big data. The presentation underscores that e-commerce in the region is still in a nascent stage, with significant opportunities for innovation and market expansion.