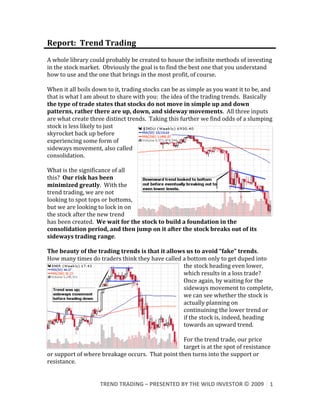

This document discusses trend trading, which is a method of investing in stocks that follows trends rather than trying to predict tops and bottoms. It states that stocks move in up, down, and sideways trends rather than simple patterns. The trend trading method involves waiting for a stock to move sideways to form a base before buying after it breaks out of the sideways range in the direction of the new trend. This allows traders to avoid "fake" trends and reduce their risk by not trying to call exact tops and bottoms. The document provides an example of how trend trading can be applied.