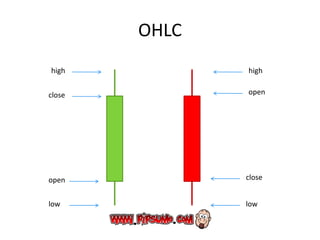

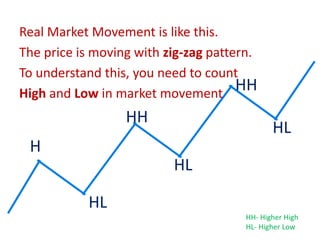

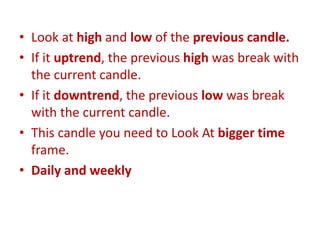

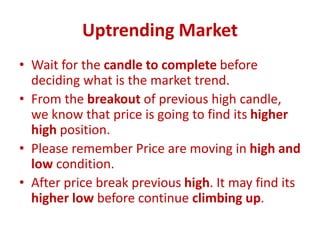

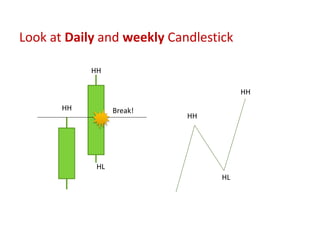

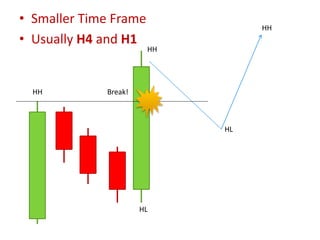

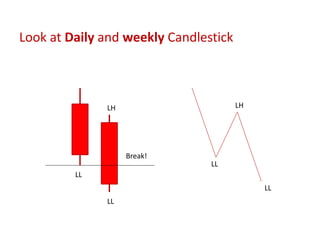

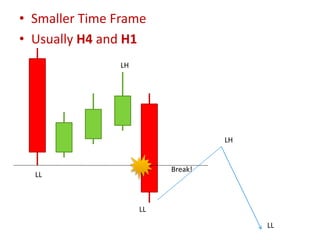

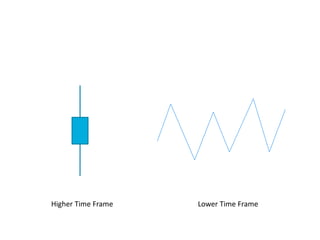

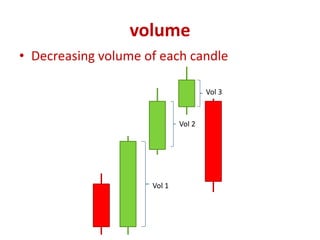

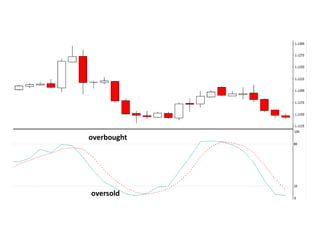

This document provides an overview of market trending in forex trading. It discusses the three types of market trends - uptrend, downtrend, and sideways. An uptrend is identified when the price breaks above the high of the previous candlestick, while a downtrend is identified when the price breaks below the low. Sideways trends occur when there is little price movement and candles form dojis. It also describes how to identify a weakening trend through indicators like shadow length, decreasing volume, and stochastic signals. The best entries are at support and resistance levels on smaller time frames once the trend is confirmed on larger time frames.