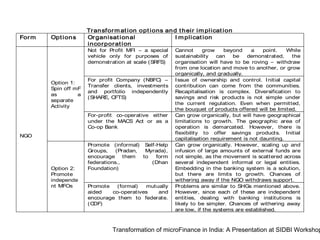

1. The document discusses options for transforming microfinance institutions (MFIs) in India as they grow in size and seek to diversify their services and improve financial sustainability.

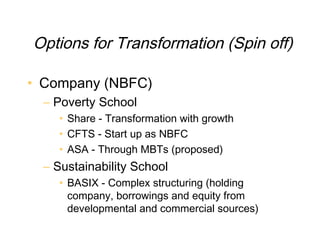

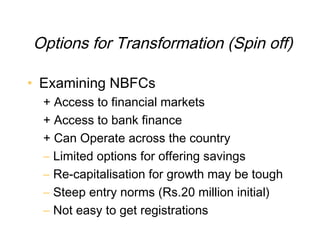

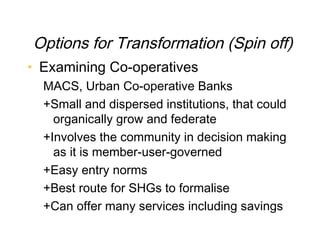

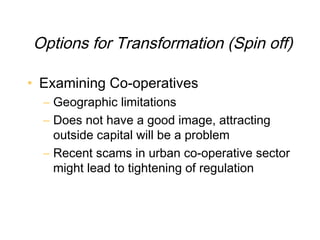

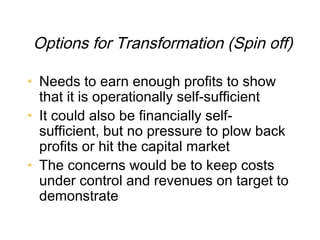

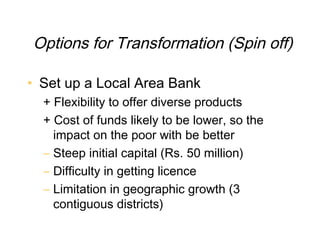

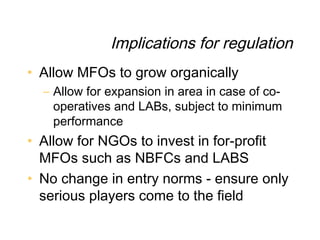

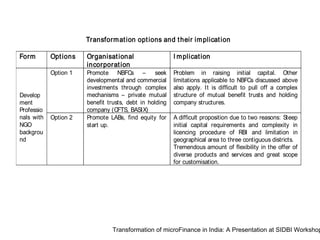

2. Key options explored are transforming NGOs into for-profit companies like non-banking financial companies (NBFCs), cooperatives, or local area banks. Challenges include meeting high initial capital requirements and regulatory limitations on product offerings.

3. Organically promoting independent MFIs like self-help groups (SHGs) or mutually aided cooperatives allows growth while maintaining local control but scaling up access to funding is difficult without more formal integration with banks.