This document summarizes Transcom's fourth quarter 2014 results presentation. Some key points:

- Transcom is a global customer experience specialist with 29,000 employees generating €616.8 million in revenue in 2014.

- In Q4 2014, Transcom saw a 3.8% increase in like-for-like revenue compared to Q4 2013 and an improved EBIT margin of 5.8%.

- For all of 2014, Transcom's core customer relationship management business saw an EBIT margin increase to 3.5%, driven by improvements in North America & Asia Pacific and North Europe.

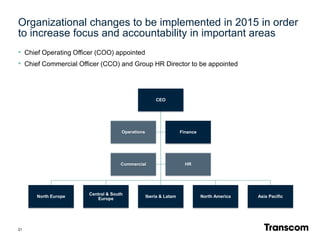

- Going forward, Transcom has set mid-term targets for revenue growth and EBIT