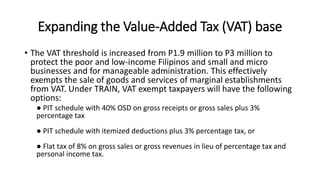

The document discusses tax reforms proposed under the TRAIN (Tax Reform for Acceleration and Inclusion) program. It proposes lowering personal income tax for 83% of taxpayers by exempting those earning below 250,000 PHP and lowering rates for others. It also aims to simplify estate and donor taxes by imposing a single 6% tax rate. The VAT base will be expanded by limiting exemptions but protecting necessities, while the threshold is raised to 3 million PHP. Fuel and automobile excise taxes will be increased gradually, and a new tax on sugar-sweetened beverages is introduced to promote health.