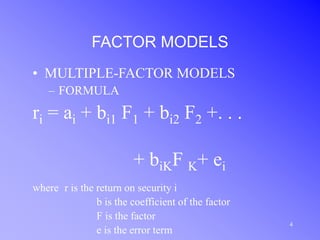

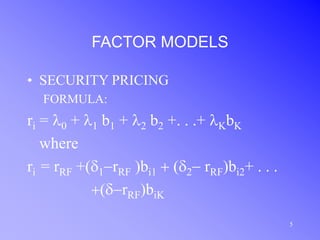

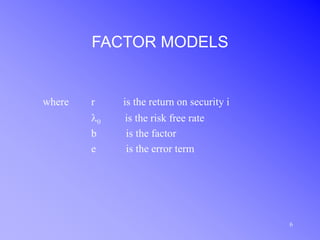

Arbitrage pricing theory (APT) is an equilibrium factor model of security returns based on the principle of arbitrage. It assumes capital markets are perfectly competitive, investors prefer more wealth, and prices are generated by a factor model. APT states that a security's expected return is equal to the risk-free rate plus risk premiums based on the security's sensitivity to multiple factors.