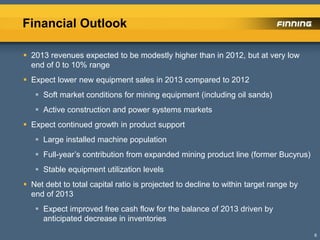

- Revenues in 2013 expected to be modestly higher than 2012 but at low end of 0-10% range due to lower mining equipment sales from soft market conditions. Product support expected to continue growing.

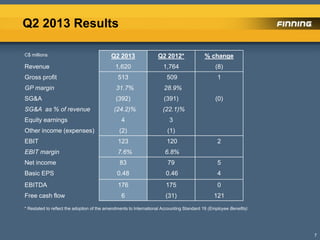

- Q2 2013 results showed revenue decline of 8% but gross profit and EBIT margin improvements. Net income up 5% and free cash flow turned positive after being negative in Q2 2012.

- Mining activity softening in Canada and South America is impacting equipment sales and support growth. Construction and non-mining presents opportunities. UK facing macroeconomic challenges in construction and coal mining.