1) Mike Waites, President and CEO of Finning International Inc., presented at the CIBC Whistler Institutional Investor Conference on January 19, 2012.

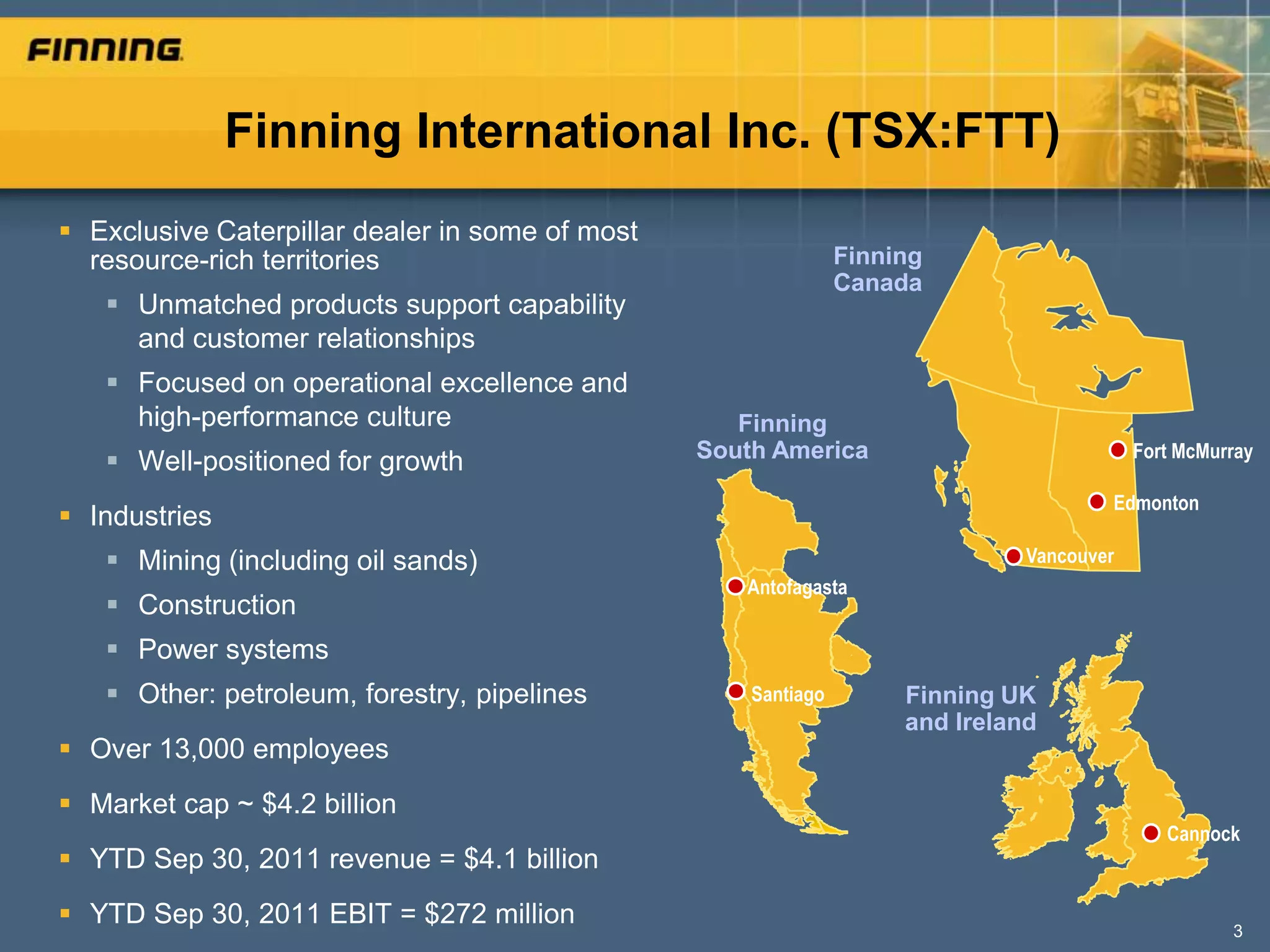

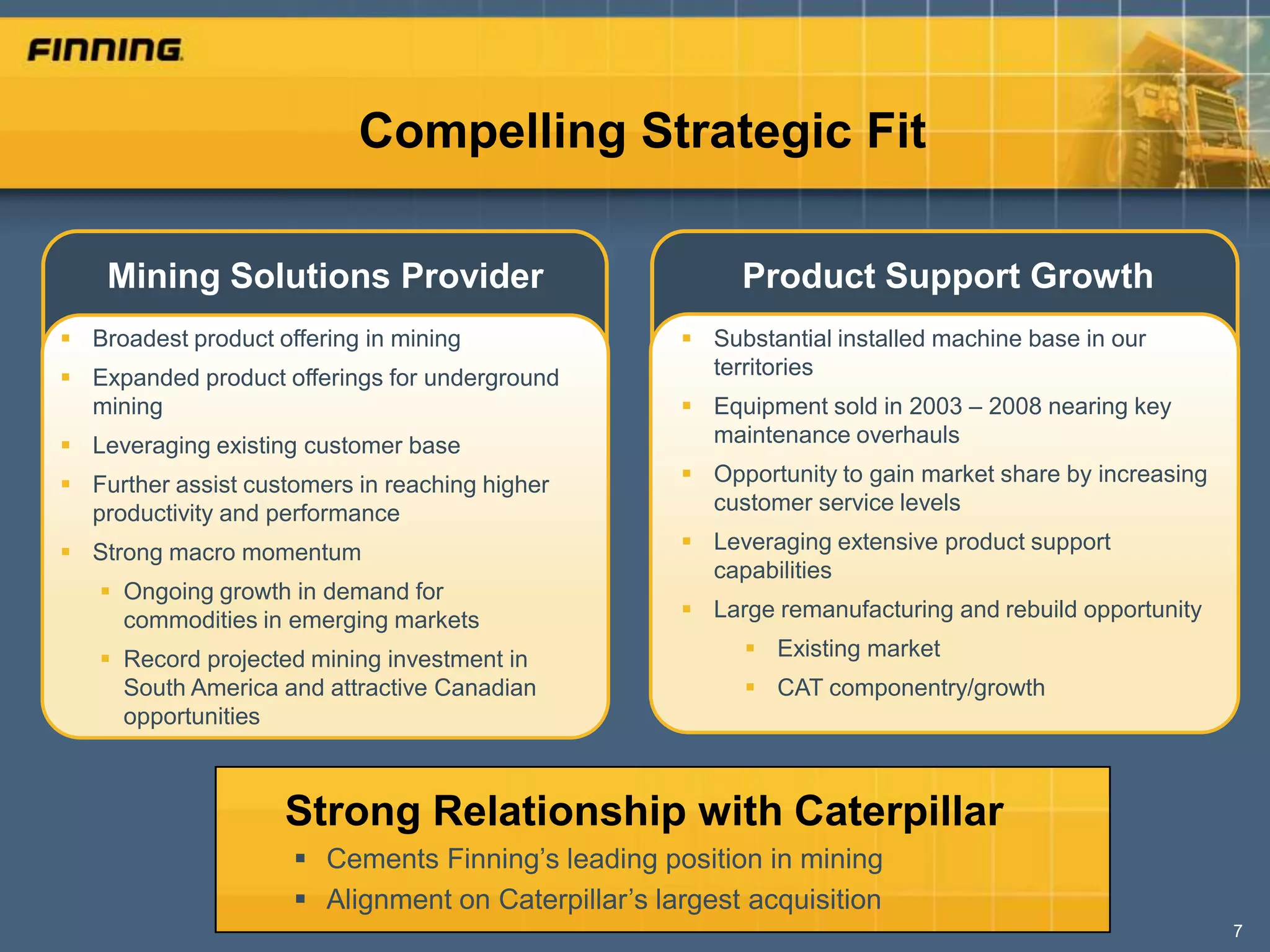

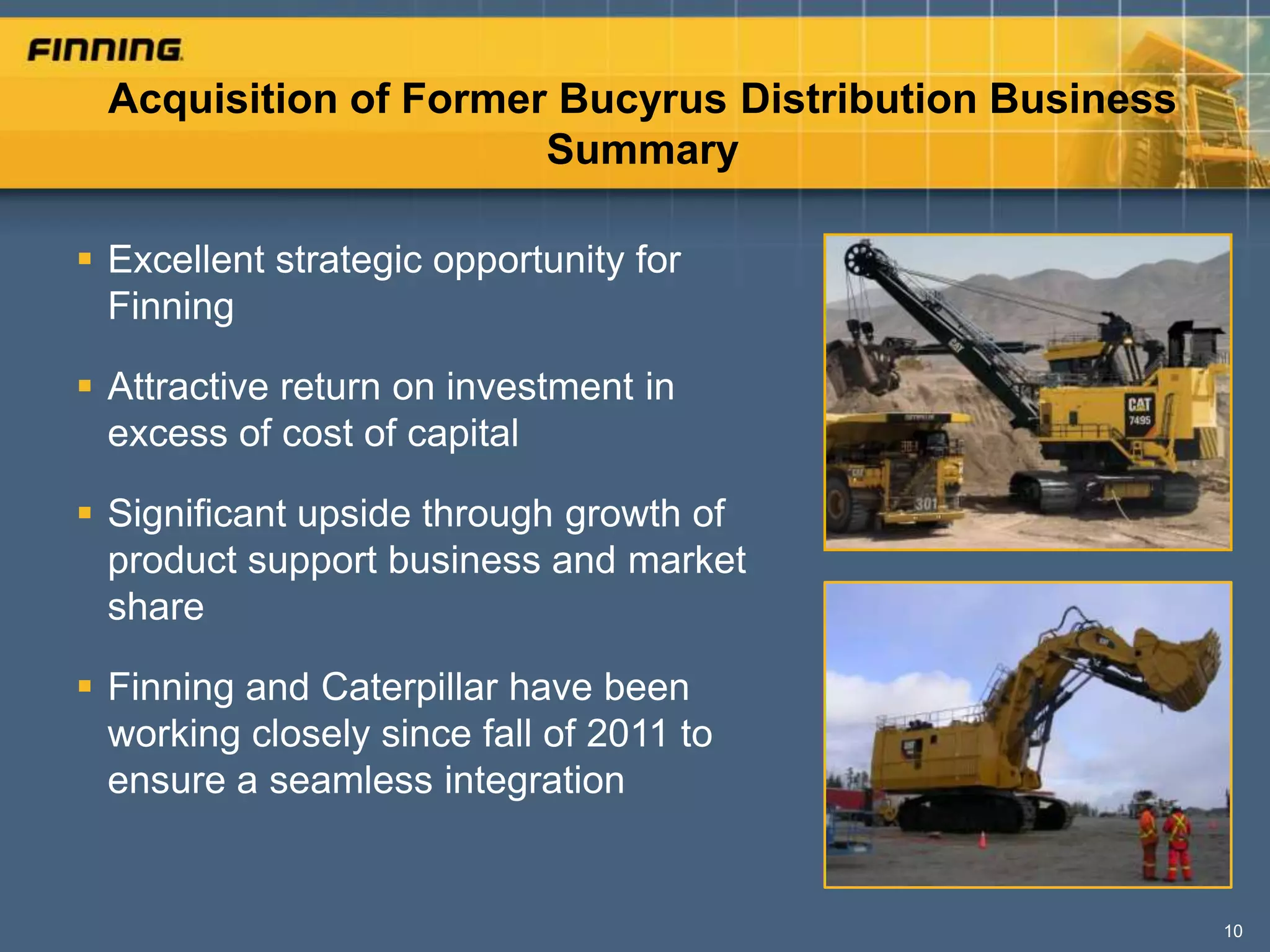

2) Finning is well positioned for growth as the exclusive Caterpillar dealer in resource-rich territories with unmatched product support capabilities.

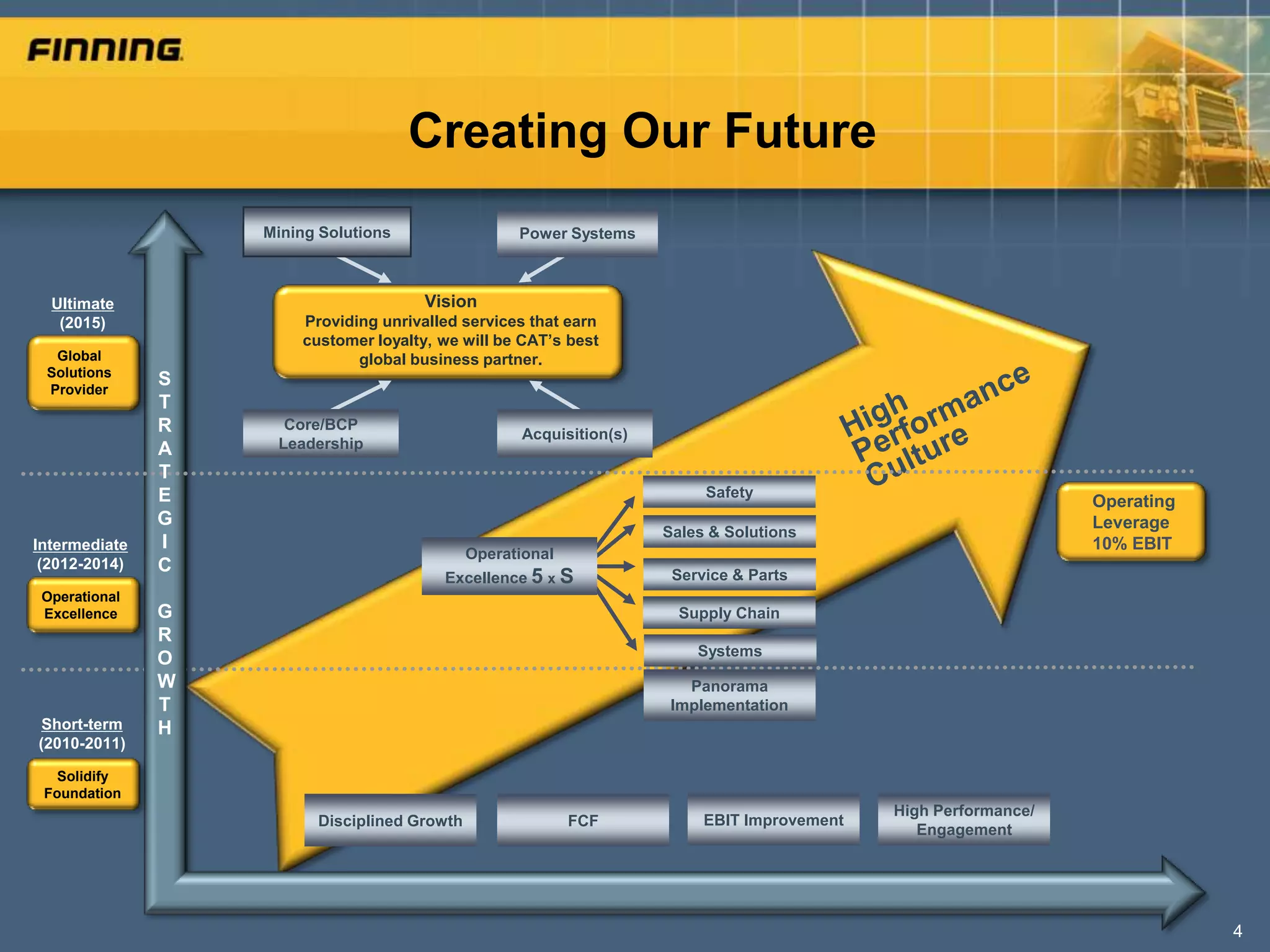

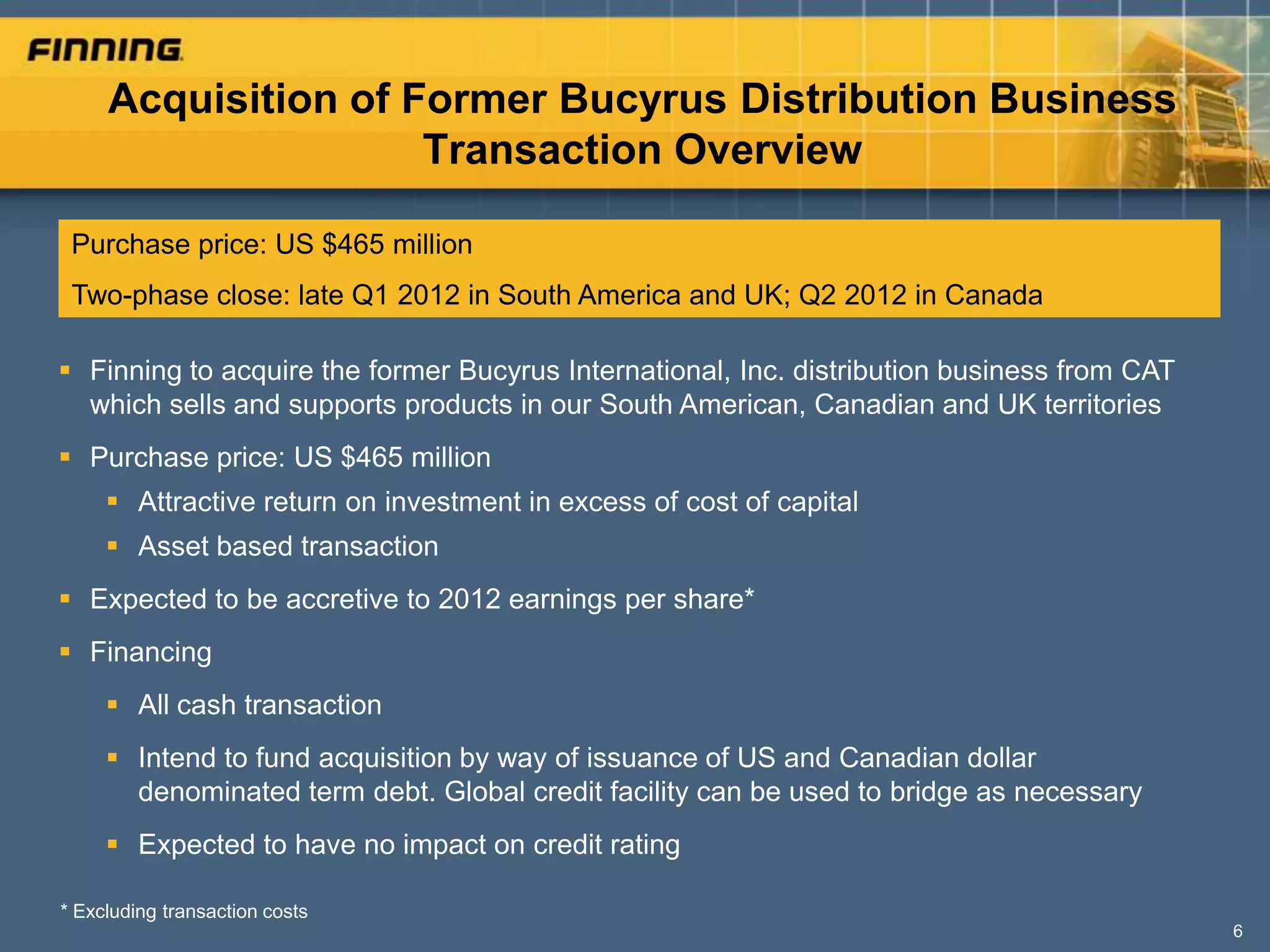

3) Waites discussed Finning's strategic priorities to become CAT's best global partner, including operational excellence, sales and solutions growth, and safety. He also outlined expectations to meet financial commitments around revenue growth, improved operating leverage, and investing to maintain competitive advantage.