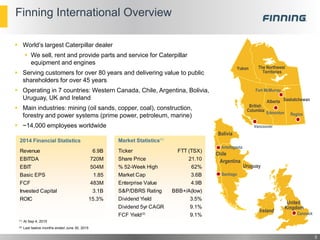

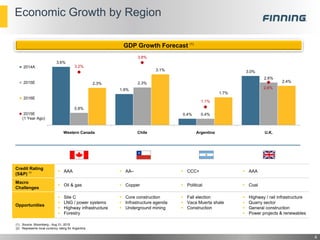

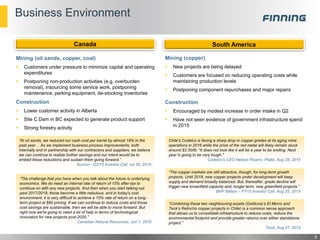

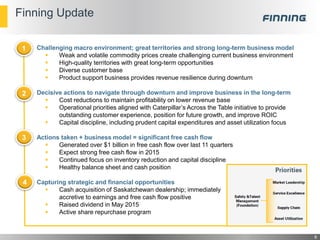

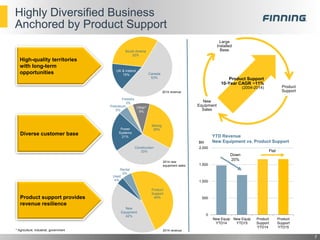

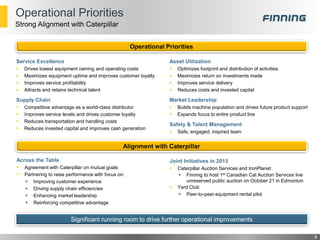

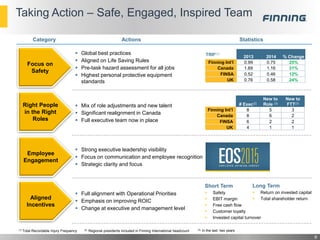

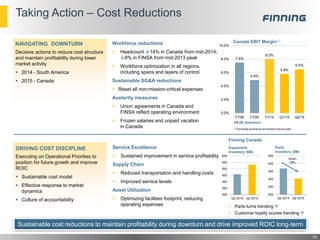

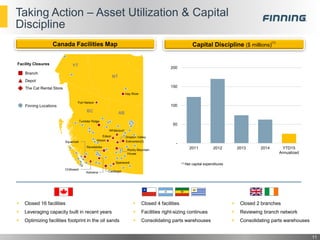

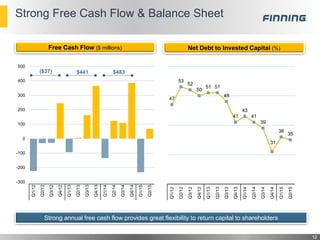

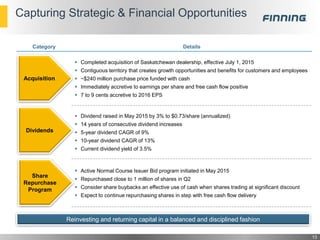

Finning International is a Caterpillar dealer operating in 7 countries. It provides equipment, parts, and services. The presentation discusses challenging macroeconomic conditions for mining and construction customers. Finning is taking decisive actions to reduce costs, improve operations through its service excellence plan, and maintain profitability during lower activity. Actions include workforce reductions, sustainable SG&A cuts, and asset utilization. Finning generated over $1B in free cash flow in the last 11 quarters and expects strong free cash flow in 2015.