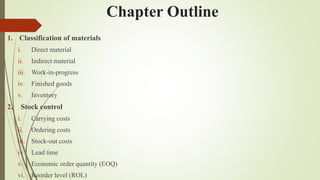

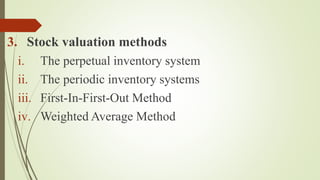

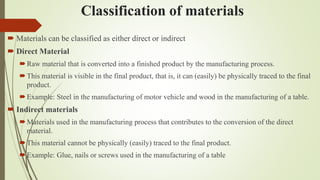

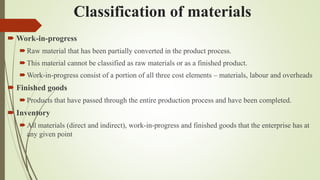

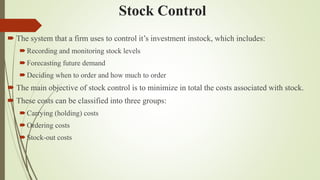

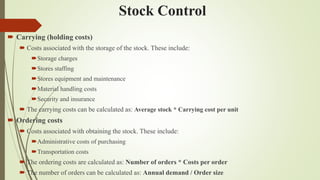

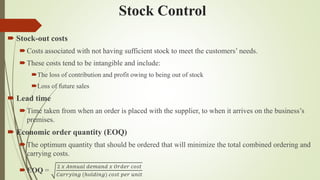

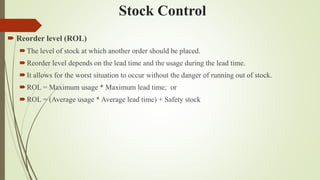

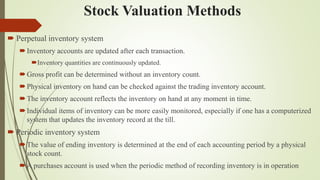

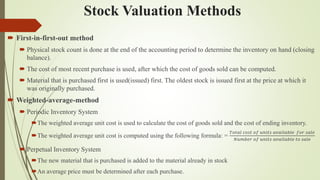

This document discusses materials and stock control in business accounting. It defines different types of materials like direct, indirect, work-in-progress and finished goods. It also discusses stock control methods like economic order quantity and reorder level which aim to minimize total costs of carrying, ordering and stock-out. Finally, it explains stock valuation methods like perpetual inventory system, FIFO and weighted average which are used to calculate inventory costs.