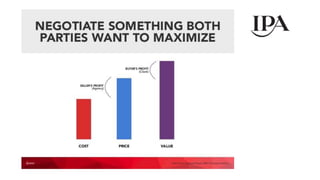

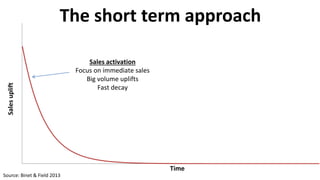

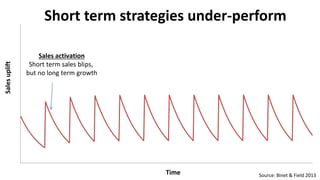

This document discusses the importance of long-term brand building versus short-term sales activation strategies in marketing. It argues that short-term strategies may produce quick sales uplifts but do not lead to sustainable long-term growth. Effective long-term strategies focus on reducing price sensitivity through branding, which produces slower but longer-lasting sales growth and increased profit margins over time. However, the trend in marketing is toward more short-termism as organizations prioritize quick gains over long-term effectiveness. The document advocates for an approach that views marketing investments as long-term investments, focuses on desired outcomes rather than just outputs, and considers how purchasing behaviors impact the value received.