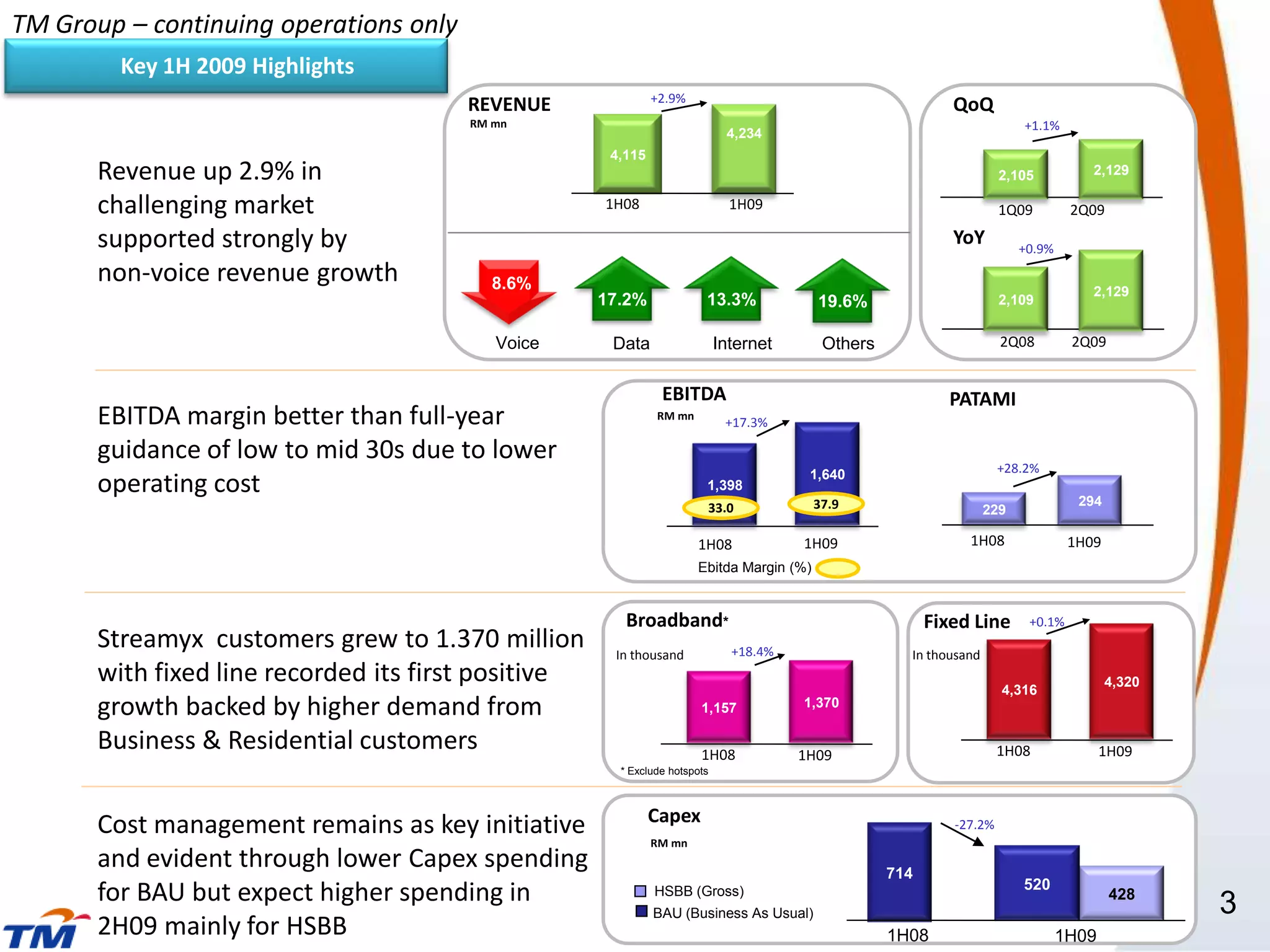

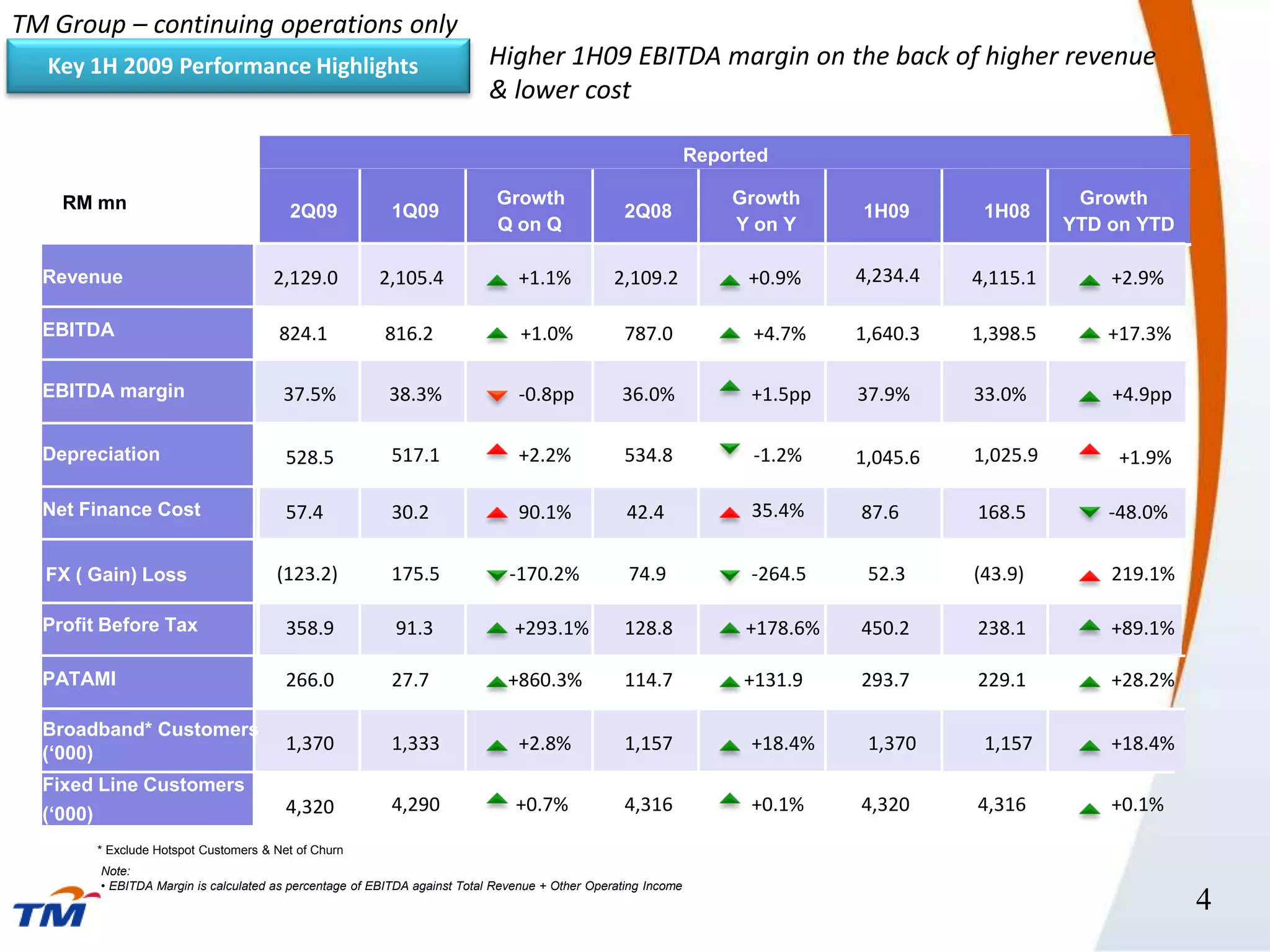

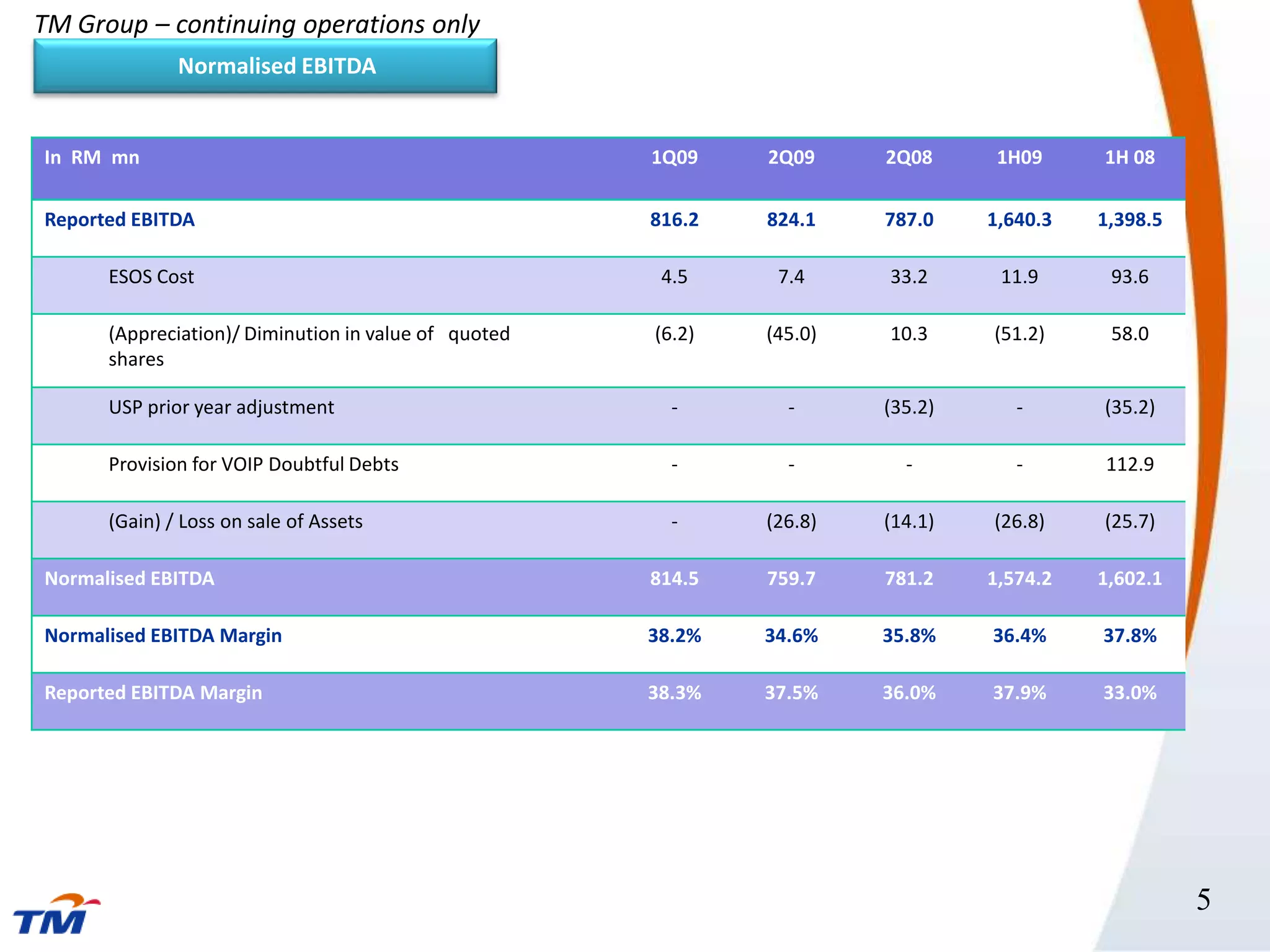

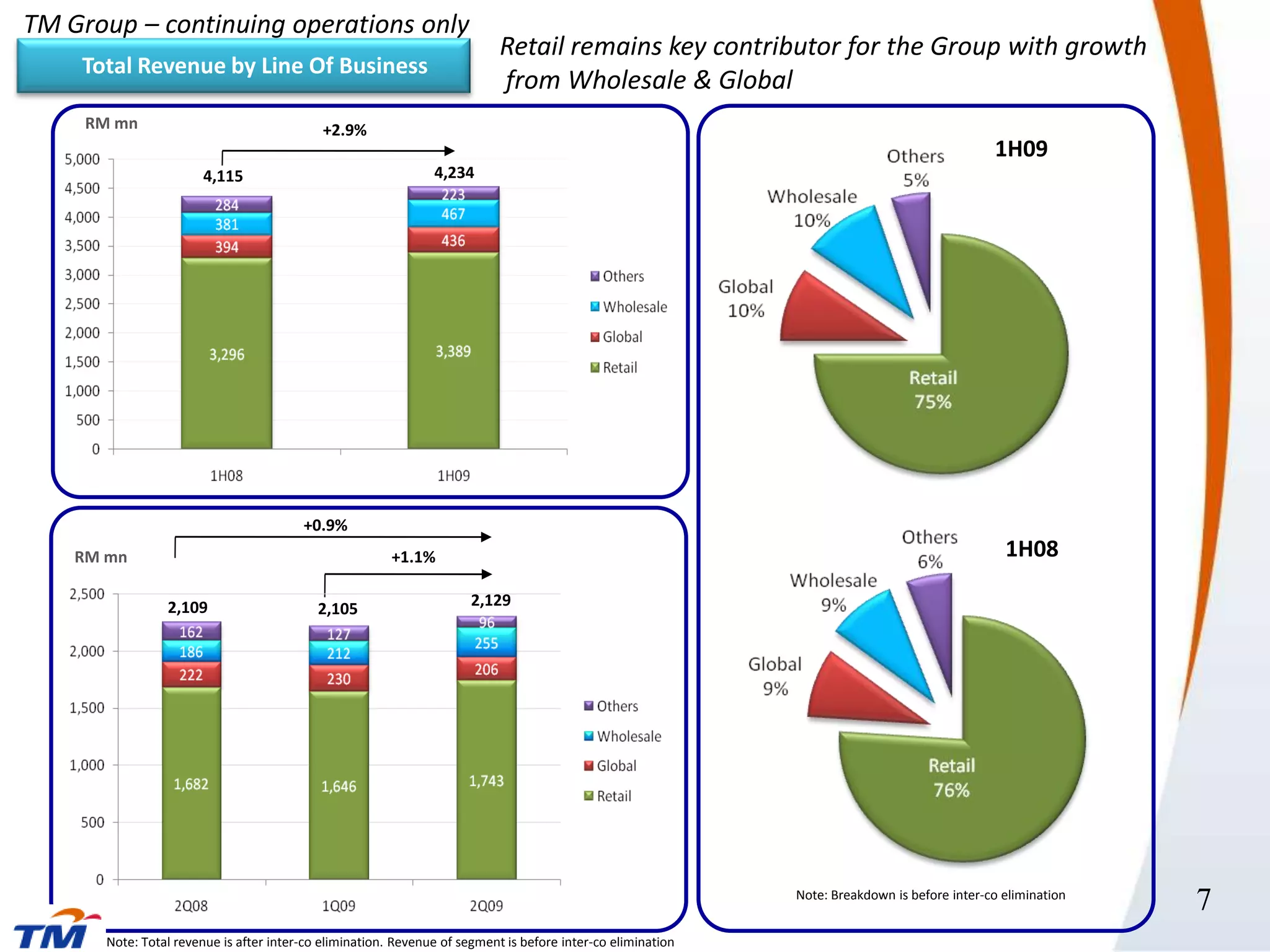

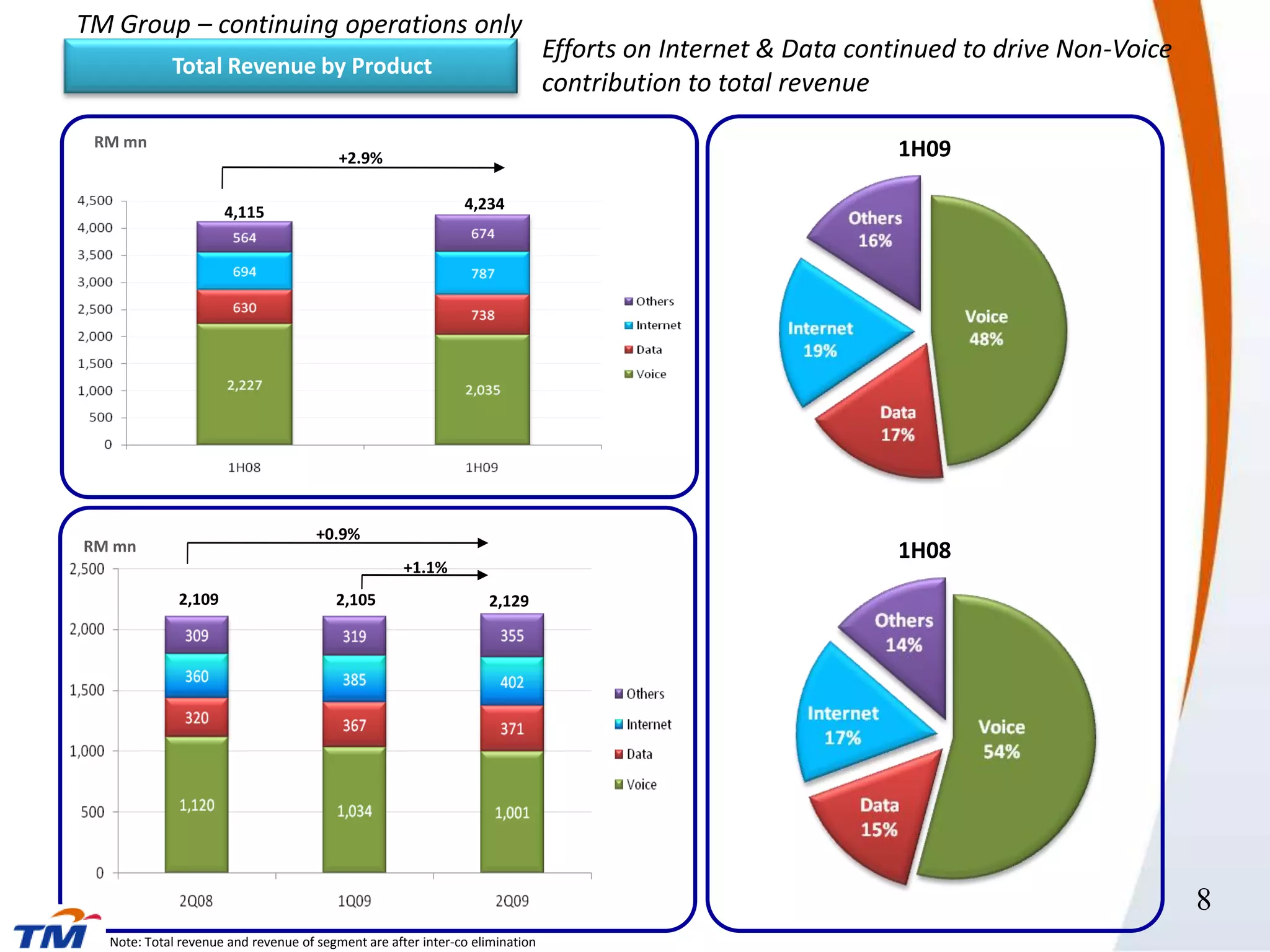

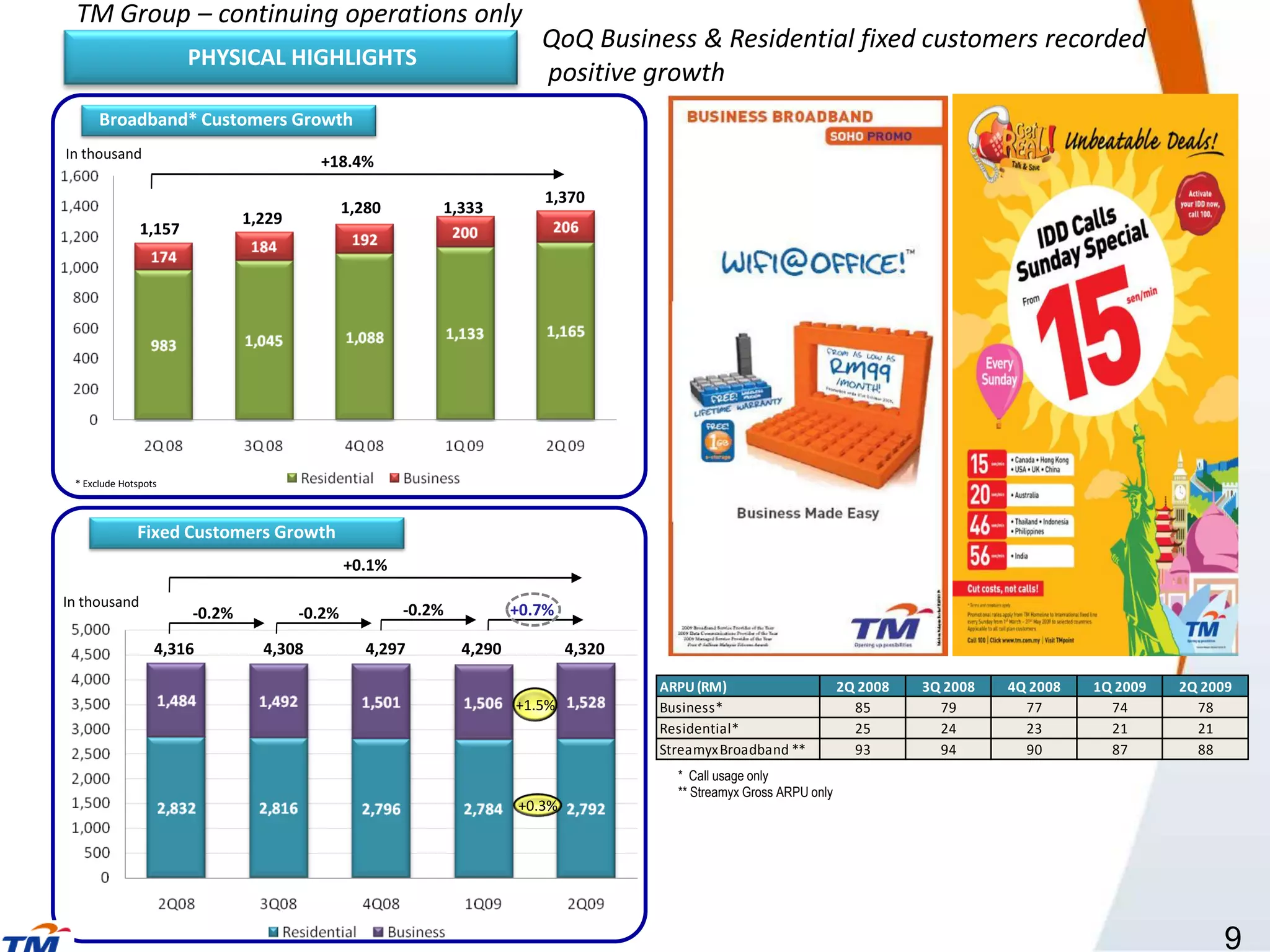

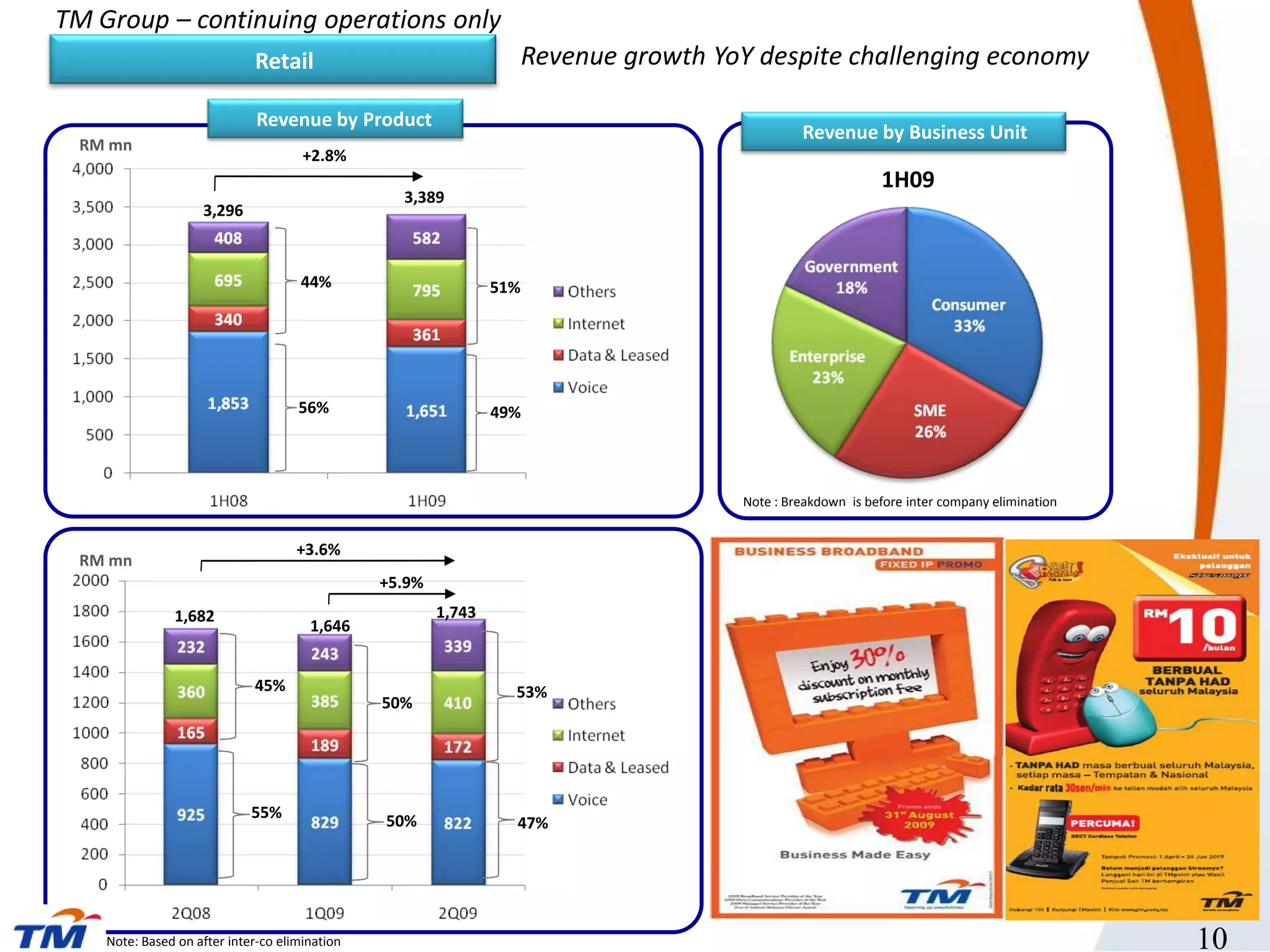

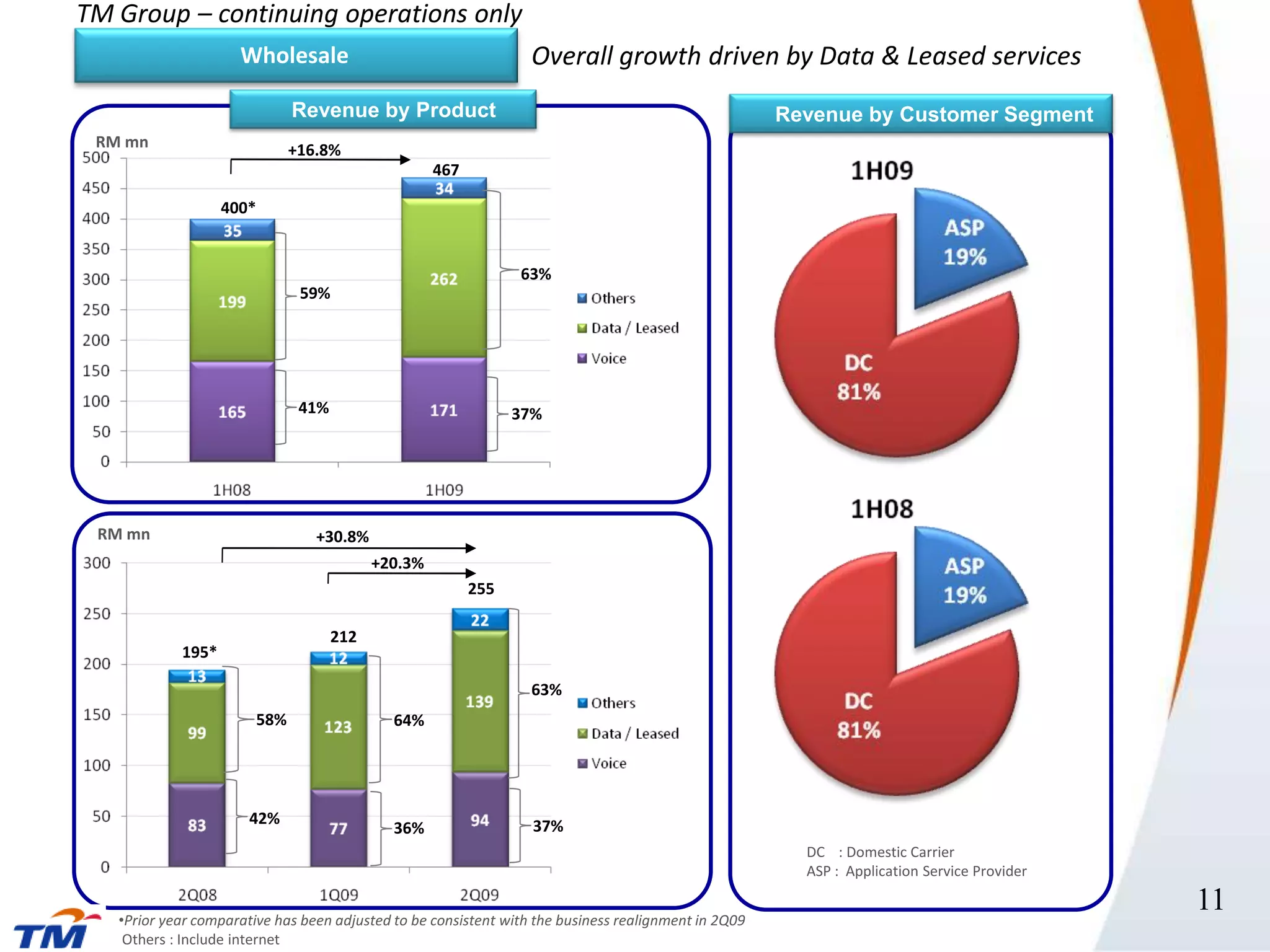

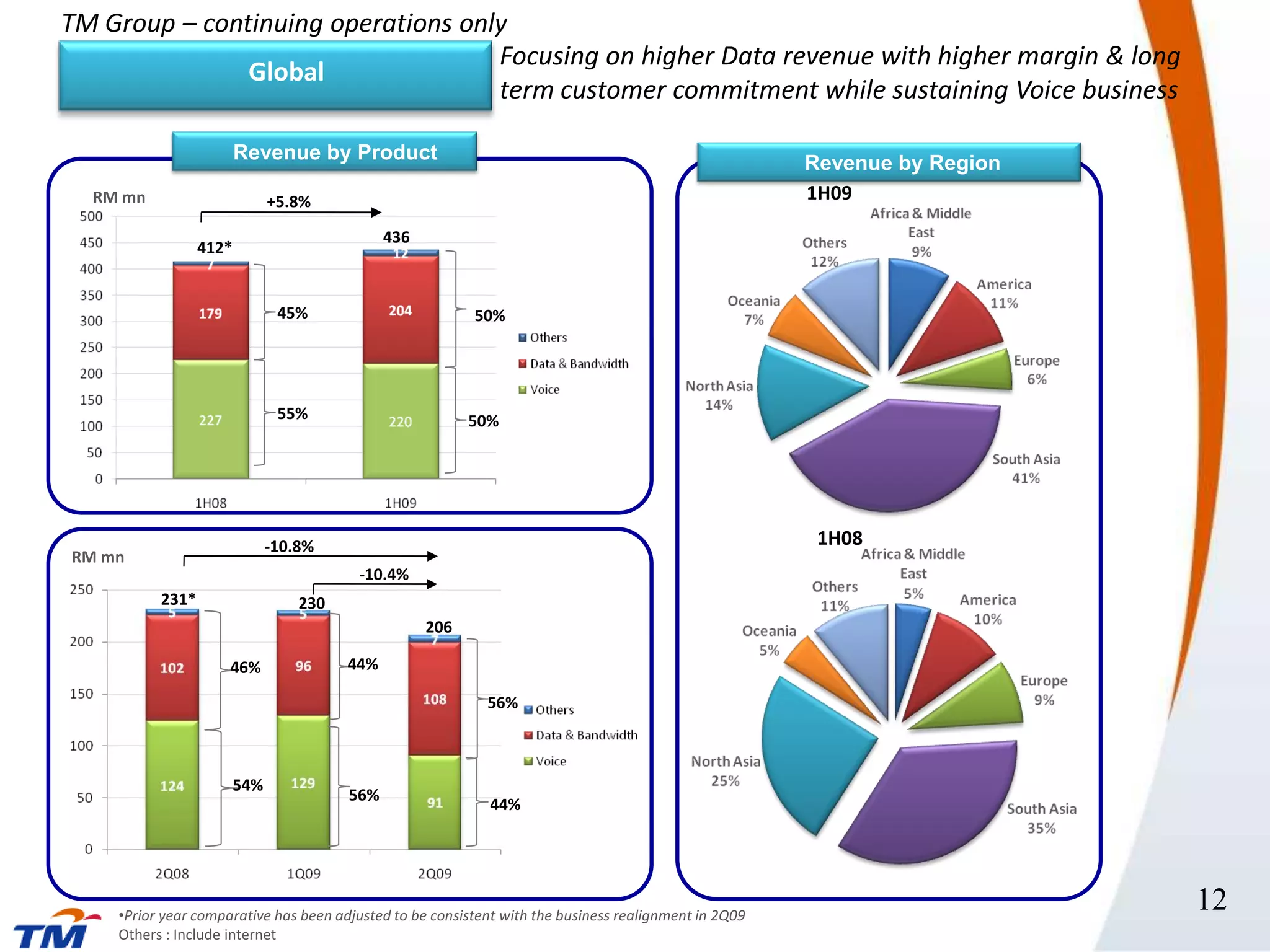

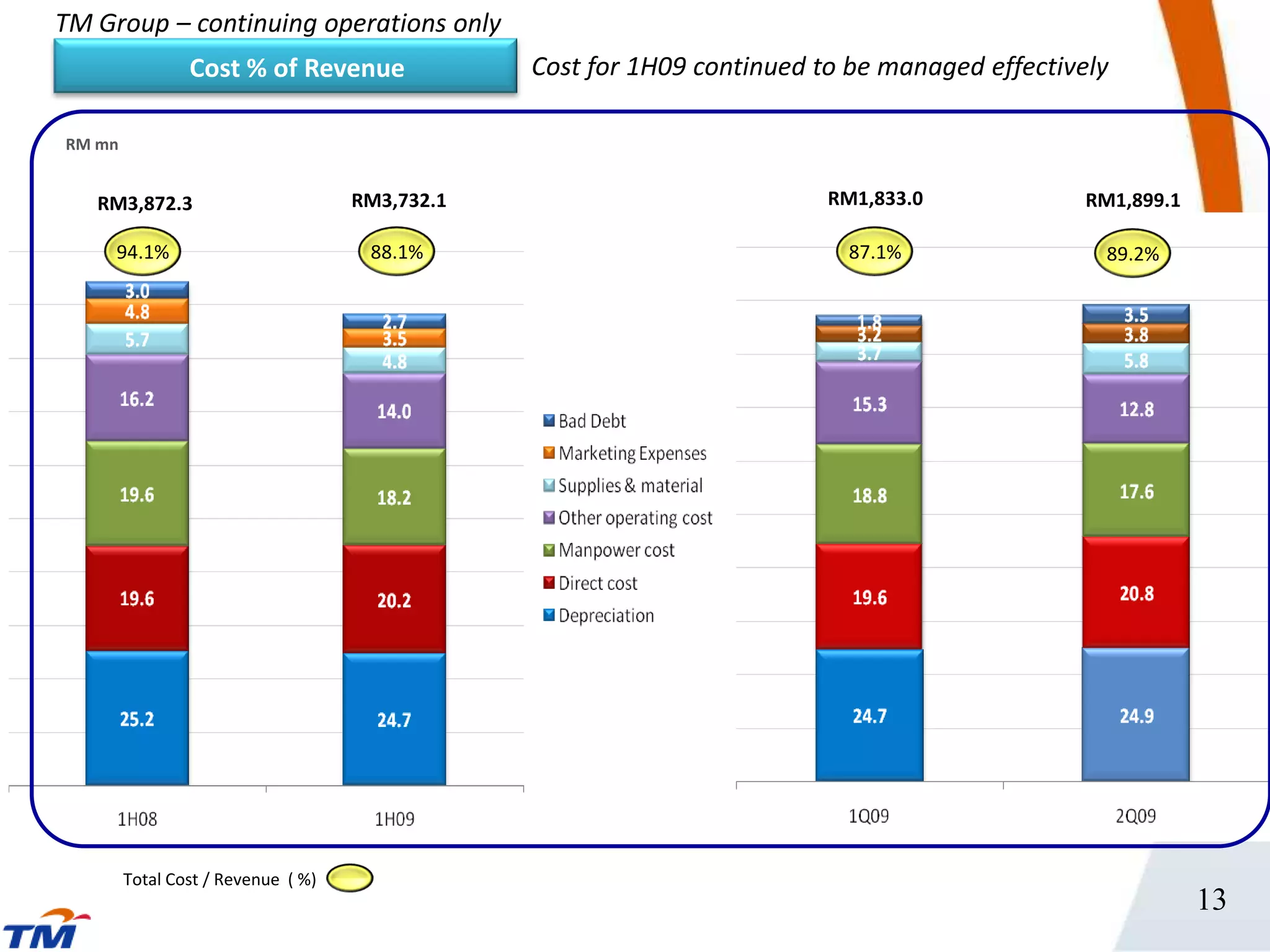

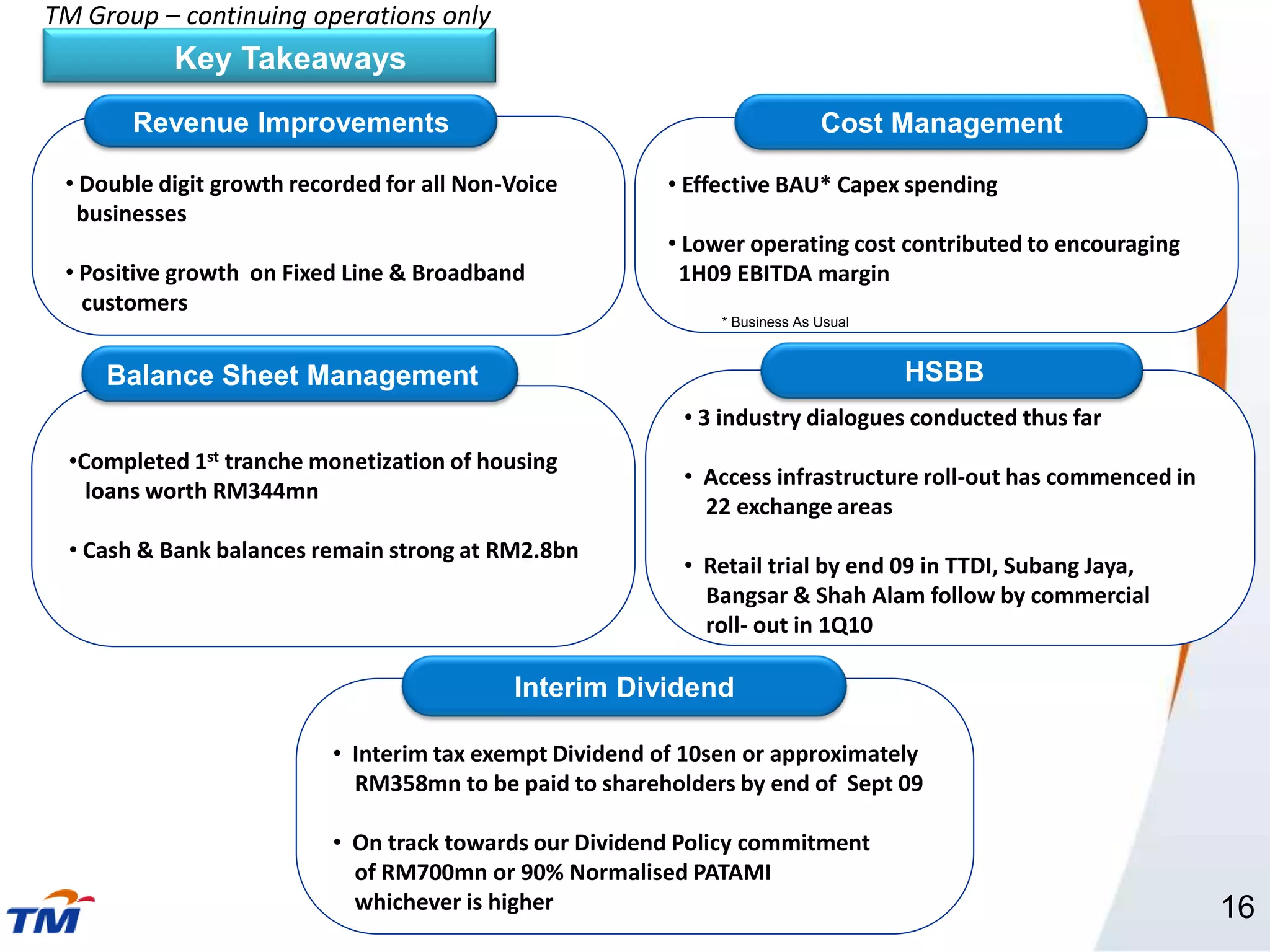

Telekom Malaysia Berhad reported its 1H 2009 results, showing a 2.9% increase in revenue compared to the previous quarter, driven by a 0.9% year-over-year growth in non-voice revenue. The company's EBITDA margin improved due to reduced operating costs and higher demand for broadband services, leading to a significant growth in fixed-line and broadband customers. However, the presentation includes forward-looking statements that suggest caution, as actual results may differ due to various risks and uncertainties.