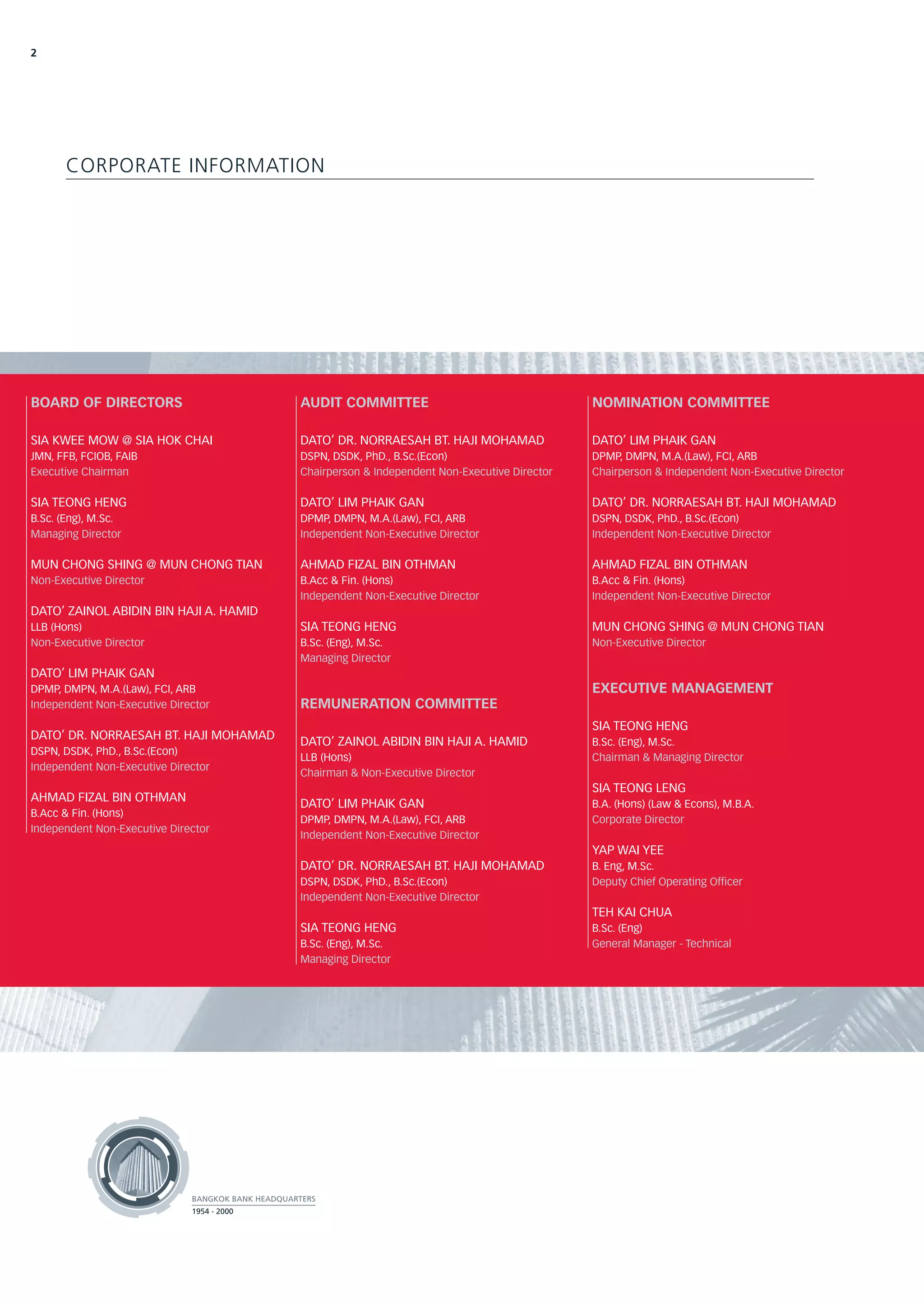

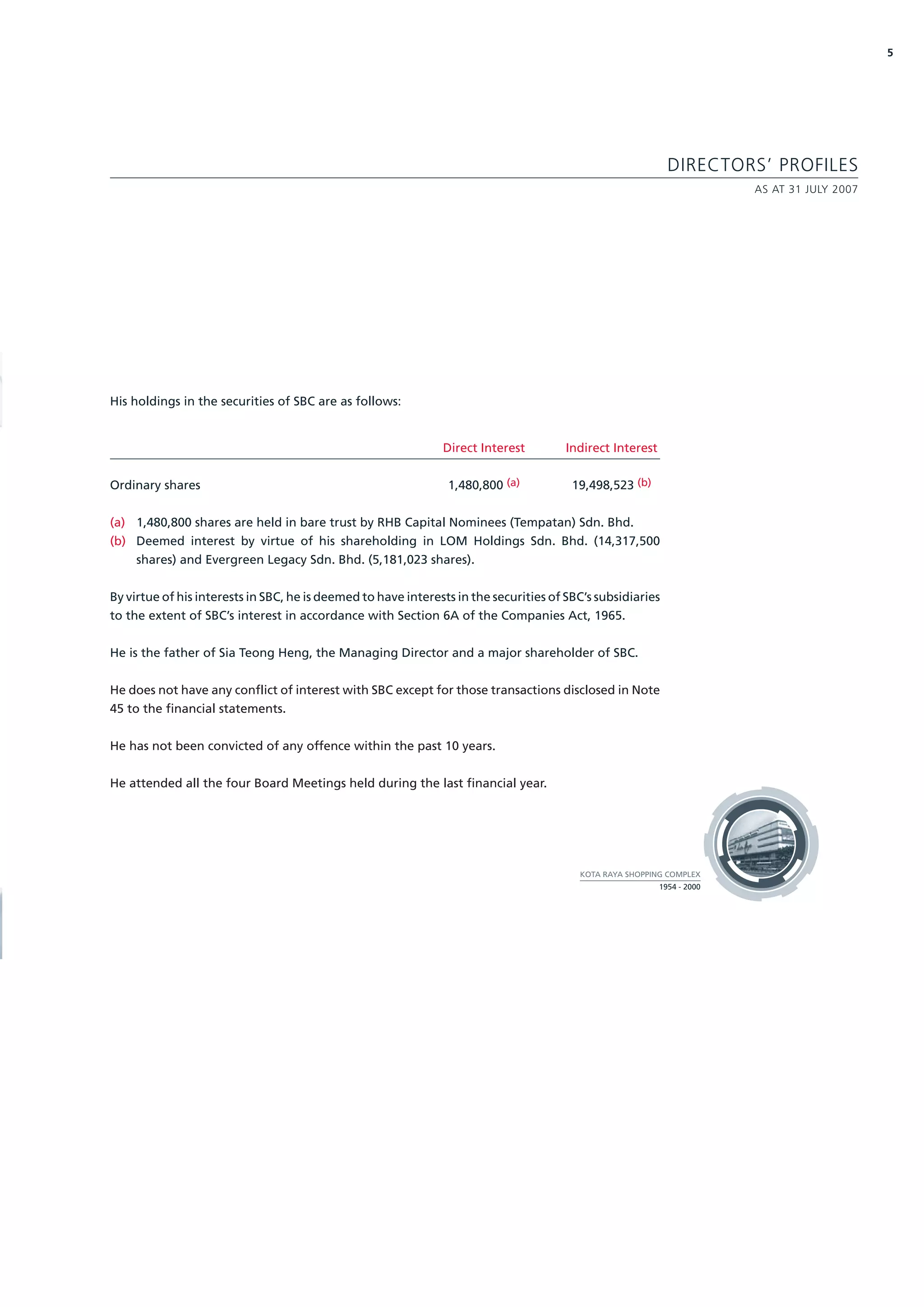

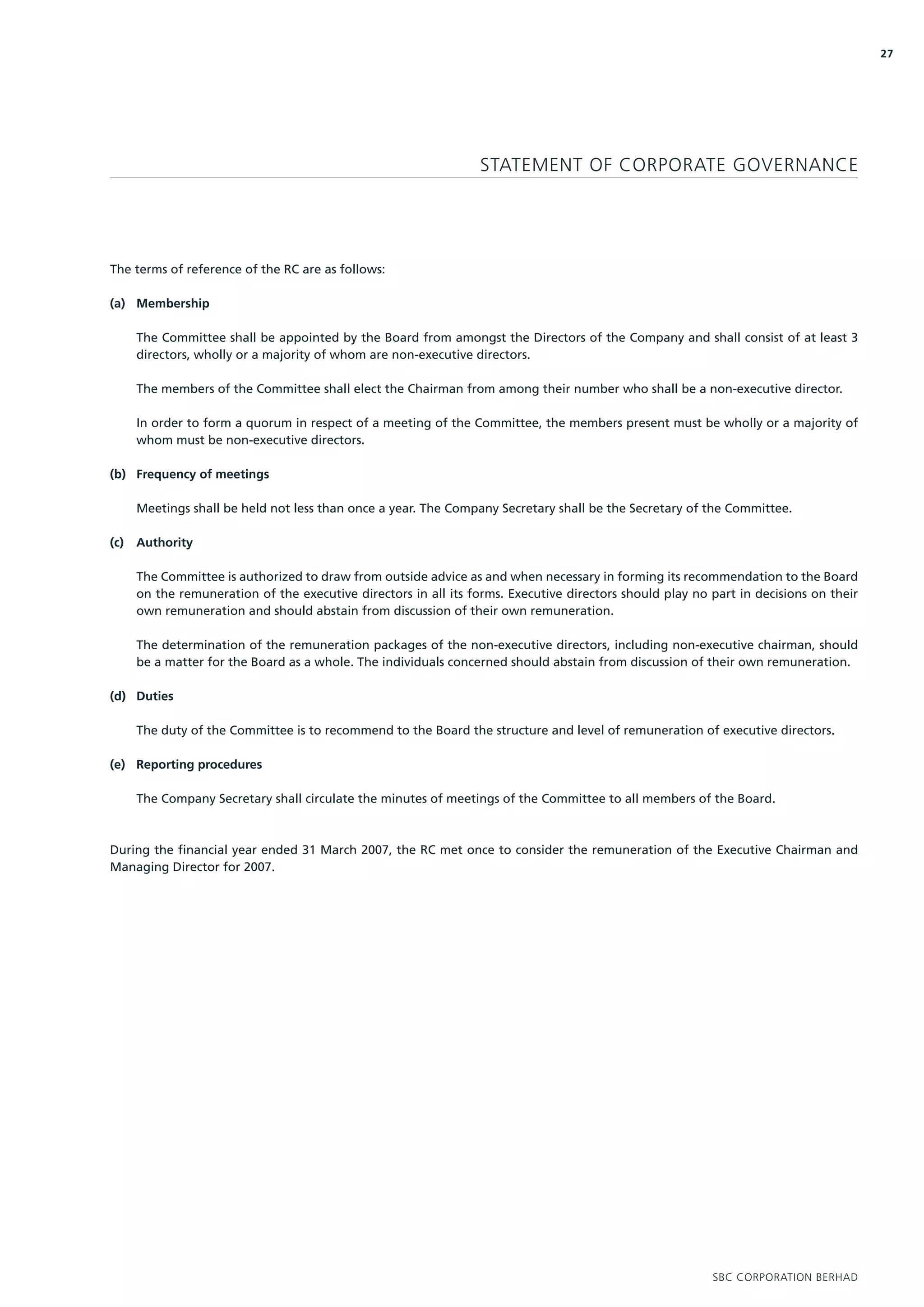

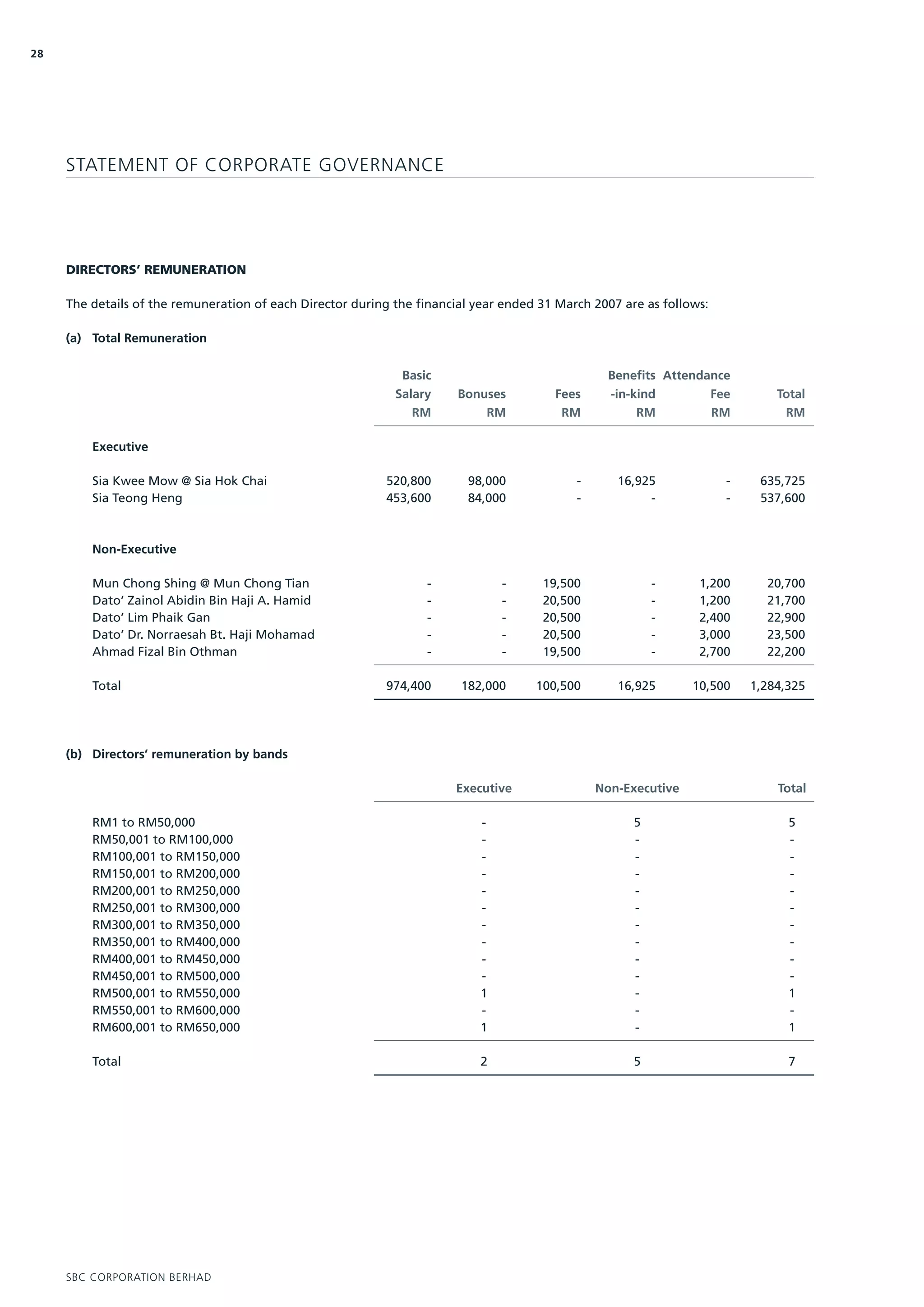

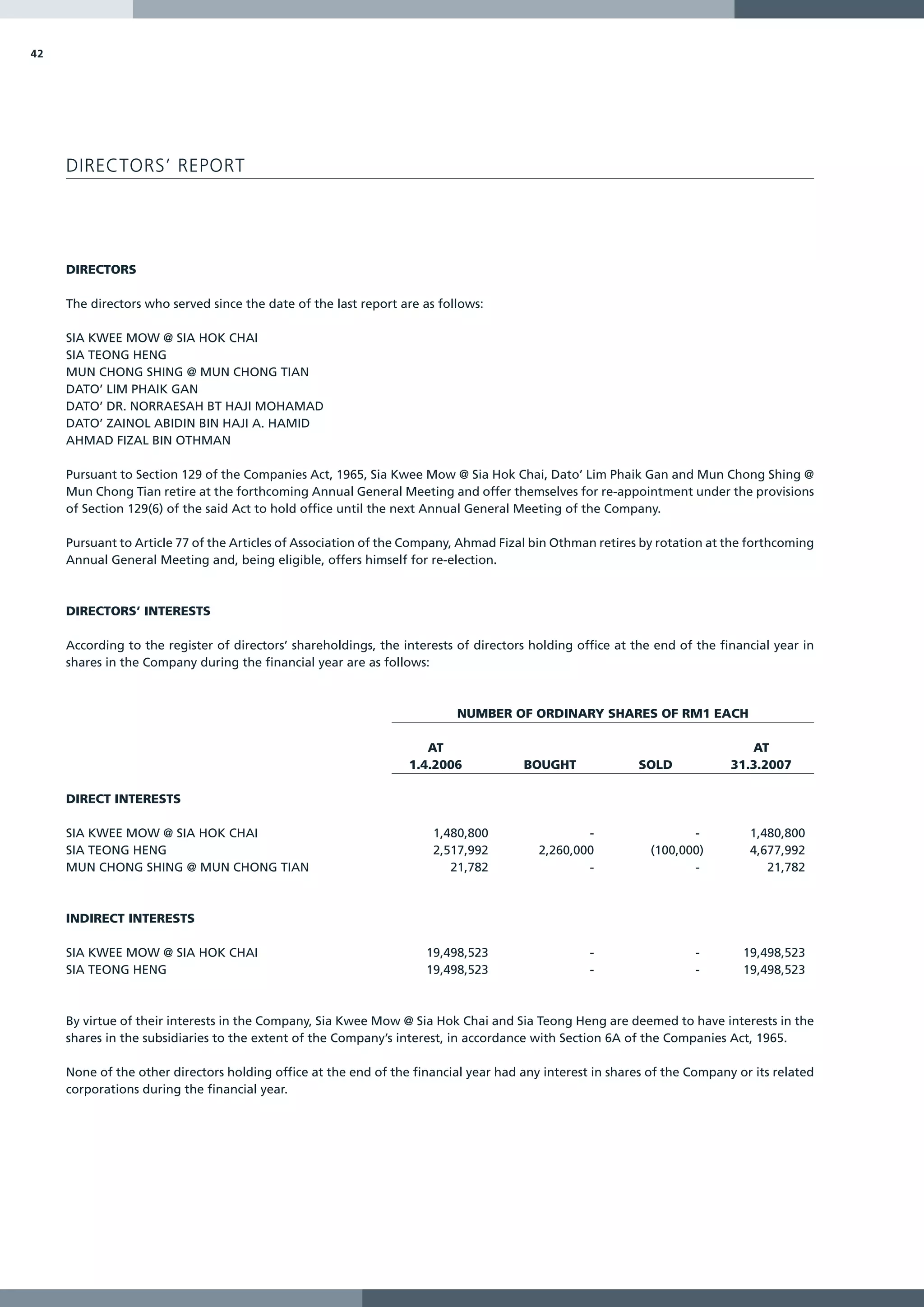

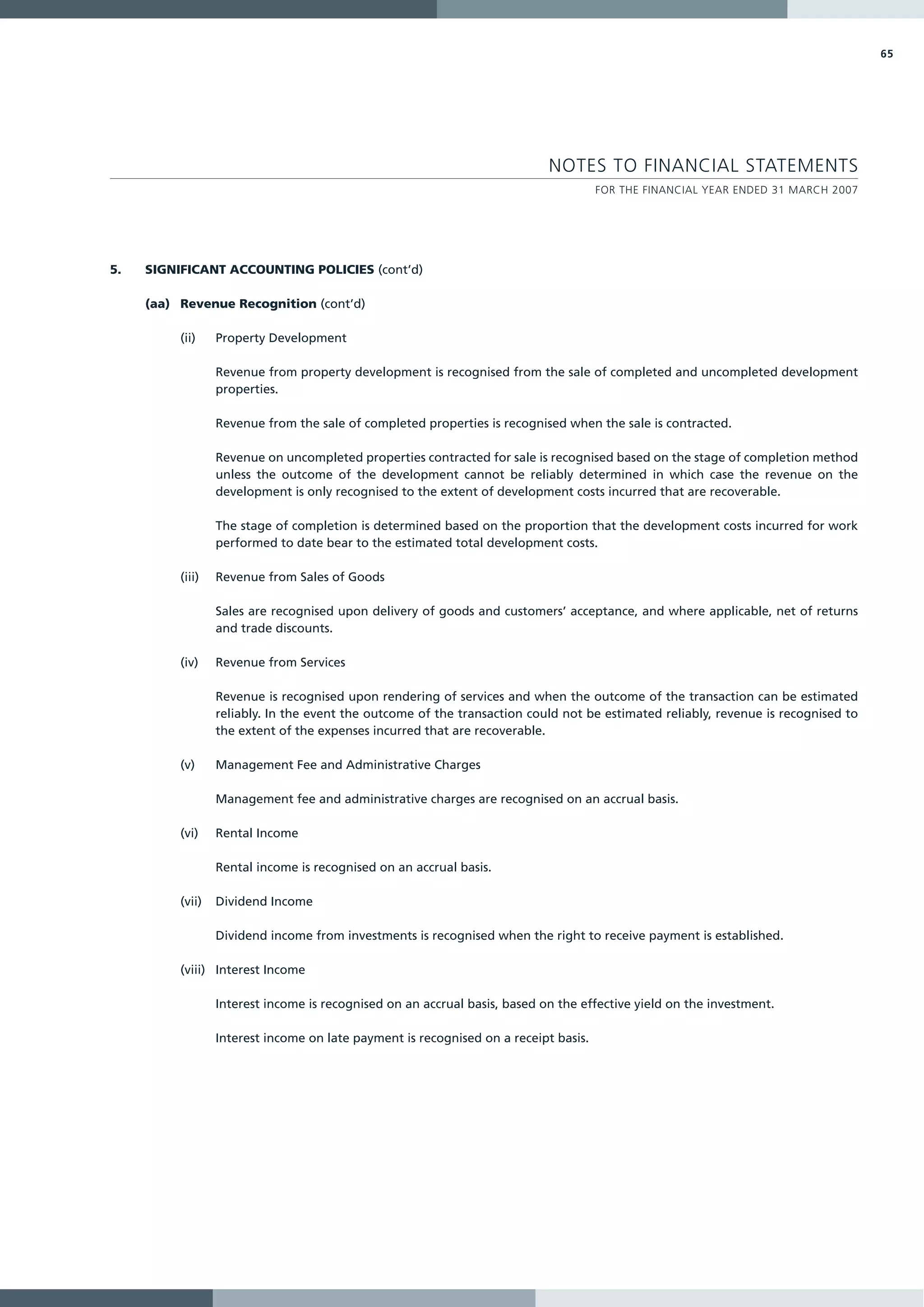

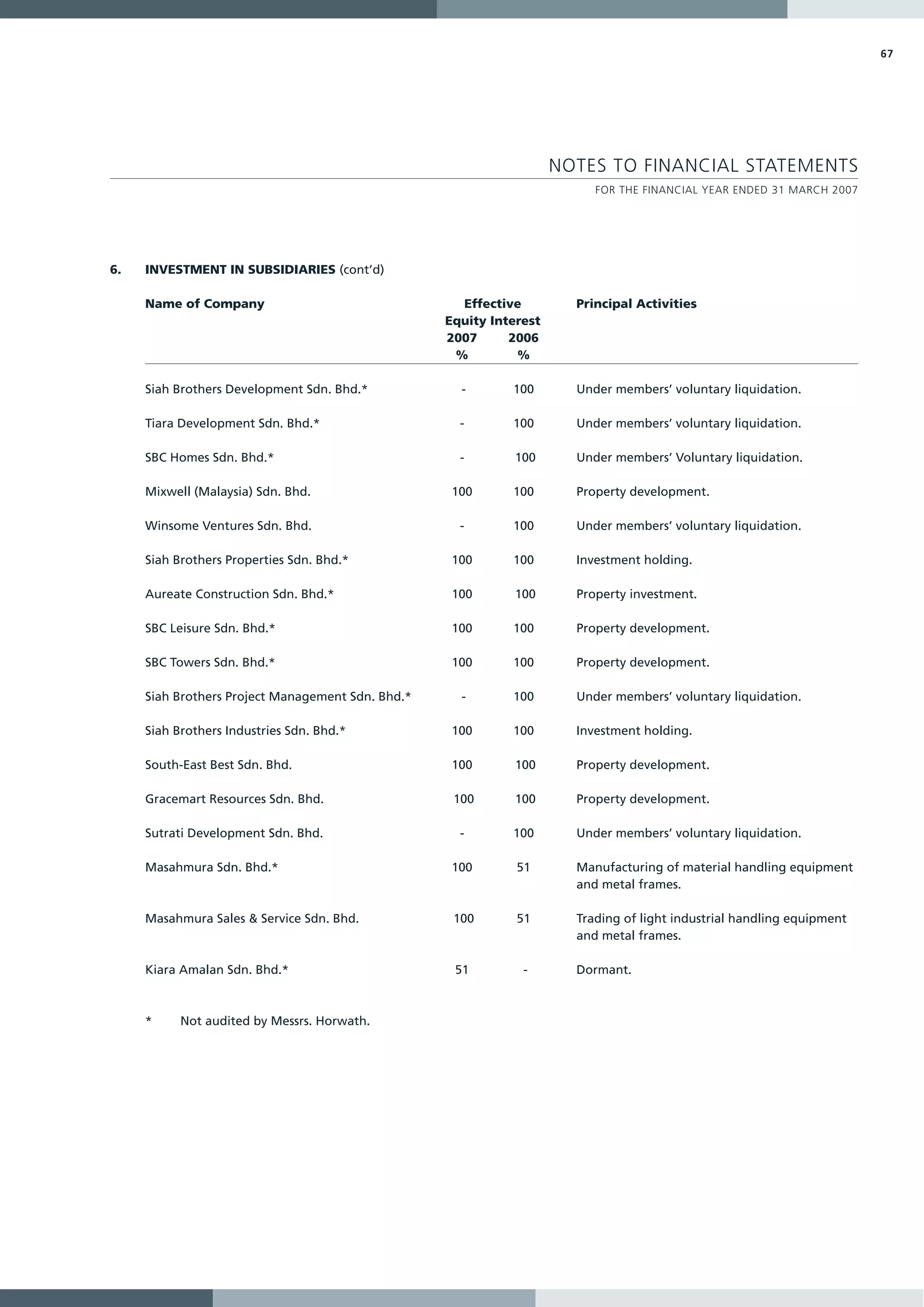

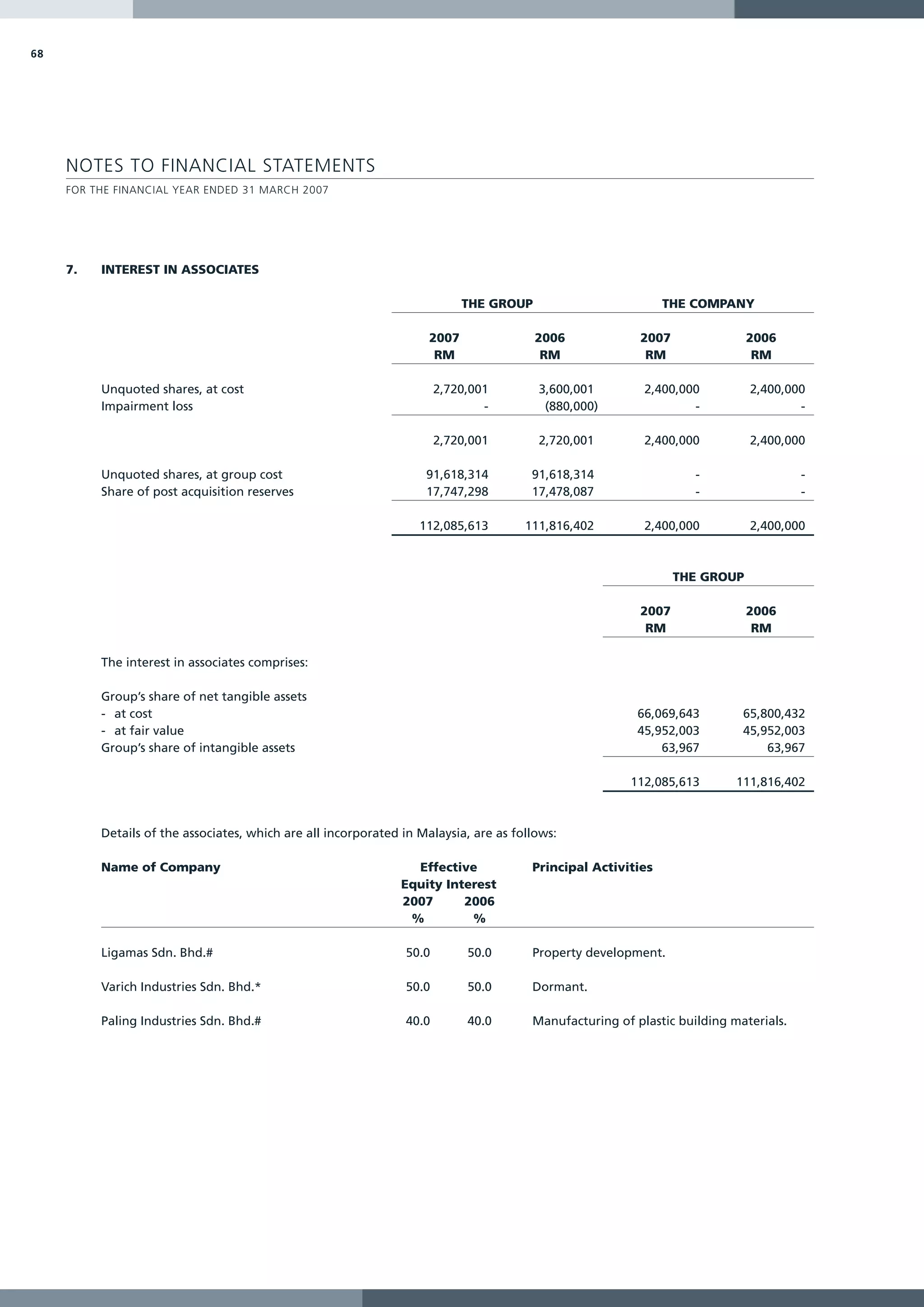

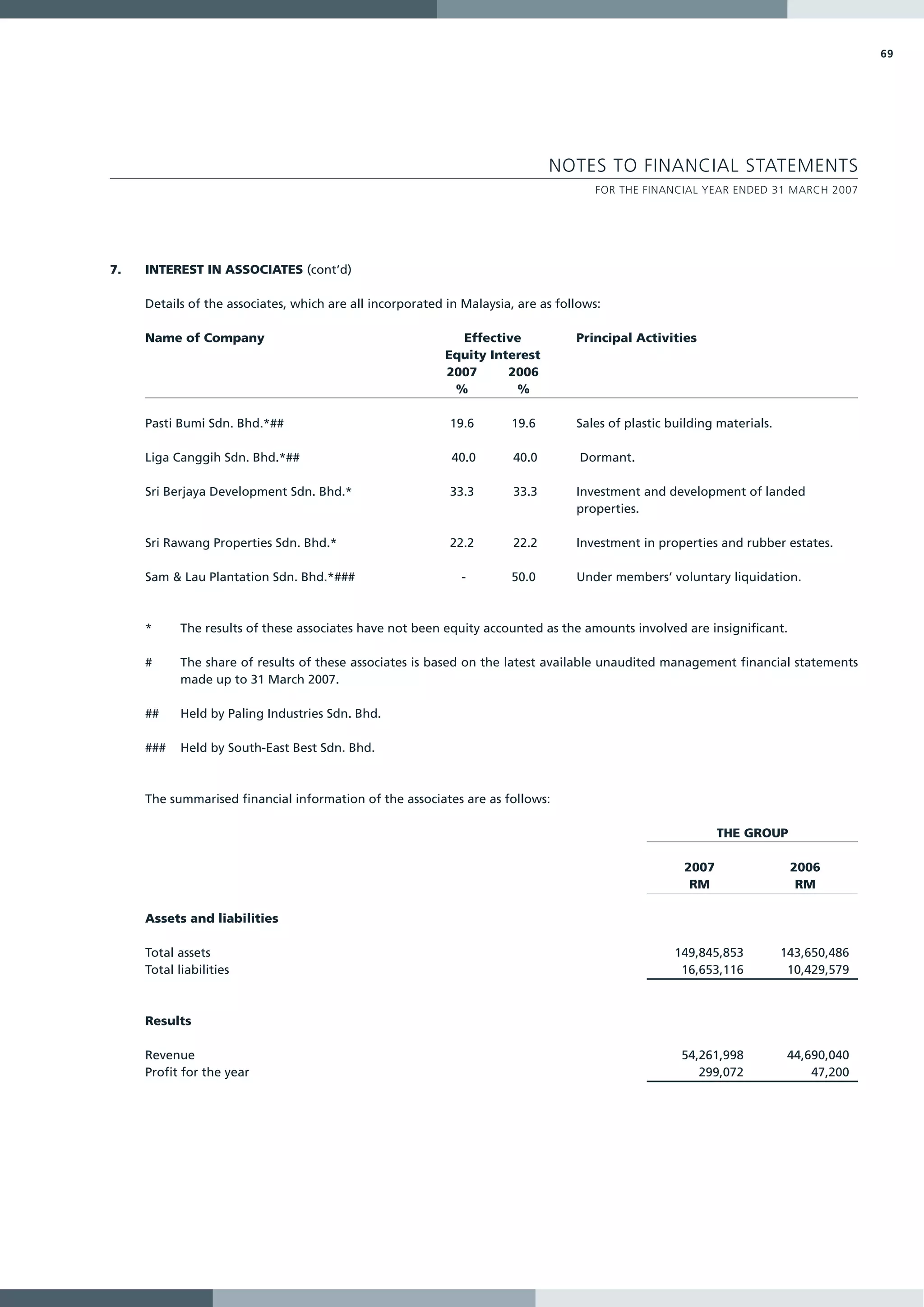

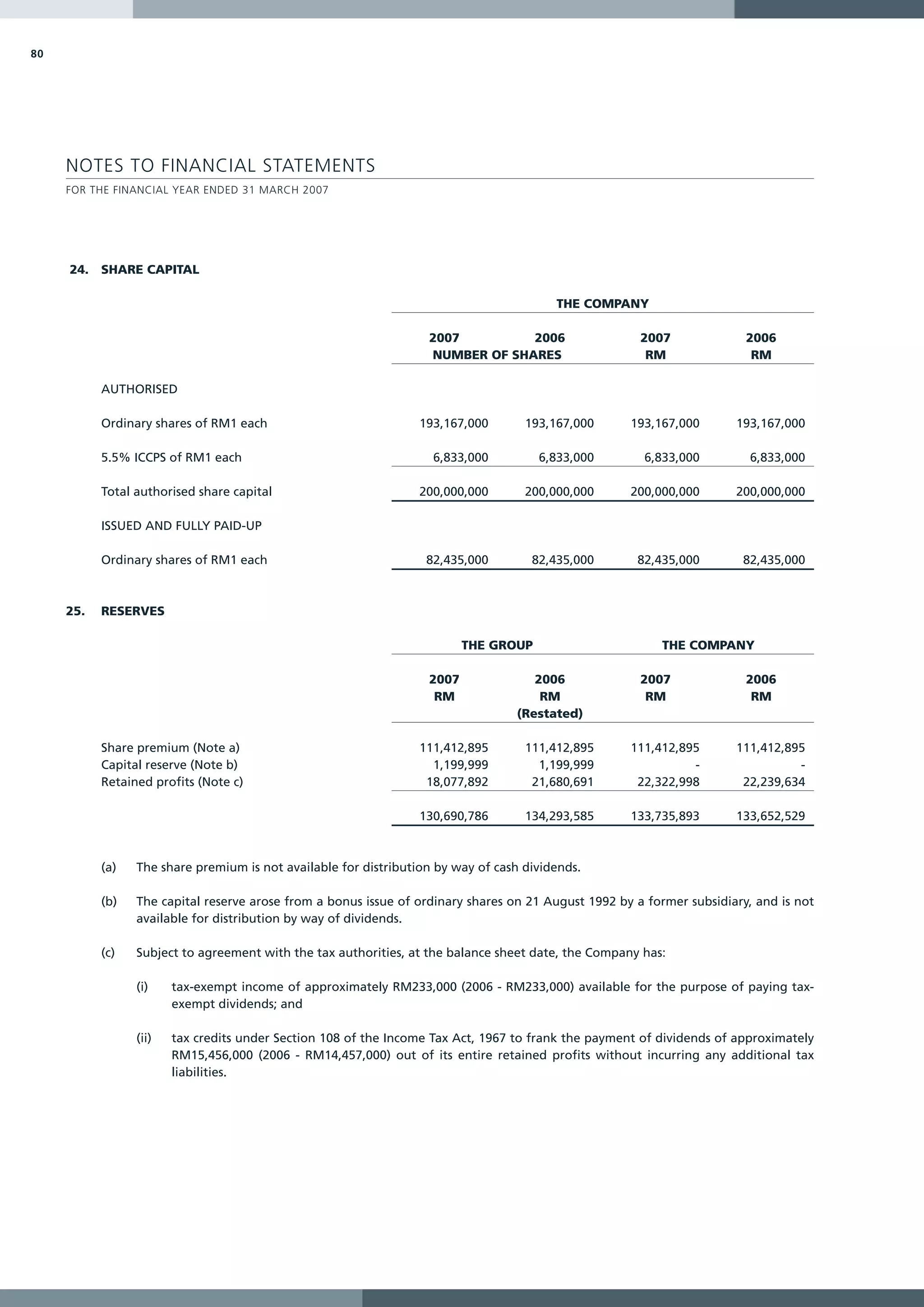

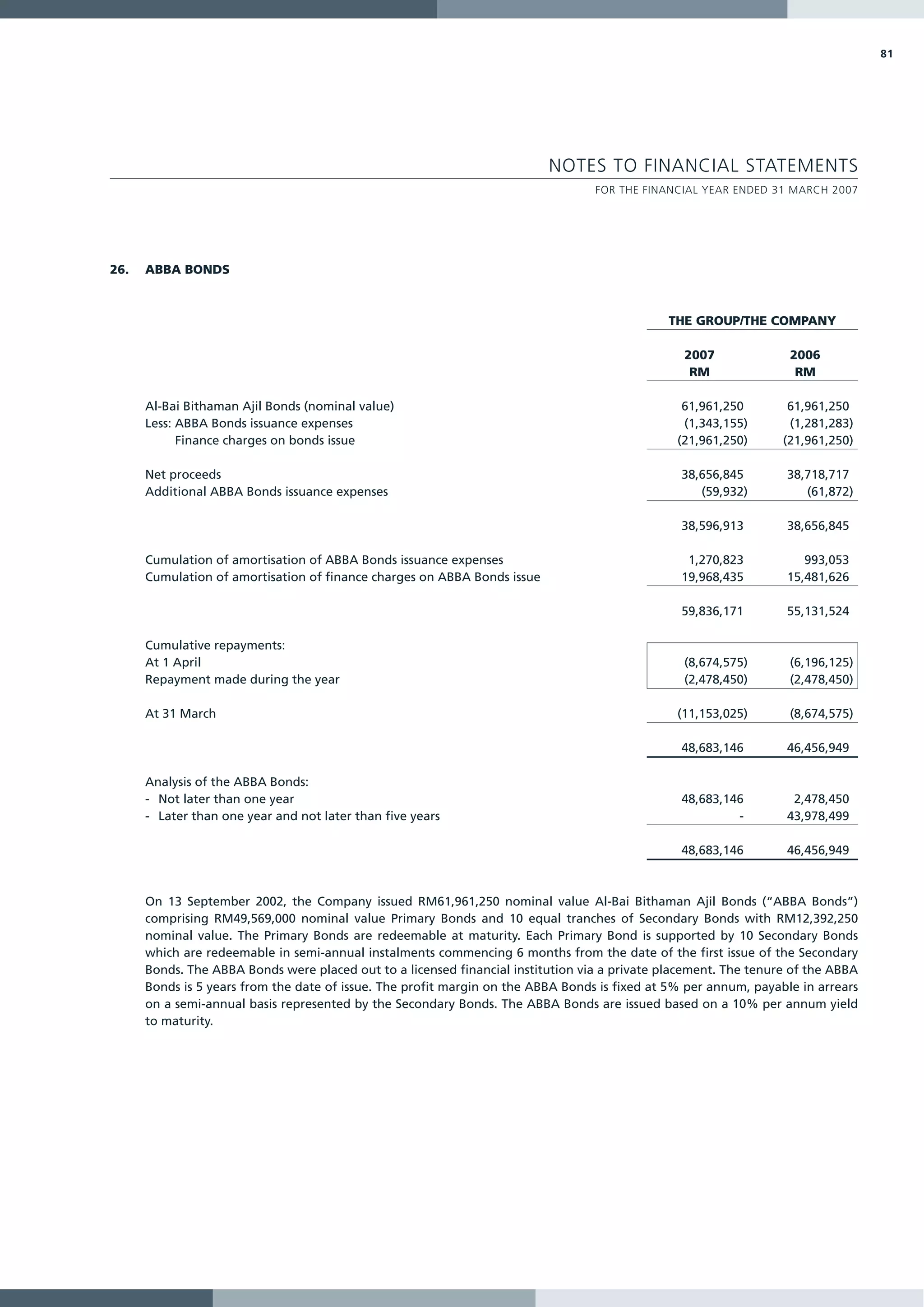

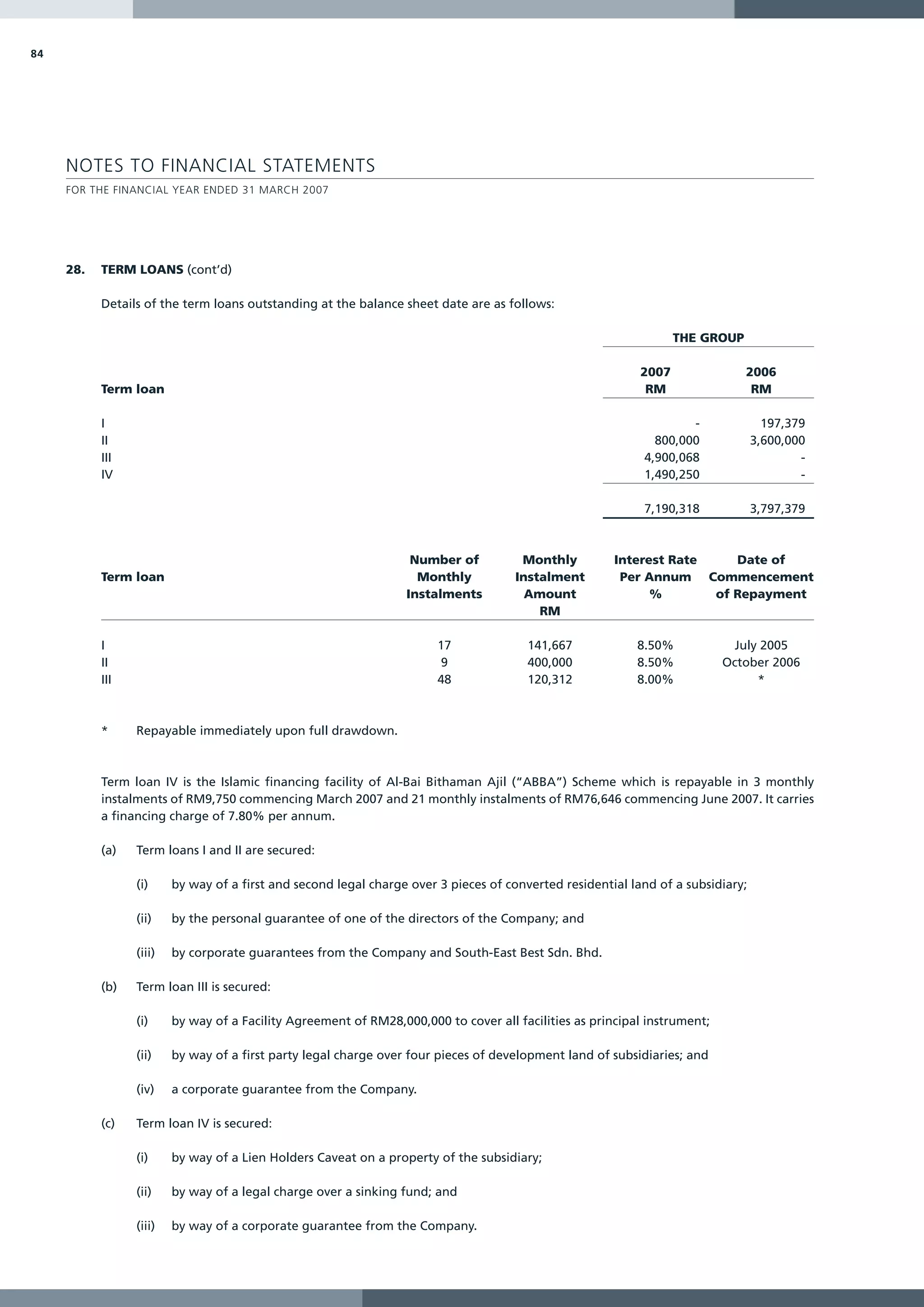

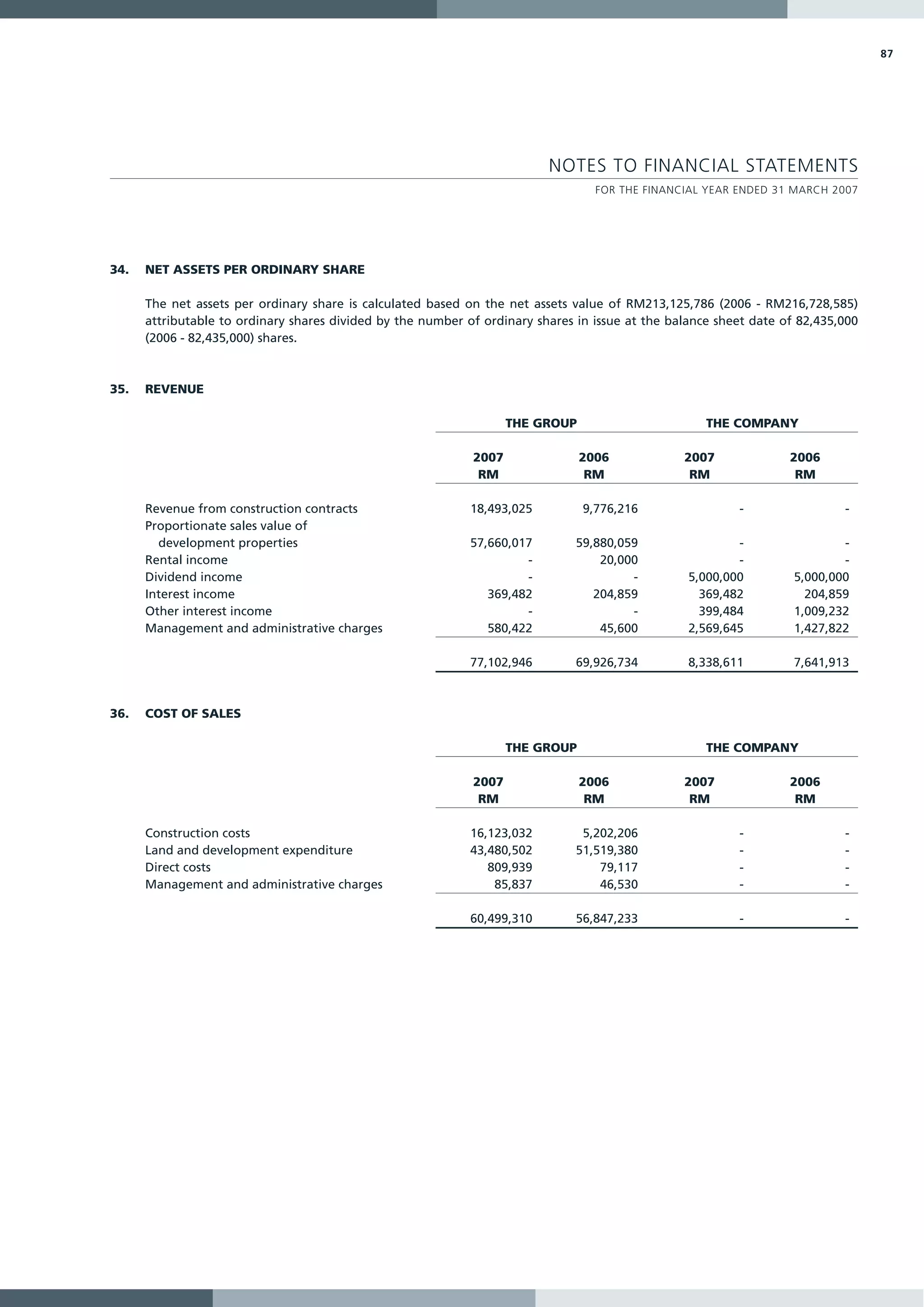

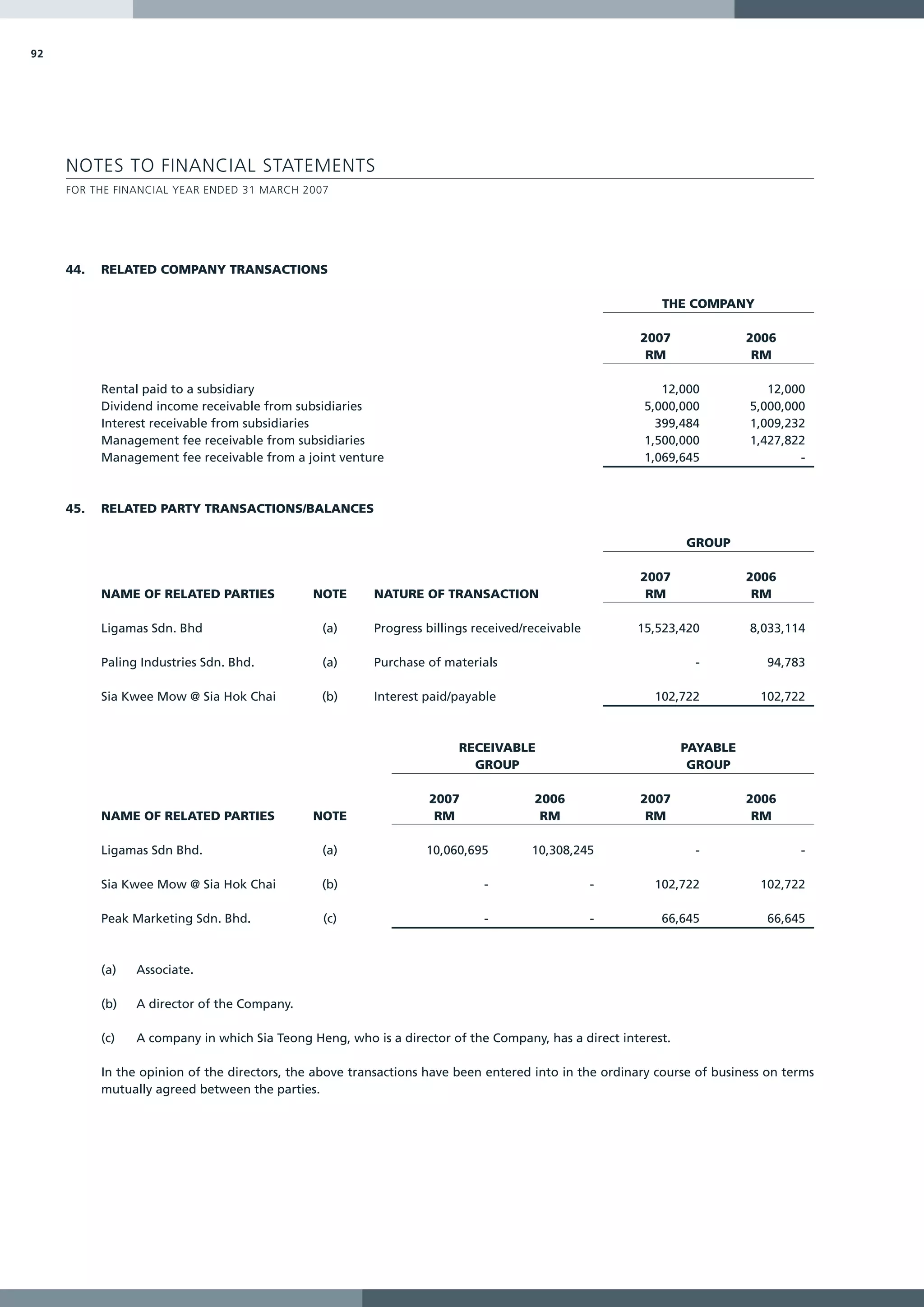

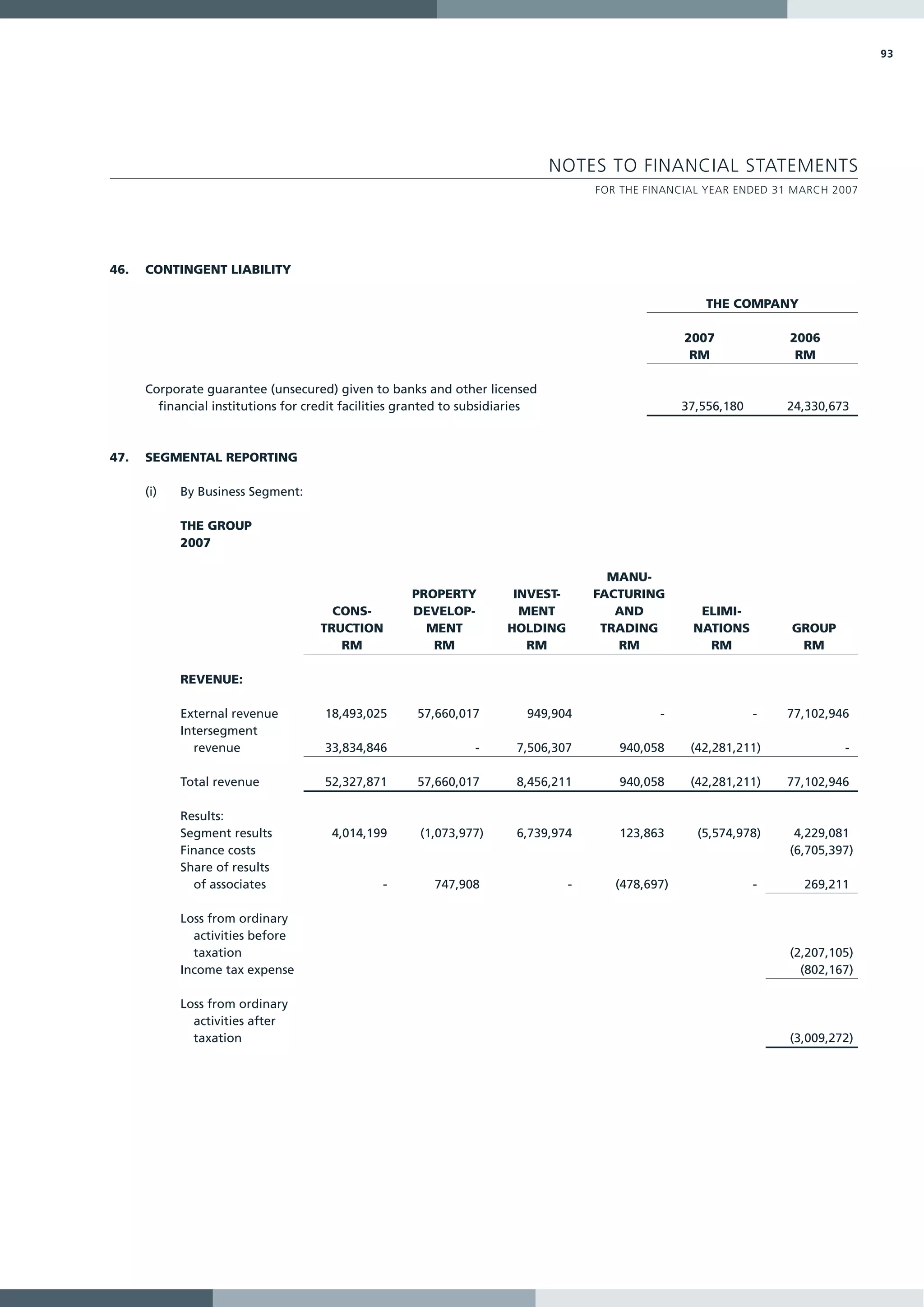

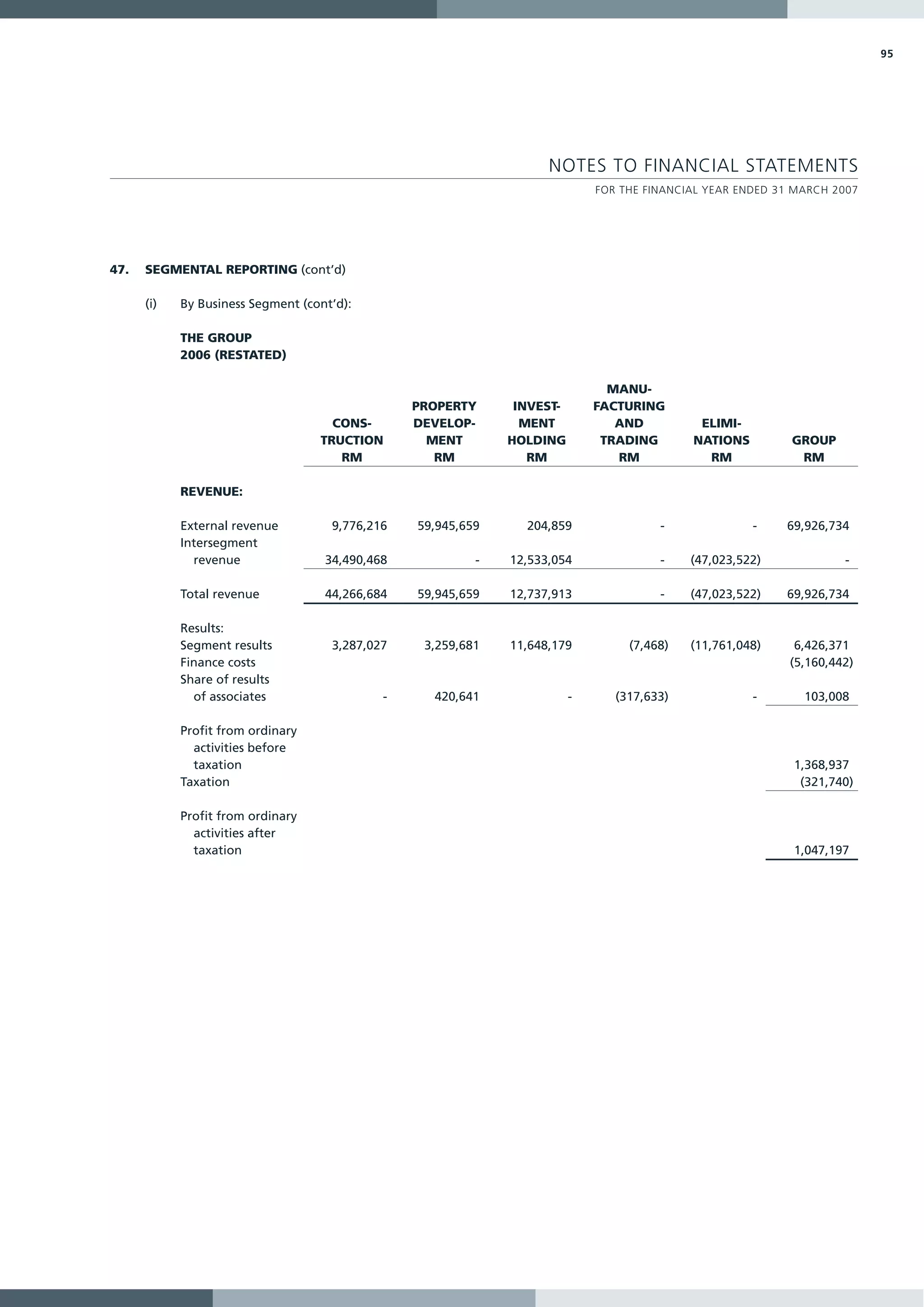

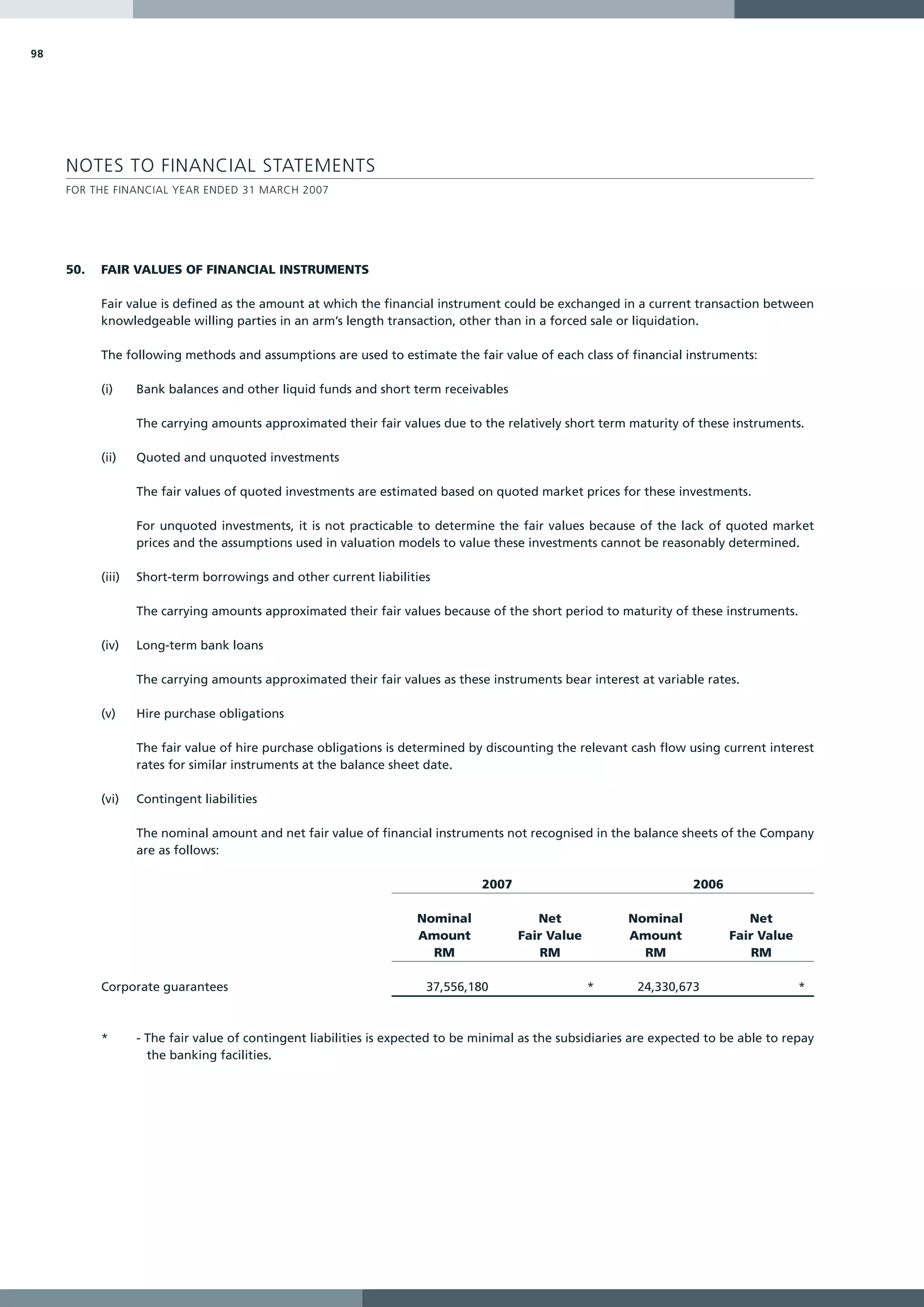

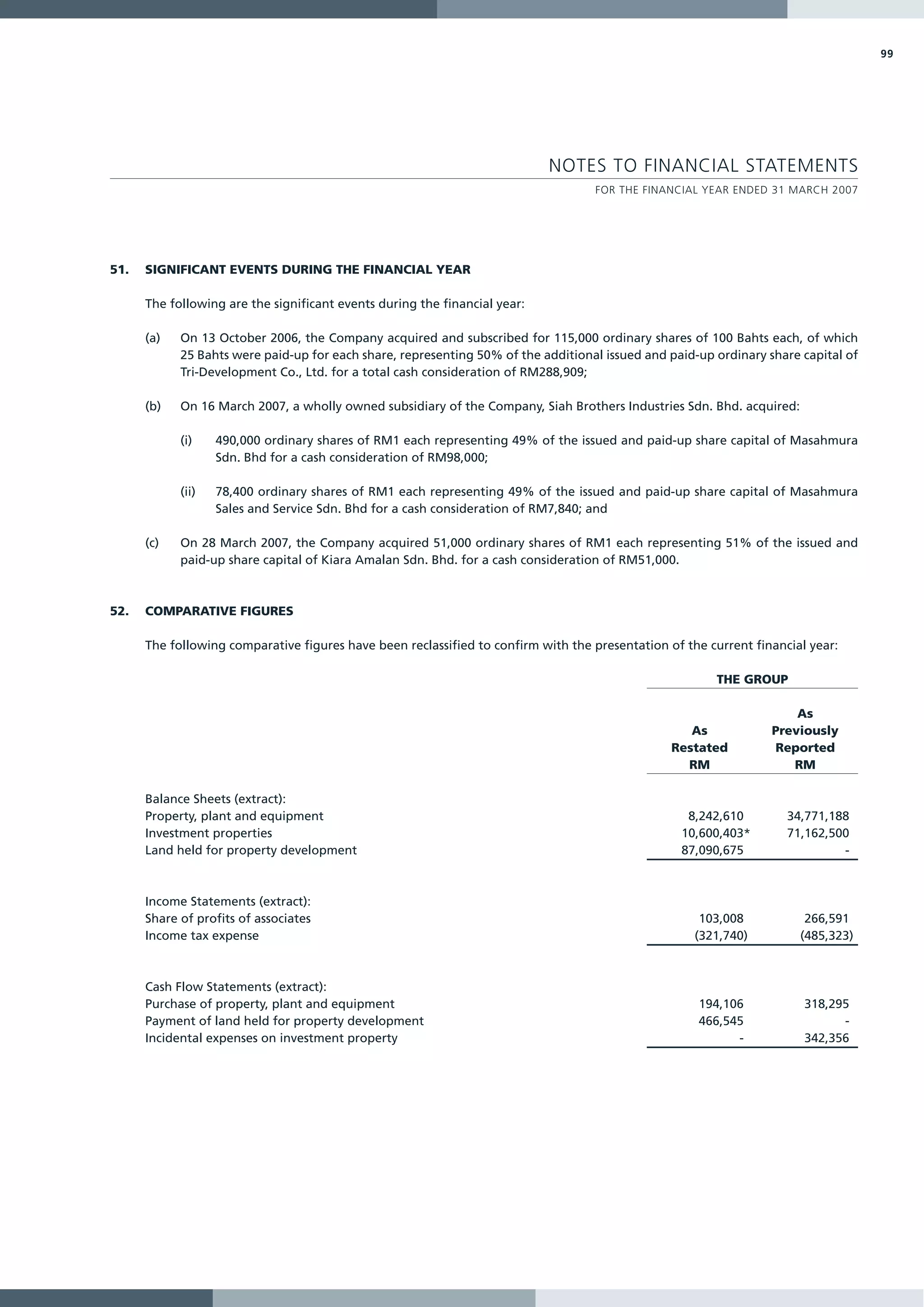

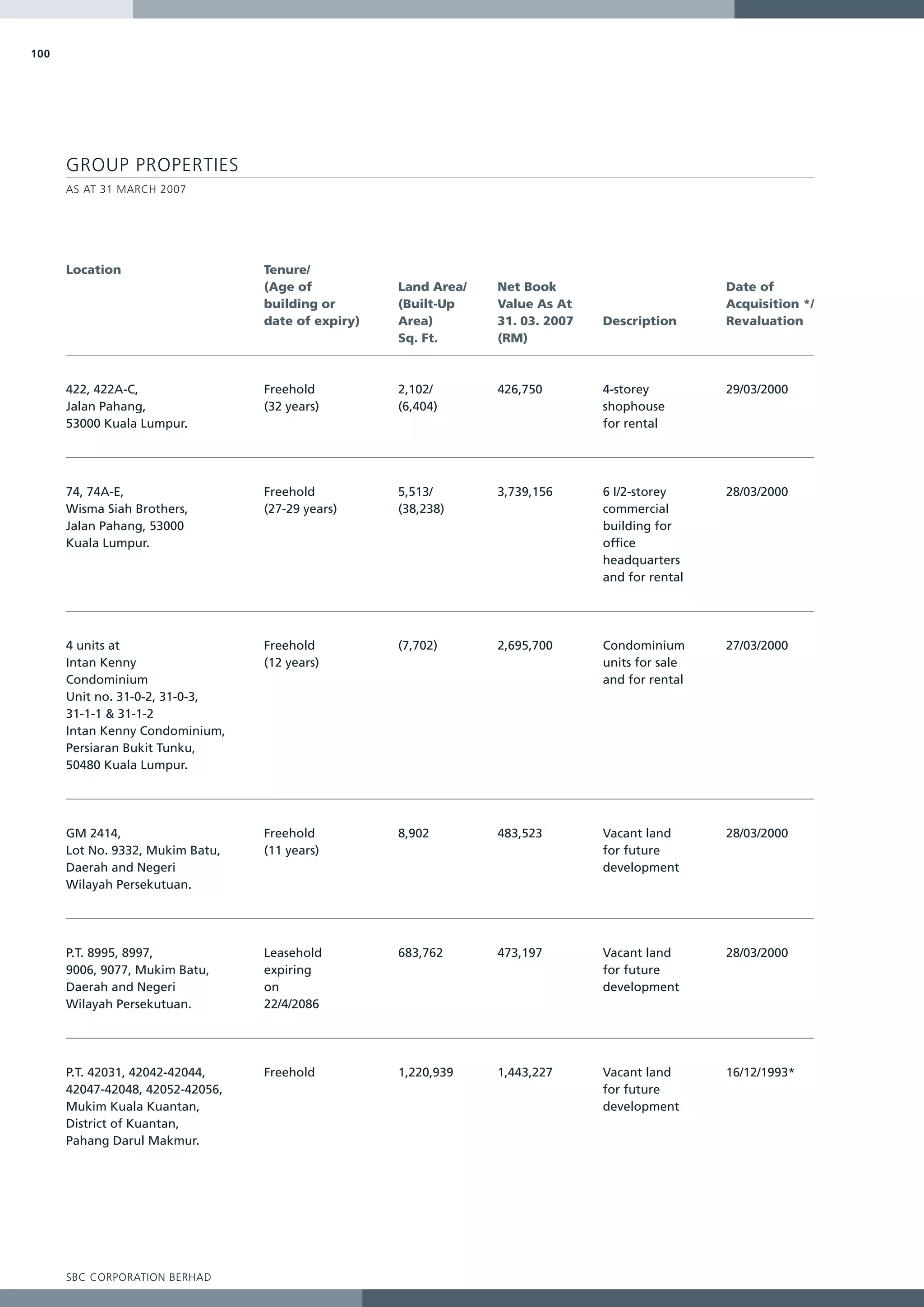

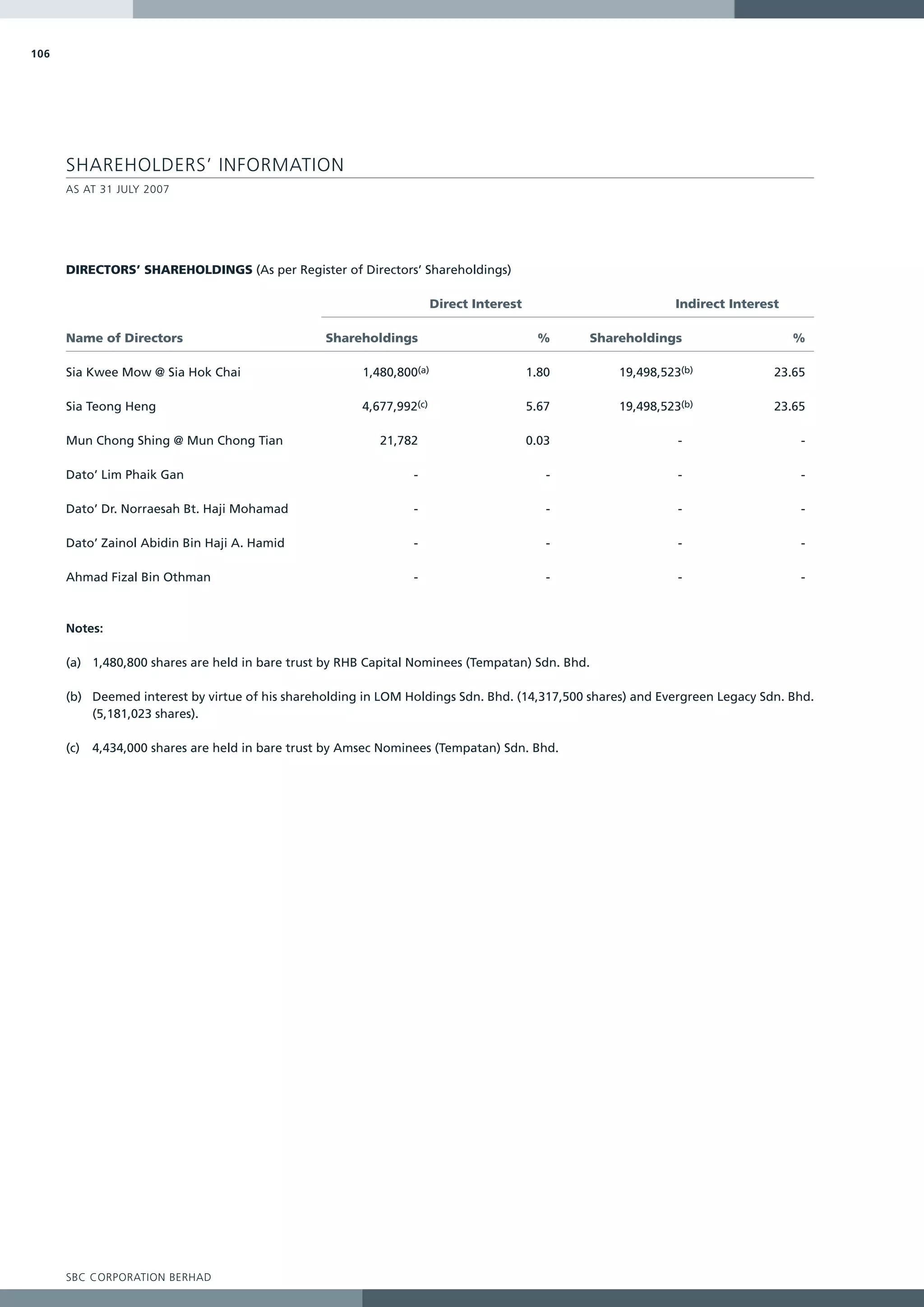

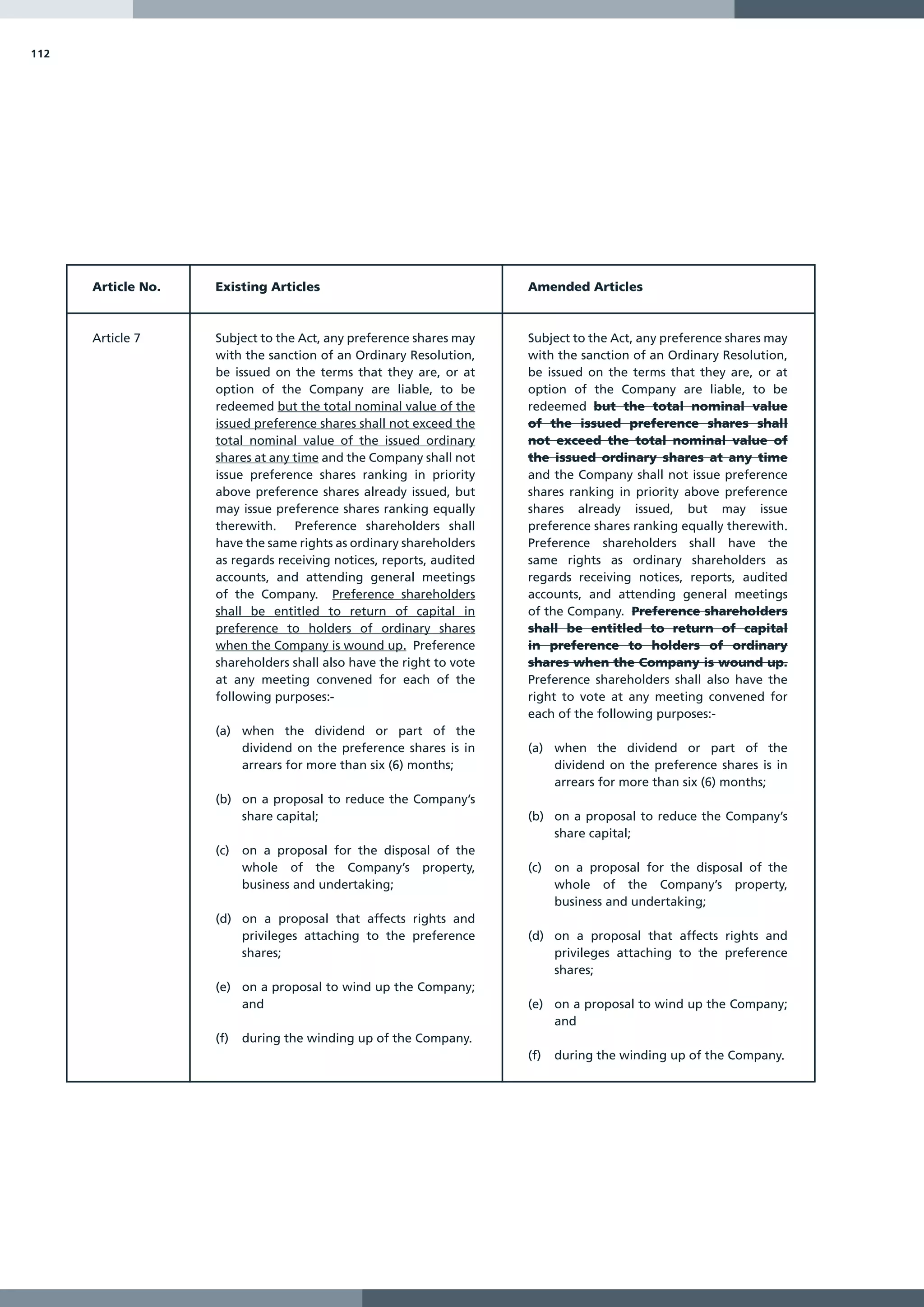

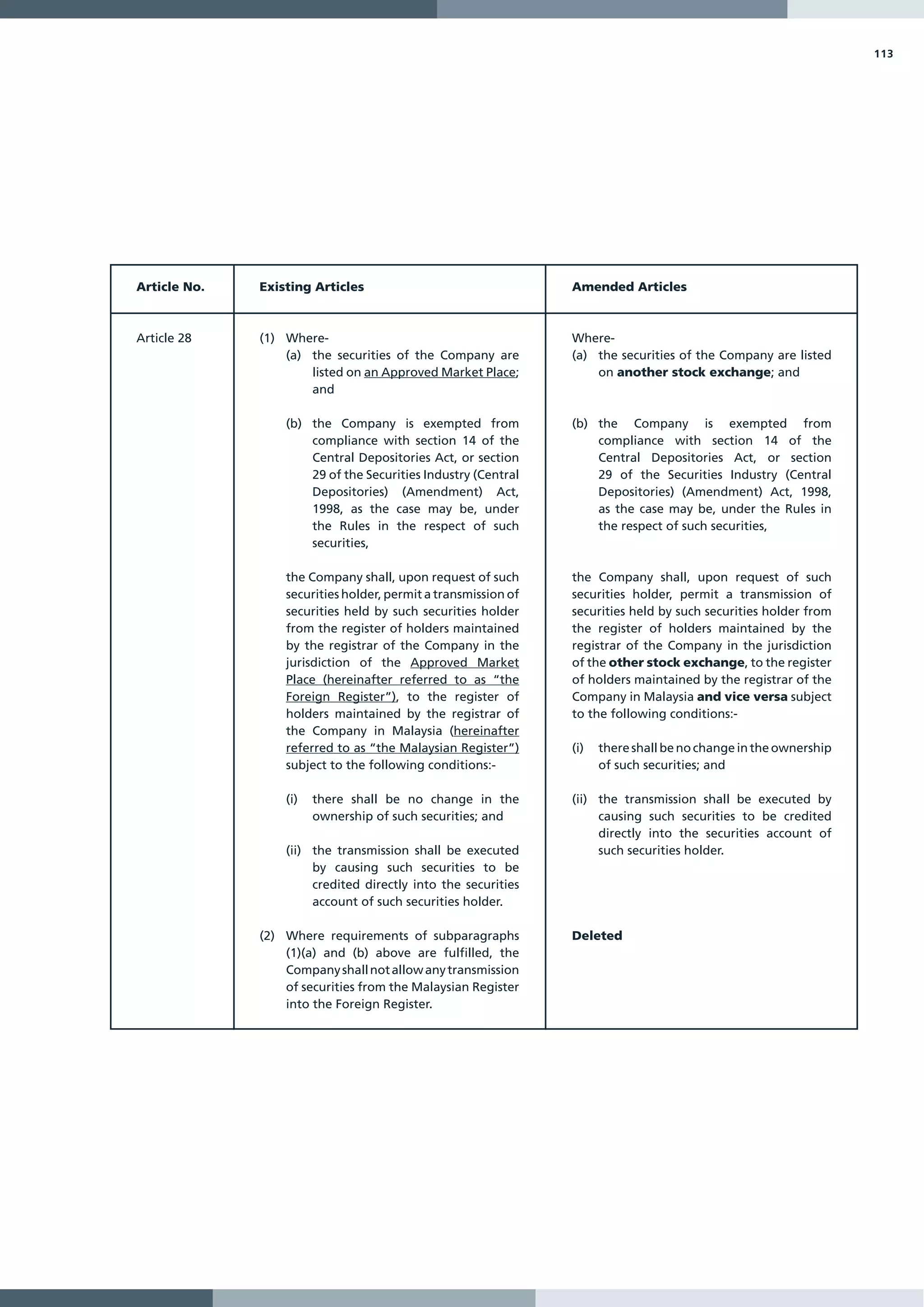

The document is SBC Corporation Berhad's 2007 Annual Report. It provides information on the company's board of directors, corporate structure, financial highlights, statements from the Executive Chairman and Managing Director, and other corporate governance information such as statements on internal control and audit committee report.