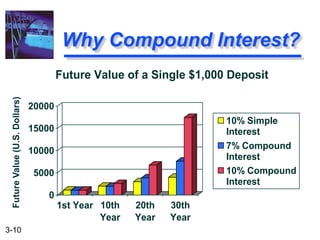

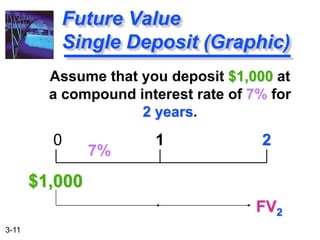

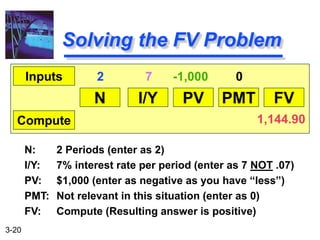

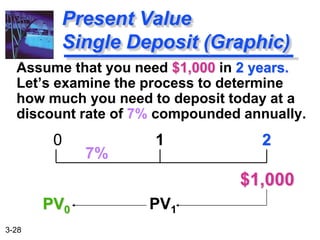

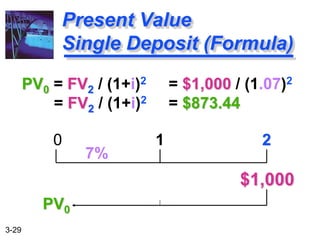

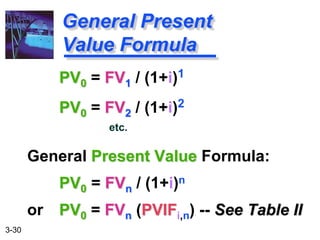

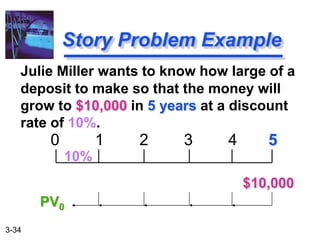

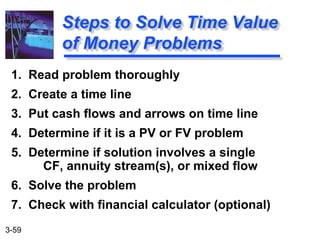

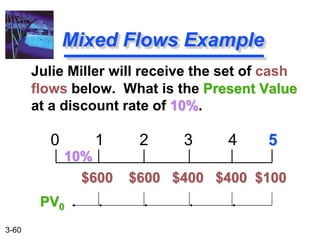

The document provides an overview of time value of money concepts including compound and simple interest, present and future value calculations, and annuities. It defines key terms, shows examples of calculations using formulas and tables, and step-by-step solutions to practice problems involving deposits, loans, and determining unknown values. The document aims to help readers understand how to adjust cash flows to a single point in time using interest rates and calculate future and present values.

![3-16

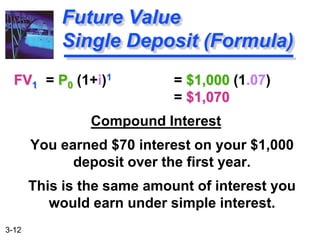

FV2 = $1,000 (FVIF7%,2)

= $1,000 (1.145)

= $1,145 [Due to Rounding]

Using Future Value Tables

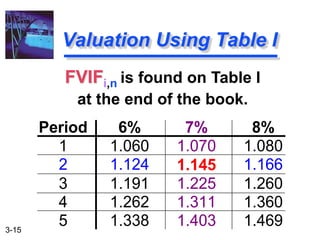

Period 6% 7% 8%

1 1.060 1.070 1.080

2 1.124 1.145 1.166

3 1.191 1.225 1.260

4 1.262 1.311 1.360

5 1.338 1.403 1.469](https://image.slidesharecdn.com/timevalueslide-210425170428/85/Time-value-slide-16-320.jpg)

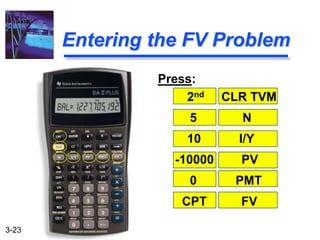

![3-22

Calculation based on Table I:

FV5 = $10,000 (FVIF10%, 5)

= $10,000 (1.611)

= $16,110 [Due to Rounding]

Story Problem Solution

Calculation based on general formula:

FVn = P0 (1+i)n

FV5 = $10,000 (1+ 0.10)5

= $16,105.10](https://image.slidesharecdn.com/timevalueslide-210425170428/85/Time-value-slide-22-320.jpg)

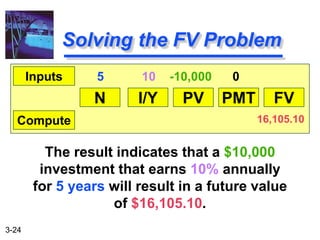

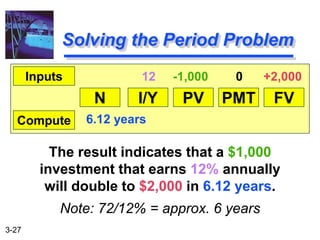

![3-26

Approx. Years to Double = 72 / i%

72 / 12% = 6 Years

[Actual Time is 6.12 Years]

The “Rule-of-72”

Quick! How long does it take to

double $5,000 at a compound rate

of 12% per year (approx.)?](https://image.slidesharecdn.com/timevalueslide-210425170428/85/Time-value-slide-26-320.jpg)

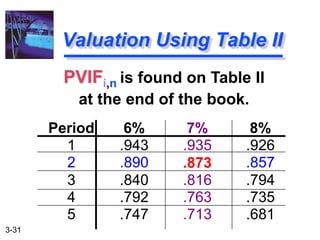

![3-32

PV2 = $1,000 (PVIF7%,2)

= $1,000 (.873)

= $873 [Due to Rounding]

Using Present Value Tables

Period 6% 7% 8%

1 .943 .935 .926

2 .890 .873 .857

3 .840 .816 .794

4 .792 .763 .735

5 .747 .713 .681](https://image.slidesharecdn.com/timevalueslide-210425170428/85/Time-value-slide-32-320.jpg)

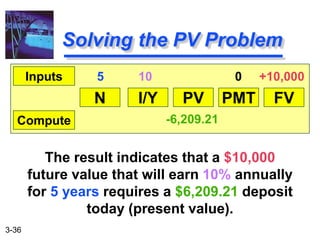

![3-35

Calculation based on general formula:

PV0 = FVn / (1+i)n

PV0 = $10,000 / (1+ 0.10)5

= $6,209.21

Calculation based on Table I:

PV0 = $10,000 (PVIF10%, 5)

= $10,000 (.621)

= $6,210.00 [Due to Rounding]

Story Problem Solution](https://image.slidesharecdn.com/timevalueslide-210425170428/85/Time-value-slide-35-320.jpg)

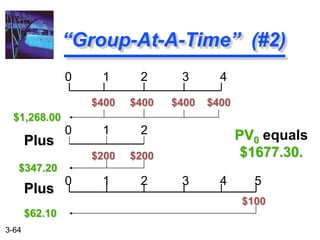

![3-63

“Group-At-A-Time” (#1)

0 1 2 3 4 5

$600 $600 $400 $400 $100

10%

$1,041.60

$ 573.57

$ 62.10

$1,677.27 = PV0 of Mixed Flow [Using Tables]

$600(PVIFA10%,2) = $600(1.736) = $1,041.60

$400(PVIFA10%,2)(PVIF10%,2) = $400(1.736)(0.826) = $573.57

$100 (PVIF10%,5) = $100 (0.621) = $62.10](https://image.slidesharecdn.com/timevalueslide-210425170428/85/Time-value-slide-63-320.jpg)

![3-69

General Formula:

FVn = PV0(1 + [i/m])mn

n: Number of Years

m: Compounding Periods per Year

i: Annual Interest Rate

FVn,m: FV at the end of Year n

PV0: PV of the Cash Flow today

Frequency of

Compounding](https://image.slidesharecdn.com/timevalueslide-210425170428/85/Time-value-slide-69-320.jpg)

![3-70

Julie Miller has $1,000 to invest for 2

Years at an annual interest rate of

12%.

Annual FV2 = 1,000(1+ [.12/1])(1)(2)

= 1,254.40

Semi FV2 = 1,000(1+ [.12/2])(2)(2)

= 1,262.48

Impact of Frequency](https://image.slidesharecdn.com/timevalueslide-210425170428/85/Time-value-slide-70-320.jpg)

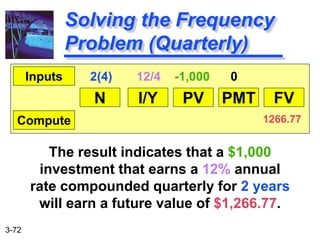

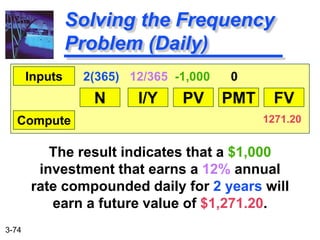

![3-71

Qrtly FV2 = 1,000(1+ [.12/4])(4)(2)

= 1,266.77

Monthly FV2 = 1,000(1+ [.12/12])(12)(2)

= 1,269.73

Daily FV2 = 1,000(1+[.12/365])(365)(2)

= 1,271.20

Impact of Frequency](https://image.slidesharecdn.com/timevalueslide-210425170428/85/Time-value-slide-71-320.jpg)

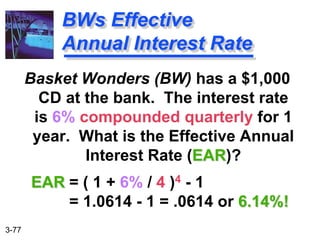

![3-76

Effective Annual Interest Rate

The actual rate of interest earned

(paid) after adjusting the nominal

rate for factors such as the number

of compounding periods per year.

(1 + [ i / m ] )m - 1

Effective Annual

Interest Rate](https://image.slidesharecdn.com/timevalueslide-210425170428/85/Time-value-slide-76-320.jpg)

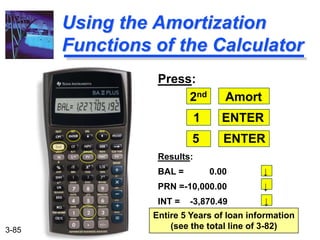

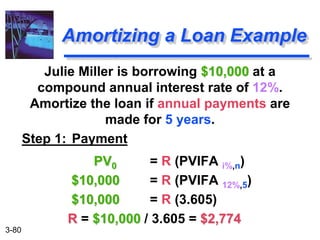

![3-81

Amortizing a Loan Example

End of

Year

Payment Interest Principal Ending

Balance

0 --- --- --- $10,000

1 $2,774 $1,200 $1,574 8,426

2 2,774 1,011 1,763 6,663

3 2,774 800 1,974 4,689

4 2,774 563 2,211 2,478

5 2,775 297 2,478 0

$13,871 $3,871 $10,000

[Last Payment Slightly Higher Due to Rounding]](https://image.slidesharecdn.com/timevalueslide-210425170428/85/Time-value-slide-81-320.jpg)