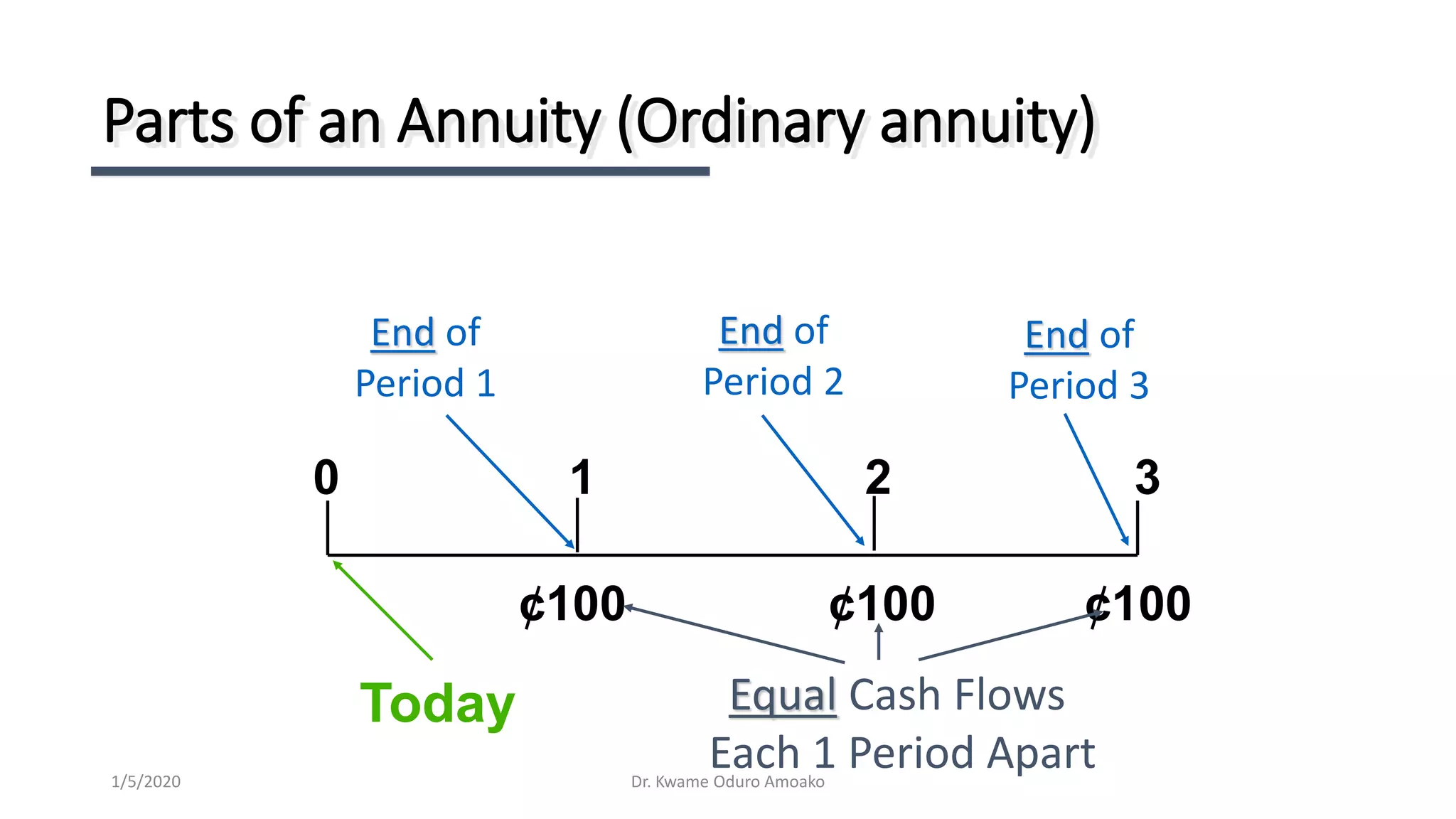

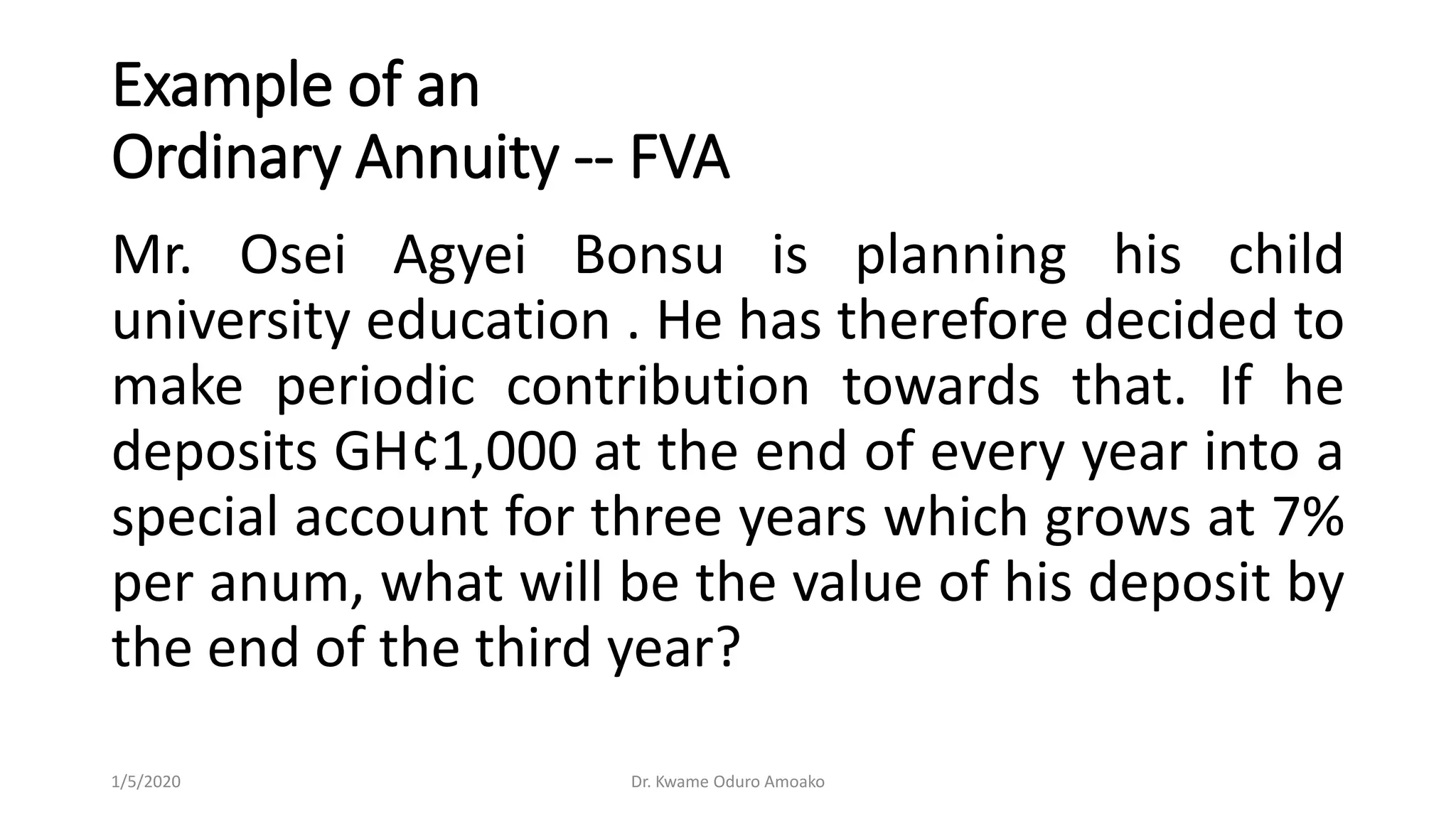

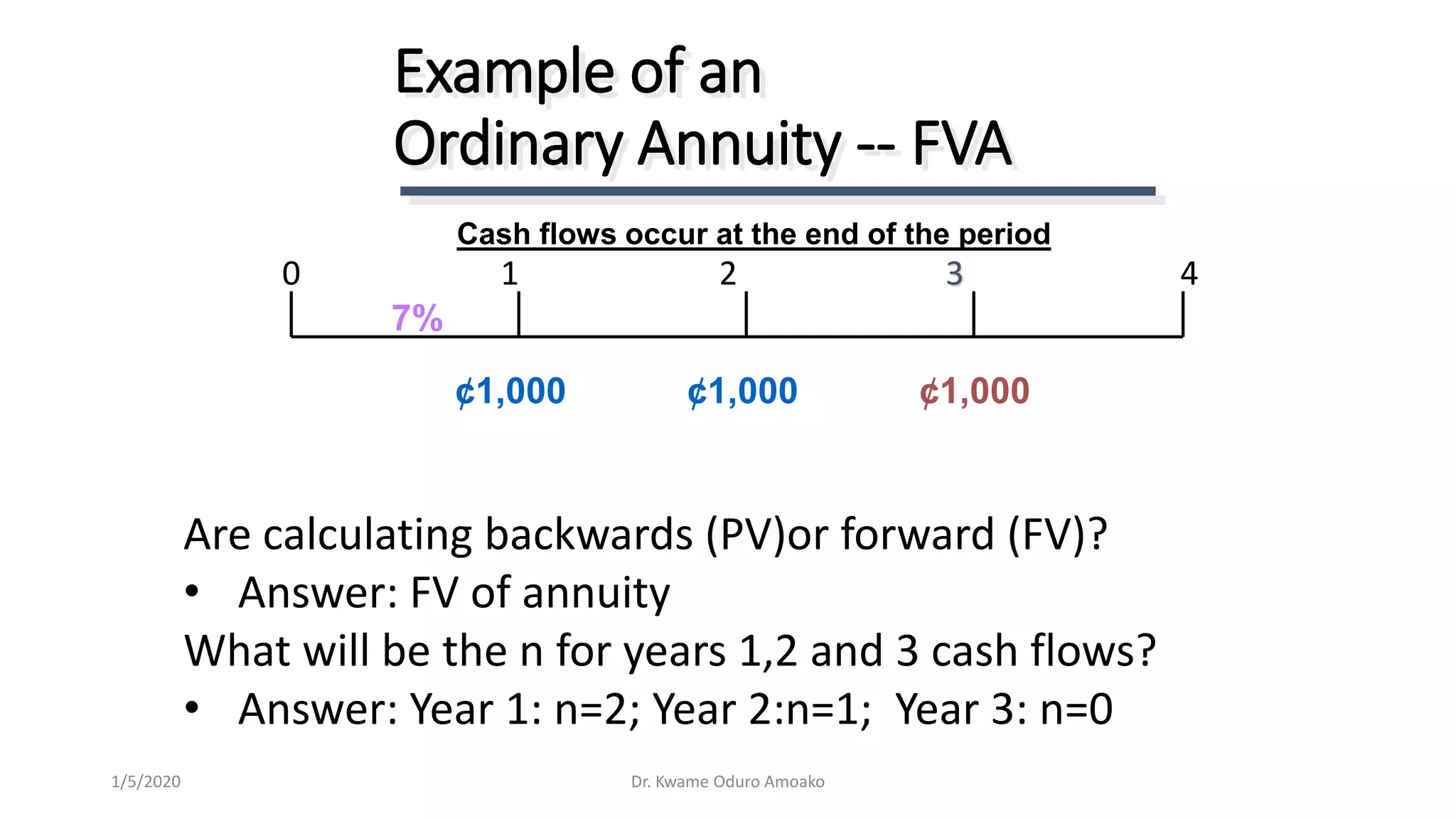

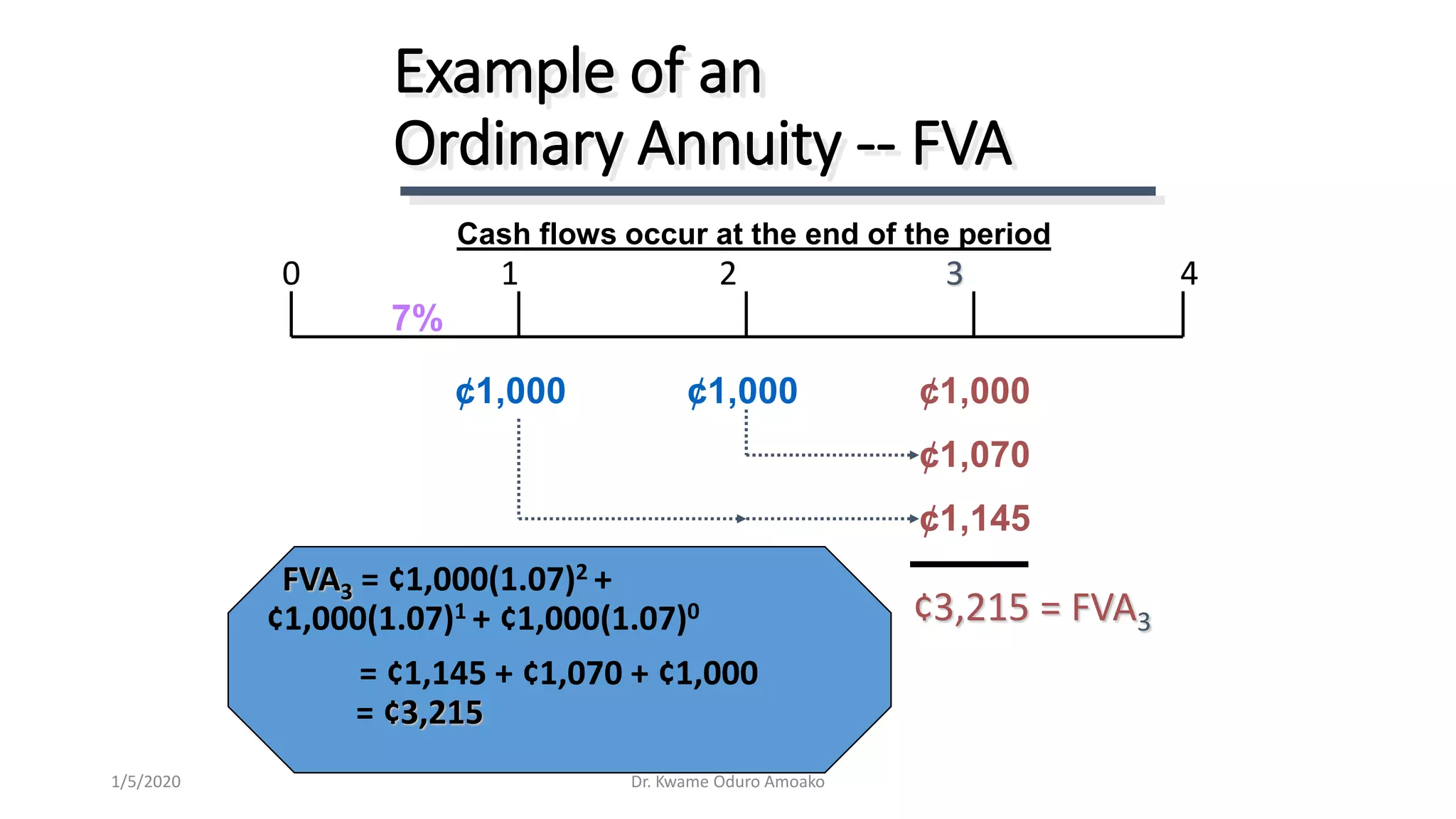

The lecture discusses the time value of money and financial calculations. It introduces key concepts like present value, future value, and annuities. Students will learn to calculate the future and present value of single deposits and streams of cash flows using formulas and tables. They will also learn to distinguish between ordinary annuities and annuities due, and build amortization schedules for loans. Examples are provided to demonstrate calculations for present value, future value, and ordinary annuities.

![FV2 = ¢1,000 (FVIF7%,2)

= ¢1,000 (1.145)

= ¢1,145 [Due to Rounding]

Using Future Value Tables

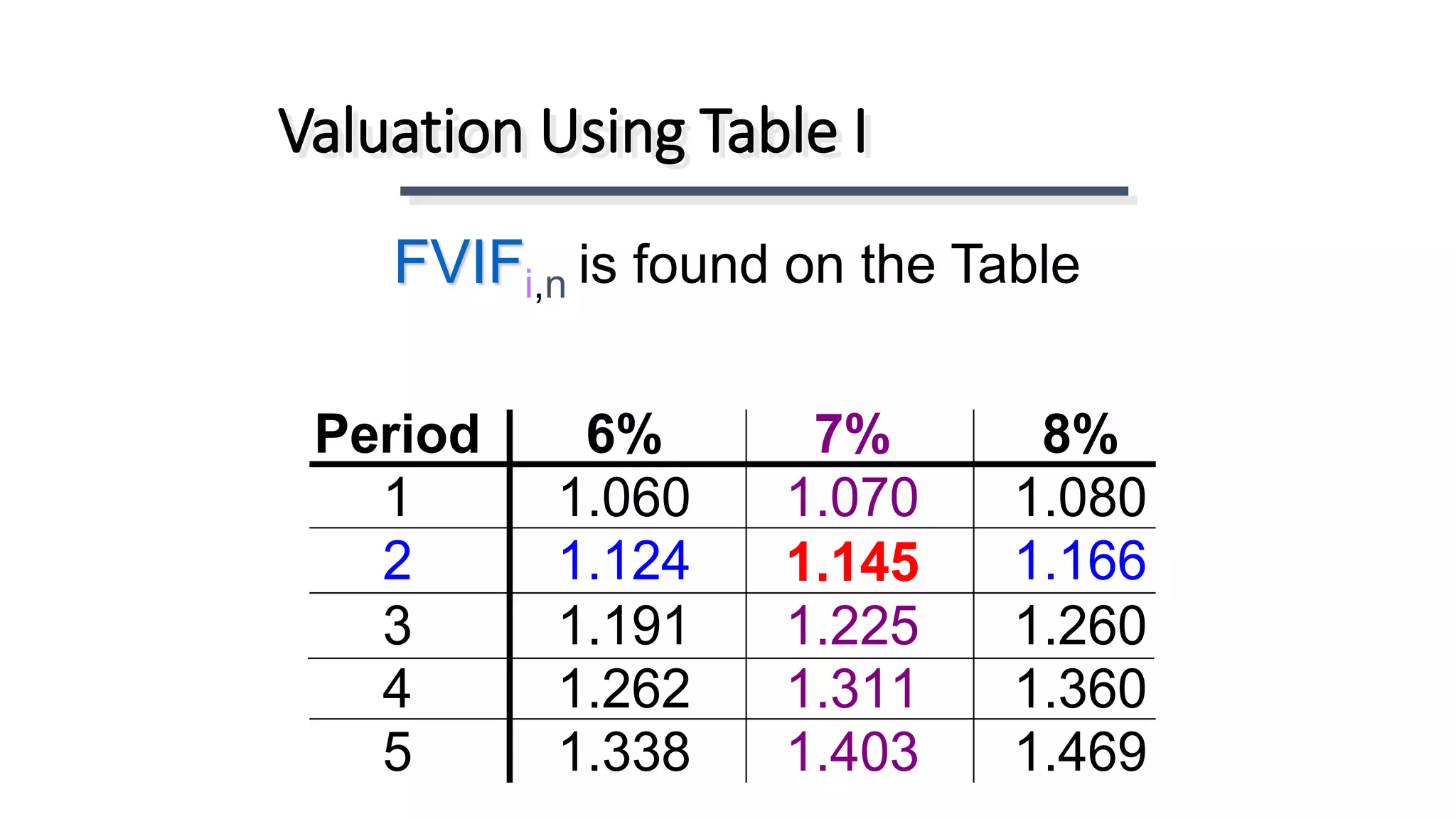

Period 6% 7% 8%

1 1.060 1.070 1.080

2 1.124 1.145 1.166

3 1.191 1.225 1.260

4 1.262 1.311 1.360

5 1.338 1.403 1.469](https://image.slidesharecdn.com/mbafinmgtlecture3timevalueofmoney-200105132059/75/Mba-fin-mgt-lecture-3-time-value-of-money-17-2048.jpg)

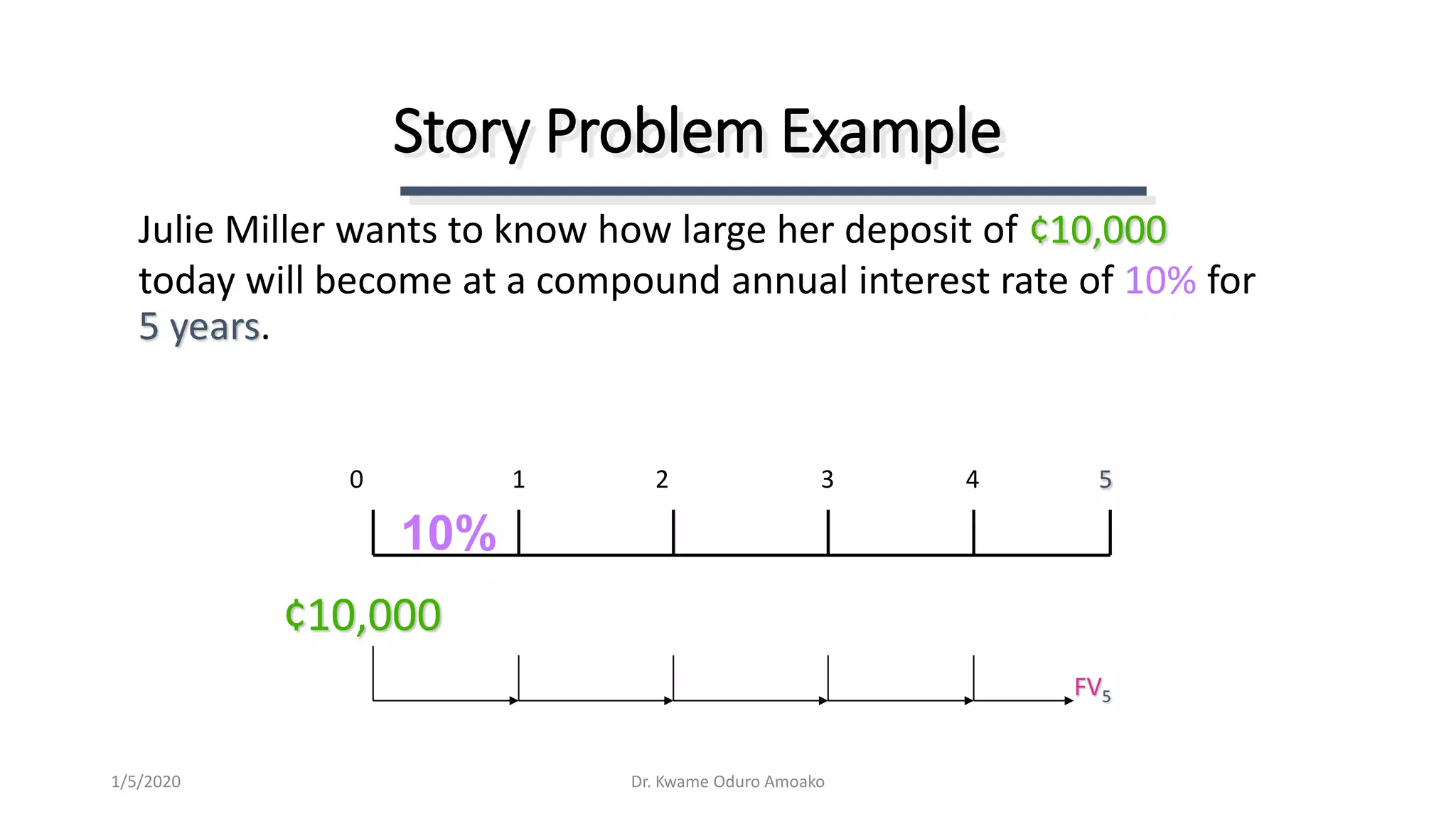

![Story Problem Solution

Calculation based on general formula:

FVn = P0 (1+i)n

FV5 = ¢10,000 (1+ 0.10)5

= ¢16,105.10

Calculation based on Table I:

FV5 = ¢10,000 (FVIF10%, 5)

= ¢10,000 (1.611)

= ¢16,110 [Due to Rounding]

1/5/2020 Dr. Kwame Oduro Amoako](https://image.slidesharecdn.com/mbafinmgtlecture3timevalueofmoney-200105132059/75/Mba-fin-mgt-lecture-3-time-value-of-money-19-2048.jpg)

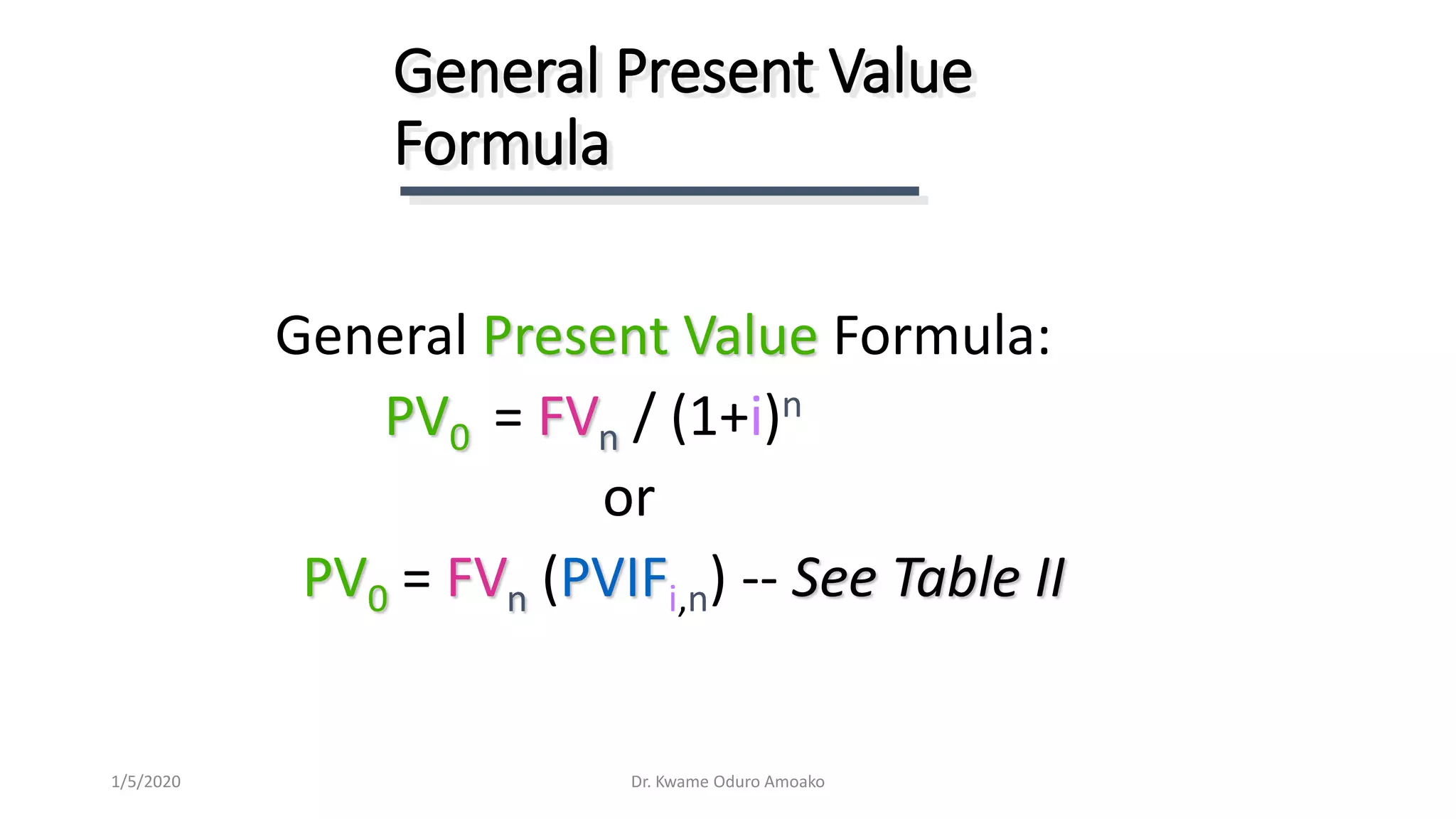

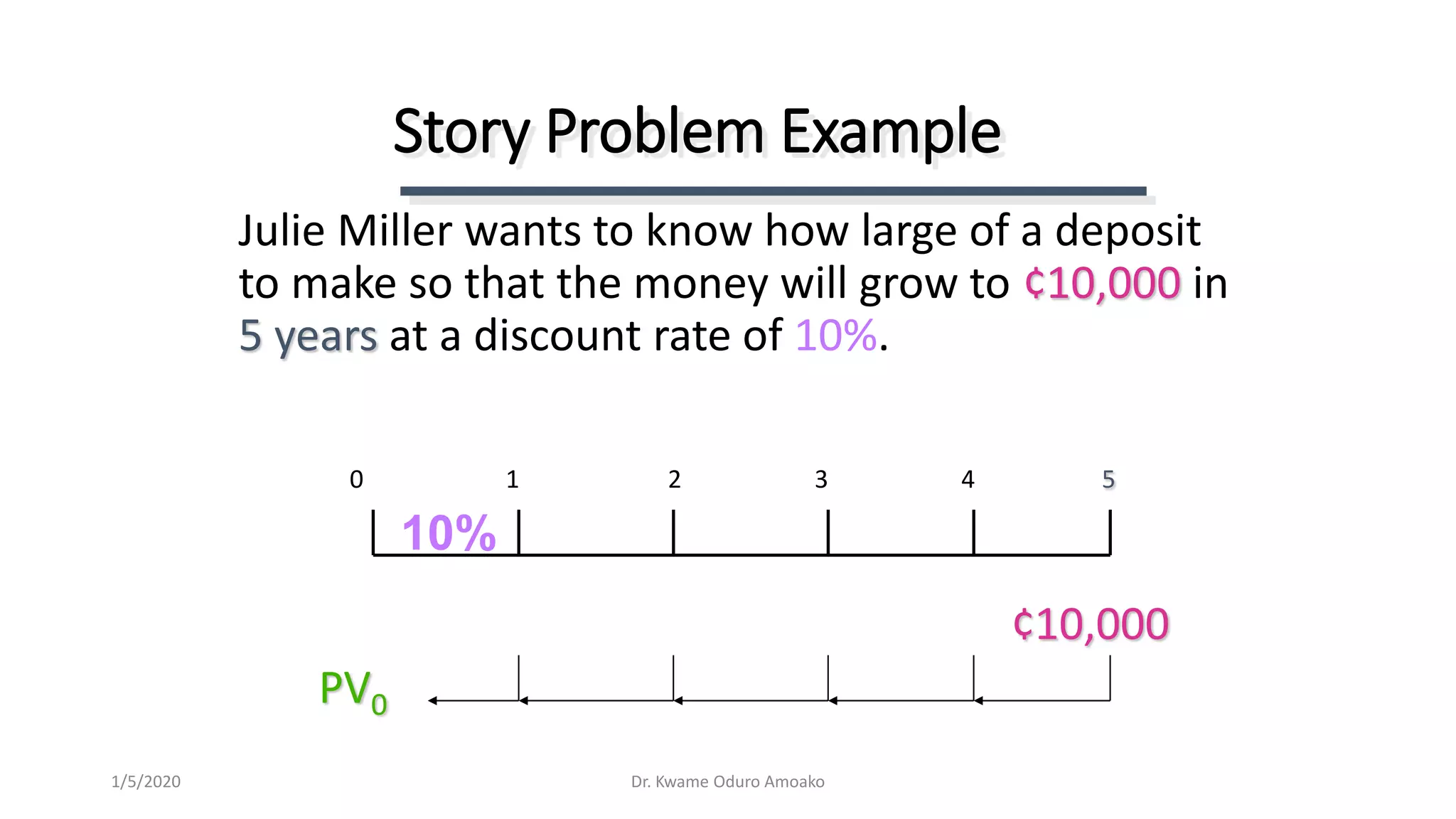

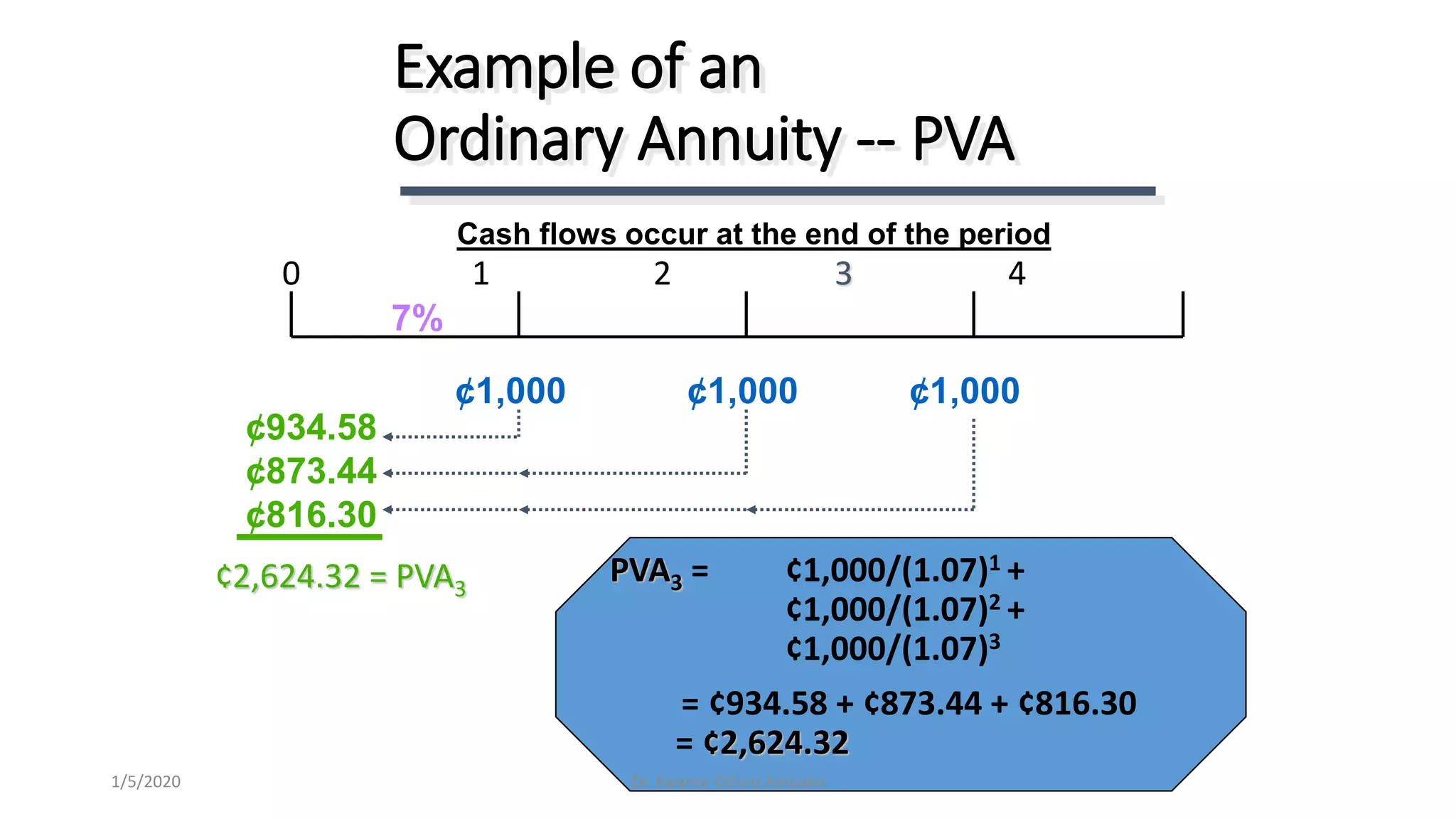

![PV2 = ¢1,000 (PVIF7%,2)

= ¢1,000 (.873)

= ¢873 [Due to Rounding]

Using Present Value Tables

Period 6% 7% 8%

1 .943 .935 .926

2 .890 .873 .857

3 .840 .816 .794

4 .792 .763 .735

5 .747 .713 .681](https://image.slidesharecdn.com/mbafinmgtlecture3timevalueofmoney-200105132059/75/Mba-fin-mgt-lecture-3-time-value-of-money-25-2048.jpg)

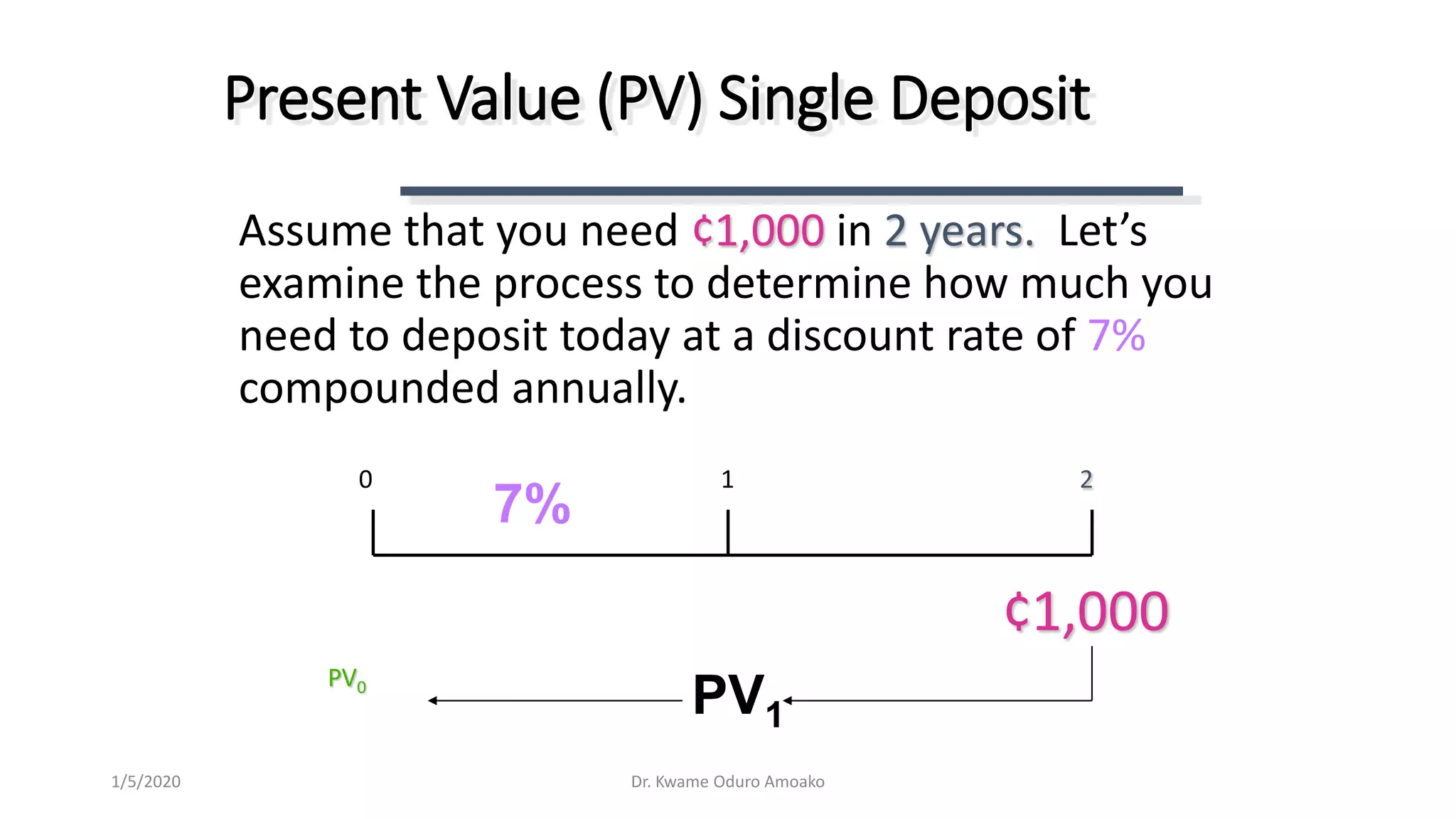

![ Calculation based on general formula:

PV0 = FVn / (1+i)n

PV0 = ¢10,000 / (1+ 0.10)5

= ¢6,209.21

Calculation based on Table I:

PV0 = ¢10,000 (PVIF10%, 5)

= ¢10,000 (.621)

=¢6,210.00 [Due to Rounding]

Story Problem Solution

Dr. Kwame Oduro Amoako1/5/2020](https://image.slidesharecdn.com/mbafinmgtlecture3timevalueofmoney-200105132059/75/Mba-fin-mgt-lecture-3-time-value-of-money-27-2048.jpg)

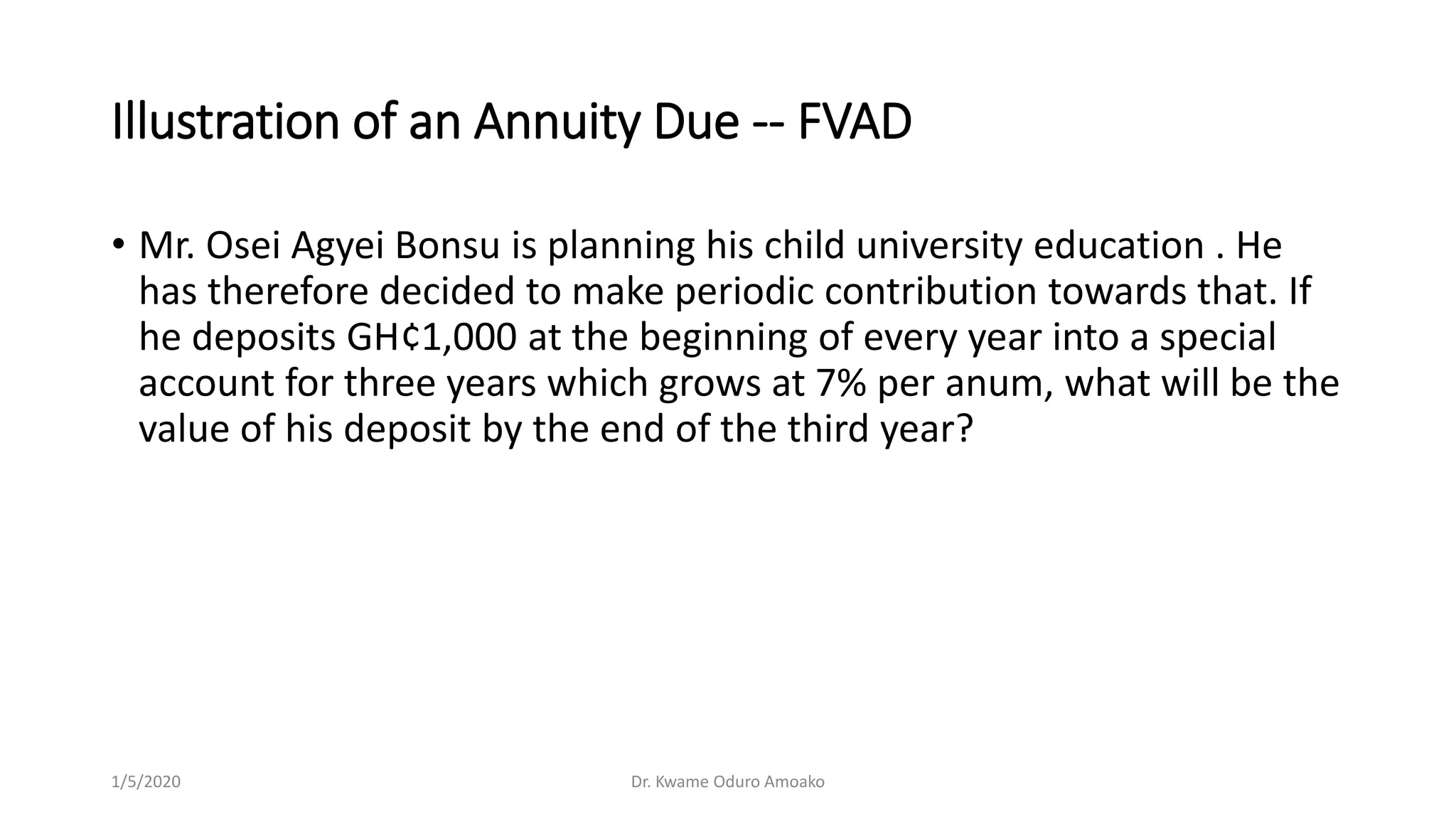

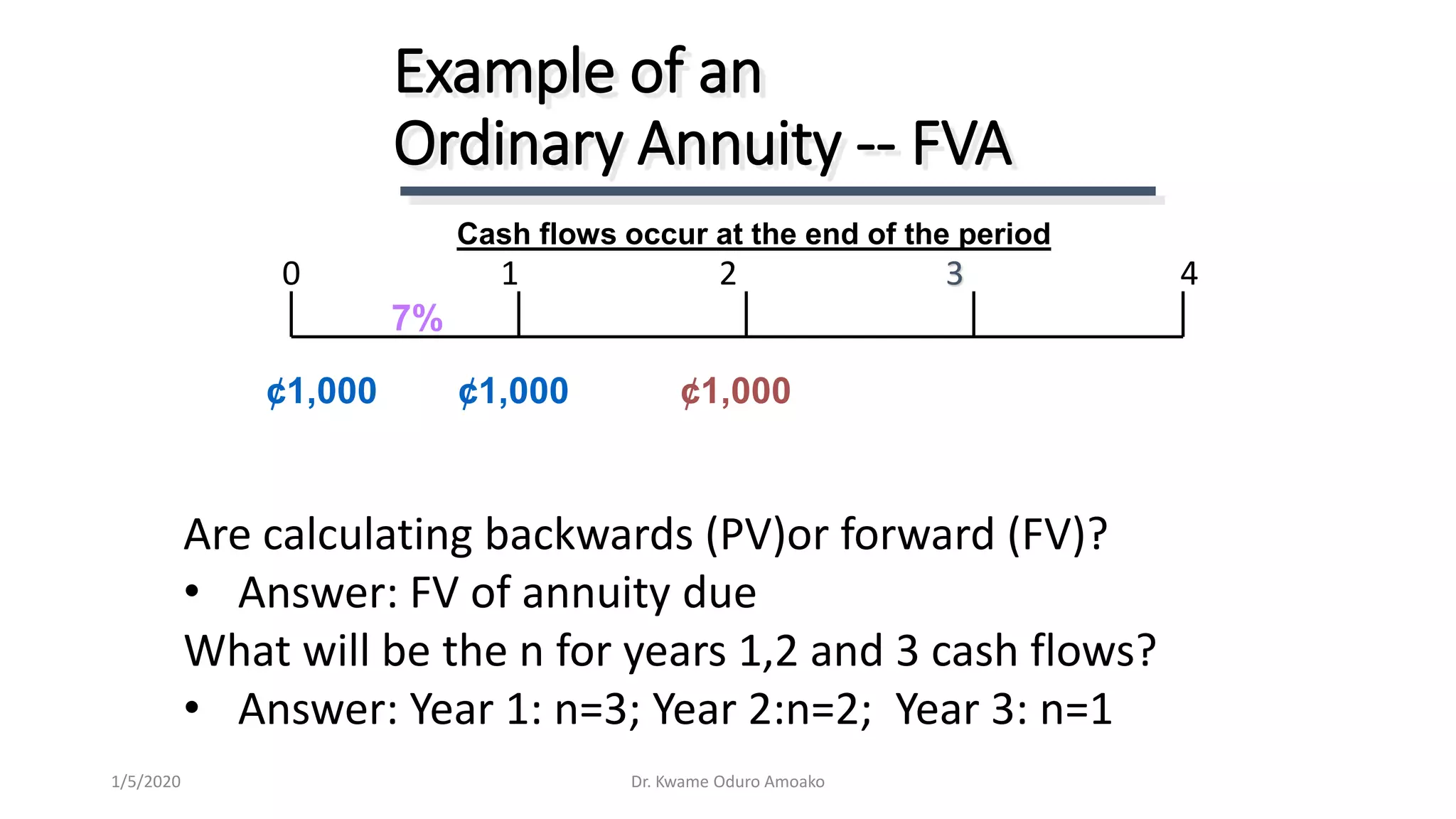

![FVAn = CF(1+i)3 + CF(1+i)2………

or FVAn = PV/k [(1 + k) n – 1]

Overview of an

Ordinary Annuity -- FVA

CF CF CF

0 1 2 n n+1

FVAn

CF = Periodic

Cash Flow

Cash flows occur at the end of the period

i% . . .

Dr. Kwame Oduro Amoako1/5/2020](https://image.slidesharecdn.com/mbafinmgtlecture3timevalueofmoney-200105132059/75/Mba-fin-mgt-lecture-3-time-value-of-money-34-2048.jpg)

![General Formula:

FVn = PV0(1 + [i/m])mn

n: Number of Years

m: Compounding Periods per Yeari:

Annual Interest Rate FVn,m: FV at

the end of Year n

PV0: PV of the Cash Flow today

Frequency of

Compounding

Dr. Kwame Oduro Amoako1/5/2020](https://image.slidesharecdn.com/mbafinmgtlecture3timevalueofmoney-200105132059/75/Mba-fin-mgt-lecture-3-time-value-of-money-56-2048.jpg)

![Julie Miller has ¢1,000 to invest for 2 Years at an annual

interest rate of 12%.

Annual FV2 = 1,000(1+ [.12/1])(1)(2)

= 1,254.40

Julie Miller has ¢1,000 to invest for 2 Years at a semi-

annual interest rate of 12%.

Semi FV2 = 1,000(1+ [.12/2])(2)(2)

= 1,262.48

Impact of Frequency

Dr. Kwame Oduro Amoako1/5/2020](https://image.slidesharecdn.com/mbafinmgtlecture3timevalueofmoney-200105132059/75/Mba-fin-mgt-lecture-3-time-value-of-money-57-2048.jpg)

![Qrtly FV2 = 1,000(1+ [.12/4])(4)(2) =

=1,266.77

Monthly FV2 = 1,000(1+ [.12/12])(12)(2)

= 1,269.73

Daily FV2 = 1,000(1+[.12/365])(365)(2)

= 1,271.20

Impact of Frequency

Dr. Kwame Oduro Amoako1/5/2020](https://image.slidesharecdn.com/mbafinmgtlecture3timevalueofmoney-200105132059/75/Mba-fin-mgt-lecture-3-time-value-of-money-58-2048.jpg)

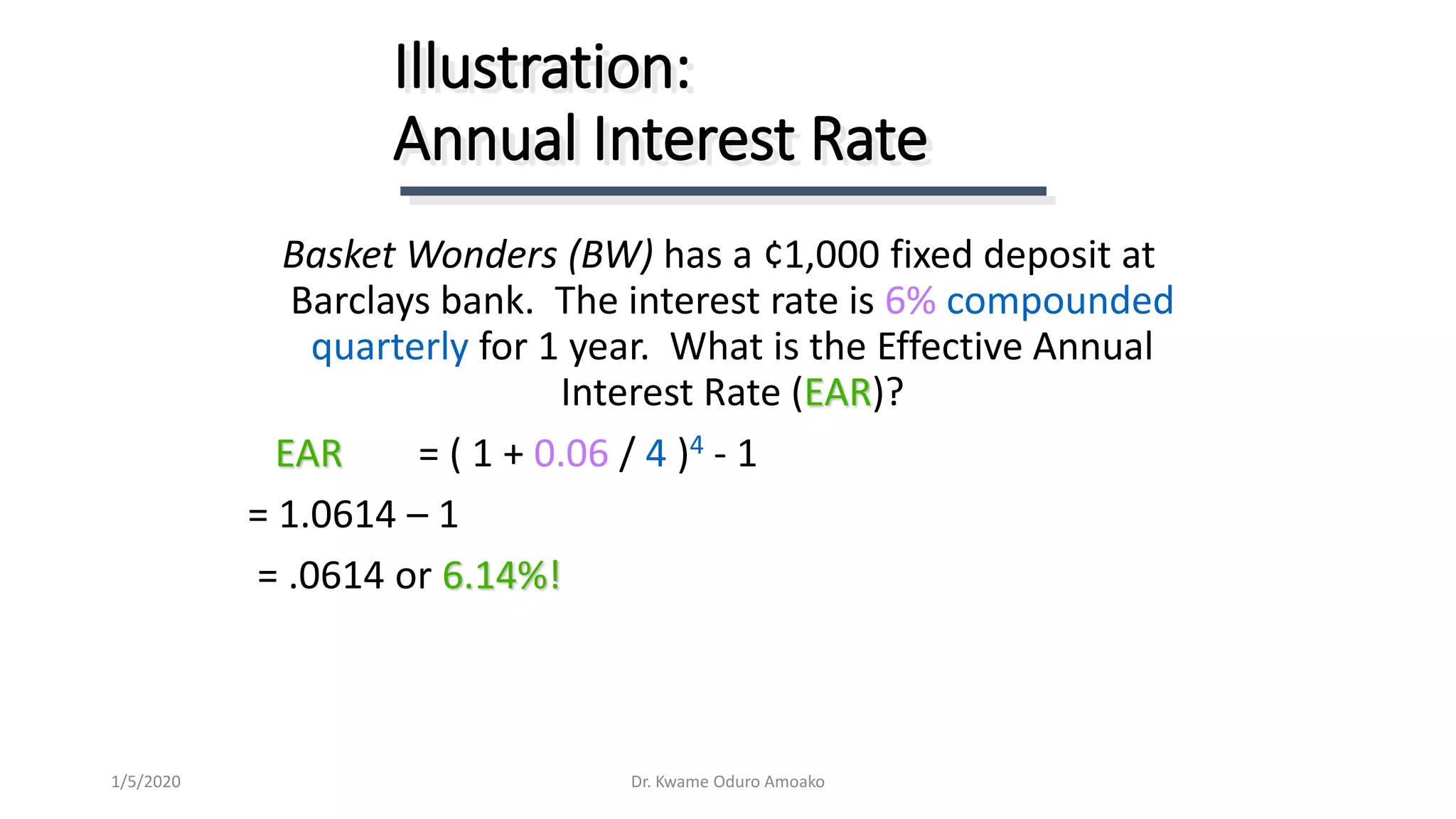

![The actual rate of interest earned (paid) after

adjusting the nominal rate for factors such as

the number of compounding periods per year.

(1 + [ i / n ] )n – 1

Where n= number of compounding

periods per year

Effective Annual

Interest Rate

Dr. Kwame Oduro Amoako1/5/2020](https://image.slidesharecdn.com/mbafinmgtlecture3timevalueofmoney-200105132059/75/Mba-fin-mgt-lecture-3-time-value-of-money-60-2048.jpg)

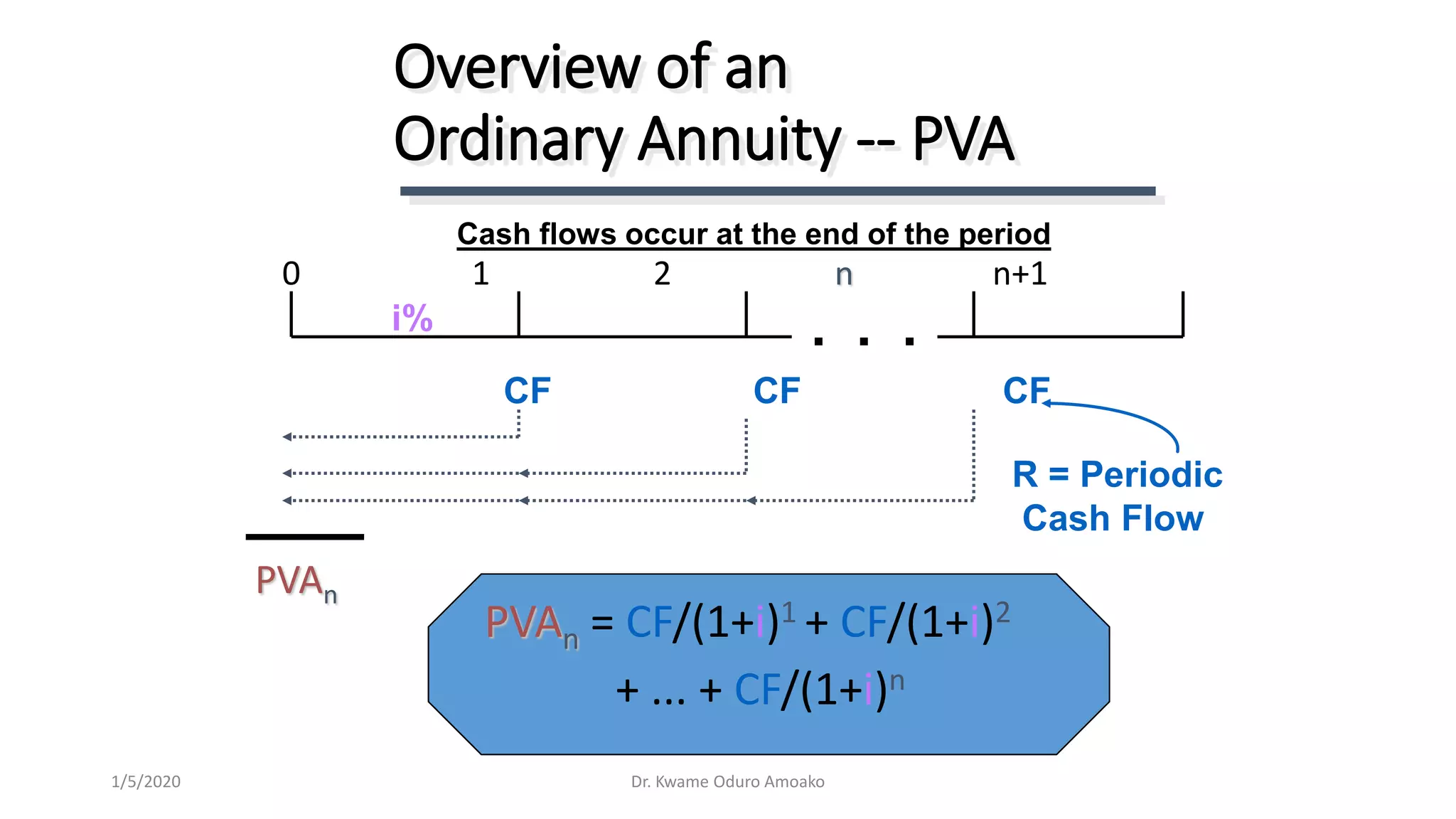

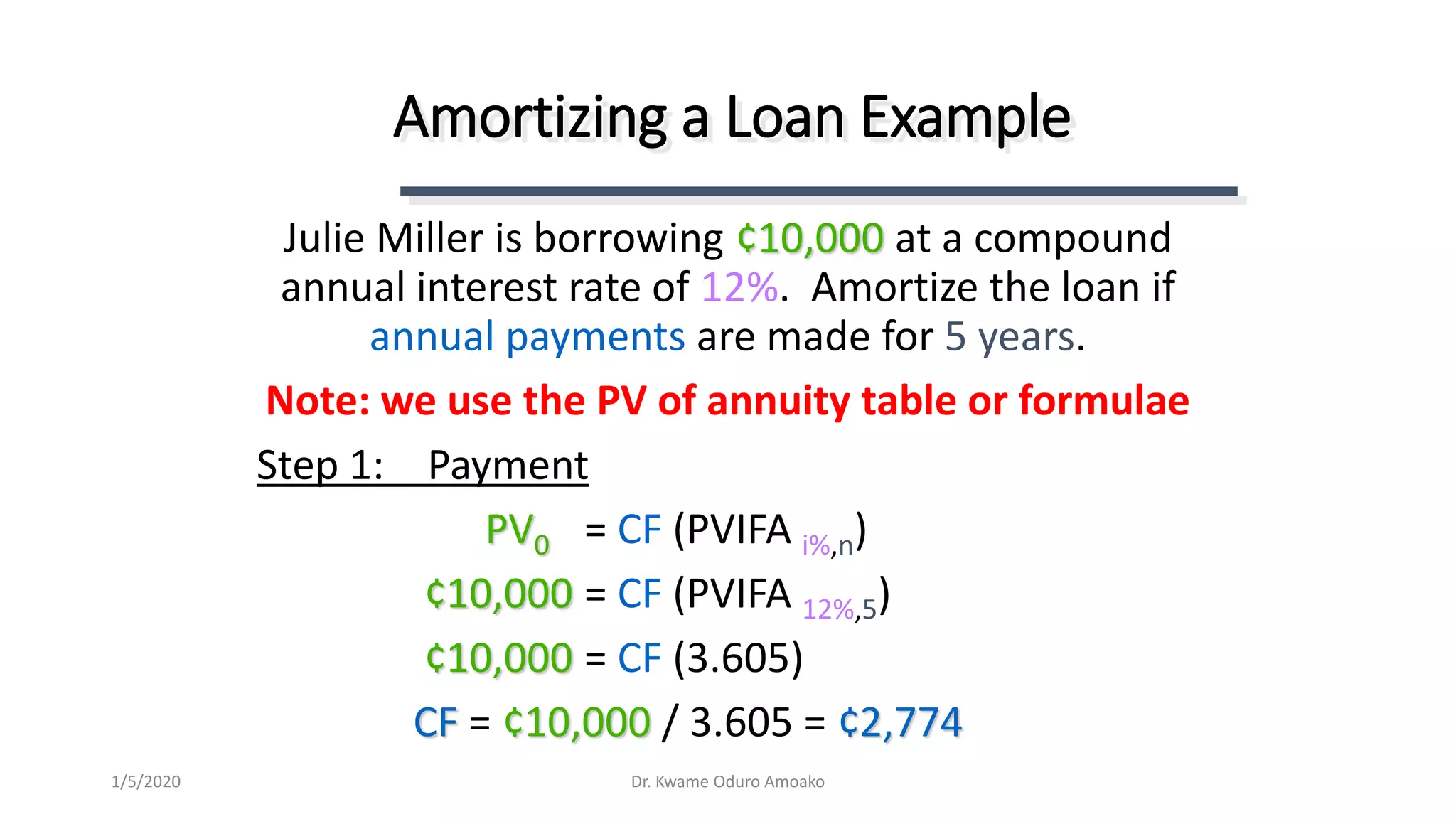

![Amortizing a Loan Example

End of

Year

Payment Interest Principal Ending

Balance

0 --- --- --- $10,000

1 $2,774 $1,200 $1,574 8,426

2 2,774 1,011 1,763 6,663

3 2,774 800 1,974 4,689

4 2,774 563 2,211 2,478

5 2,775 297 2,478 0

$13,871 $3,871 $10,000

[Last Payment Slightly Higher Due to Rounding]](https://image.slidesharecdn.com/mbafinmgtlecture3timevalueofmoney-200105132059/75/Mba-fin-mgt-lecture-3-time-value-of-money-66-2048.jpg)