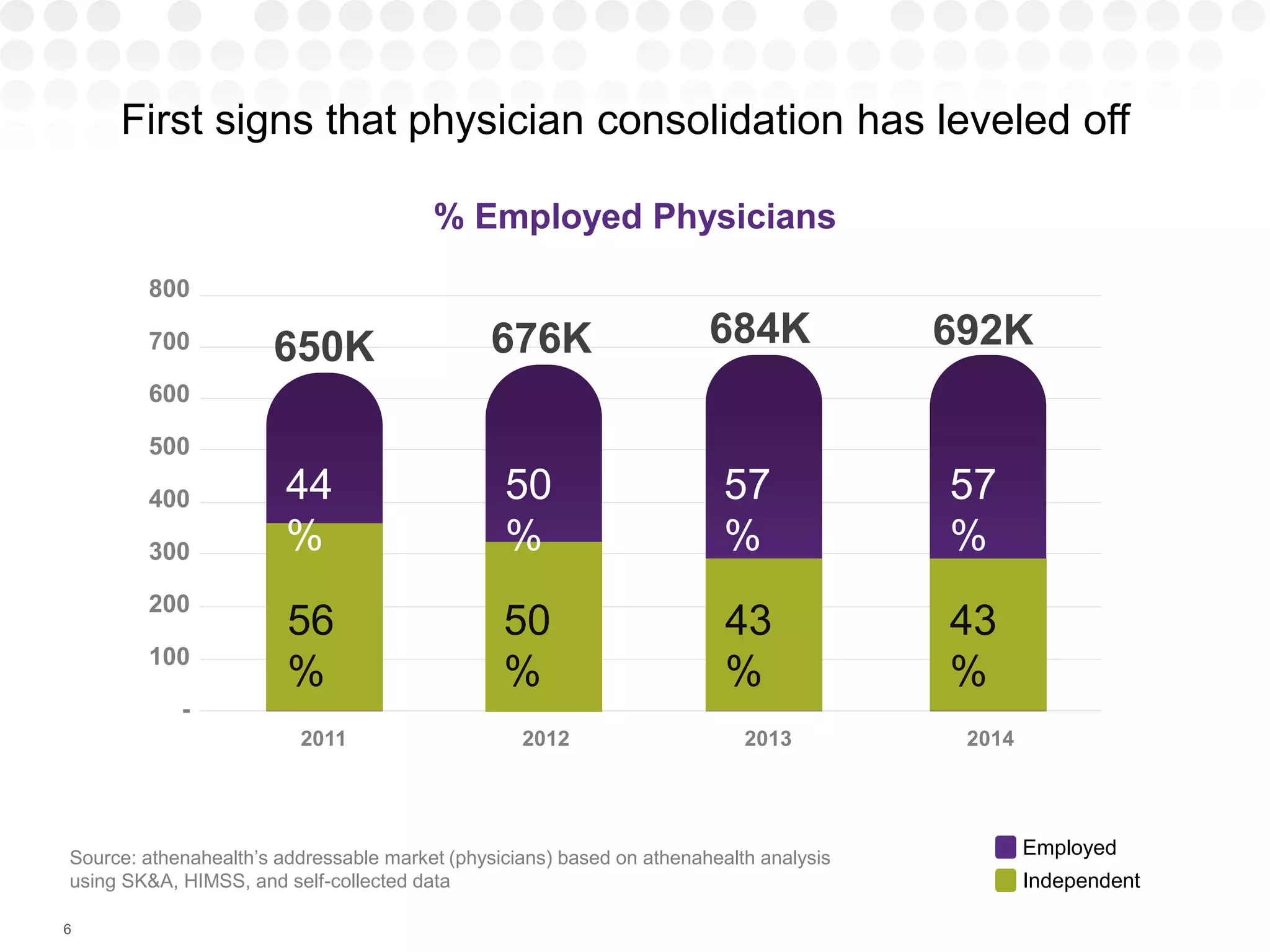

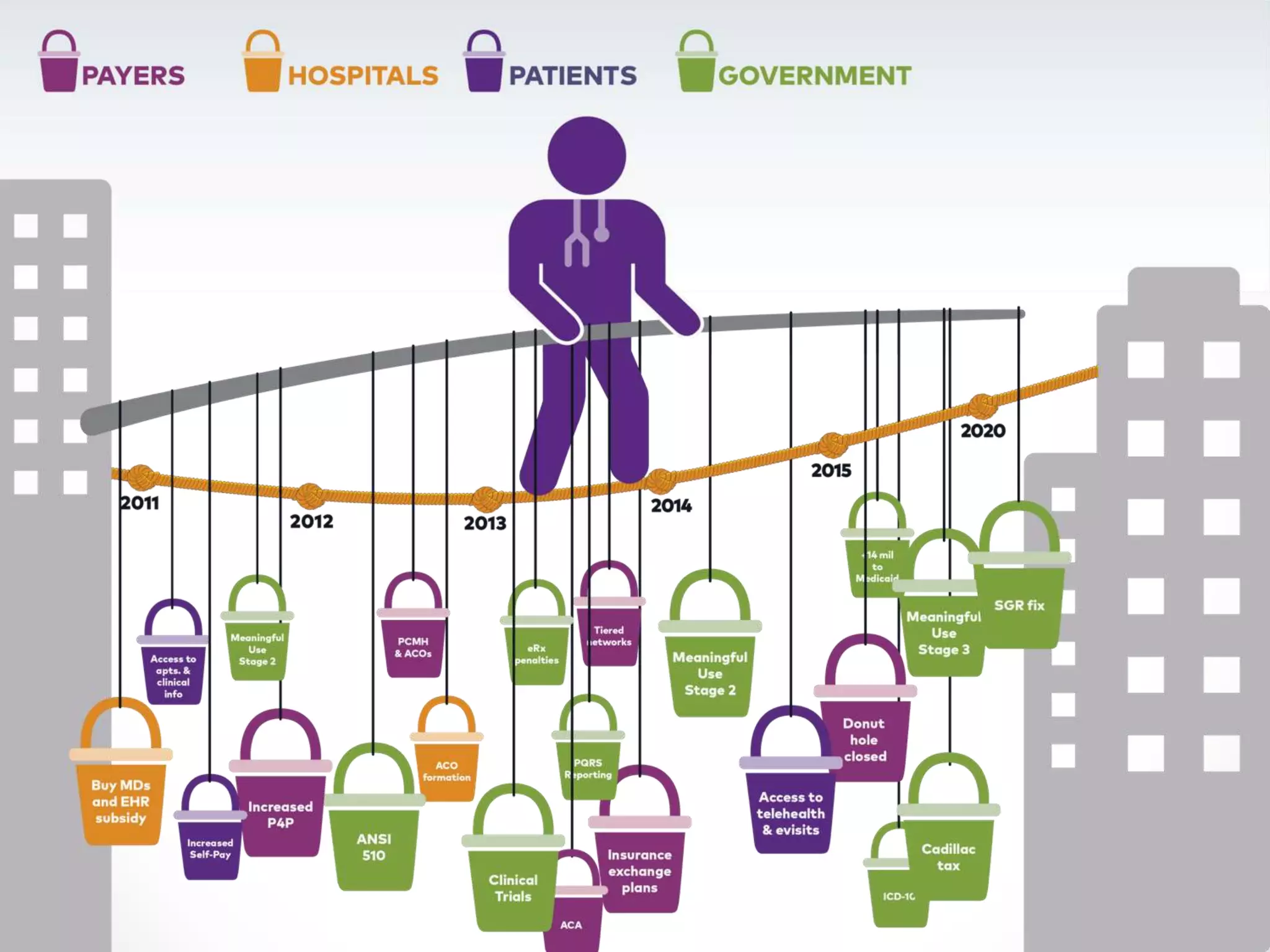

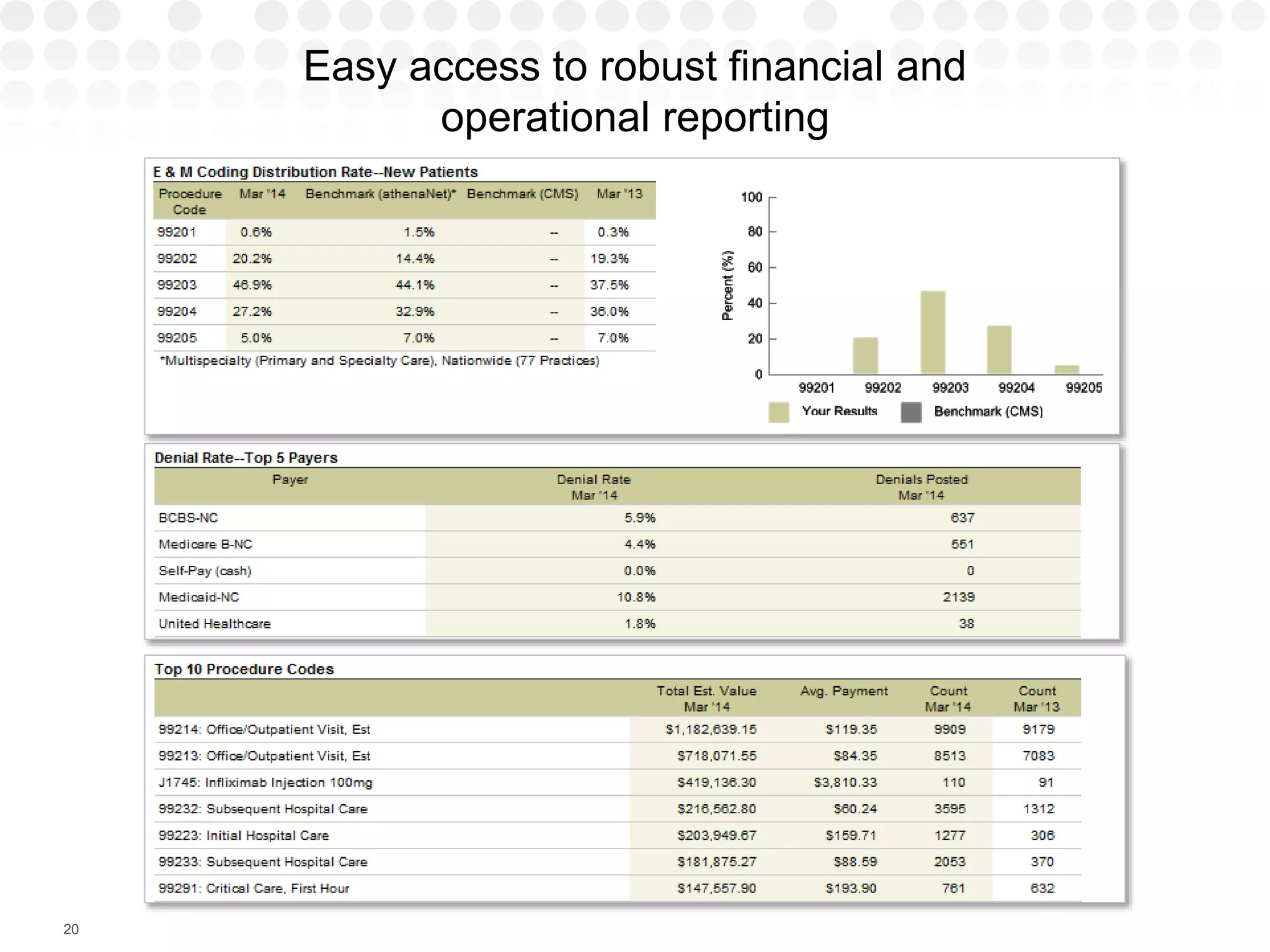

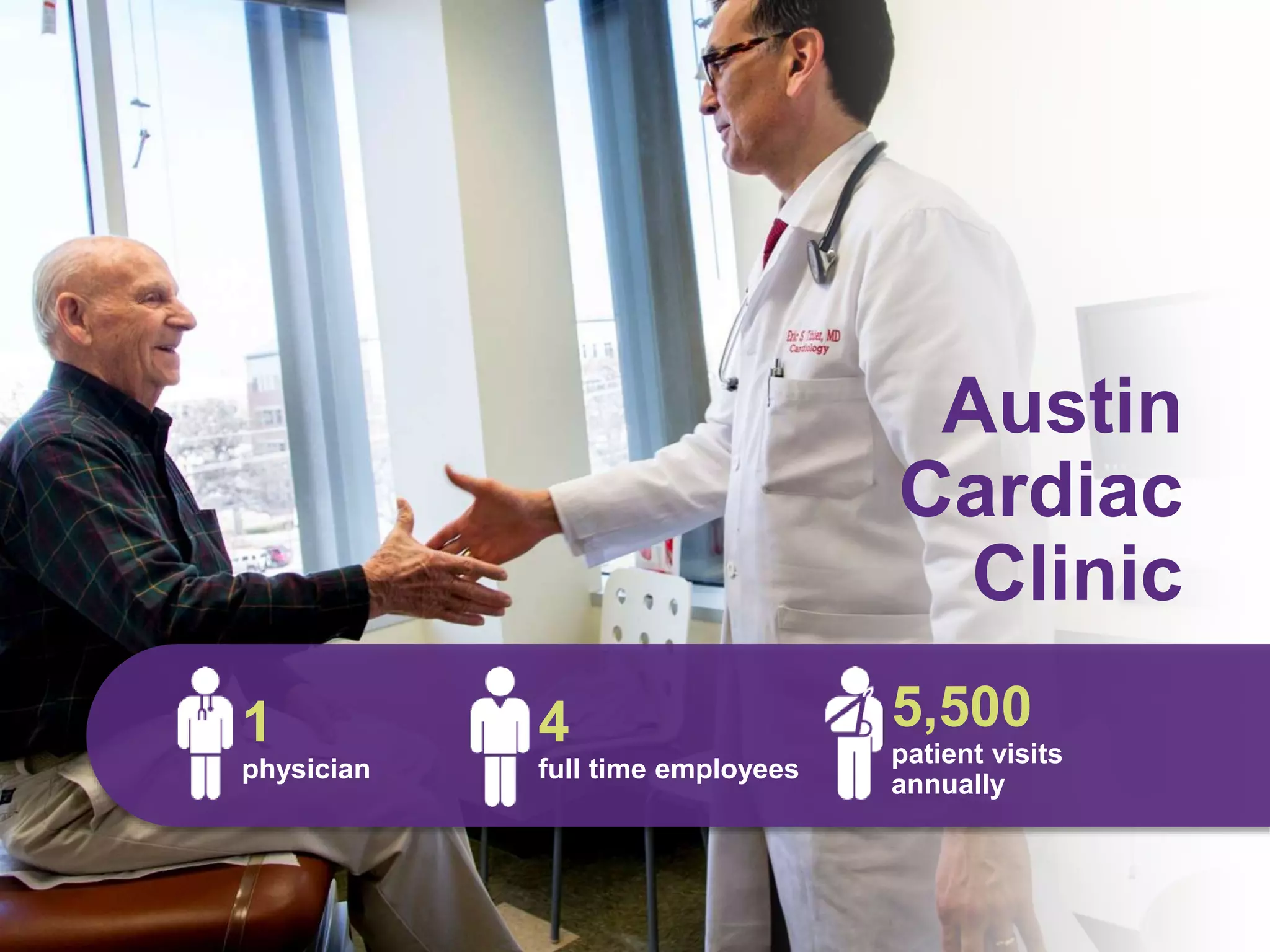

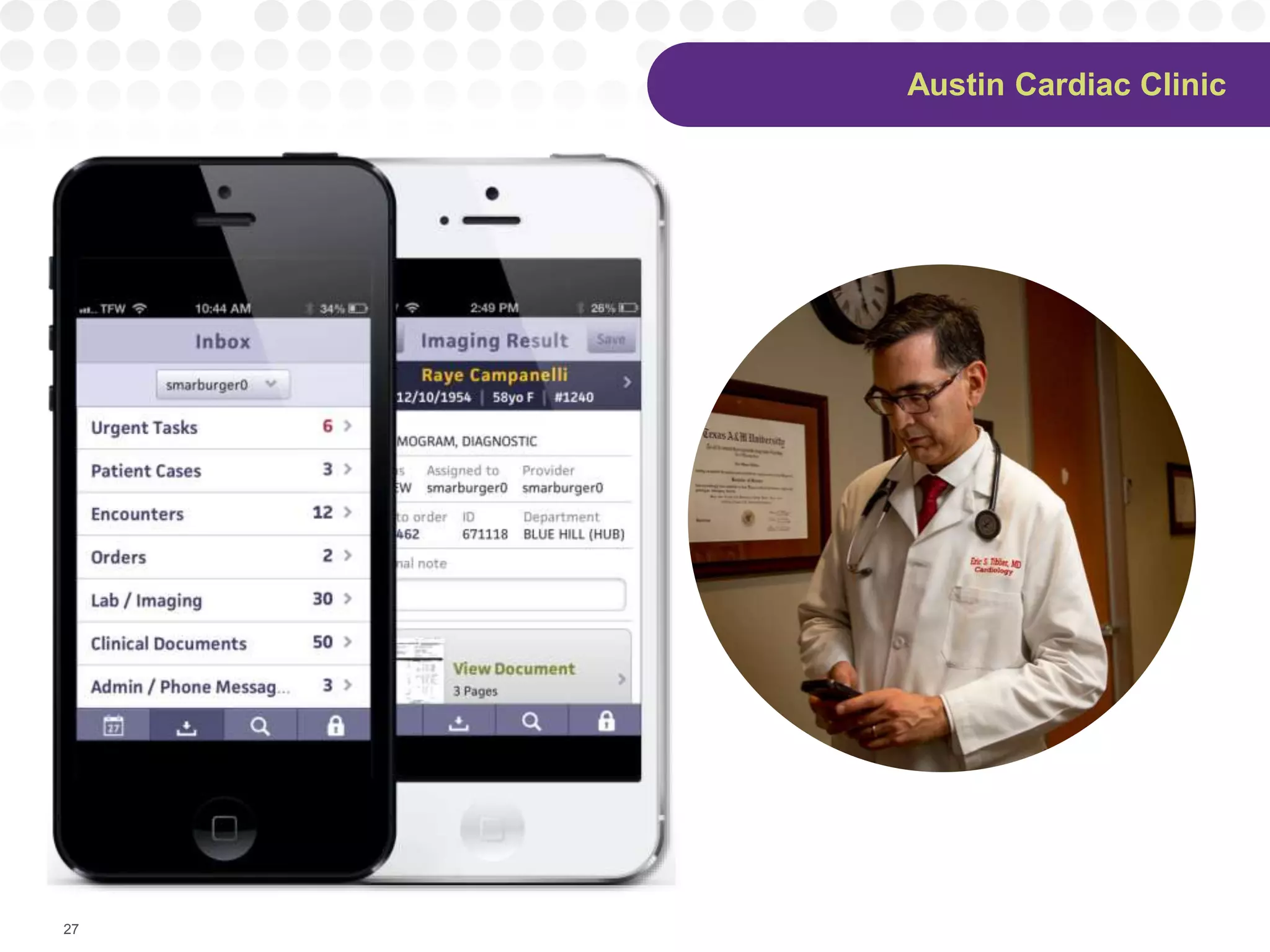

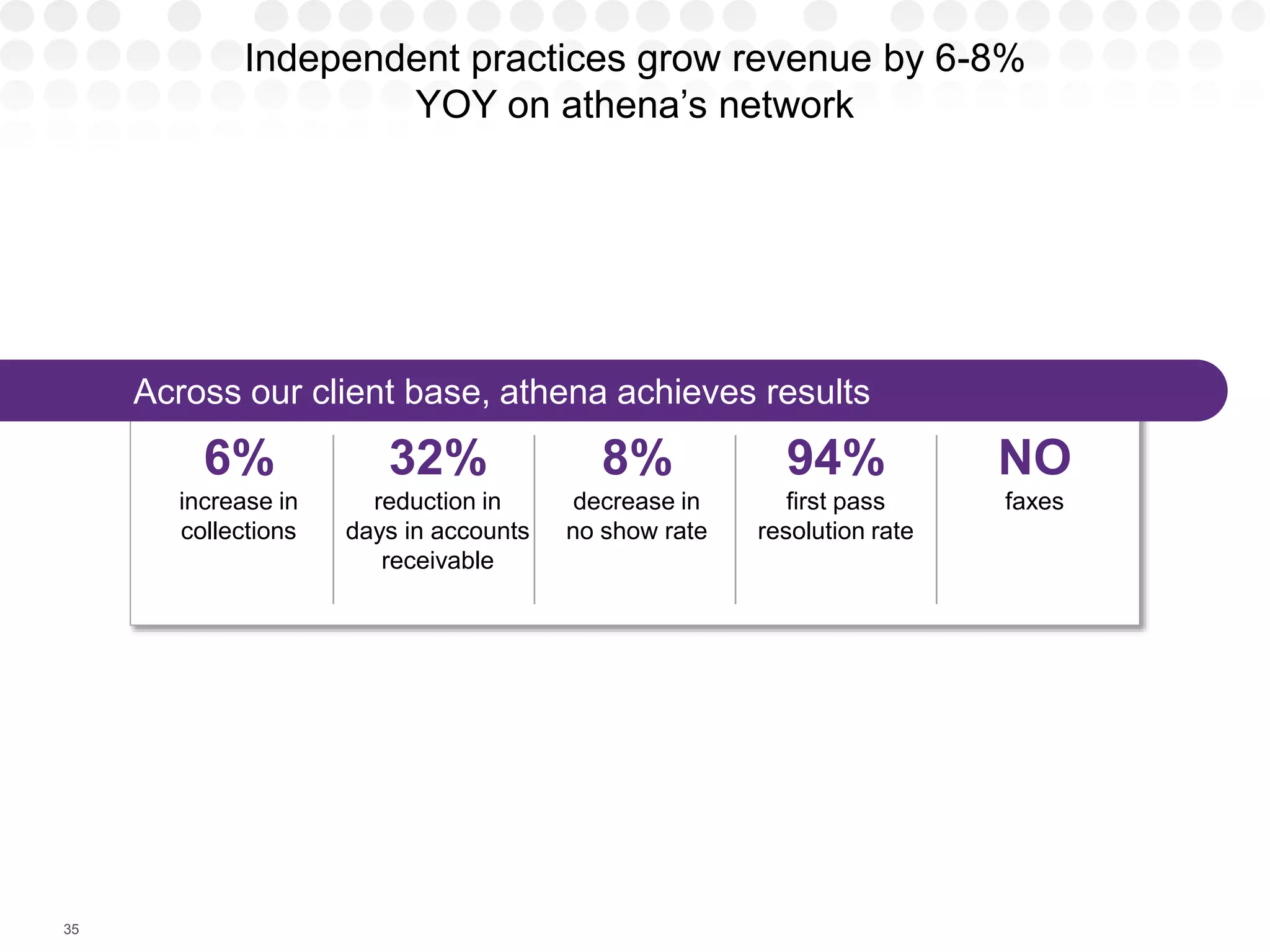

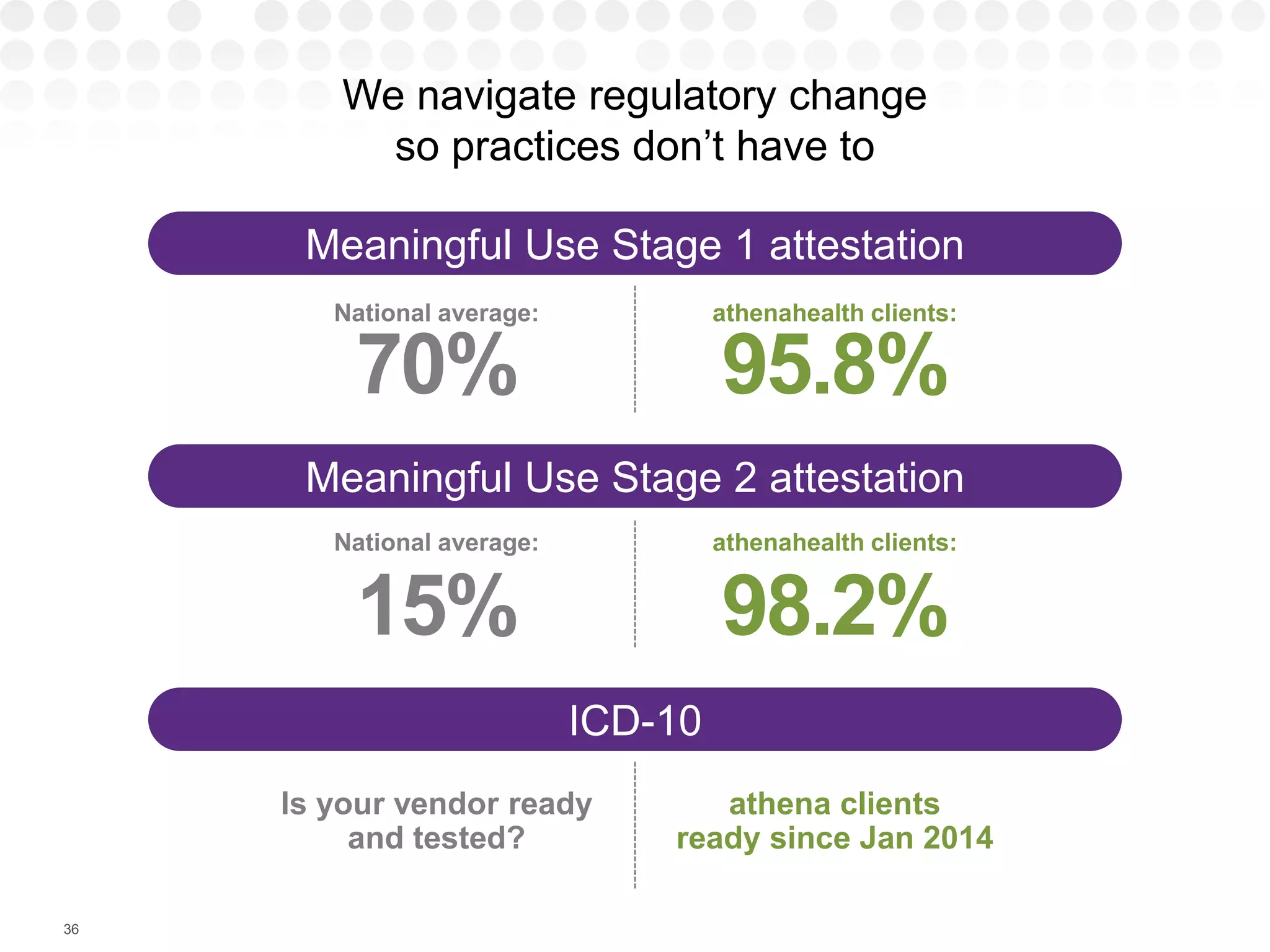

The document discusses the trend of outpatient care rising while hospitals increasingly acquire independent practices, reflecting a shift in the healthcare landscape. It highlights the challenges faced by independent physicians regarding survival and employs case studies to illustrate how technology solutions can enhance operational efficiency and revenue for practices. Despite the consolidation trend, independent practices using athenahealth’s services are reportedly experiencing growth in revenue and patient collections.