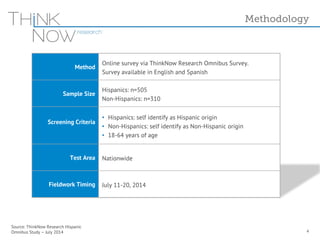

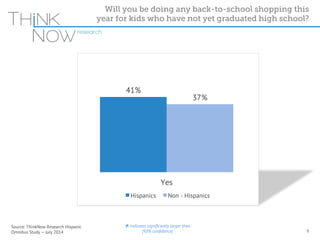

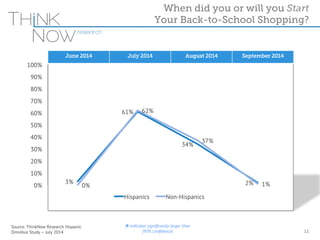

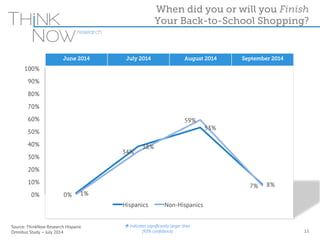

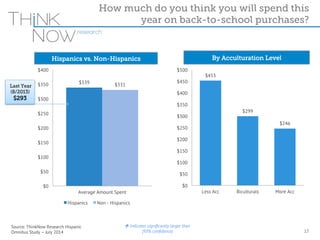

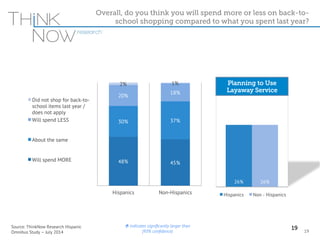

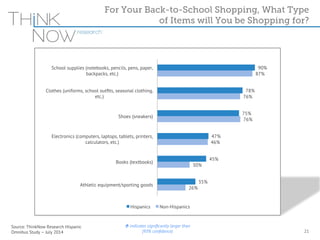

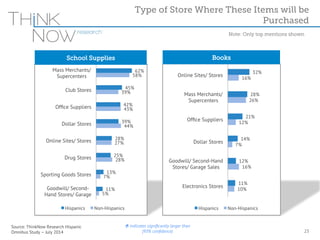

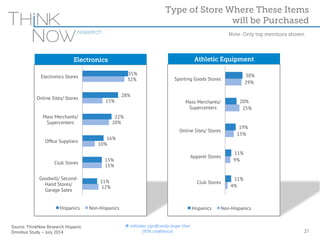

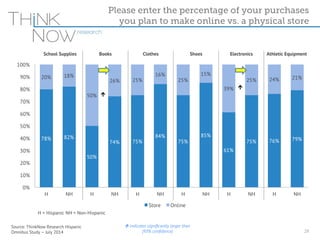

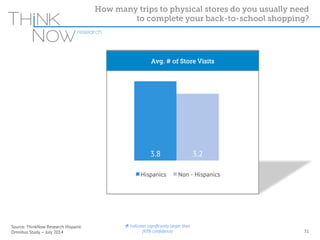

The ThinkNow Research Hispanic Omnibus Study from July 2014 reveals that approximately 40% of Hispanic adults are engaged in back-to-school shopping, which is slightly higher than their non-Hispanic counterparts. Hispanic parents are expected to spend an average of $340 this season, up from $293 the previous year, and tend to shop for more children than non-Hispanics. Key shopping trends indicate a preference for in-store purchases, particularly for general school supplies, with online shopping being more common for books and electronics.