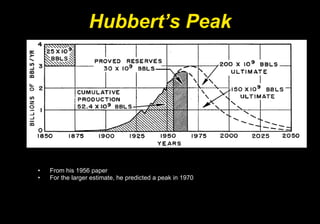

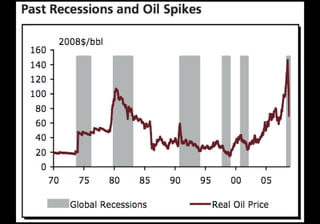

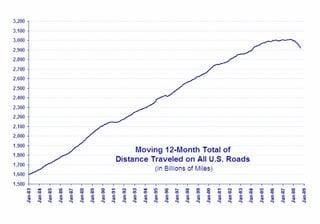

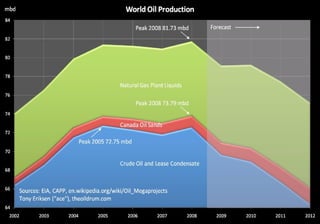

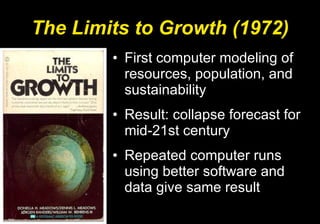

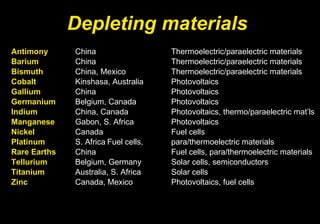

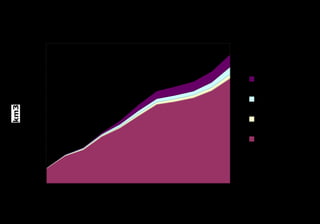

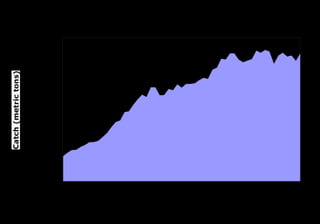

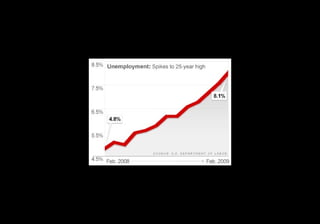

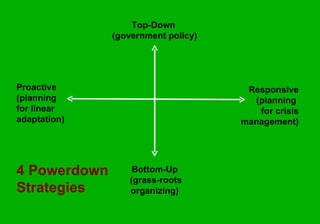

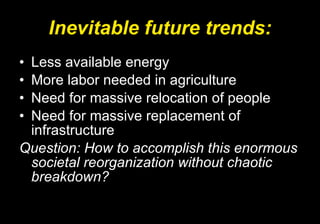

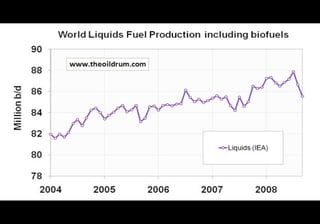

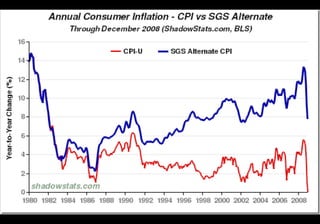

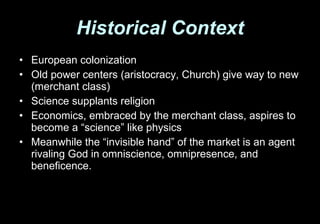

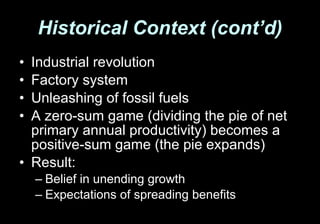

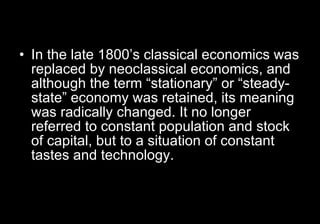

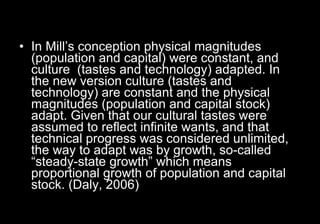

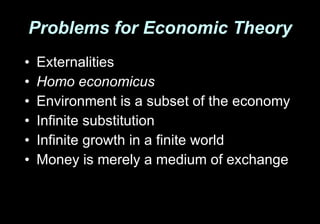

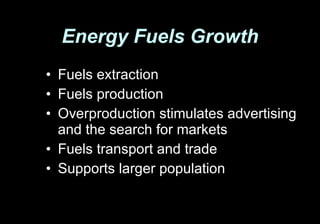

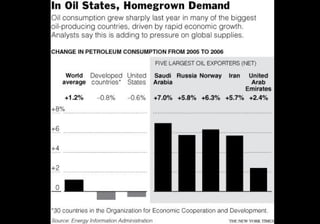

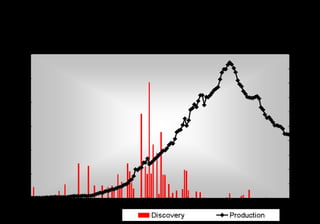

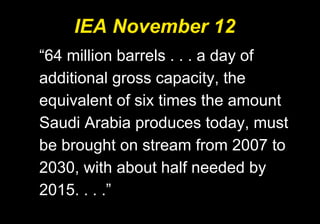

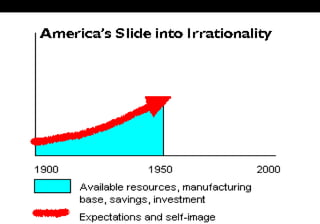

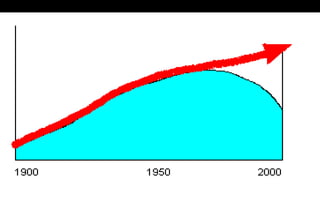

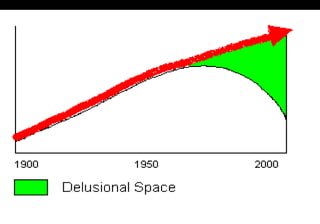

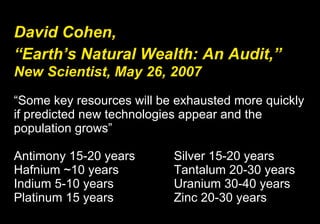

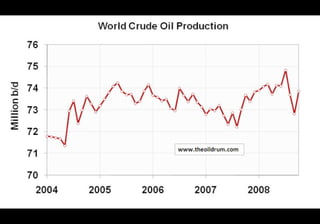

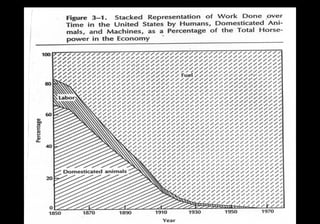

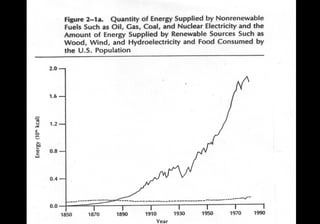

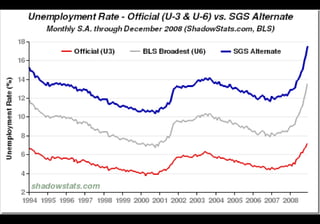

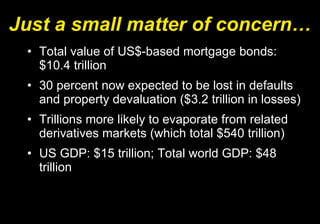

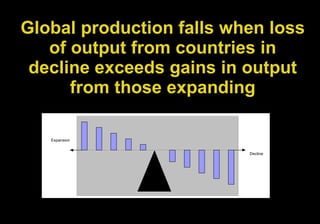

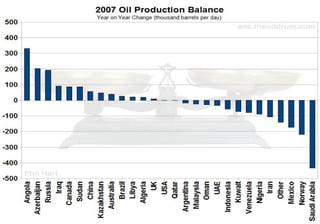

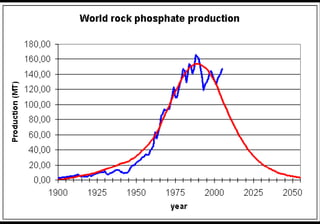

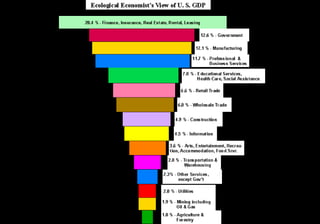

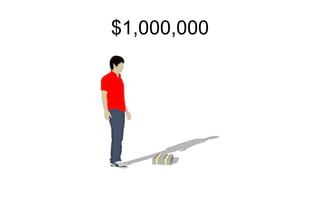

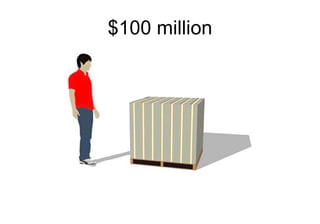

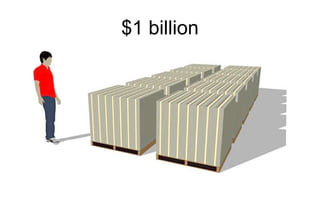

The document discusses how the economic crisis has changed everything and how understanding historical context is important. It summarizes that economic growth has been fueled by cheap fossil fuels but that growth cannot continue indefinitely as energy supplies become constrained. It outlines strategies for building resilient communities that can better withstand economic and energy challenges.