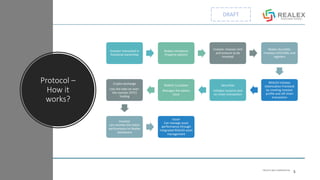

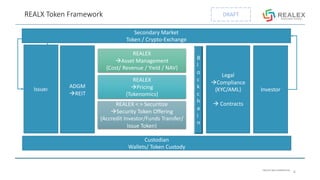

The document discusses tokenizing real estate assets using security tokens. It outlines the benefits of tokenization such as increased liquidity, fractional ownership, and portfolio diversification. It then provides an overview of the key components of setting up a real estate security token offering, including deal structuring, technology selection, the token creation process, and ongoing governance.