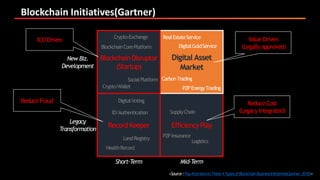

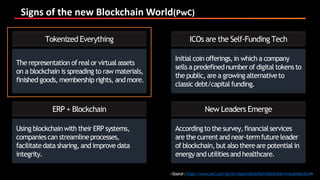

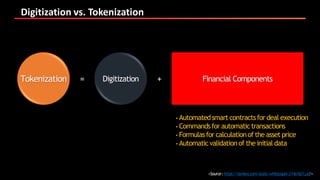

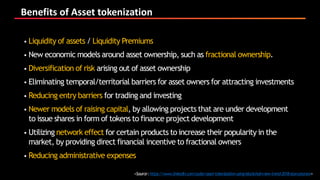

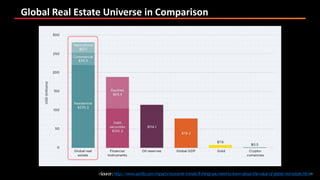

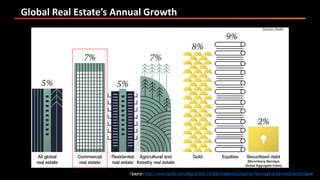

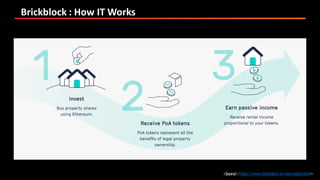

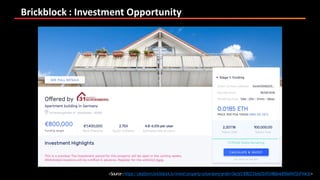

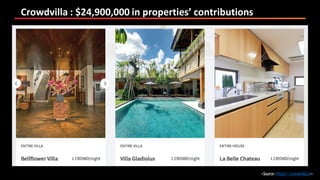

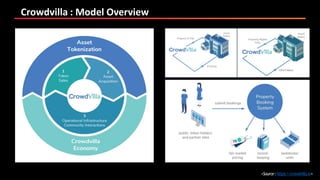

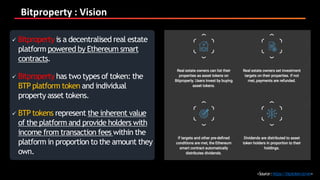

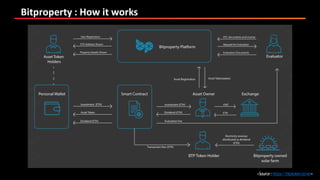

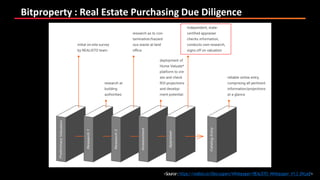

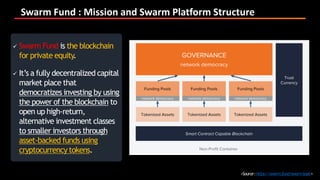

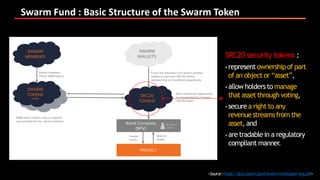

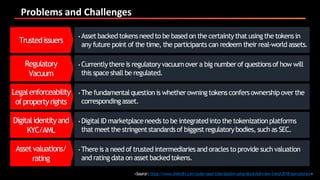

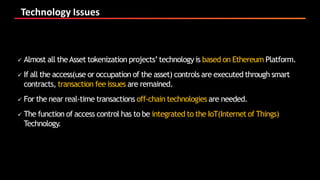

Asset tokenization allows converting ownership rights to real-world assets such as real estate into digital tokens on blockchain. This provides benefits like increased liquidity, fractional ownership, and global access for investors. Several startups are developing platforms for real estate asset tokenization using various models. For example, Brickblock allows investors to purchase tokenized shares of individual properties. Challenges include ensuring regulatory compliance, addressing legal issues around property rights, and developing trusted technology solutions. Overall, asset tokenization has potential to significantly transform traditional asset markets.