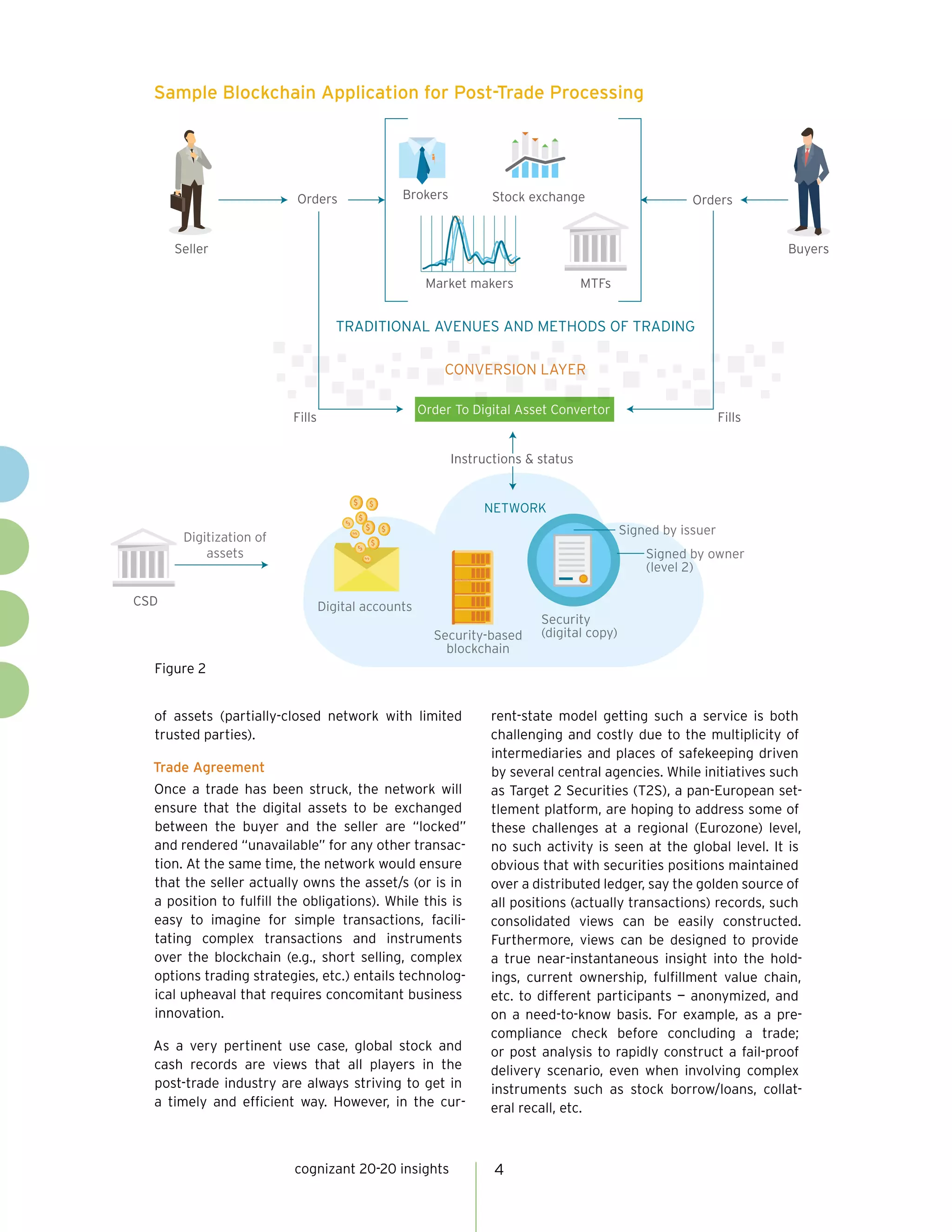

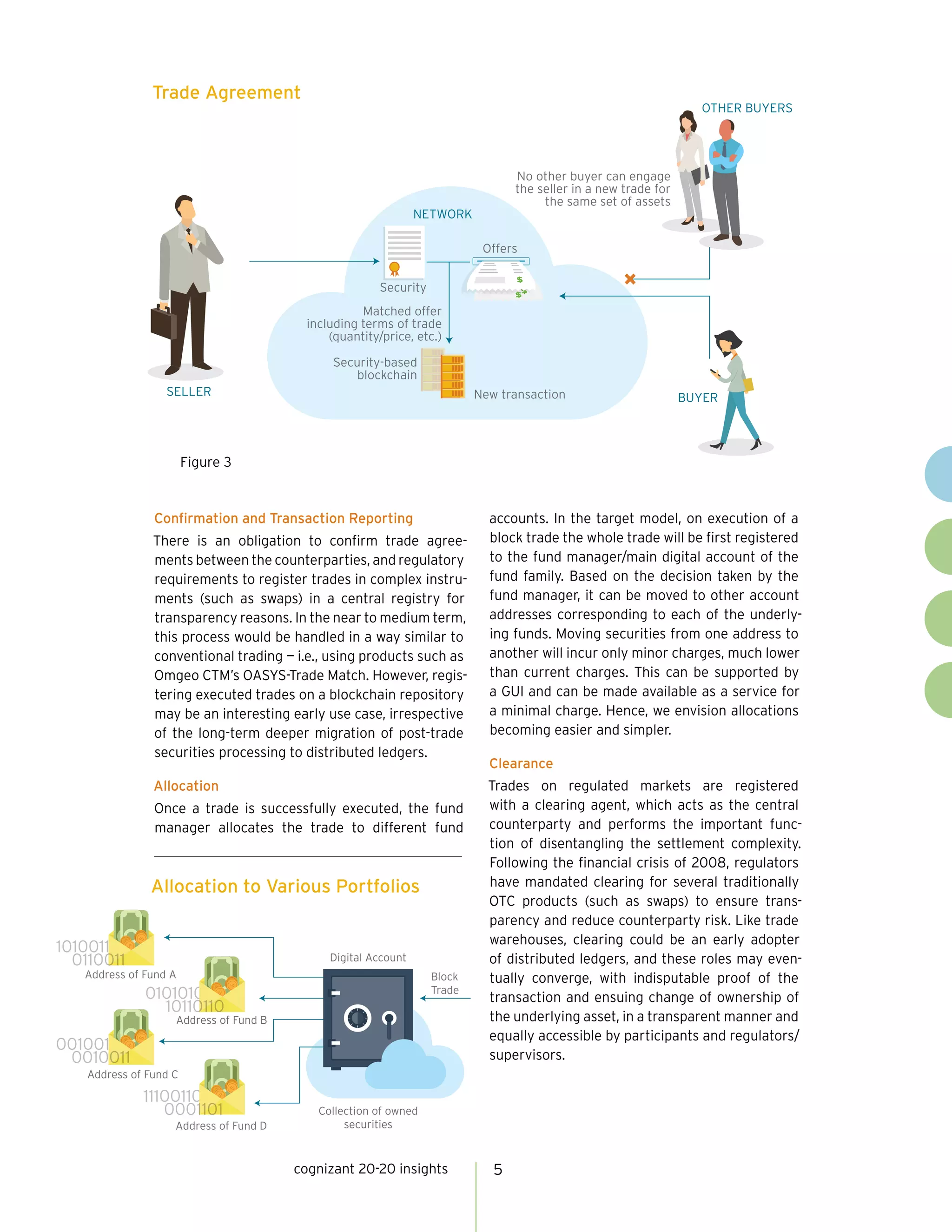

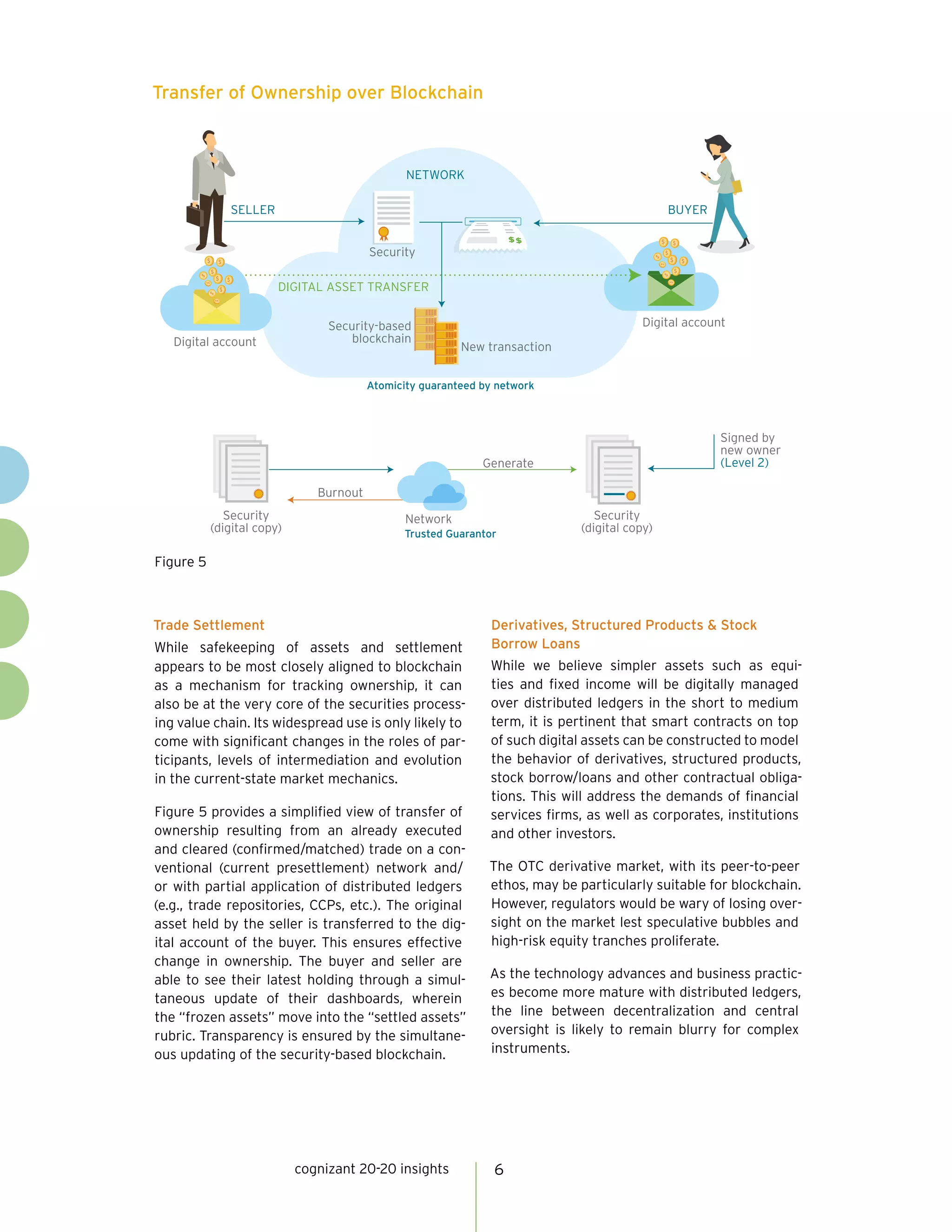

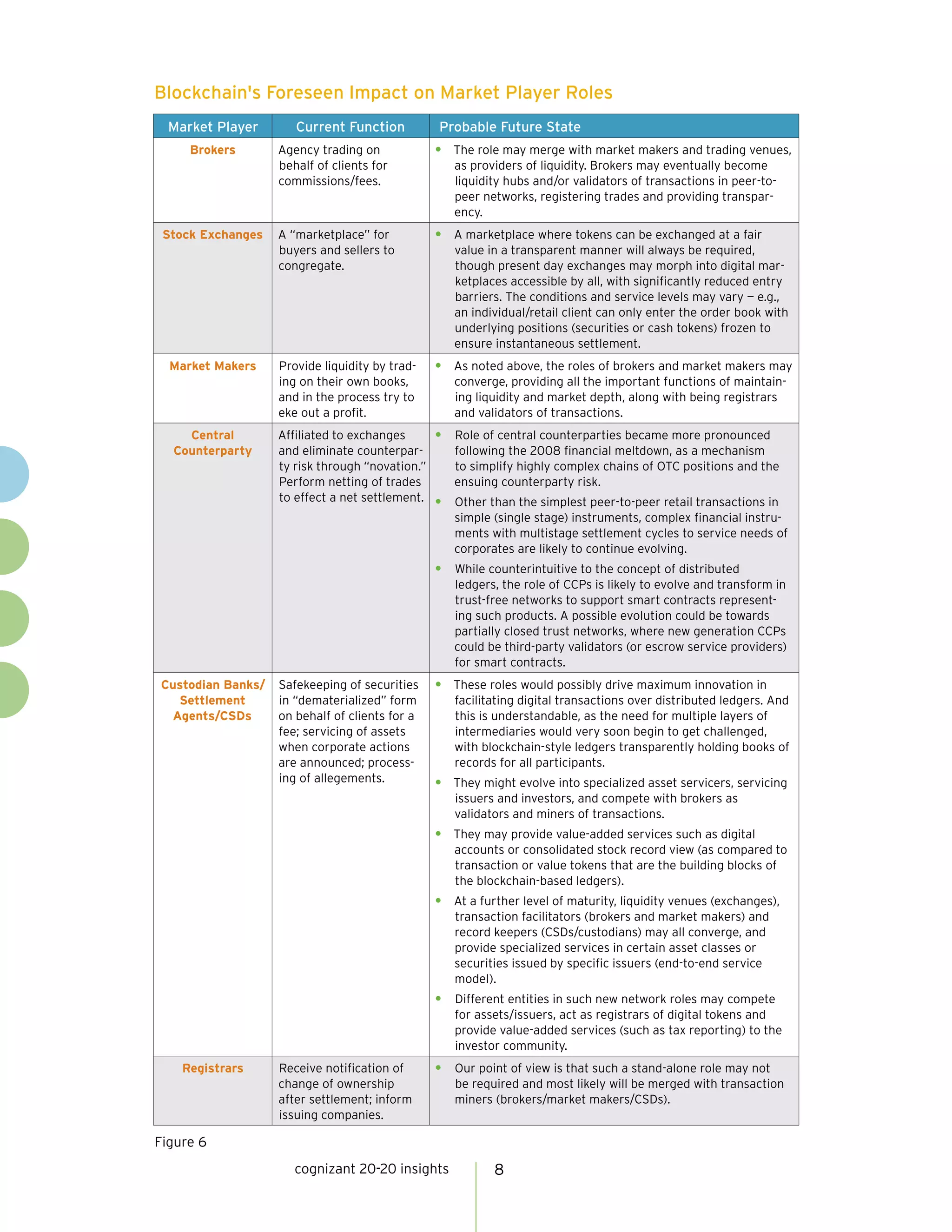

The document discusses the potential of distributed ledger technology (DLT) to transform capital markets, particularly in post-trade securities processing, making processes more autonomous, secure, and efficient. It highlights the need for a gradual transition from traditional systems to DLT, emphasizing coexistence with current practices and the evolving roles of market participants. The paper also outlines various use cases, regulatory considerations, and initiatives by financial institutions exploring blockchain applications.