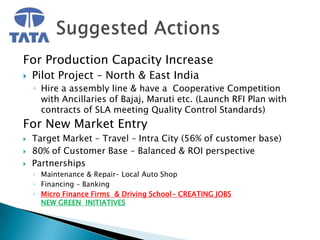

Tata Ace is a new commercial vehicle launched by Tata Motors that has achieved initial success. It has doubled its production capacity to 60,000 units. To further increase production capacity efficiently, the group recommends a pilot project in North and East India involving cooperative competition with ancillary companies of other automakers. For new market entry, the group targets the intra-city travel market, and recommends partnerships with local auto shops, banks, microfinance firms and driving schools to strengthen distribution, financing, and job creation. International expansion is not recommended, rather the focus should be on strengthening the brand and launching new variants in India.