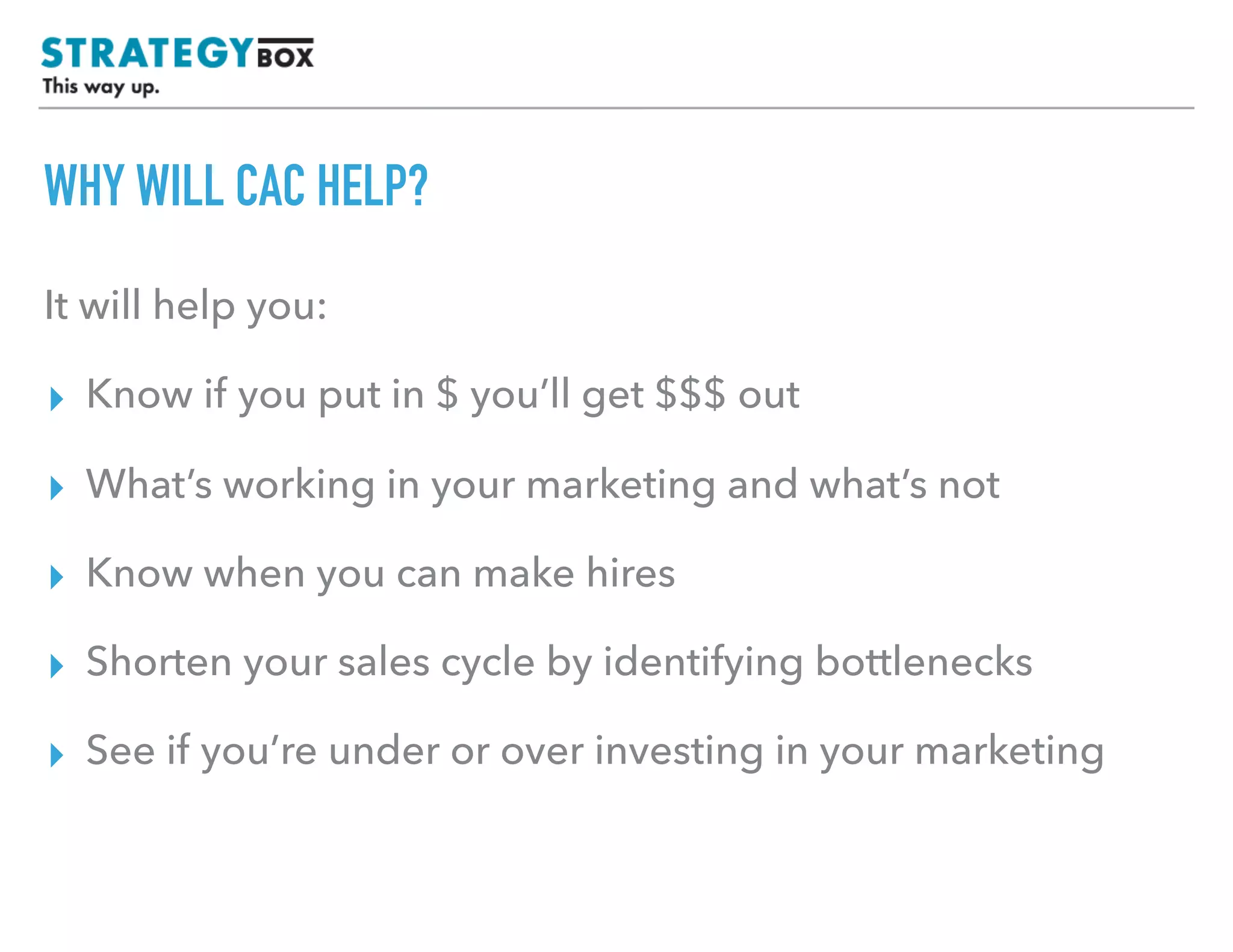

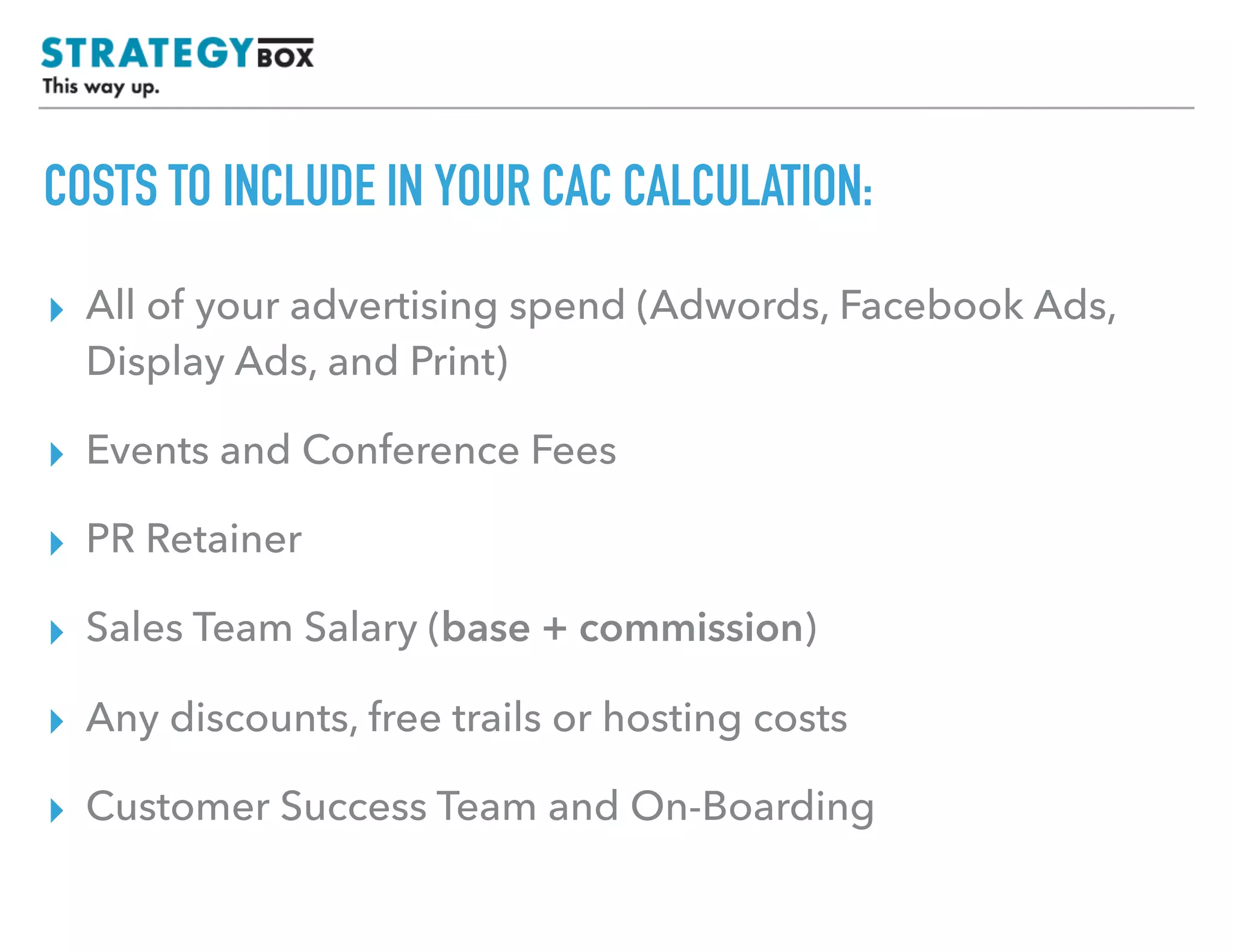

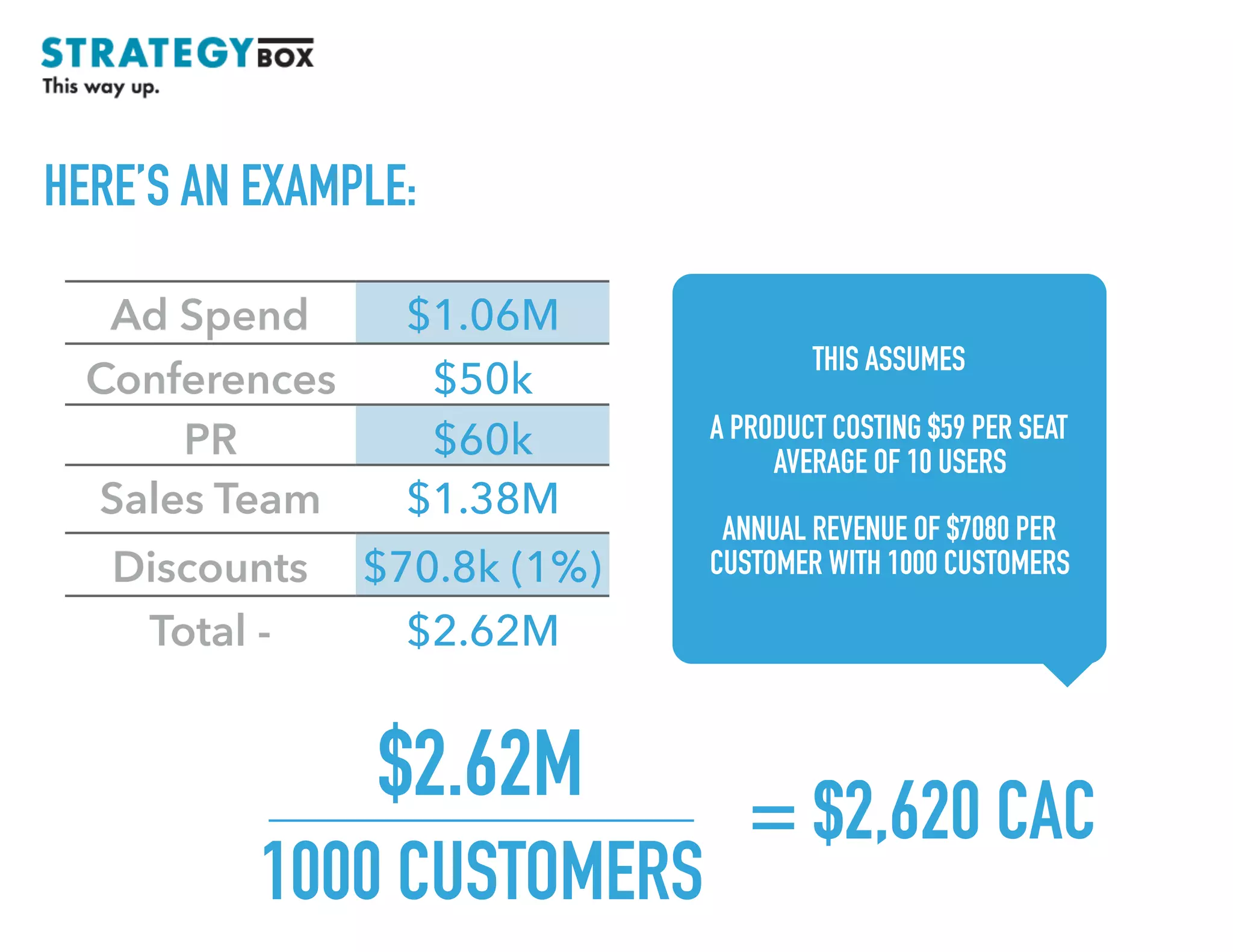

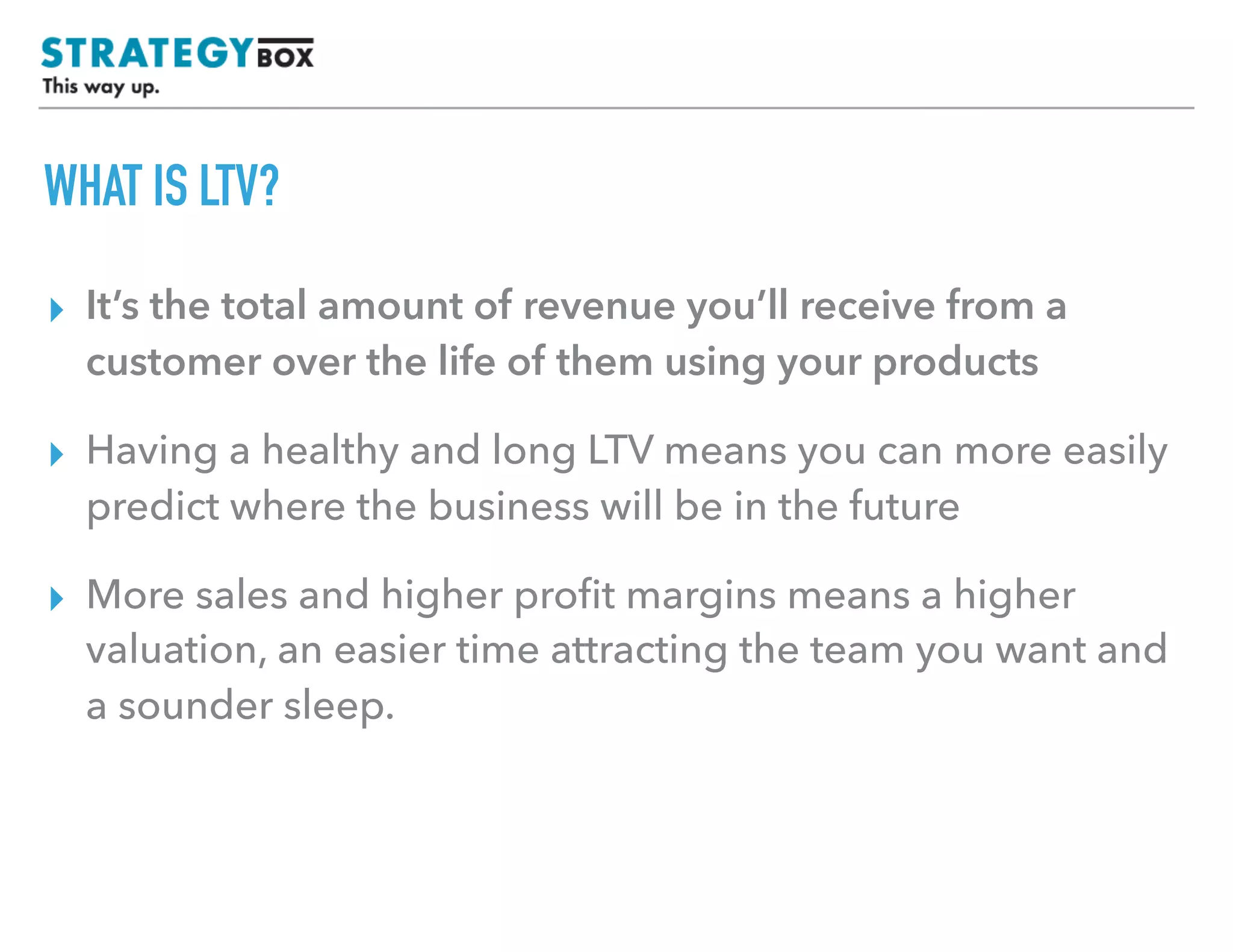

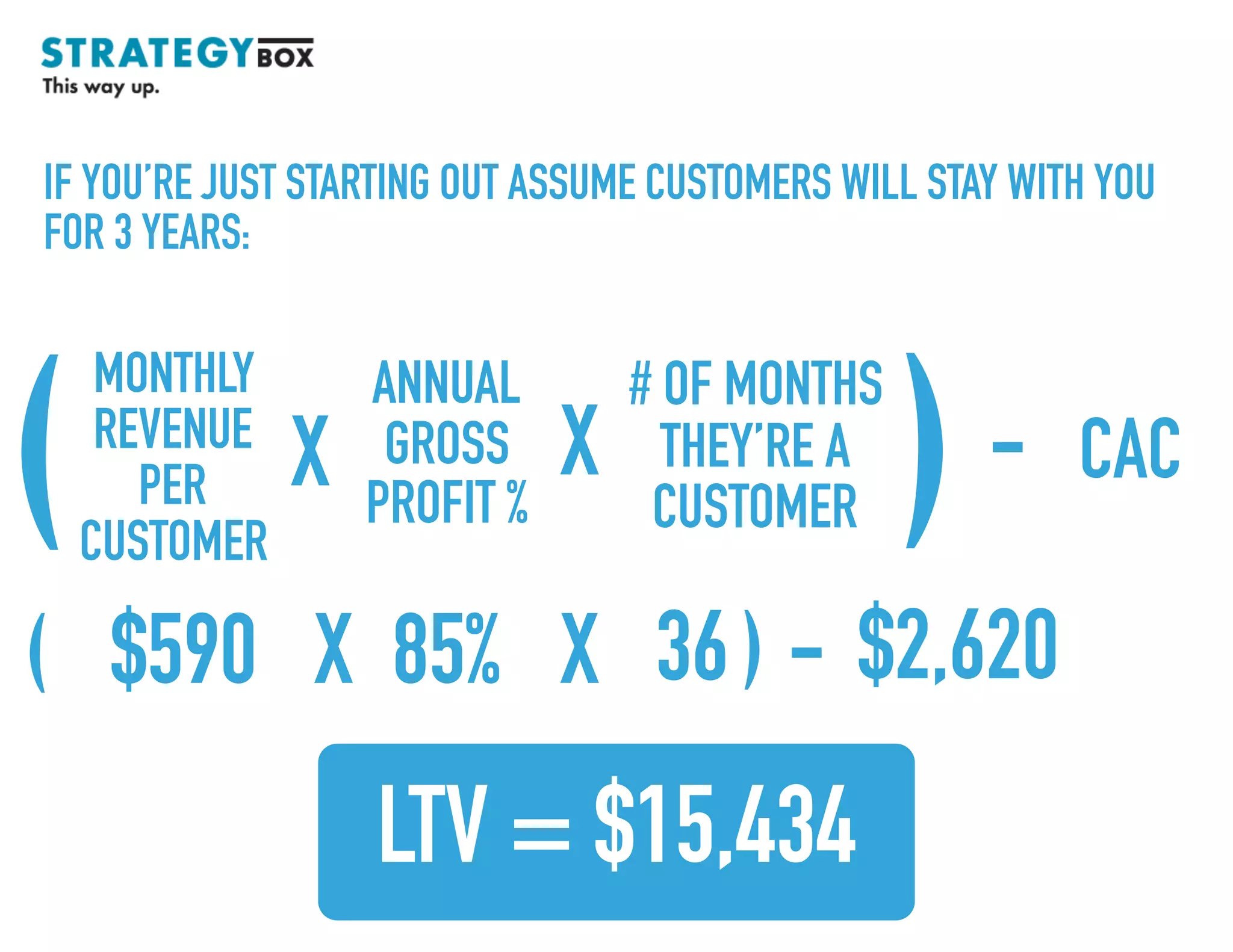

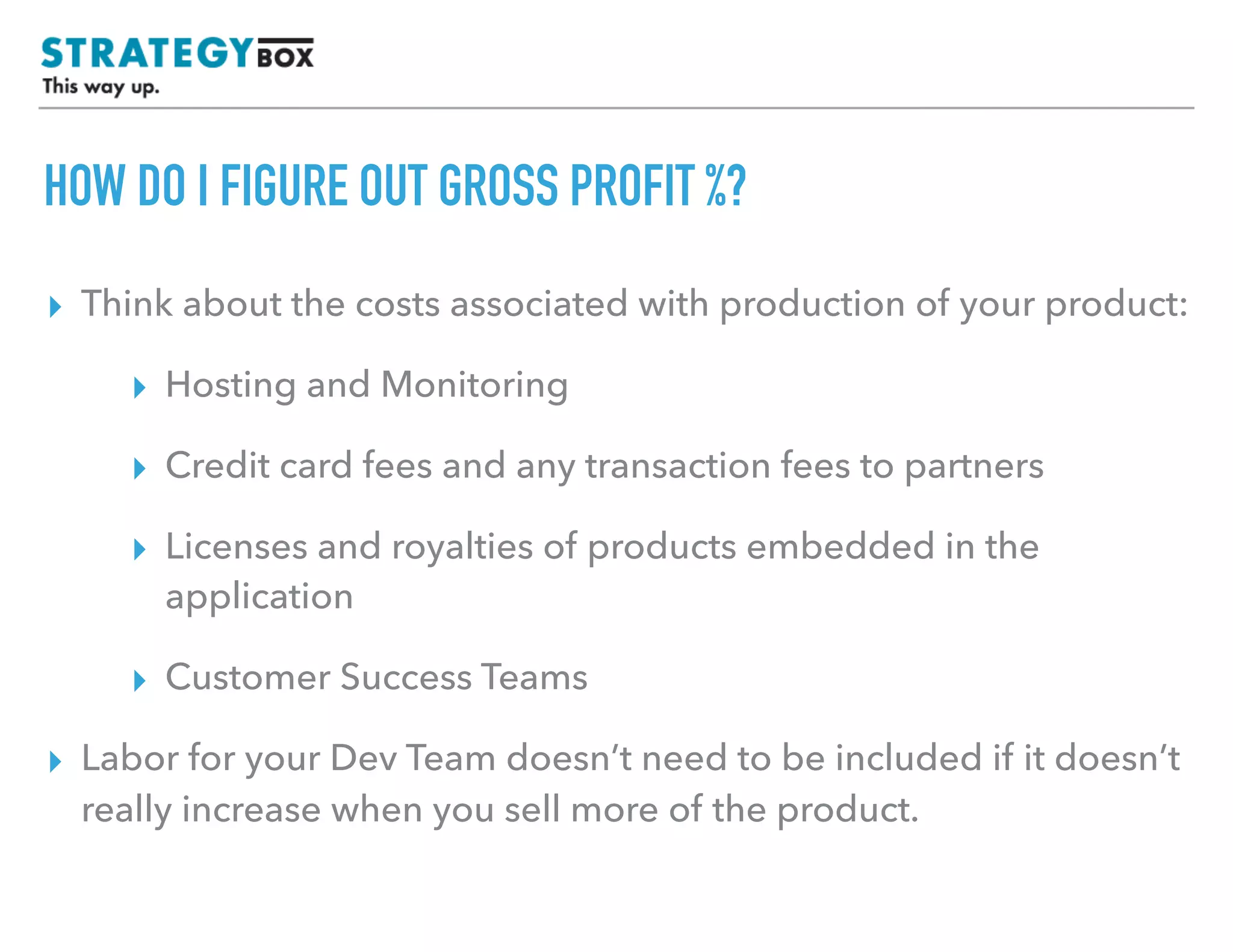

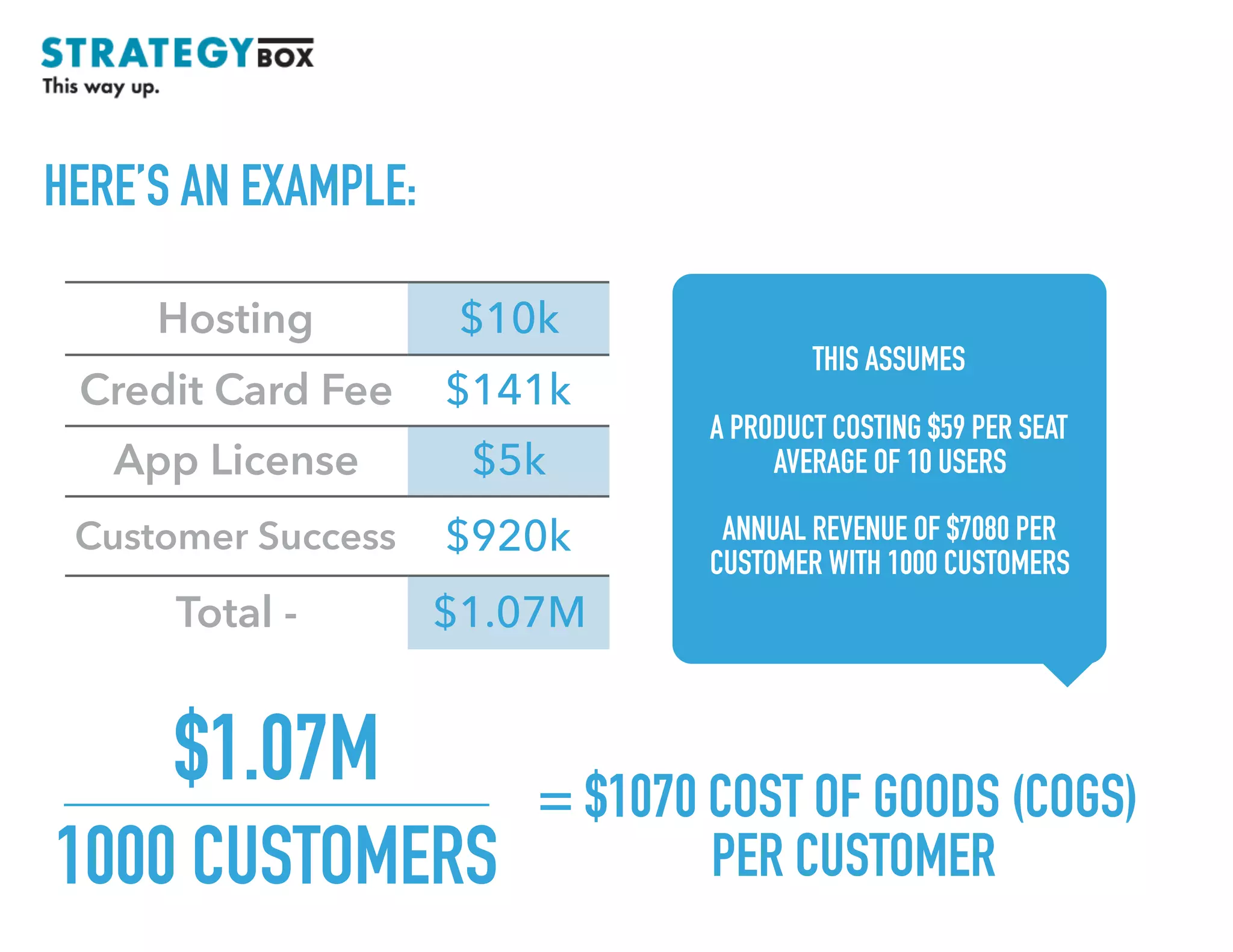

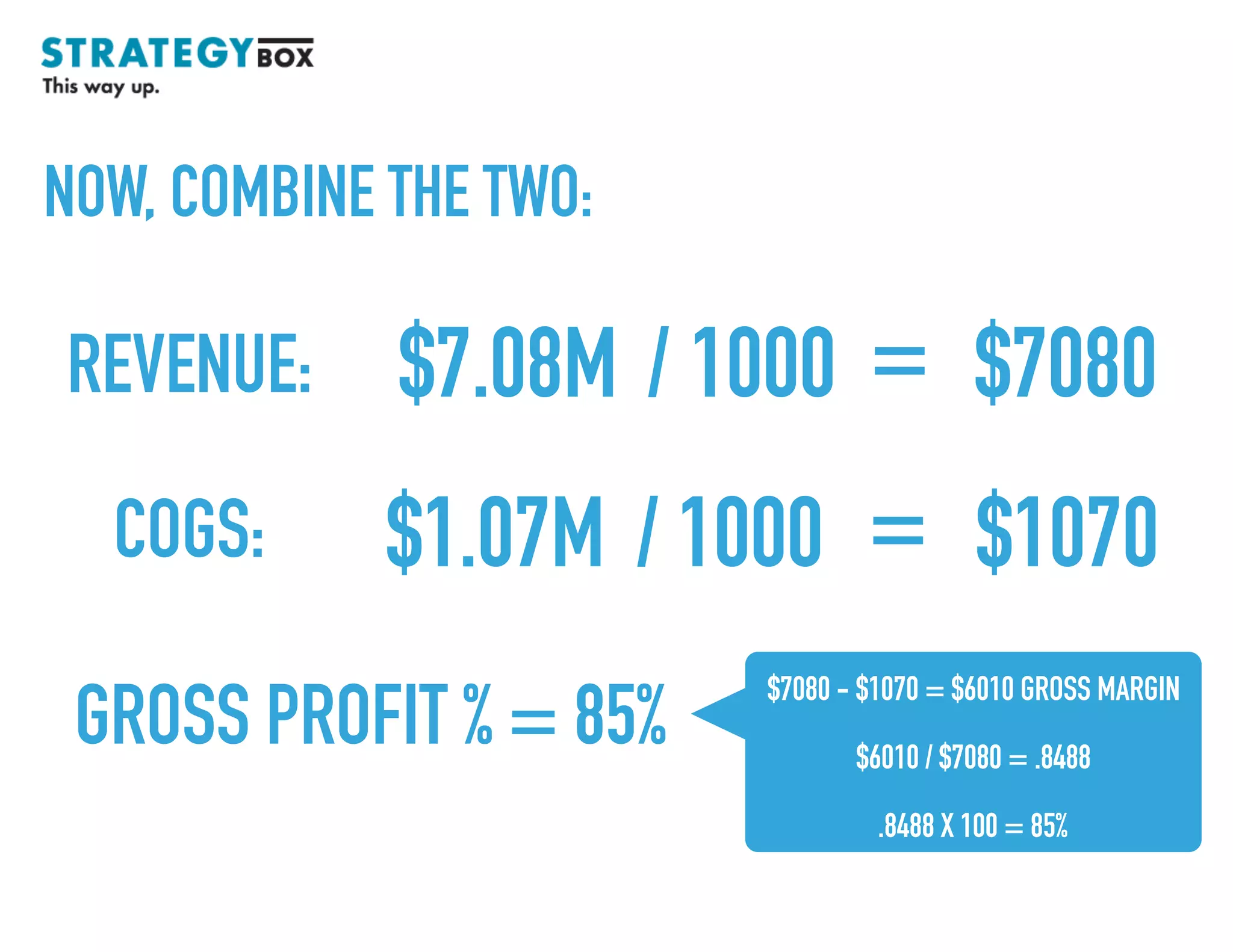

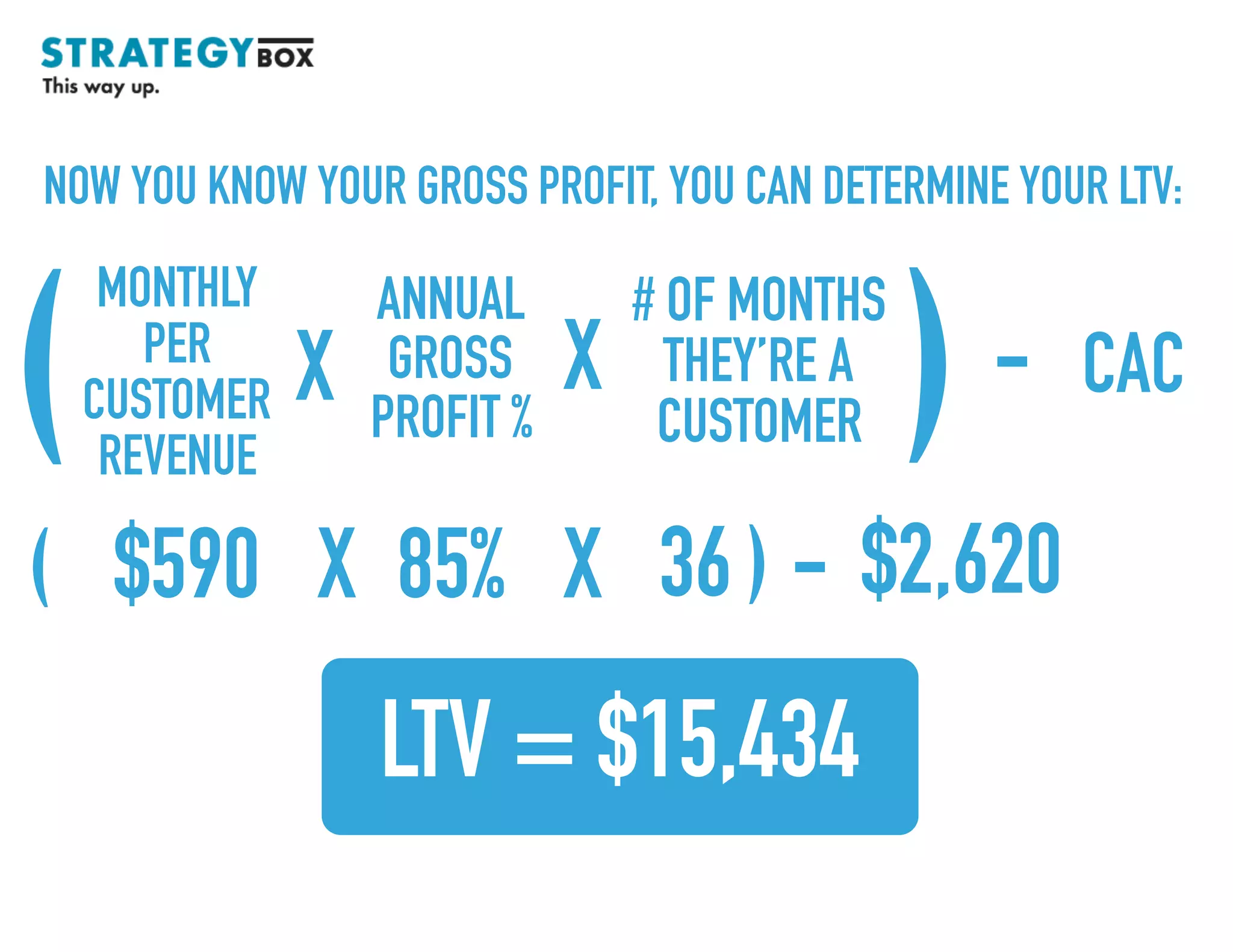

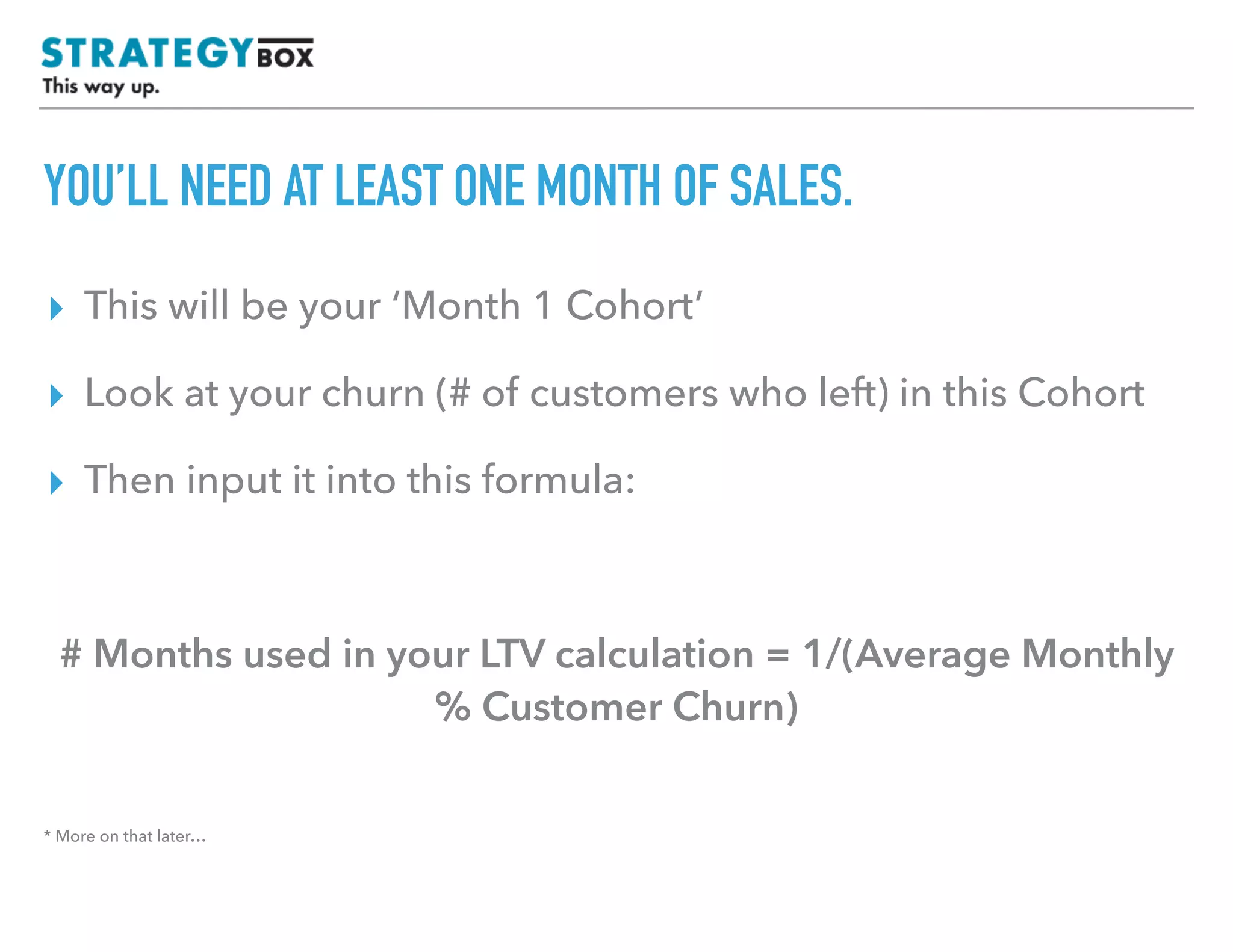

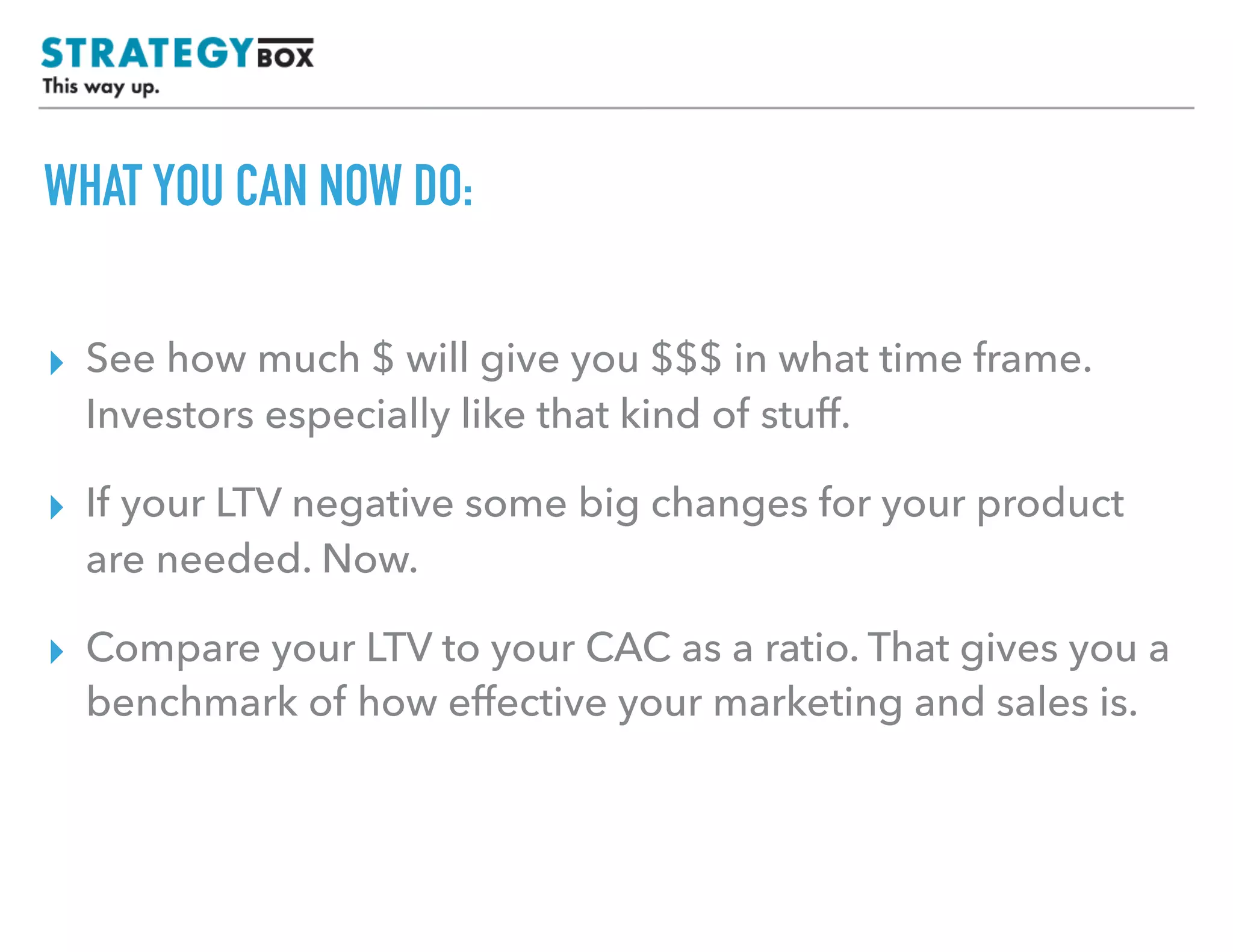

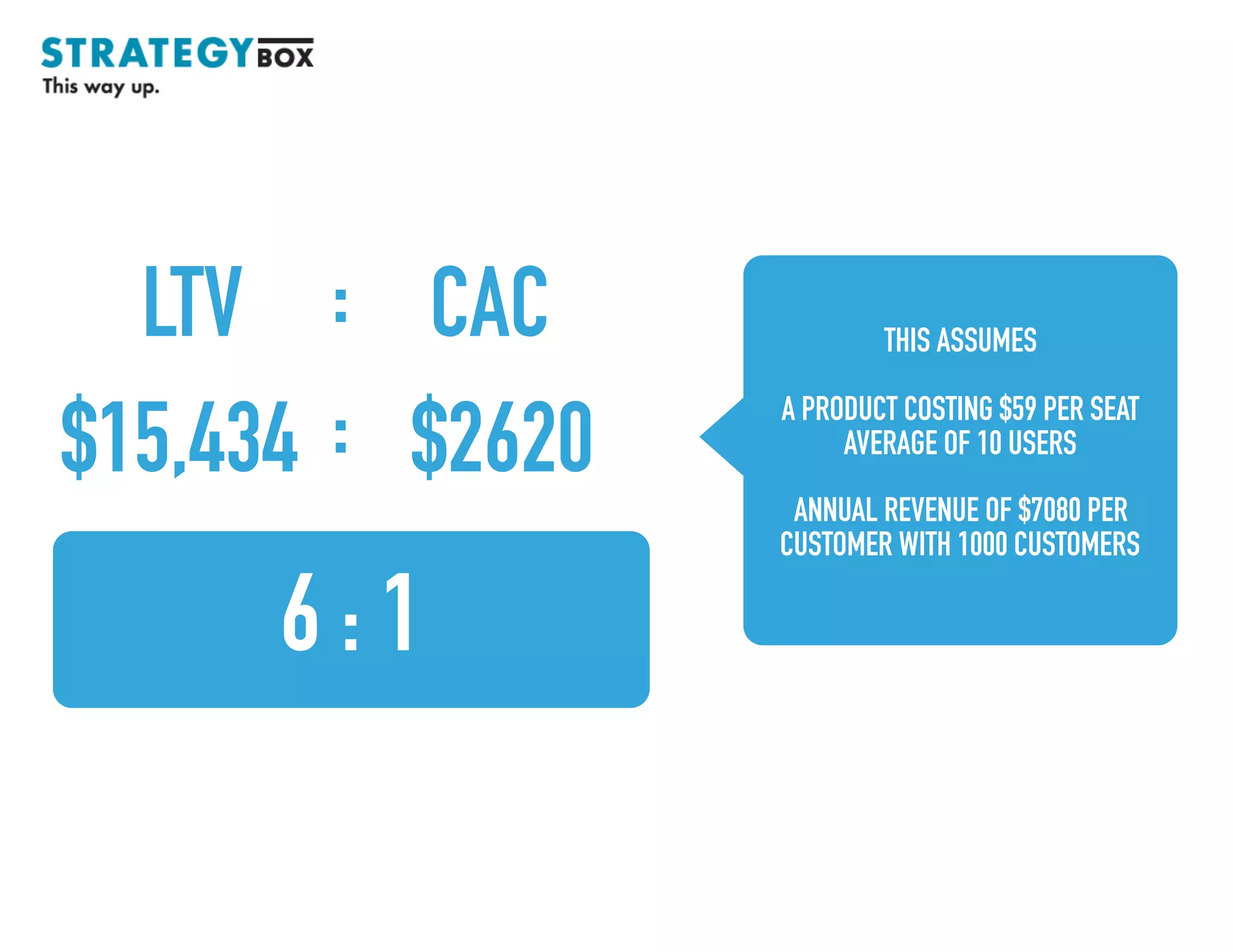

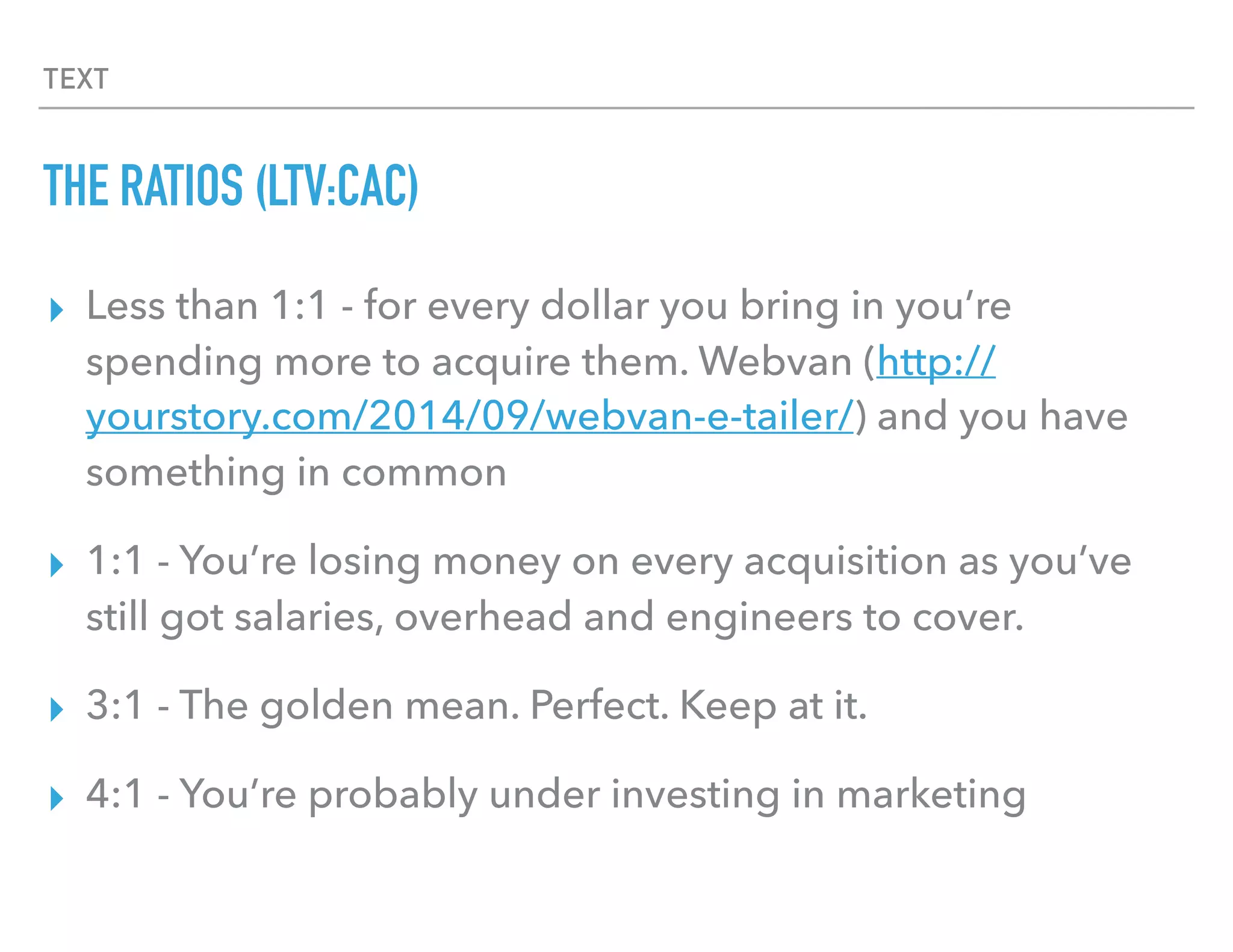

This document discusses how to calculate customer acquisition cost (CAC) and lifetime value (LTV) to optimize marketing spend for a Saaas business. It defines CAC as the total costs to acquire a new customer divided by the number of new customers acquired. LTV is defined as the total revenue expected from a customer over their lifetime. The document provides examples of how to calculate CAC and LTV using made-up company data. It recommends an LTV to CAC ratio of 3:1 or higher as ideal, indicating the business is making more money from customers than spending to acquire them.