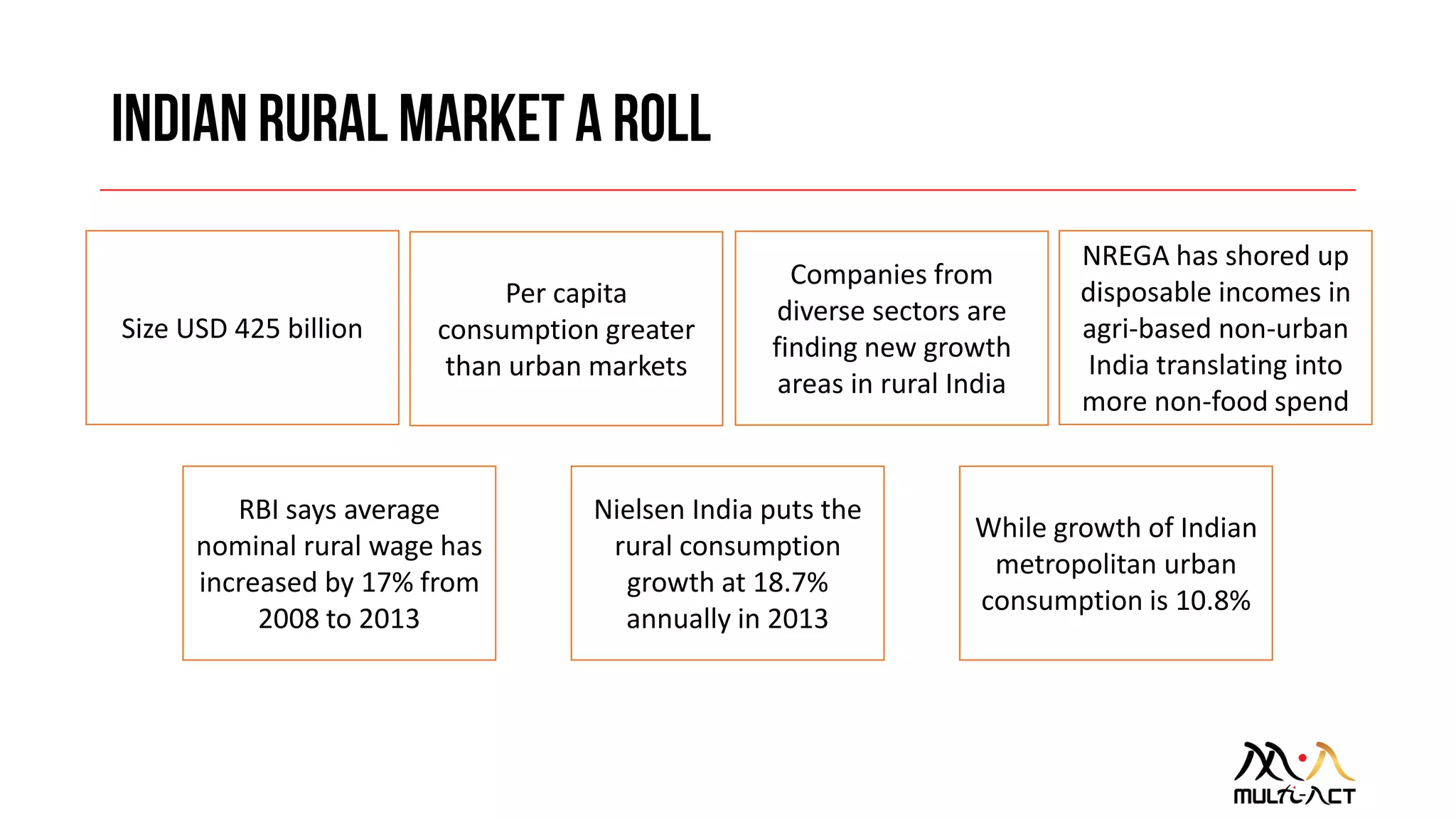

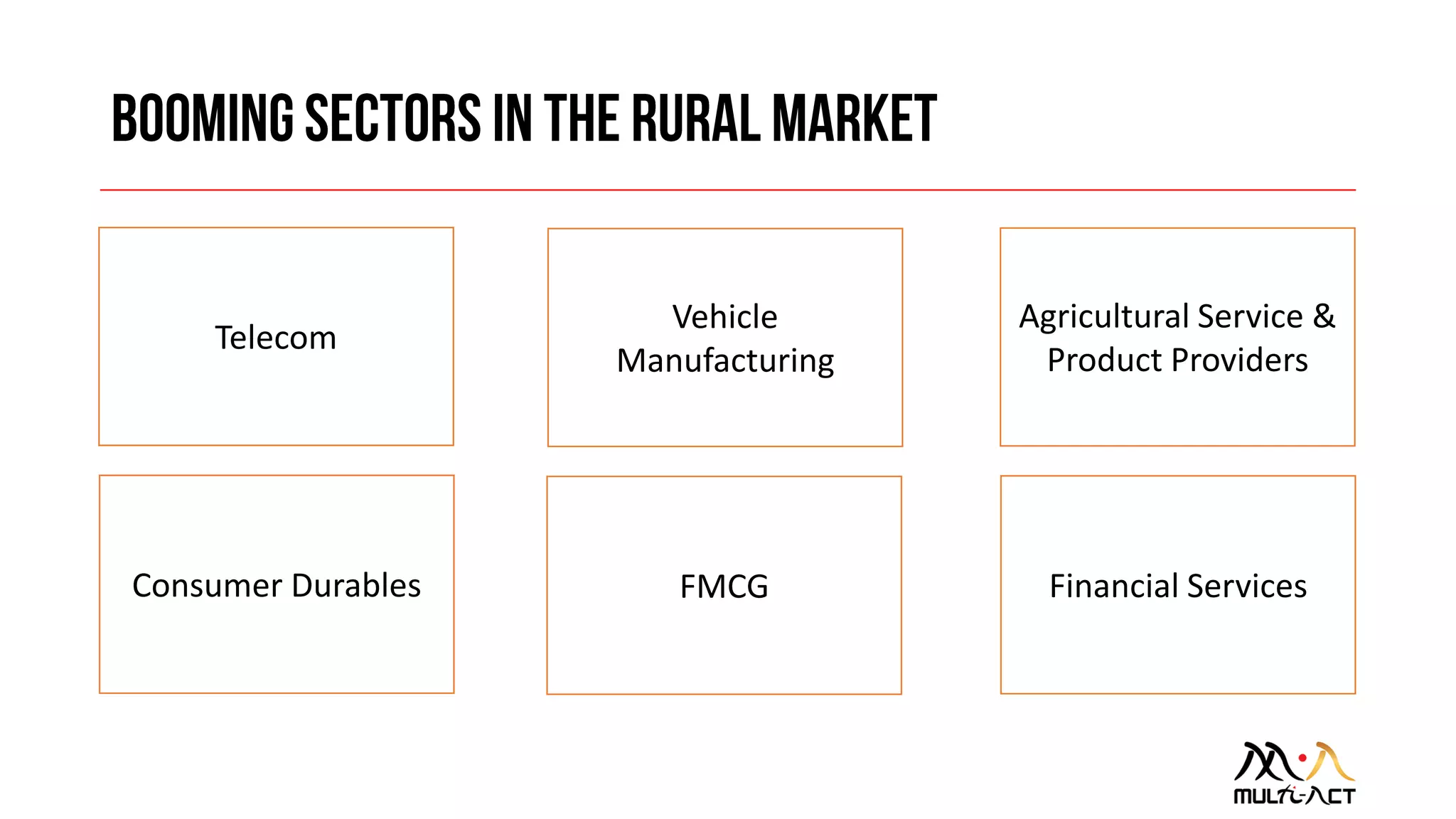

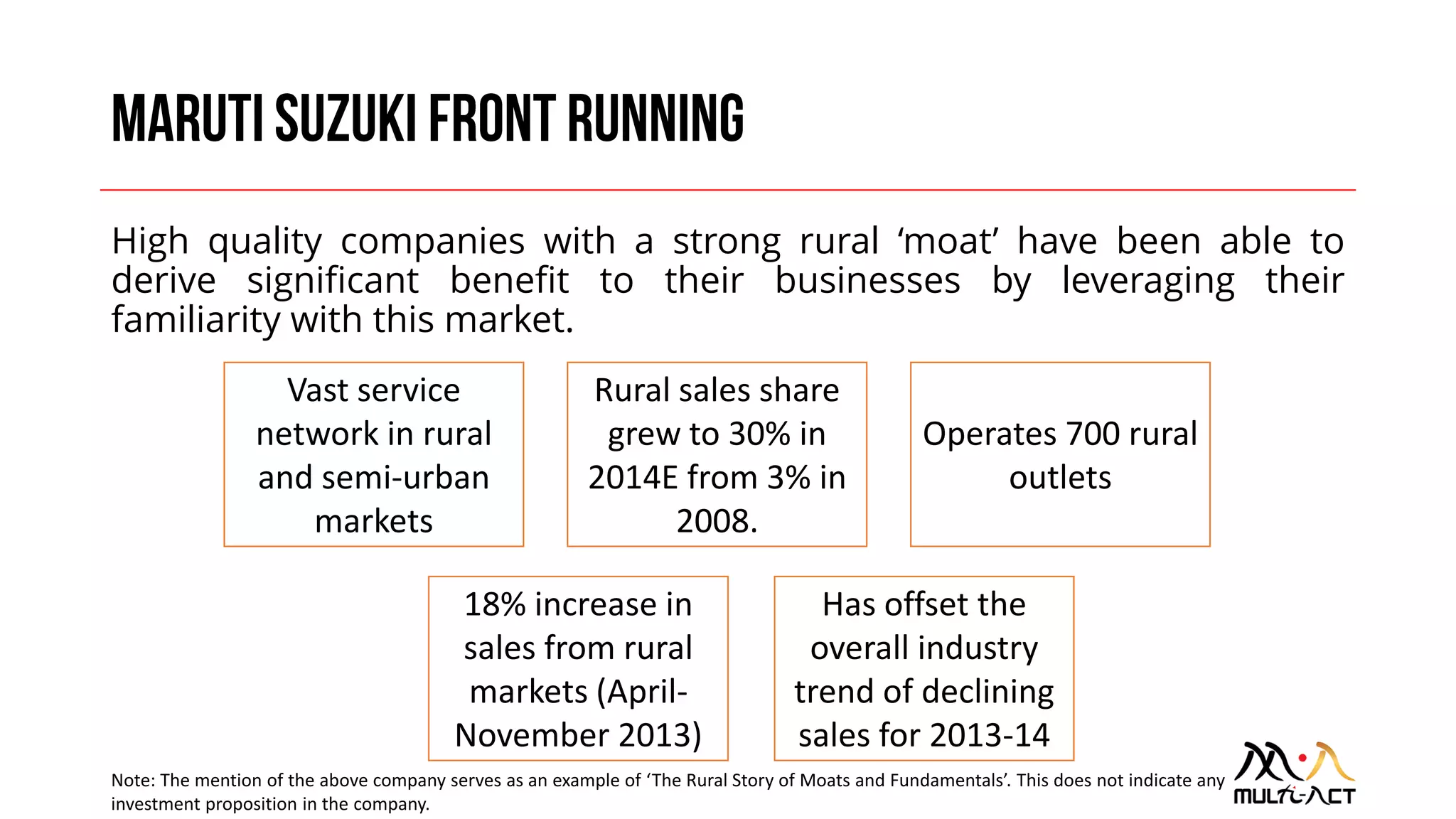

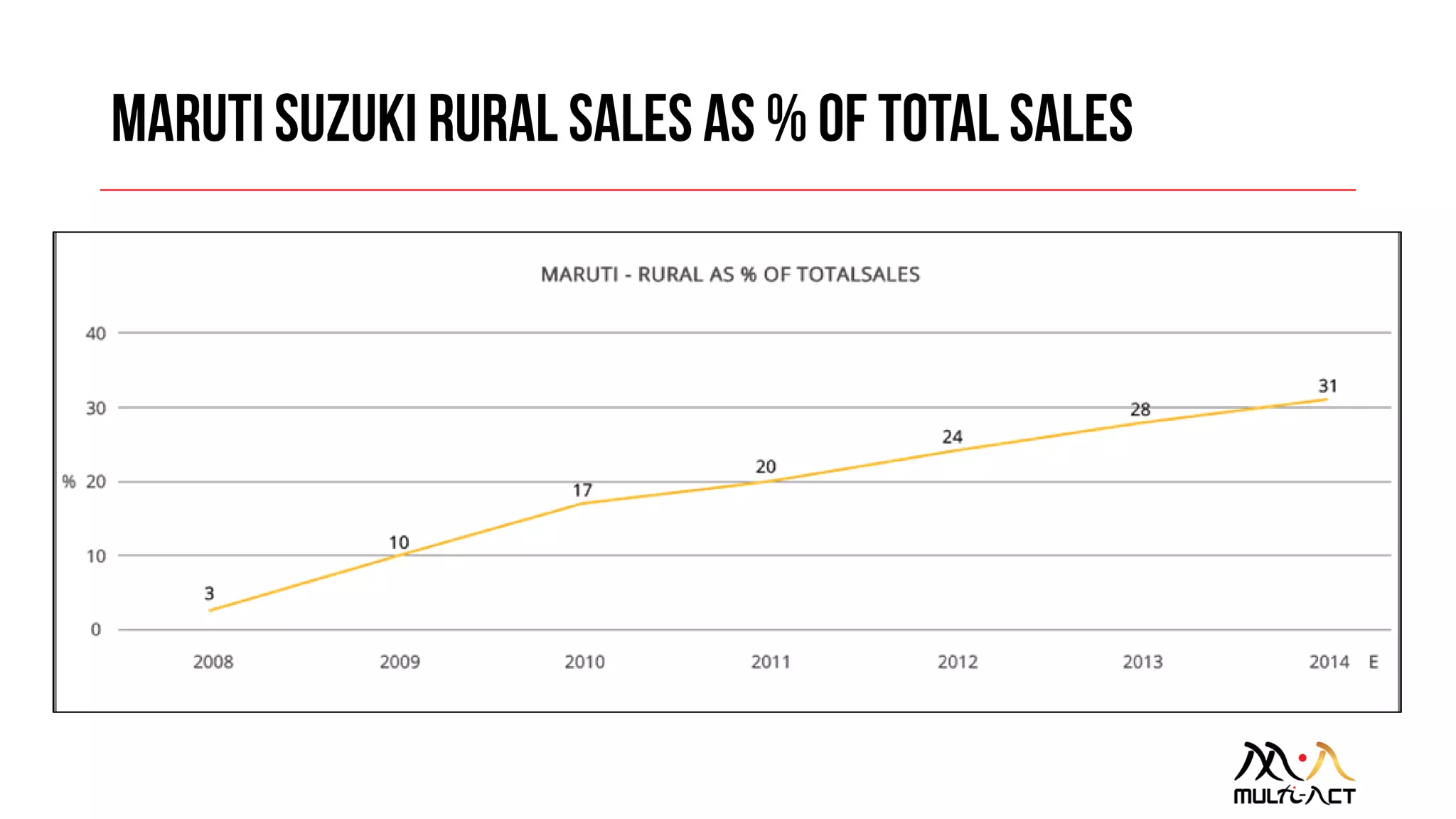

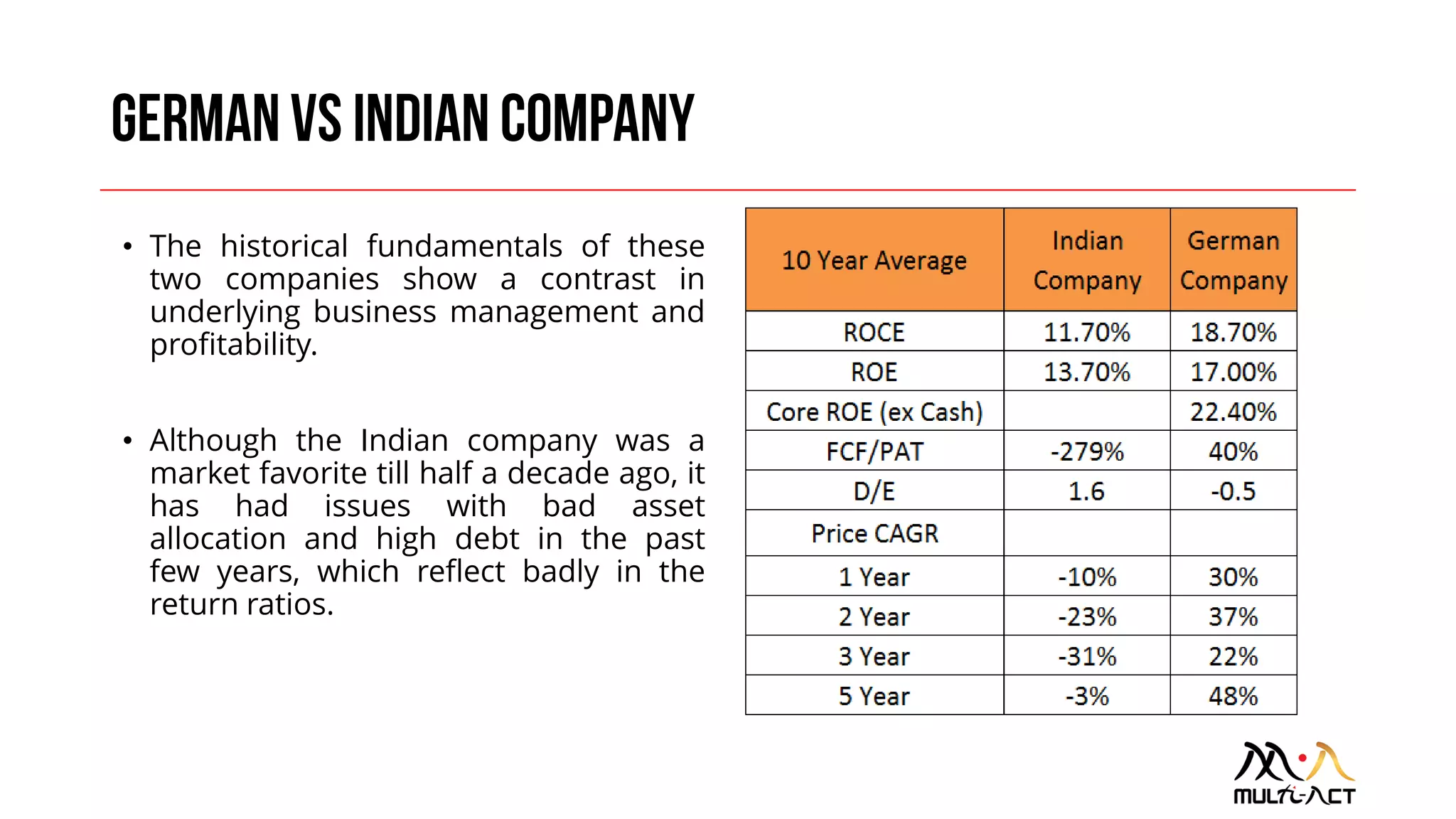

The document discusses the growth potential of rural markets in India, with rural consumption increasing at 18.7% annually as of 2013. Companies that effectively leverage strong rural distribution channels and meet specific market needs benefit significantly, whereas those with weak fundamentals struggle. It emphasizes that while access to rural markets is crucial, the inherent quality and fundamentals of a company are ultimately more important for long-term success and investment viability.