Chappuis Halder - EU Benchmark Regulation threepager - May 2016

•

4 likes•676 views

Threepager on the upcoming EU Benchmark Regulation. In this article, we review the main objectives, characteristics and impacts of the regulation as well as how Chappuis Halder can help the involved financial institutions.

Report

Share

Report

Share

Download to read offline

Recommended

NICSA Webinar | Reimaging the Future of the Fund Industry Through Emerging Te...

Technology innovation enables us to reimagine new ways of doing business and more importantly, how we service our clients. In this webinar, panelists will discuss recent research on new financial technologies with a specific focus on blockchain, robo-advisors, and machine learning.

CH&Co - Supporting the development and adoption of RegTech

This presentation was submitted in January 2016 as an answer to the UK Financial Conduct Authority’s Call for Input on Regtech.

We’re publishing it also here to foster wider discussion on development and adoption of RegTech in the UK.

Special thanks to @Stephane_eyraud, @Patrick_bucquet, @Ekaterina_diakonova, @Sebastien_meunier and @Jean-stephane_gourevitch

The programmable RegTech Eco System by Liv Apneseth Watson

The Programmable RegTech Eco System is here to stay !!

The Compliance Avalanche - why Regtech is the only workable solution

The presentation covers the following points:

- A summary of Accountability II, also known as the Senior Managers and Certification Regime (SM&CR), and why it’s a compliance ‘avalanche’

- The impact on firms, senior managers and staff

- A summary of the challenges faced in implementing

- An overview of why Regtech is the only workable solution

Regtech: How to digitalise the customer experience with KYC and AML Innovation

How can ‘digitalising’ client onboarding help to speed up data processing and improve customer experience? How can you leverage digital capabilities to improve your Know Your Customer (KYC) and Anti-Money Laundering (AML) workflows, processes and checks?

The task is not easy for financial institutions that have large, complex, legacy ecosystems, and standalone solutions and processes.

However, all is not lost, with the emergence of specialist regtech providers that can help you leap frog heritage infrastructure and deploy new and improved workflows, systems and applications.

This webinar will gauge the extent of digitalisation across onboarding, KYC and AML, review the latest market developments, and explore the capabilities of regtech tools that can help you solve the problems inherent in today’s onboarding processes, and enhance customer experience.

If your organisation is working to improve customer experience, register for this webinar to find out more about:

-The state of play on digitalising customer experience

-Problems caused by legacy and standalone systems

-Best practice approaches to digitalisation

-Regtech tools that innovate KYC and AML processes

-Guidance on how to set and achieve your goals

RegTech Markets Directory 2017 insights

This is a copy of the speech and presentation I have at RegTech Rising and the RegTech Awards Ceremony in November 2017.

Recommended

NICSA Webinar | Reimaging the Future of the Fund Industry Through Emerging Te...

Technology innovation enables us to reimagine new ways of doing business and more importantly, how we service our clients. In this webinar, panelists will discuss recent research on new financial technologies with a specific focus on blockchain, robo-advisors, and machine learning.

CH&Co - Supporting the development and adoption of RegTech

This presentation was submitted in January 2016 as an answer to the UK Financial Conduct Authority’s Call for Input on Regtech.

We’re publishing it also here to foster wider discussion on development and adoption of RegTech in the UK.

Special thanks to @Stephane_eyraud, @Patrick_bucquet, @Ekaterina_diakonova, @Sebastien_meunier and @Jean-stephane_gourevitch

The programmable RegTech Eco System by Liv Apneseth Watson

The Programmable RegTech Eco System is here to stay !!

The Compliance Avalanche - why Regtech is the only workable solution

The presentation covers the following points:

- A summary of Accountability II, also known as the Senior Managers and Certification Regime (SM&CR), and why it’s a compliance ‘avalanche’

- The impact on firms, senior managers and staff

- A summary of the challenges faced in implementing

- An overview of why Regtech is the only workable solution

Regtech: How to digitalise the customer experience with KYC and AML Innovation

How can ‘digitalising’ client onboarding help to speed up data processing and improve customer experience? How can you leverage digital capabilities to improve your Know Your Customer (KYC) and Anti-Money Laundering (AML) workflows, processes and checks?

The task is not easy for financial institutions that have large, complex, legacy ecosystems, and standalone solutions and processes.

However, all is not lost, with the emergence of specialist regtech providers that can help you leap frog heritage infrastructure and deploy new and improved workflows, systems and applications.

This webinar will gauge the extent of digitalisation across onboarding, KYC and AML, review the latest market developments, and explore the capabilities of regtech tools that can help you solve the problems inherent in today’s onboarding processes, and enhance customer experience.

If your organisation is working to improve customer experience, register for this webinar to find out more about:

-The state of play on digitalising customer experience

-Problems caused by legacy and standalone systems

-Best practice approaches to digitalisation

-Regtech tools that innovate KYC and AML processes

-Guidance on how to set and achieve your goals

RegTech Markets Directory 2017 insights

This is a copy of the speech and presentation I have at RegTech Rising and the RegTech Awards Ceremony in November 2017.

What is RegTech?

With an increase in regulatory compliance, innovation in technology has become increasingly prevalent throughout the professional and financial services. With the birth of RegTech, we ask, what is it, and how can it be effectively utilised by firms across sectors.

Innovate Finance Industry Sandbox Report

The FCA commissioned research report by Innovate Finance about how and why industry sandboxes work.

FinTech Belgium – RegTech Belgium Kick Off MeetUp – M. Cañada Cornejo – Deloi...

FinTech Belgium – RegTech Belgium Kick Off MeetUp – M. Cañada Cornejo – Deloitte – 24-10-19

London leads growth in RegTech investments. Research by FinTech Global, Jan 2017

The presentation provides a summary of research findings undertaken by FinTech Global. RegTech investments have more than tripled over the last five years. 2016 saw two record quarters for RegTech investments. London has established itself as the global leader in RegTech deals.

Blome - Translating supply chain finance into SME productivity

20-21 February 2018, Mexico City: Workshop on building business linkages that boost SME productivity. http://www.oecd.org/cfe/smes/workshop-on-building-business-linkages-that-boost-SME-productivity.htm

Digital disruption in financial markets – BARBERIS – June 2019 OECD discussion

Digital disruption in financial markets – BARBERIS – June 2019 OECD discussionOECD Directorate for Financial and Enterprise Affairs

This presentation by Janos BARBERIS, Senior Research Fellow at the Asian Institute of International Financial Law, was made during the discussion “Digital disruption in financial markets” held at the 131st meeting of the OECD Competition Committee on 5 June 2019. More papers and presentations on the topic can be found out at oe.cd/ddfm.Professor Lester Lloyd-Reason: Digital technologies and SME internationalisation

20-21 February 2018, Mexico City: Workshop on building business linkages that boost SME productivity.

oe.cd/sme

Alberto Wyderka - Building business linkage that boost SME productivity: the ...

20-21 February 2018, Mexico City: Workshop on building business linkages that boost SME productivity. http://www.oecd.org/cfe/smes/workshop-on-building-business-linkages-that-boost-SME-productivity.htm

Regulation and competition in light of digitalisation – Norwegian Competition...

Regulation and competition in light of digitalisation – Norwegian Competition...OECD Directorate for Financial and Enterprise Affairs

This presentation by the Norwegian Competition Authority was made during a workshop on “Regulation and competition in light of digitalisation” held by the OECD in Paris on 31 January 2018. More papers and presentations on the topic can be found out at oe.cd/wrcd. Regulation and competition in light of digitalisation – UK Competition & Mark...

Regulation and competition in light of digitalisation – UK Competition & Mark...OECD Directorate for Financial and Enterprise Affairs

This presentation by the UK Competition & Markets Authority was made during a workshop on “Regulation and competition in light of digitalisation” held by the OECD in Paris on 31 January 2018. More papers and presentations on the topic can be found out at oe.cd/wrcd. CxO Roadmap: Designing a Fintech Strategy Around Your Legacy Core IT Supplier

Senior Execs struggle with how to pick the best alternative fintech suppliers while simultaneously de-handcuffing from one-sided legacy core relationships. With so many choices appearing in the market CEOs want to know which neo-cores are ready? What fintech suppliers are mature enough to partner? How does the bank structure a greenfield deal with a new market entrant and manage the associated business risk?

CEOs need strategic insights on how to set the vision and direct their franchise to take advantage of the fintech opportunity without creating too much disruption with clients, staff and the bottom line. Information is pouring in from all directions on fintech and it has become difficult to adopt the right strategy in a fragmented evolving marketplace providing many options.

This session will provide an unbiased, no BS summary for non-technical CEOs ready to lead their franchise in the new fintech era while minimizing the long term hold that legacy core IT suppliers have on them.

Mattia Corbetta - Crowdinvesting in Italy: a case study

20-21 February 2018, Mexico City: Workshop on building business linkages that boost SME productivity. http://www.oecd.org/cfe/smes/workshop-on-building-business-linkages-that-boost-SME-productivity.htm

Veronika Michalkova: Data analytics in SMEs relevant policies

20-21 February 2018, Mexico City: Workshop on building business linkages that books SME productivity.

oe.cd/sme

Regulation and competition in light of digitalisation – Competition Bureau Ca...

Regulation and competition in light of digitalisation – Competition Bureau Ca...OECD Directorate for Financial and Enterprise Affairs

This presentation by Competition Bureau Canada was made during a workshop on “Regulation and competition in light of digitalisation” held by the OECD in Paris on 31 January 2018. More papers and presentations on the topic can be found out at oe.cd/wrcd. Paolo Casini - Digitalisation, scale-ups and access to finance

20-21 February 2018, Mexico City: Workshop on building business linkages that books SME productivity. http://www.oecd.org/cfe/smes/workshop-on-building-business-linkages-that-boost-SME-productivity.htm

Digital economy-legal-updates-webinar-co-investment-in-new-infrastructure-rol...

Digital economy-legal-updates-webinar-co-investment-in-new-infrastructure-rol...Francesco Liberatore

This presentation considers the financial, economic, regulatory and competition law aspects of EU co-investment projects in telecoms infrastructure.Digital disruption in financial markets – DRURY – June 2019 OECD discussion

Digital disruption in financial markets – DRURY – June 2019 OECD discussionOECD Directorate for Financial and Enterprise Affairs

This presentation by Stephen DRURY, Santander UK, was made during the discussion “Digital disruption in financial markets” held at the 131st meeting of the OECD Competition Committee on 5 June 2019. More papers and presentations on the topic can be found out at oe.cd/cclm.Regulation and competition in light of digitalisation – CNMC Spain – January ...

Regulation and competition in light of digitalisation – CNMC Spain – January ...OECD Directorate for Financial and Enterprise Affairs

This presentation by the CNMC (Spanish Competition Authority) was made during a workshop on “Regulation and competition in light of digitalisation” held by the OECD in Paris on 31 January 2018. More papers and presentations on the topic can be found out at oe.cd/wrcd. Cartel screening in the digital era – UK Competition & Markets Authority – Ja...

Cartel screening in the digital era – UK Competition & Markets Authority – Ja...OECD Directorate for Financial and Enterprise Affairs

This presentation by the UK Competition and Markets Authorities was made during a workshop on “Cartel screening in the digital era” held by the OECD in Paris on 30 January 2018. More papers and presentations on the topic can be found out at oe.cd/wcsde. More Related Content

What's hot

What is RegTech?

With an increase in regulatory compliance, innovation in technology has become increasingly prevalent throughout the professional and financial services. With the birth of RegTech, we ask, what is it, and how can it be effectively utilised by firms across sectors.

Innovate Finance Industry Sandbox Report

The FCA commissioned research report by Innovate Finance about how and why industry sandboxes work.

FinTech Belgium – RegTech Belgium Kick Off MeetUp – M. Cañada Cornejo – Deloi...

FinTech Belgium – RegTech Belgium Kick Off MeetUp – M. Cañada Cornejo – Deloitte – 24-10-19

London leads growth in RegTech investments. Research by FinTech Global, Jan 2017

The presentation provides a summary of research findings undertaken by FinTech Global. RegTech investments have more than tripled over the last five years. 2016 saw two record quarters for RegTech investments. London has established itself as the global leader in RegTech deals.

Blome - Translating supply chain finance into SME productivity

20-21 February 2018, Mexico City: Workshop on building business linkages that boost SME productivity. http://www.oecd.org/cfe/smes/workshop-on-building-business-linkages-that-boost-SME-productivity.htm

Digital disruption in financial markets – BARBERIS – June 2019 OECD discussion

Digital disruption in financial markets – BARBERIS – June 2019 OECD discussionOECD Directorate for Financial and Enterprise Affairs

This presentation by Janos BARBERIS, Senior Research Fellow at the Asian Institute of International Financial Law, was made during the discussion “Digital disruption in financial markets” held at the 131st meeting of the OECD Competition Committee on 5 June 2019. More papers and presentations on the topic can be found out at oe.cd/ddfm.Professor Lester Lloyd-Reason: Digital technologies and SME internationalisation

20-21 February 2018, Mexico City: Workshop on building business linkages that boost SME productivity.

oe.cd/sme

Alberto Wyderka - Building business linkage that boost SME productivity: the ...

20-21 February 2018, Mexico City: Workshop on building business linkages that boost SME productivity. http://www.oecd.org/cfe/smes/workshop-on-building-business-linkages-that-boost-SME-productivity.htm

Regulation and competition in light of digitalisation – Norwegian Competition...

Regulation and competition in light of digitalisation – Norwegian Competition...OECD Directorate for Financial and Enterprise Affairs

This presentation by the Norwegian Competition Authority was made during a workshop on “Regulation and competition in light of digitalisation” held by the OECD in Paris on 31 January 2018. More papers and presentations on the topic can be found out at oe.cd/wrcd. Regulation and competition in light of digitalisation – UK Competition & Mark...

Regulation and competition in light of digitalisation – UK Competition & Mark...OECD Directorate for Financial and Enterprise Affairs

This presentation by the UK Competition & Markets Authority was made during a workshop on “Regulation and competition in light of digitalisation” held by the OECD in Paris on 31 January 2018. More papers and presentations on the topic can be found out at oe.cd/wrcd. CxO Roadmap: Designing a Fintech Strategy Around Your Legacy Core IT Supplier

Senior Execs struggle with how to pick the best alternative fintech suppliers while simultaneously de-handcuffing from one-sided legacy core relationships. With so many choices appearing in the market CEOs want to know which neo-cores are ready? What fintech suppliers are mature enough to partner? How does the bank structure a greenfield deal with a new market entrant and manage the associated business risk?

CEOs need strategic insights on how to set the vision and direct their franchise to take advantage of the fintech opportunity without creating too much disruption with clients, staff and the bottom line. Information is pouring in from all directions on fintech and it has become difficult to adopt the right strategy in a fragmented evolving marketplace providing many options.

This session will provide an unbiased, no BS summary for non-technical CEOs ready to lead their franchise in the new fintech era while minimizing the long term hold that legacy core IT suppliers have on them.

Mattia Corbetta - Crowdinvesting in Italy: a case study

20-21 February 2018, Mexico City: Workshop on building business linkages that boost SME productivity. http://www.oecd.org/cfe/smes/workshop-on-building-business-linkages-that-boost-SME-productivity.htm

Veronika Michalkova: Data analytics in SMEs relevant policies

20-21 February 2018, Mexico City: Workshop on building business linkages that books SME productivity.

oe.cd/sme

Regulation and competition in light of digitalisation – Competition Bureau Ca...

Regulation and competition in light of digitalisation – Competition Bureau Ca...OECD Directorate for Financial and Enterprise Affairs

This presentation by Competition Bureau Canada was made during a workshop on “Regulation and competition in light of digitalisation” held by the OECD in Paris on 31 January 2018. More papers and presentations on the topic can be found out at oe.cd/wrcd. Paolo Casini - Digitalisation, scale-ups and access to finance

20-21 February 2018, Mexico City: Workshop on building business linkages that books SME productivity. http://www.oecd.org/cfe/smes/workshop-on-building-business-linkages-that-boost-SME-productivity.htm

Digital economy-legal-updates-webinar-co-investment-in-new-infrastructure-rol...

Digital economy-legal-updates-webinar-co-investment-in-new-infrastructure-rol...Francesco Liberatore

This presentation considers the financial, economic, regulatory and competition law aspects of EU co-investment projects in telecoms infrastructure.Digital disruption in financial markets – DRURY – June 2019 OECD discussion

Digital disruption in financial markets – DRURY – June 2019 OECD discussionOECD Directorate for Financial and Enterprise Affairs

This presentation by Stephen DRURY, Santander UK, was made during the discussion “Digital disruption in financial markets” held at the 131st meeting of the OECD Competition Committee on 5 June 2019. More papers and presentations on the topic can be found out at oe.cd/cclm.Regulation and competition in light of digitalisation – CNMC Spain – January ...

Regulation and competition in light of digitalisation – CNMC Spain – January ...OECD Directorate for Financial and Enterprise Affairs

This presentation by the CNMC (Spanish Competition Authority) was made during a workshop on “Regulation and competition in light of digitalisation” held by the OECD in Paris on 31 January 2018. More papers and presentations on the topic can be found out at oe.cd/wrcd. Cartel screening in the digital era – UK Competition & Markets Authority – Ja...

Cartel screening in the digital era – UK Competition & Markets Authority – Ja...OECD Directorate for Financial and Enterprise Affairs

This presentation by the UK Competition and Markets Authorities was made during a workshop on “Cartel screening in the digital era” held by the OECD in Paris on 30 January 2018. More papers and presentations on the topic can be found out at oe.cd/wcsde. What's hot (20)

FinTech Belgium – RegTech Belgium Kick Off MeetUp – M. Cañada Cornejo – Deloi...

FinTech Belgium – RegTech Belgium Kick Off MeetUp – M. Cañada Cornejo – Deloi...

London leads growth in RegTech investments. Research by FinTech Global, Jan 2017

London leads growth in RegTech investments. Research by FinTech Global, Jan 2017

Blome - Translating supply chain finance into SME productivity

Blome - Translating supply chain finance into SME productivity

Digital disruption in financial markets – BARBERIS – June 2019 OECD discussion

Digital disruption in financial markets – BARBERIS – June 2019 OECD discussion

Professor Lester Lloyd-Reason: Digital technologies and SME internationalisation

Professor Lester Lloyd-Reason: Digital technologies and SME internationalisation

Alberto Wyderka - Building business linkage that boost SME productivity: the ...

Alberto Wyderka - Building business linkage that boost SME productivity: the ...

Regulation and competition in light of digitalisation – Norwegian Competition...

Regulation and competition in light of digitalisation – Norwegian Competition...

Regulation and competition in light of digitalisation – UK Competition & Mark...

Regulation and competition in light of digitalisation – UK Competition & Mark...

CxO Roadmap: Designing a Fintech Strategy Around Your Legacy Core IT Supplier

CxO Roadmap: Designing a Fintech Strategy Around Your Legacy Core IT Supplier

Mattia Corbetta - Crowdinvesting in Italy: a case study

Mattia Corbetta - Crowdinvesting in Italy: a case study

Veronika Michalkova: Data analytics in SMEs relevant policies

Veronika Michalkova: Data analytics in SMEs relevant policies

Regulation and competition in light of digitalisation – Competition Bureau Ca...

Regulation and competition in light of digitalisation – Competition Bureau Ca...

Paolo Casini - Digitalisation, scale-ups and access to finance

Paolo Casini - Digitalisation, scale-ups and access to finance

Digital economy-legal-updates-webinar-co-investment-in-new-infrastructure-rol...

Digital economy-legal-updates-webinar-co-investment-in-new-infrastructure-rol...

Digital disruption in financial markets – DRURY – June 2019 OECD discussion

Digital disruption in financial markets – DRURY – June 2019 OECD discussion

Regulation and competition in light of digitalisation – CNMC Spain – January ...

Regulation and competition in light of digitalisation – CNMC Spain – January ...

Cartel screening in the digital era – UK Competition & Markets Authority – Ja...

Cartel screening in the digital era – UK Competition & Markets Authority – Ja...

Viewers also liked

FRTB Outlook - Chappuis Halder & Co

Outlook and market survey on the fresh Standards for Minimum capital requirements for market risk (FRTB), published January 14th, 2016.

FRTB will deeply impact banks on IT, process, human and organizational aspects.

CH&Co can assist banks navigate through these fundamental changes

Application design for MiFID II-compliant operations

Software Daten Service (SDS) specialises in the development of

standard software for the financial industry.

MiFID II: the next step presentation

Another 1500 pages of regulatory standards and commentary on MiFID II has been released. Our briefing will help you get up to speed.

State of Blockchain Consortia by William Mougayar - December 2016

A survey of blockchain consortia around the world.

Can Bitcoin be forecasted like any other asset?

Bitcoin raises a lot of interrogations and challenges due to its youth and disruptive technology. This paper starts by giving an overview of bitcoin and blockchain technology. Then, a comparison with other asset classes is presented to identify possible similarities or divergences. The final objective of this document is to propose a pricing model for bitcoin.

Viewers also liked (12)

Application design for MiFID II-compliant operations

Application design for MiFID II-compliant operations

State of Blockchain Consortia by William Mougayar - December 2016

State of Blockchain Consortia by William Mougayar - December 2016

Similar to Chappuis Halder - EU Benchmark Regulation threepager - May 2016

Initio Regulatory Watch March 2019

Discover here the result of our permanent regulatory watch lead by Initio’s business line “Regulatory & Compliance”

Regulatory updates from RR Donnelley December 2015

December Regulatory Updates covering PRIIPs, Solvency II, European Market Infrastructure Regulation and additional reporting requirements under Irish Domiciled UCITS Funds.

Legal shorts 21.10.16 including criminal finances bill introduced and mld4

Welcome to Legal Shorts, a short briefing on some of the week’s developments in the financial services industry.

If you would like to discuss any of the points we raise below, please contact me or one of our other lawyers.

Claire Cummings

020 7585 1406

claire.cummings@cummingslaw.com

www.cummingslaw.com

Regulatory Focus - Issue 107

In this edition of Regulatory Focus, Duff & Phelps provides a synopsis of the FCA's latest news and publications issued in May 2017.

Highlights include:

MiFID II Topics and Challenges

FCA's increased focus on cyber resilience

Guidance on the Criminal Finances Act 2017

Joint report on regulatory sandboxes and innovation hubs

The European Supervisory Authorities (ESAs) published today a joint report on innovation facilitators (regulatory sandboxes and innovation hubs). The report sets out a comparative analysis of the innovation facilitators established to date within the EU. The ESAs also set out best practices for the design and operation of innovation facilitators.

The number of innovation facilitators in the EU has grown rapidly in recent years. As at the date of the report, 21 EU Member States and 3 EEA States have established innovation hubs and 5 EU Member States have regulatory sandboxes in operation. A comparative analysis of these national innovation facilitators is set out in the report and, based on this analysis, a set of best practices has been prepared. The best practices are intended to: (i) promote consistency across the single market in the design and operation of innovation facilitators; (ii) promote transparency of regulatory and supervisory policy outcomes from arising from interactions in the context of innovation facilitators; and (iii) facilitate cooperation between national authorities, including consumer and data protection authorities.

The ESAs also set out options, to be considered in the context of future EU-level work on innovation facilitators, to promote coordination and cooperation between innovation facilitators which would support the scaling-up of FinTech across the single market.

Similar to Chappuis Halder - EU Benchmark Regulation threepager - May 2016 (20)

Legal shorts 07.02.14, including AIFMD remuneration code and crowdfunding

Legal shorts 07.02.14, including AIFMD remuneration code and crowdfunding

Legal Shorts 31.01.14, including FMLC response to client asset review and ios...

Legal Shorts 31.01.14, including FMLC response to client asset review and ios...

Legal shorts 28.11.14 including FCA reminder of new ‘connect’ portal for firm...

Legal shorts 28.11.14 including FCA reminder of new ‘connect’ portal for firm...

Regulatory updates from RR Donnelley December 2015

Regulatory updates from RR Donnelley December 2015

Legal shorts 21.10.16 including criminal finances bill introduced and mld4

Legal shorts 21.10.16 including criminal finances bill introduced and mld4

New Financial Regulations In Europe After Financial Crisis Abhijeet Singhal

New Financial Regulations In Europe After Financial Crisis Abhijeet Singhal

Legal shorts 19.06.15 including MiFID II and ESMA launches new strategy

Legal shorts 19.06.15 including MiFID II and ESMA launches new strategy

Legal shorts 25.07.14 including AIFM partnership tax changes and FCA update o...

Legal shorts 25.07.14 including AIFM partnership tax changes and FCA update o...

Legal shorts 14.03.14 including LLP tax changes delay and delegated regulatio...

Legal shorts 14.03.14 including LLP tax changes delay and delegated regulatio...

Euro shorts 24.07.15 including AIFMD EMIR delay on passporting opinion and AI...

Euro shorts 24.07.15 including AIFMD EMIR delay on passporting opinion and AI...

Euro shorts 17.07.15 including EMIR: Bank of England response on CCP interope...

Euro shorts 17.07.15 including EMIR: Bank of England response on CCP interope...

Joint report on regulatory sandboxes and innovation hubs

Joint report on regulatory sandboxes and innovation hubs

Recently uploaded

how to sell pi coins in all Africa Countries.

Yes. You can sell your pi network for other cryptocurrencies like Bitcoin, usdt , Ethereum and other currencies And this is done easily with the help from a pi merchant.

What is a pi merchant ?

Since pi is not launched yet in any exchange. The only way you can sell right now is through merchants.

A verified Pi merchant is someone who buys pi network coins from miners and resell them to investors looking forward to hold massive quantities of pi coins before mainnet launch in 2026.

I will leave the telegram contact of my personal pi merchant to trade with.

@Pi_vendor_247

The secret way to sell pi coins effortlessly.

Well as we all know pi isn't launched yet. But you can still sell your pi coins effortlessly because some whales in China are interested in holding massive pi coins. And they are willing to pay good money for it. If you are interested in selling I will leave a contact for you. Just telegram this number below. I sold about 3000 pi coins to him and he paid me immediately.

Telegram: @Pi_vendor_247

Empowering the Unbanked: The Vital Role of NBFCs in Promoting Financial Inclu...

In India, financial inclusion remains a critical challenge, with a significant portion of the population still unbanked. Non-Banking Financial Companies (NBFCs) have emerged as key players in bridging this gap by providing financial services to those often overlooked by traditional banking institutions. This article delves into how NBFCs are fostering financial inclusion and empowering the unbanked.

一比一原版BCU毕业证伯明翰城市大学毕业证成绩单如何办理

BCU毕业证原版定制【微信:176555708】【伯明翰城市大学毕业证成绩单-学位证】【微信:176555708】(留信学历认证永久存档查询)采用学校原版纸张、特殊工艺完全按照原版一比一制作(包括:隐形水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠,文字图案浮雕,激光镭射,紫外荧光,温感,复印防伪)行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备,十五年致力于帮助留学生解决难题,业务范围有加拿大、英国、澳洲、韩国、美国、新加坡,新西兰等学历材料,包您满意。

◆◆◆◆◆ — — — — — — — — 【留学教育】留学归国服务中心 — — — — — -◆◆◆◆◆

【主营项目】

一.毕业证【微信:176555708】成绩单、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证【微信:176555708】

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分→ 【关于价格问题(保证一手价格)

我们所定的价格是非常合理的,而且我们现在做得单子大多数都是代理和回头客户介绍的所以一般现在有新的单子 我给客户的都是第一手的代理价格,因为我想坦诚对待大家 不想跟大家在价格方面浪费时间

对于老客户或者被老客户介绍过来的朋友,我们都会适当给一些优惠。

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

选择实体注册公司办理,更放心,更安全!我们的承诺:可来公司面谈,可签订合同,会陪同客户一起到教育部认证窗口递交认证材料,客户在教育部官方认证查询网站查询到认证通过结果后付款,不成功不收费!

学历顾问:微信:176555708

how can I sell pi coins after successfully completing KYC

Pi coins is not launched yet in any exchange 💱 this means it's not swappable, the current pi displaying on coin market cap is the iou version of pi. And you can learn all about that on my previous post.

RIGHT NOW THE ONLY WAY you can sell pi coins is through verified pi merchants. A pi merchant is someone who buys pi coins and resell them to exchanges and crypto whales. Looking forward to hold massive quantities of pi coins before the mainnet launch.

This is because pi network is not doing any pre-sale or ico offerings, the only way to get my coins is from buying from miners. So a merchant facilitates the transactions between the miners and these exchanges holding pi.

I and my friends has sold more than 6000 pi coins successfully with this method. I will be happy to share the contact of my personal pi merchant. The one i trade with, if you have your own merchant you can trade with them. For those who are new.

Message: @Pi_vendor_247 on telegram.

I wouldn't advise you selling all percentage of the pi coins. Leave at least a before so its a win win during open mainnet. Have a nice day pioneers ♥️

#kyc #mainnet #picoins #pi #sellpi #piwallet

#pinetwork

US Economic Outlook - Being Decided - M Capital Group August 2021.pdf

The U.S. economy is continuing its impressive recovery from the COVID-19 pandemic and not slowing down despite re-occurring bumps. The U.S. savings rate reached its highest ever recorded level at 34% in April 2020 and Americans seem ready to spend. The sectors that had been hurt the most by the pandemic specifically reduced consumer spending, like retail, leisure, hospitality, and travel, are now experiencing massive growth in revenue and job openings.

Could this growth lead to a “Roaring Twenties”? As quickly as the U.S. economy contracted, experiencing a 9.1% drop in economic output relative to the business cycle in Q2 2020, the largest in recorded history, it has rebounded beyond expectations. This surprising growth seems to be fueled by the U.S. government’s aggressive fiscal and monetary policies, and an increase in consumer spending as mobility restrictions are lifted. Unemployment rates between June 2020 and June 2021 decreased by 5.2%, while the demand for labor is increasing, coupled with increasing wages to incentivize Americans to rejoin the labor force. Schools and businesses are expected to fully reopen soon. In parallel, vaccination rates across the country and the world continue to rise, with full vaccination rates of 50% and 14.8% respectively.

However, it is not completely smooth sailing from here. According to M Capital Group, the main risks that threaten the continued growth of the U.S. economy are inflation, unsettled trade relations, and another wave of Covid-19 mutations that could shut down the world again. Have we learned from the past year of COVID-19 and adapted our economy accordingly?

“In order for the U.S. economy to continue growing, whether there is another wave or not, the U.S. needs to focus on diversifying supply chains, supporting business investment, and maintaining consumer spending,” says Grace Feeley, a research analyst at M Capital Group.

While the economic indicators are positive, the risks are coming closer to manifesting and threatening such growth. The new variants spreading throughout the world, Delta, Lambda, and Gamma, are vaccine-resistant and muddy the predictions made about the economy and health of the country. These variants bring back the feeling of uncertainty that has wreaked havoc not only on the stock market but the mindset of people around the world. MCG provides unique insight on how to mitigate these risks to possibly ensure a bright economic future.

innovative-invoice-discounting-platforms-in-india-empowering-retail-investors...

innovative-invoice-discounting-platforms-in-india-empowering-retail-investors...Falcon Invoice Discounting

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.NO1 Uk Black Magic Specialist Expert In Sahiwal, Okara, Hafizabad, Mandi Bah...

NO1 Uk Black Magic Specialist Expert In Sahiwal, Okara, Hafizabad, Mandi Bah...Amil Baba Dawood bangali

Contact with Dawood Bhai Just call on +92322-6382012 and we'll help you. We'll solve all your problems within 12 to 24 hours and with 101% guarantee and with astrology systematic. If you want to take any personal or professional advice then also you can call us on +92322-6382012 , ONLINE LOVE PROBLEM & Other all types of Daily Life Problem's.Then CALL or WHATSAPP us on +92322-6382012 and Get all these problems solutions here by Amil Baba DAWOOD BANGALI

#vashikaranspecialist #astrologer #palmistry #amliyaat #taweez #manpasandshadi #horoscope #spiritual #lovelife #lovespell #marriagespell#aamilbabainpakistan #amilbabainkarachi #powerfullblackmagicspell #kalajadumantarspecialist #realamilbaba #AmilbabainPakistan #astrologerincanada #astrologerindubai #lovespellsmaster #kalajaduspecialist #lovespellsthatwork #aamilbabainlahore#blackmagicformarriage #aamilbaba #kalajadu #kalailam #taweez #wazifaexpert #jadumantar #vashikaranspecialist #astrologer #palmistry #amliyaat #taweez #manpasandshadi #horoscope #spiritual #lovelife #lovespell #marriagespell#aamilbabainpakistan #amilbabainkarachi #powerfullblackmagicspell #kalajadumantarspecialist #realamilbaba #AmilbabainPakistan #astrologerincanada #astrologerindubai #lovespellsmaster #kalajaduspecialist #lovespellsthatwork #aamilbabainlahore #blackmagicforlove #blackmagicformarriage #aamilbaba #kalajadu #kalailam #taweez #wazifaexpert #jadumantar #vashikaranspecialist #astrologer #palmistry #amliyaat #taweez #manpasandshadi #horoscope #spiritual #lovelife #lovespell #marriagespell#aamilbabainpakistan #amilbabainkarachi #powerfullblackmagicspell #kalajadumantarspecialist #realamilbaba #AmilbabainPakistan #astrologerincanada #astrologerindubai #lovespellsmaster #kalajaduspecialist #lovespellsthatwork #aamilbabainlahore #Amilbabainuk #amilbabainspain #amilbabaindubai #Amilbabainnorway #amilbabainkrachi #amilbabainlahore #amilbabaingujranwalan #amilbabainislamabad

NO1 Uk Rohani Baba In Karachi Bangali Baba Karachi Online Amil Baba WorldWide...

Contact with Dawood Bhai Just call on +92322-6382012 and we'll help you. We'll solve all your problems within 12 to 24 hours and with 101% guarantee and with astrology systematic. If you want to take any personal or professional advice then also you can call us on +92322-6382012 , ONLINE LOVE PROBLEM & Other all types of Daily Life Problem's.Then CALL or WHATSAPP us on +92322-6382012 and Get all these problems solutions here by Amil Baba DAWOOD BANGALI

#vashikaranspecialist #astrologer #palmistry #amliyaat #taweez #manpasandshadi #horoscope #spiritual #lovelife #lovespell #marriagespell#aamilbabainpakistan #amilbabainkarachi #powerfullblackmagicspell #kalajadumantarspecialist #realamilbaba #AmilbabainPakistan #astrologerincanada #astrologerindubai #lovespellsmaster #kalajaduspecialist #lovespellsthatwork #aamilbabainlahore#blackmagicformarriage #aamilbaba #kalajadu #kalailam #taweez #wazifaexpert #jadumantar #vashikaranspecialist #astrologer #palmistry #amliyaat #taweez #manpasandshadi #horoscope #spiritual #lovelife #lovespell #marriagespell#aamilbabainpakistan #amilbabainkarachi #powerfullblackmagicspell #kalajadumantarspecialist #realamilbaba #AmilbabainPakistan #astrologerincanada #astrologerindubai #lovespellsmaster #kalajaduspecialist #lovespellsthatwork #aamilbabainlahore #blackmagicforlove #blackmagicformarriage #aamilbaba #kalajadu #kalailam #taweez #wazifaexpert #jadumantar #vashikaranspecialist #astrologer #palmistry #amliyaat #taweez #manpasandshadi #horoscope #spiritual #lovelife #lovespell #marriagespell#aamilbabainpakistan #amilbabainkarachi #powerfullblackmagicspell #kalajadumantarspecialist #realamilbaba #AmilbabainPakistan #astrologerincanada #astrologerindubai #lovespellsmaster #kalajaduspecialist #lovespellsthatwork #aamilbabainlahore #Amilbabainuk #amilbabainspain #amilbabaindubai #Amilbabainnorway #amilbabainkrachi #amilbabainlahore #amilbabaingujranwalan #amilbabainislamabad

how to swap pi coins to foreign currency withdrawable.

As of my last update, Pi is still in the testing phase and is not tradable on any exchanges.

However, Pi Network has announced plans to launch its Testnet and Mainnet in the future, which may include listing Pi on exchanges.

The current method for selling pi coins involves exchanging them with a pi vendor who purchases pi coins for investment reasons.

If you want to sell your pi coins, reach out to a pi vendor and sell them to anyone looking to sell pi coins from any country around the globe.

Below is the contact information for my personal pi vendor.

Telegram: @Pi_vendor_247

how to sell pi coins at high rate quickly.

Where can I sell my pi coins at a high rate.

Pi is not launched yet on any exchange. But one can easily sell his or her pi coins to investors who want to hold pi till mainnet launch.

This means crypto whales want to hold pi. And you can get a good rate for selling pi to them. I will leave the telegram contact of my personal pi vendor below.

A vendor is someone who buys from a miner and resell it to a holder or crypto whale.

Here is the telegram contact of my vendor:

@Pi_vendor_247

how to sell pi coins on Bitmart crypto exchange

Yes. Pi network coins can be exchanged but not on bitmart exchange. Because pi network is still in the enclosed mainnet. The only way pioneers are able to trade pi coins is by reselling the pi coins to pi verified merchants.

A verified merchant is someone who buys pi network coins and resell it to exchanges looking forward to hold till mainnet launch.

I will leave the telegram contact of my personal pi merchant to trade with.

@Pi_vendor_247

Webinar Exploring DORA for Fintechs - Simont Braun

Webinar Exploring DORA for Fintechs - Simont Braun

Falcon Invoice Discounting: Optimizing Returns with Minimal Risk

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.

NO1 Uk Divorce problem uk all amil baba in karachi,lahore,pakistan talaq ka m...

NO1 Uk Divorce problem uk all amil baba in karachi,lahore,pakistan talaq ka m...Amil Baba Dawood bangali

Contact with Dawood Bhai Just call on +92322-6382012 and we'll help you. We'll solve all your problems within 12 to 24 hours and with 101% guarantee and with astrology systematic. If you want to take any personal or professional advice then also you can call us on +92322-6382012 , ONLINE LOVE PROBLEM & Other all types of Daily Life Problem's.Then CALL or WHATSAPP us on +92322-6382012 and Get all these problems solutions here by Amil Baba DAWOOD BANGALI

#vashikaranspecialist #astrologer #palmistry #amliyaat #taweez #manpasandshadi #horoscope #spiritual #lovelife #lovespell #marriagespell#aamilbabainpakistan #amilbabainkarachi #powerfullblackmagicspell #kalajadumantarspecialist #realamilbaba #AmilbabainPakistan #astrologerincanada #astrologerindubai #lovespellsmaster #kalajaduspecialist #lovespellsthatwork #aamilbabainlahore#blackmagicformarriage #aamilbaba #kalajadu #kalailam #taweez #wazifaexpert #jadumantar #vashikaranspecialist #astrologer #palmistry #amliyaat #taweez #manpasandshadi #horoscope #spiritual #lovelife #lovespell #marriagespell#aamilbabainpakistan #amilbabainkarachi #powerfullblackmagicspell #kalajadumantarspecialist #realamilbaba #AmilbabainPakistan #astrologerincanada #astrologerindubai #lovespellsmaster #kalajaduspecialist #lovespellsthatwork #aamilbabainlahore #blackmagicforlove #blackmagicformarriage #aamilbaba #kalajadu #kalailam #taweez #wazifaexpert #jadumantar #vashikaranspecialist #astrologer #palmistry #amliyaat #taweez #manpasandshadi #horoscope #spiritual #lovelife #lovespell #marriagespell#aamilbabainpakistan #amilbabainkarachi #powerfullblackmagicspell #kalajadumantarspecialist #realamilbaba #AmilbabainPakistan #astrologerincanada #astrologerindubai #lovespellsmaster #kalajaduspecialist #lovespellsthatwork #aamilbabainlahore #Amilbabainuk #amilbabainspain #amilbabaindubai #Amilbabainnorway #amilbabainkrachi #amilbabainlahore #amilbabaingujranwalan #amilbabainislamabad

Recently uploaded (20)

Empowering the Unbanked: The Vital Role of NBFCs in Promoting Financial Inclu...

Empowering the Unbanked: The Vital Role of NBFCs in Promoting Financial Inclu...

how can I sell pi coins after successfully completing KYC

how can I sell pi coins after successfully completing KYC

US Economic Outlook - Being Decided - M Capital Group August 2021.pdf

US Economic Outlook - Being Decided - M Capital Group August 2021.pdf

innovative-invoice-discounting-platforms-in-india-empowering-retail-investors...

innovative-invoice-discounting-platforms-in-india-empowering-retail-investors...

NO1 Uk Black Magic Specialist Expert In Sahiwal, Okara, Hafizabad, Mandi Bah...

NO1 Uk Black Magic Specialist Expert In Sahiwal, Okara, Hafizabad, Mandi Bah...

NO1 Uk Rohani Baba In Karachi Bangali Baba Karachi Online Amil Baba WorldWide...

NO1 Uk Rohani Baba In Karachi Bangali Baba Karachi Online Amil Baba WorldWide...

how to swap pi coins to foreign currency withdrawable.

how to swap pi coins to foreign currency withdrawable.

655264371-checkpoint-science-past-papers-april-2023.pdf

655264371-checkpoint-science-past-papers-april-2023.pdf

Webinar Exploring DORA for Fintechs - Simont Braun

Webinar Exploring DORA for Fintechs - Simont Braun

Falcon Invoice Discounting: Optimizing Returns with Minimal Risk

Falcon Invoice Discounting: Optimizing Returns with Minimal Risk

Isios-2024-Professional-Independent-Trustee-Survey.pdf

Isios-2024-Professional-Independent-Trustee-Survey.pdf

NO1 Uk Divorce problem uk all amil baba in karachi,lahore,pakistan talaq ka m...

NO1 Uk Divorce problem uk all amil baba in karachi,lahore,pakistan talaq ka m...

Chappuis Halder - EU Benchmark Regulation threepager - May 2016

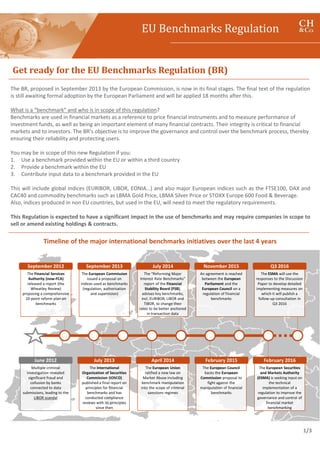

- 1. Get ready for the EU Benchmarks Regulation (BR) The BR, proposed in September 2013 by the European Commission, is now in its final stages. The final text of the regulation is still awaiting formal adoption by the European Parliament and will be applied 18 months after this. What is a “benchmark” and who is in scope of this regulation? Benchmarks are used in financial markets as a reference to price financial instruments and to measure performance of investment funds, as well as being an important element of many financial contracts. Their integrity is critical to financial markets and to investors. The BR’s objective is to improve the governance and control over the benchmark process, thereby ensuring their reliability and protecting users. You may be in scope of this new Regulation if you: 1. Use a benchmark provided within the EU or within a third country 2. Provide a benchmark within the EU 3. Contribute input data to a benchmark provided in the EU This will include global indices (EURIBOR, LIBOR, EONIA…) and also major European indices such as the FTSE100, DAX and CAC40 and commodity benchmarks such as LBMA Gold Price, LBMA Silver Price or STOXX Europe 600 Food & Beverage. Also, indices produced in non EU countries, but used in the EU, will need to meet the regulatory requirements. This Regulation is expected to have a significant impact in the use of benchmarks and may require companies in scope to sell or amend existing holdings & contracts. EU Benchmarks Regulation Timeline of the major international benchmarks initiatives over the last 4 years The Financial Services Authority (now-FCA) released a report (the Wheatley Review) proposing a comprehensive 10-point reform plan on benchmarks The European Commission issued a proposal on indices used as benchmarks (regulation, authorisation and supervision) The “Reforming Major Interest Rate Benchmarks” report of the Financial Stability Board (FSB), advises key benchmarks, incl. EURIBOR, LIBOR and TIBOR, to change their rates to be better anchored in transaction data An agreement is reached between the European Parliament and the European Council on a regulation of financial benchmarks September 2012 September 2013 July 2014 November 2015 The International Organisation of Securities Commission (IOSCO) published a final report on principles for financial benchmarks and has conducted compliance reviews with its principles since then The European Union ratified a new law on Market Abuse including benchmark manipulation into the scope of criminal sanctions regimes The European Council backs the European Commission proposal to fight against the manipulation of financial benchmarks The European Securities and Markets Authority (ESMA) is seeking input on the technical implementation of a regulation to improve the governance and control of financial market benchmarking July 2013 April 2014 February 2015 February 2016 Multiple criminal investigation revealed significant fraud and collusion by banks connected to data submissions, leading to the LIBOR scandal June 2012 The ESMA will use the responses to the Discussion Paper to develop detailed implementing measures on which it will publish a follow-up consultation in Q3 2016 Q3 2016 1/3

- 2. 2/3 REMIT …prohibits the deliberate provision of false information to undertakings which provide price assessments or market reports on wholesale energy products with the effect of misleading market participants. IOSCO …produced a set of principles on the governance, the quality of benchmark determinations, the quality of the methodologies used, and the accountability of the benchmark administrator. MAR …clarifies that any manipulation of benchmarks is clearly and unequivocally illegal and subject to administrative or criminal sanctions. MIFID II …specifies that the price, or other value measure, of an underlying instrument must be reliable and publicly available, It also contains a provision requiring the non-exclusive licencing of benchmarks for clearing and trading purposes. UCITS …ensures that only transparent indices are permitted for UCITS to use as a benchmark. These transparency requirements are extensive covering calculation, re‐balancing methodologies, as well as constituents and their respective weightings. Indices used as performance evaluation tools also need to be disclosed in advance in the UCITS KIID. EU Benchmarks Regulation Benchmarks are already controlled through several international regulations… Benchmarks REMIT Regulation on Energy Market Integrity and Transparency IOSCO International Organisation of Securities Commissions MAR Market Abuse Regulation MIFID II Markets in Financial Instruments Directive UCITS Undertakings for Collective Investments in Transferable Securities …but the new European regulation will strengthen three main pillars and widen the scope of instruments and contracts Controls Objectives of the BR Implications for involved entities Regulation Sufficient transparency to enable users to clearly understand and evaluate the methodology used to compile the benchmark. Effective control and supervision of personnel, appropriate reporting and cooperation with the authorities; monitoring and audits of submissions processes; appropriate documentation and record-keeping. Additional regulatory oversight for widely used benchmarks that are based on subjective inputs and those not adequately covered under existing financial market regulations. • Benchmark administrators will need to be authorised or registered, and subject to supervision against the requirements which cover governance, accountability, design and methodology of any benchmarks provided. They are also required to draw up a Code of Conduct for each of their benchmarks. • Benchmark contributors will need to meet additional requirements to ensure the integrity of their current submissions. Their governance, systems and controls will be subject to supervision by national relevant authorities. • Benchmark users will no longer be allowed to use a benchmark unless it is provided by an authorised or registered administrator in the EU. For non EU countries, the country administrator must be recognised or the benchmark endorsed in the EU. Transparency 1 2 3

- 3. 3/3 EU Benchmarks Regulation What’s next and how we can help? As numerous questions & concerns have been raised across the financial industry, the ESMA has published a Discussion Paper (DP) in February 2016 regarding the technical implementation of the incoming Benchmarks Regulation. The DP is seeking stakeholder’s feedback in the following areas: …and penalties for non adherence are: at least 3X the amount of the profits gained or losses avoided €500k on an individual and €1M or 10% of total annual turnover of a firm or Stéphane Eyraud, Partner & CEO Tel UK: + 44 78 34 55 03 98 Tel FR: + 33 6 12 41 64 06 seyraud@chappuishalder.com Nicolas Heguy, Manager Tel UK: + 44 75 25 86 30 89 nheguy@chappuishalder.com Our added value CH&Co has a dedicated team of experts in regulatory matters, focused on both the interpretation of regulations (via market watch, benchmarks and lobbying within the financial industry) and providing project management & experienced resources to ensure adherence and achieve sustainable results. How does the Benchmark Regulation affect you? • definition of benchmarks • requirements for the benchmark oversight function • requirements for the benchmark input data • transparency requirements regarding the methodology • code of conduct for an administrator • governance and control requirements for supervised benchmark contributors • criteria defining critical and significant benchmarks • You are in scope of the BR if you are an EU Supervised Entity (which includes banks, insurance companies, fund managers, UCITS, AIFMs, pension funds, investment companies). • Supervised Entities will only be able to use benchmarks that are authorised by EU administrators or non EU administrators, authorised by ESMA. This includes both the use of a benchmark to reference a financial contract or instrument and to measure the performance of an investment. • It will be required that Supervised Entities establish a Code of Conduct, which must include detailed contingency plans in the case of a benchmark being withdrawn or amended. These plans will also need to be referenced in client contracts. • Non EU benchmarks will be required to obtain authorisation under the regulatory terms. This will involve considerable challenges for some administrators of indices and may result in them not able to obtain the required permissions. Accordingly, Supervised Entities will not be able use these indices for reference or measurement.