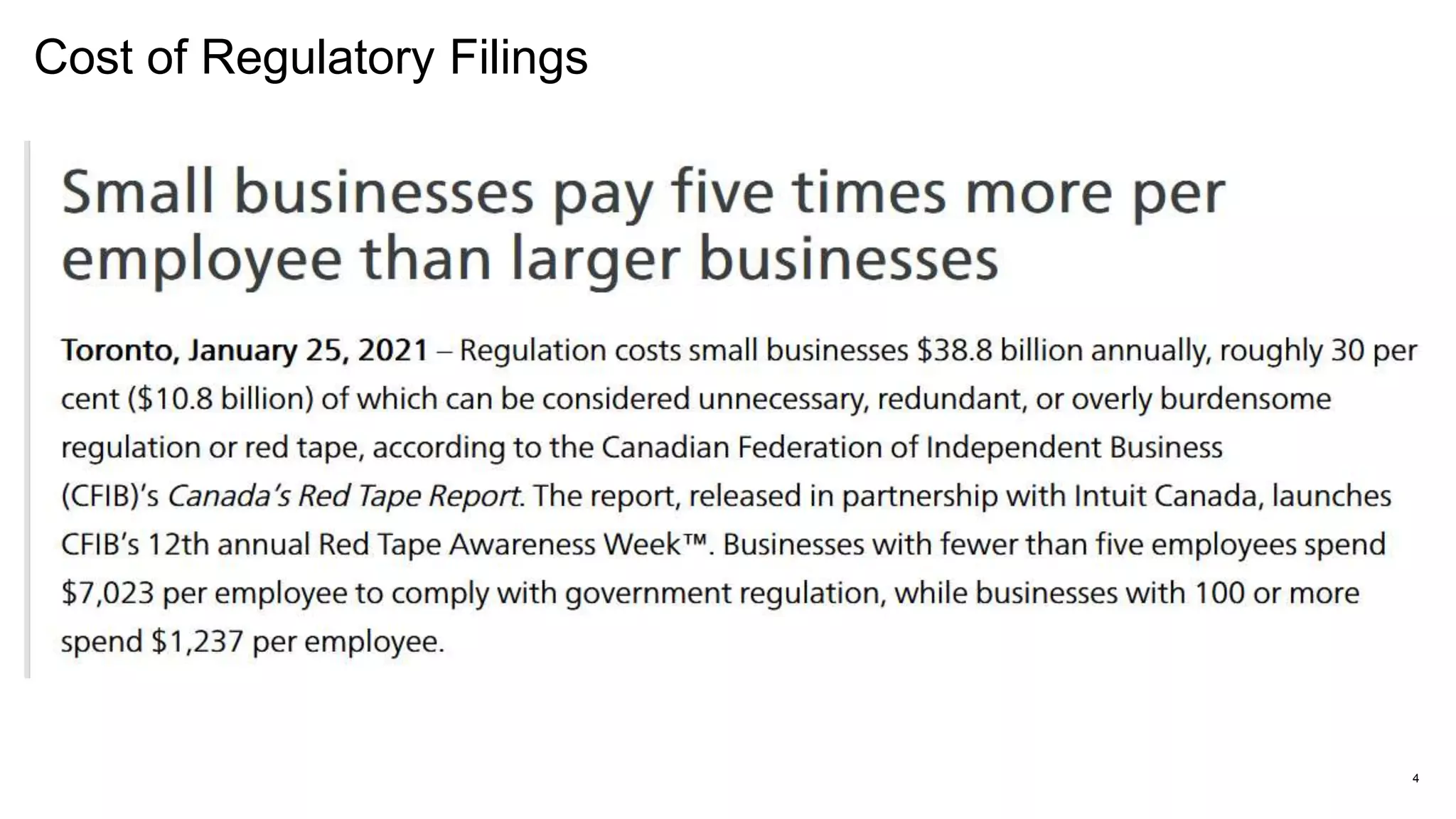

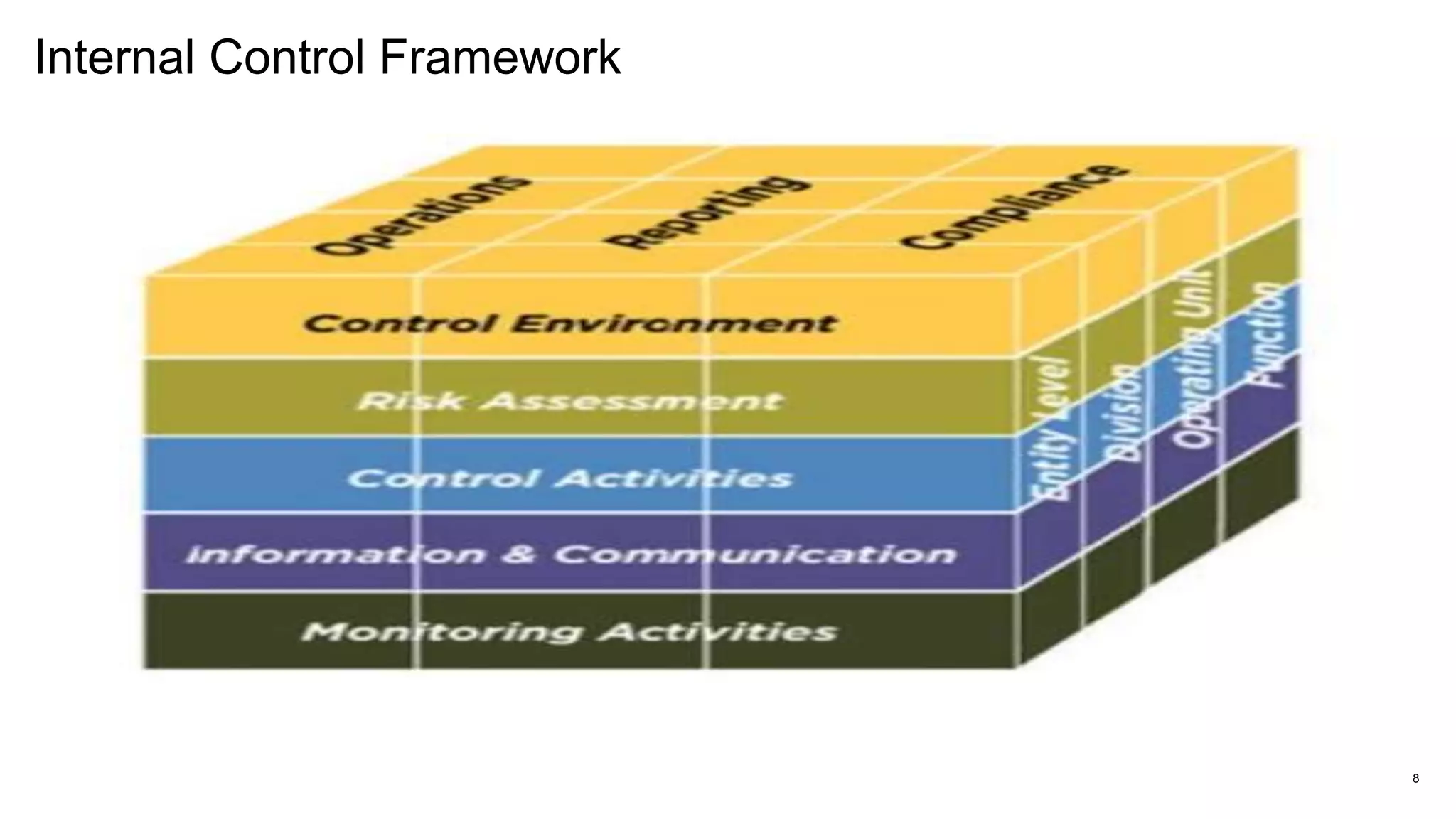

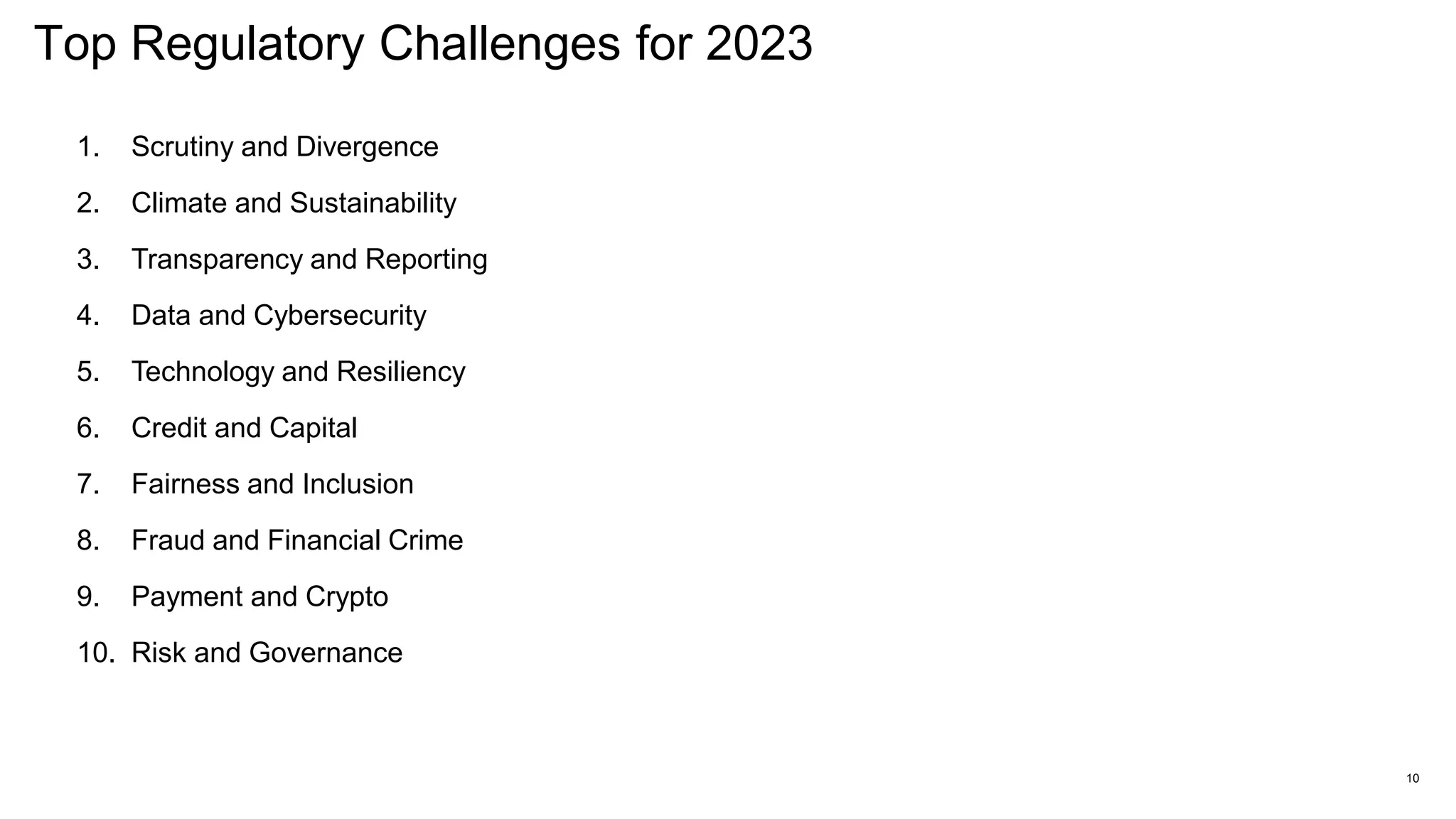

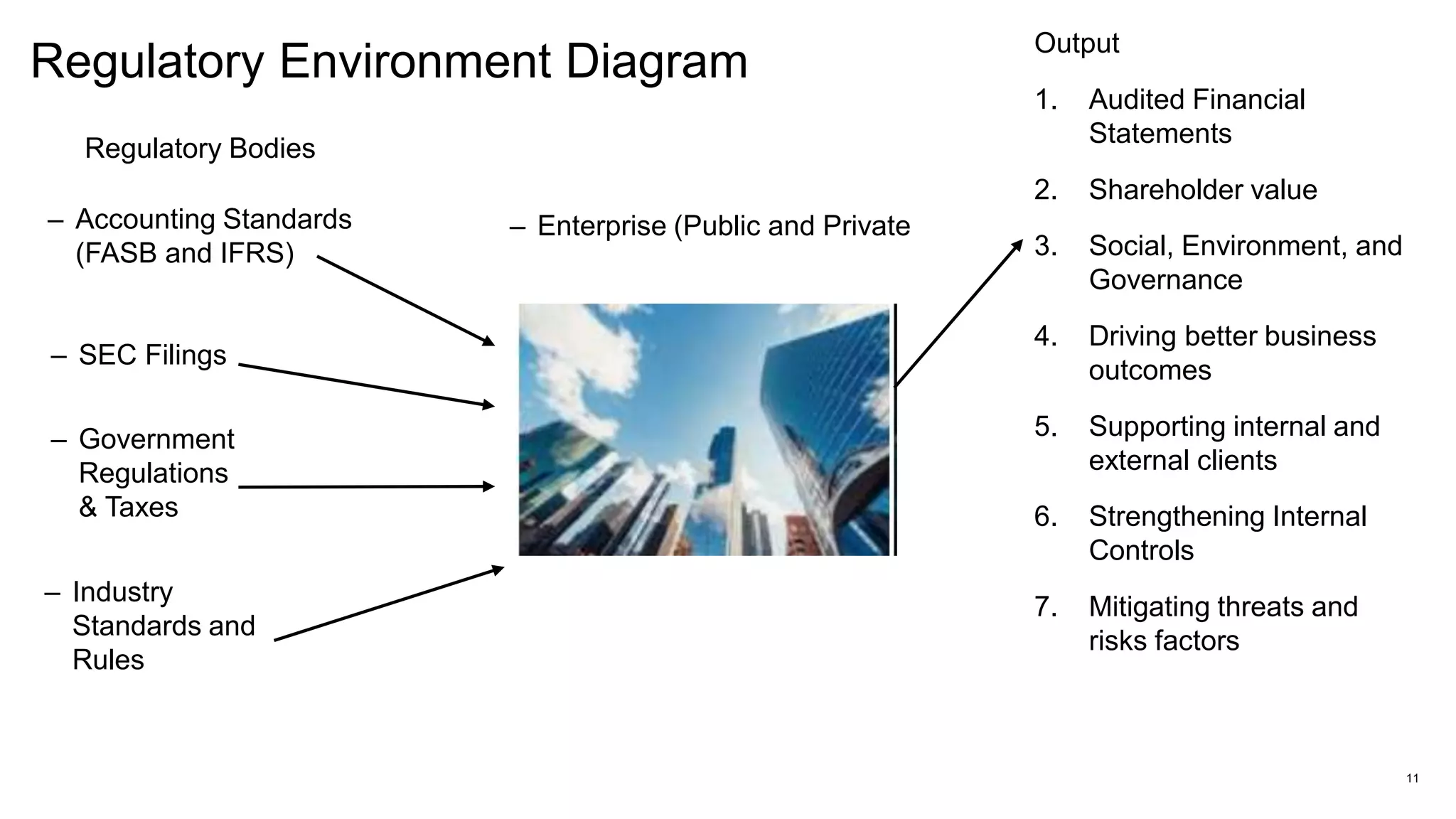

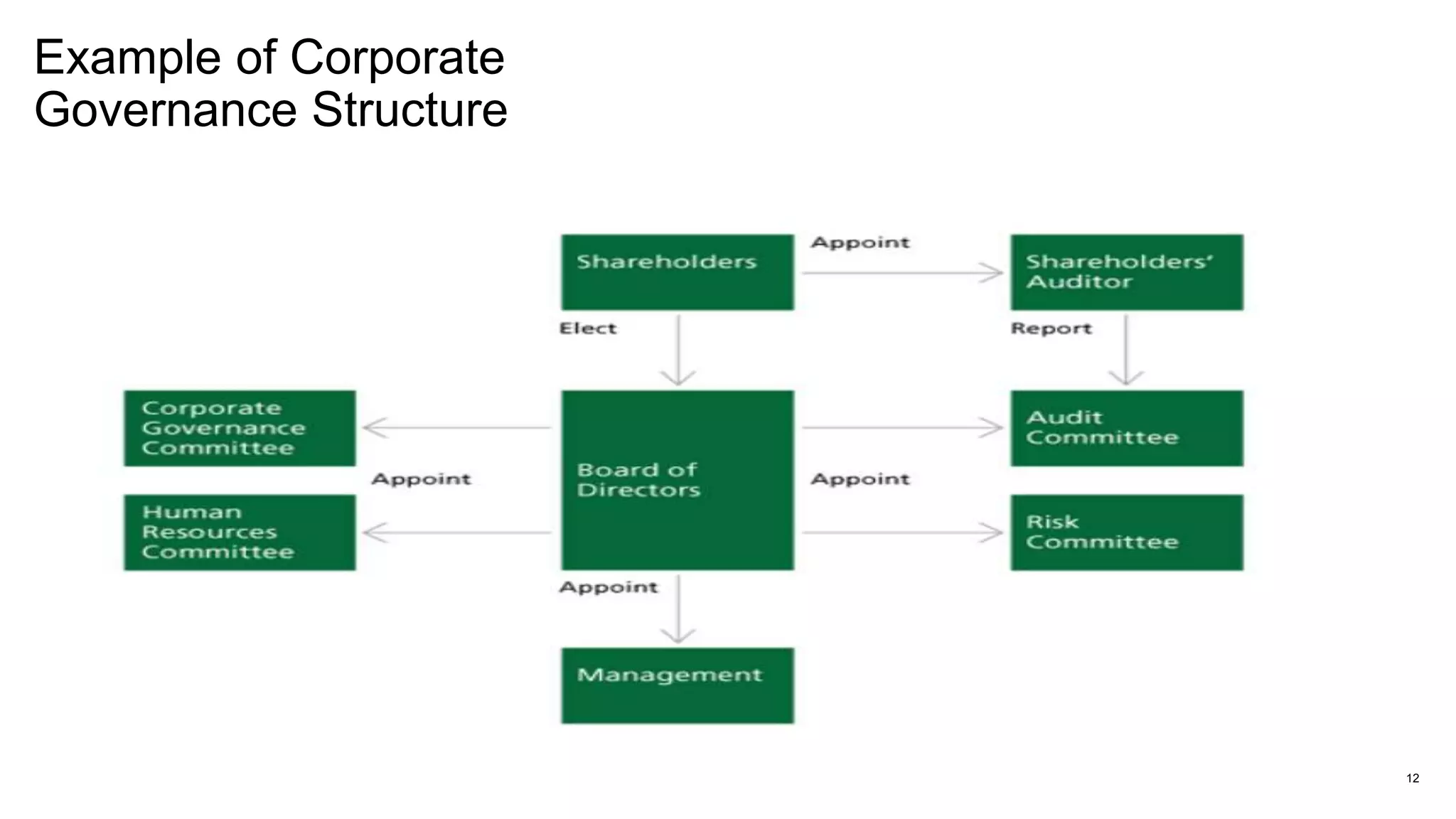

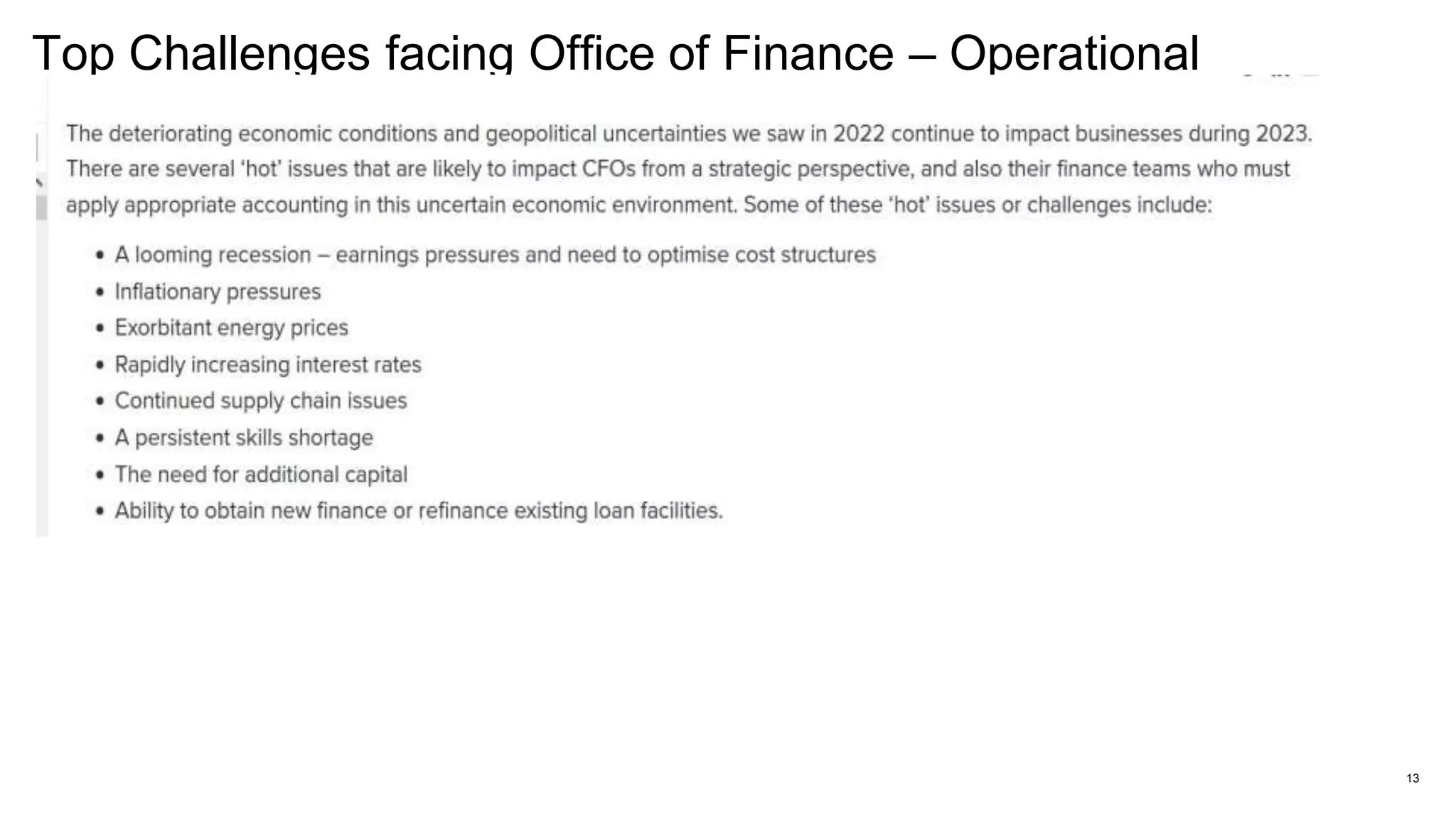

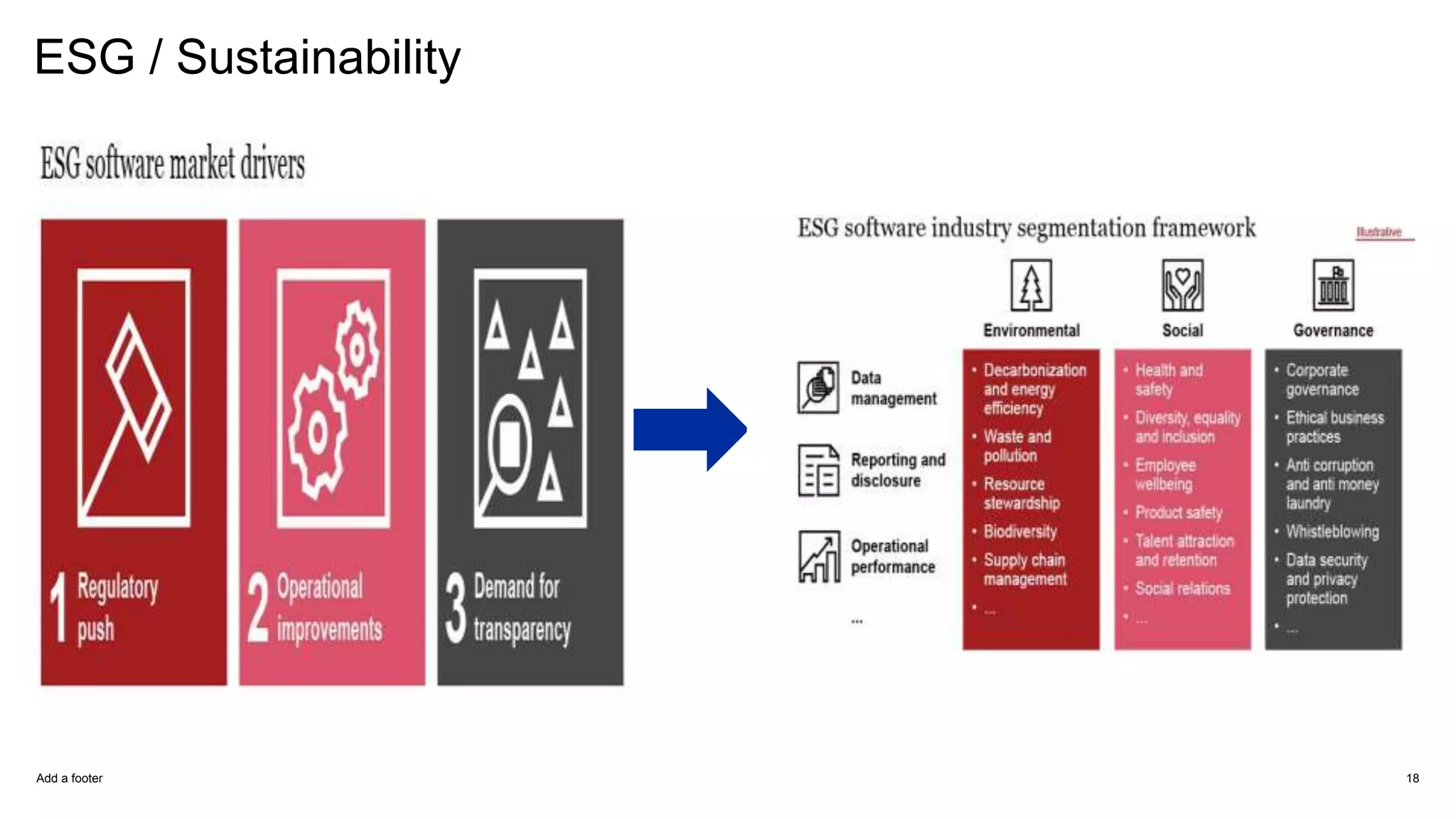

This document discusses how organizations can strengthen internal controls and compliance through the use of data and AI as part of regulatory and corporate reporting cycles. It outlines Paul Young's background and expertise in various areas related to finance, risk management, sustainability, and emerging technologies. The document then covers topics like the types of compliance risk, internal control frameworks, challenges facing finance departments, and how data and AI can help streamline processes like close/consolidate/reporting and ESG reporting. Key regulatory challenges for 2023 are also summarized.