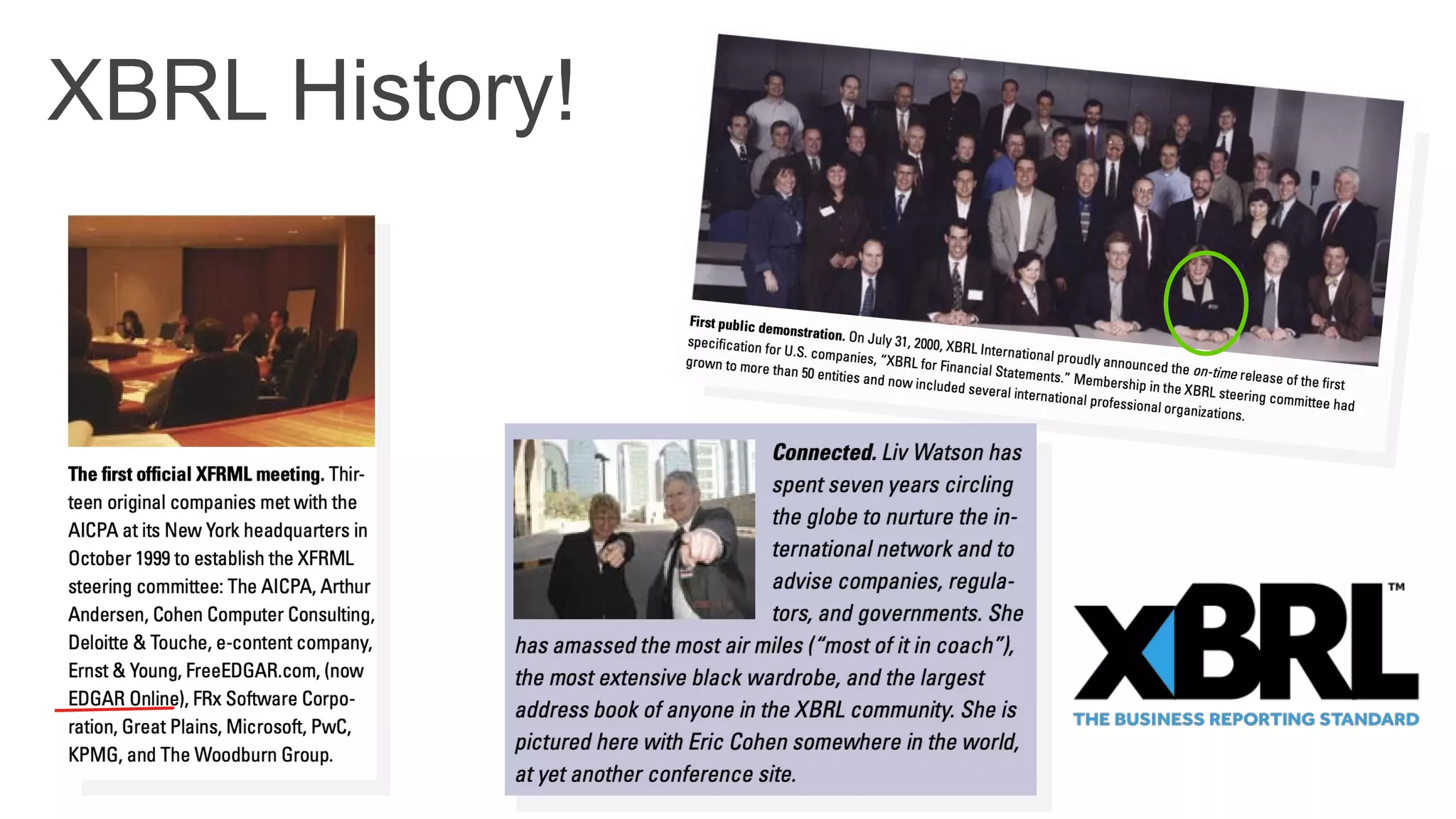

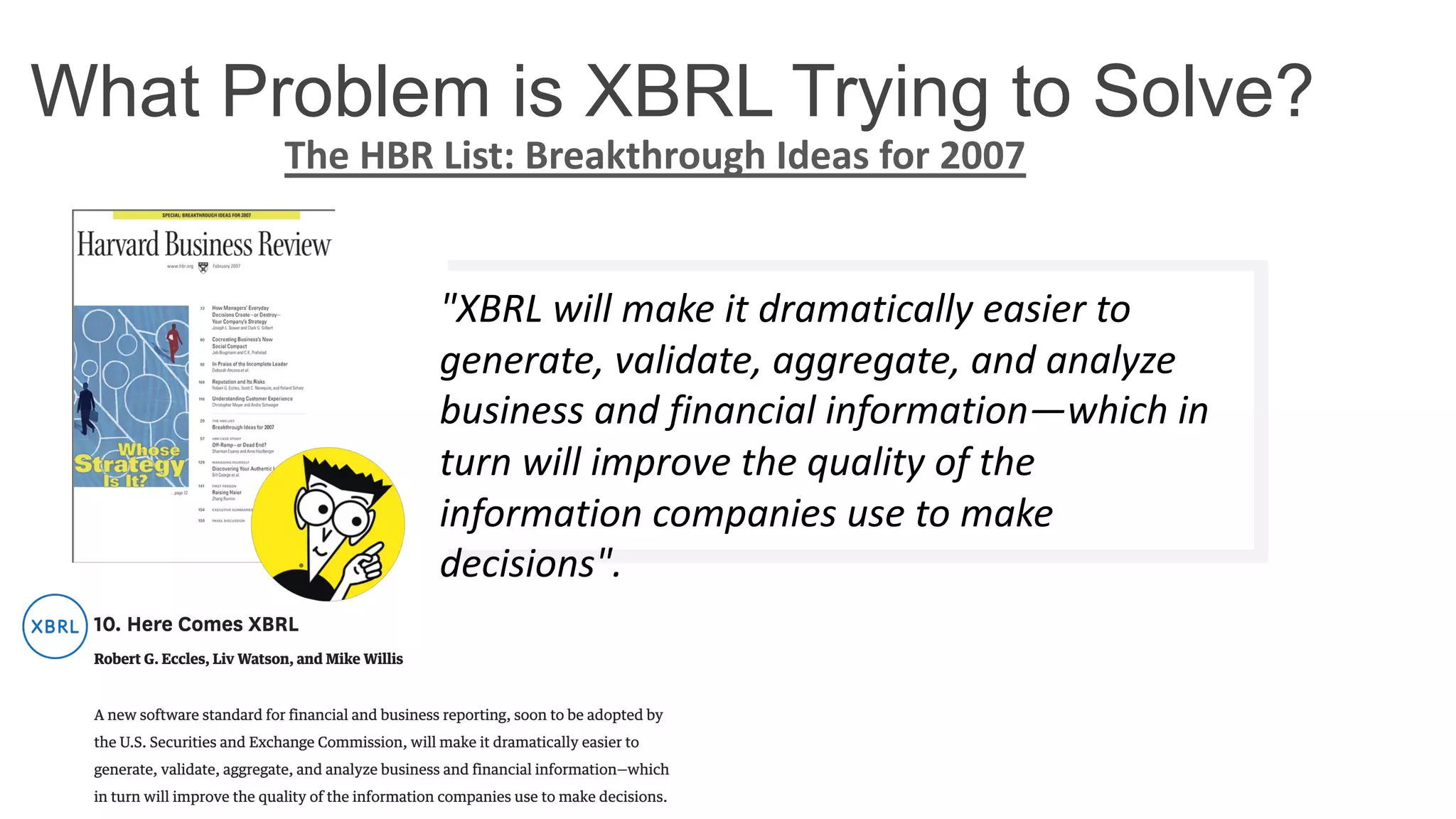

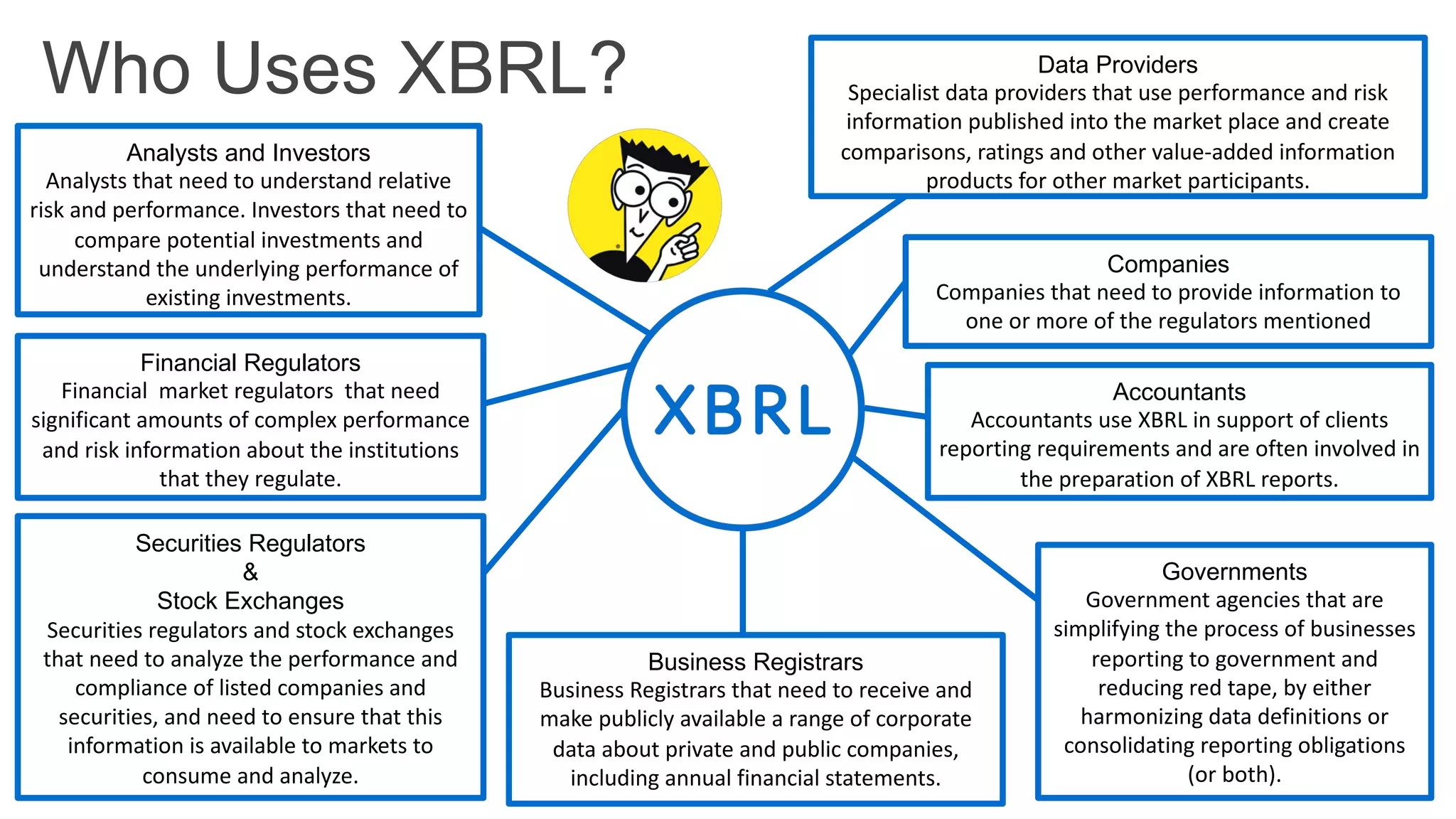

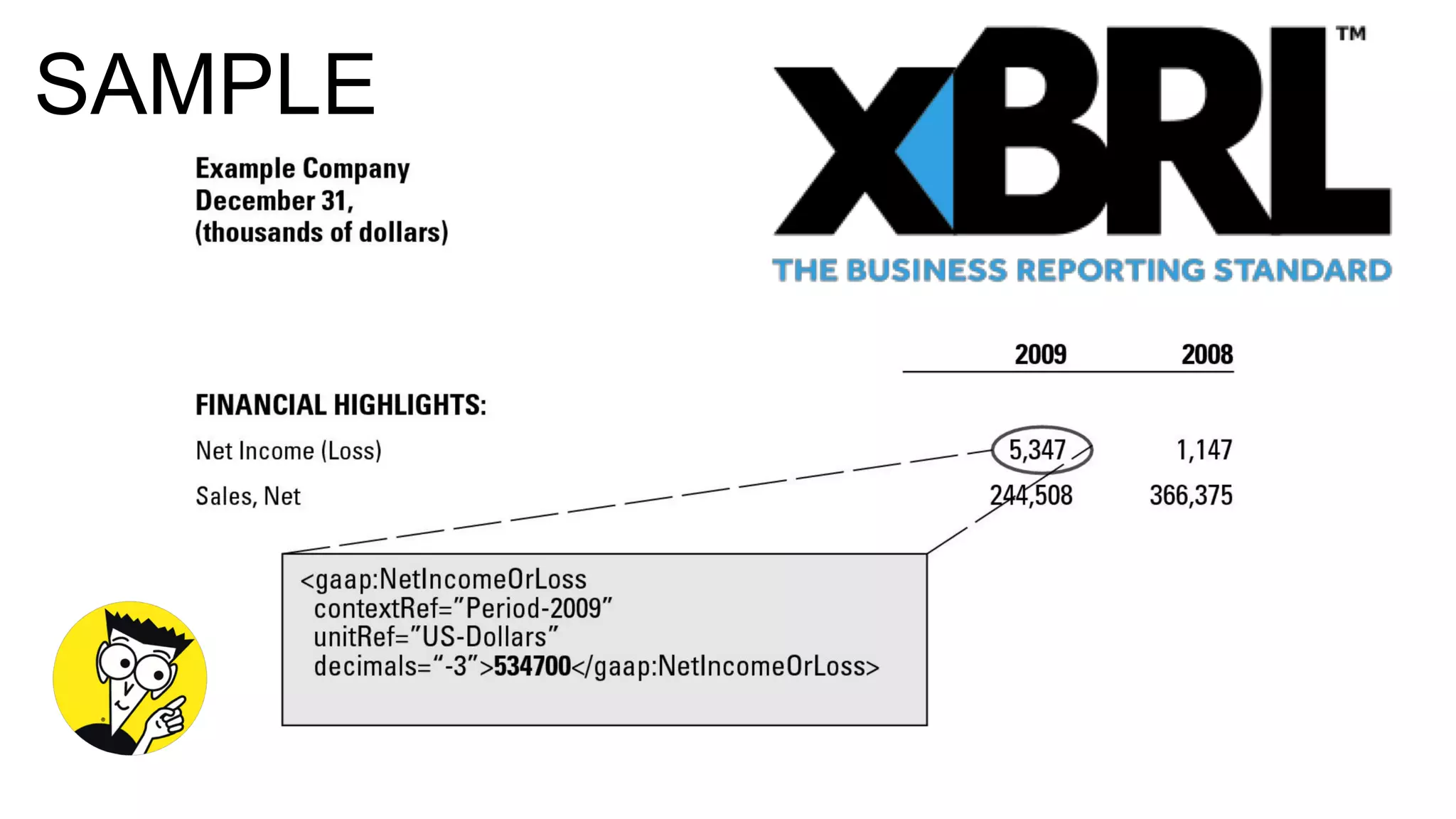

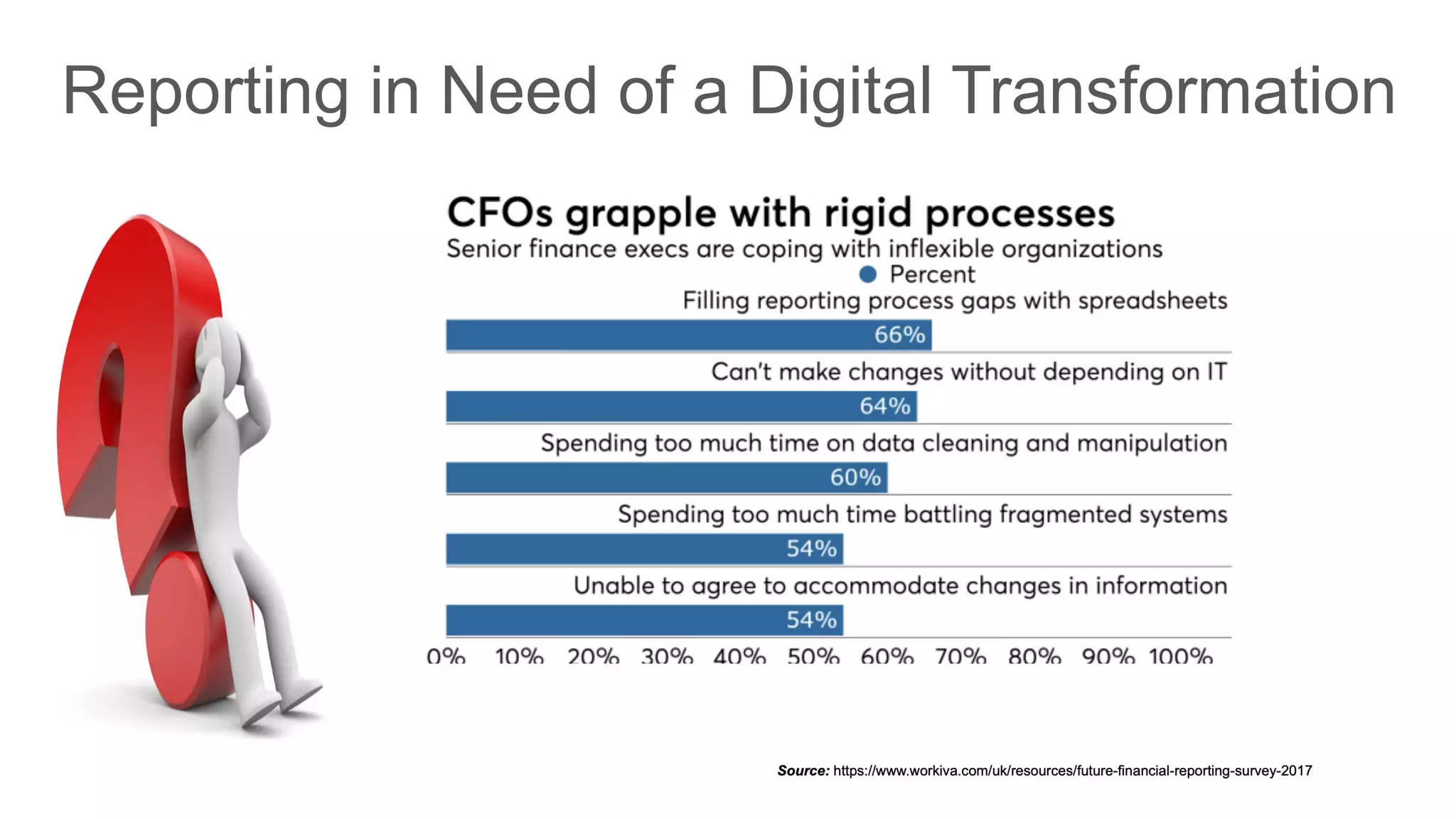

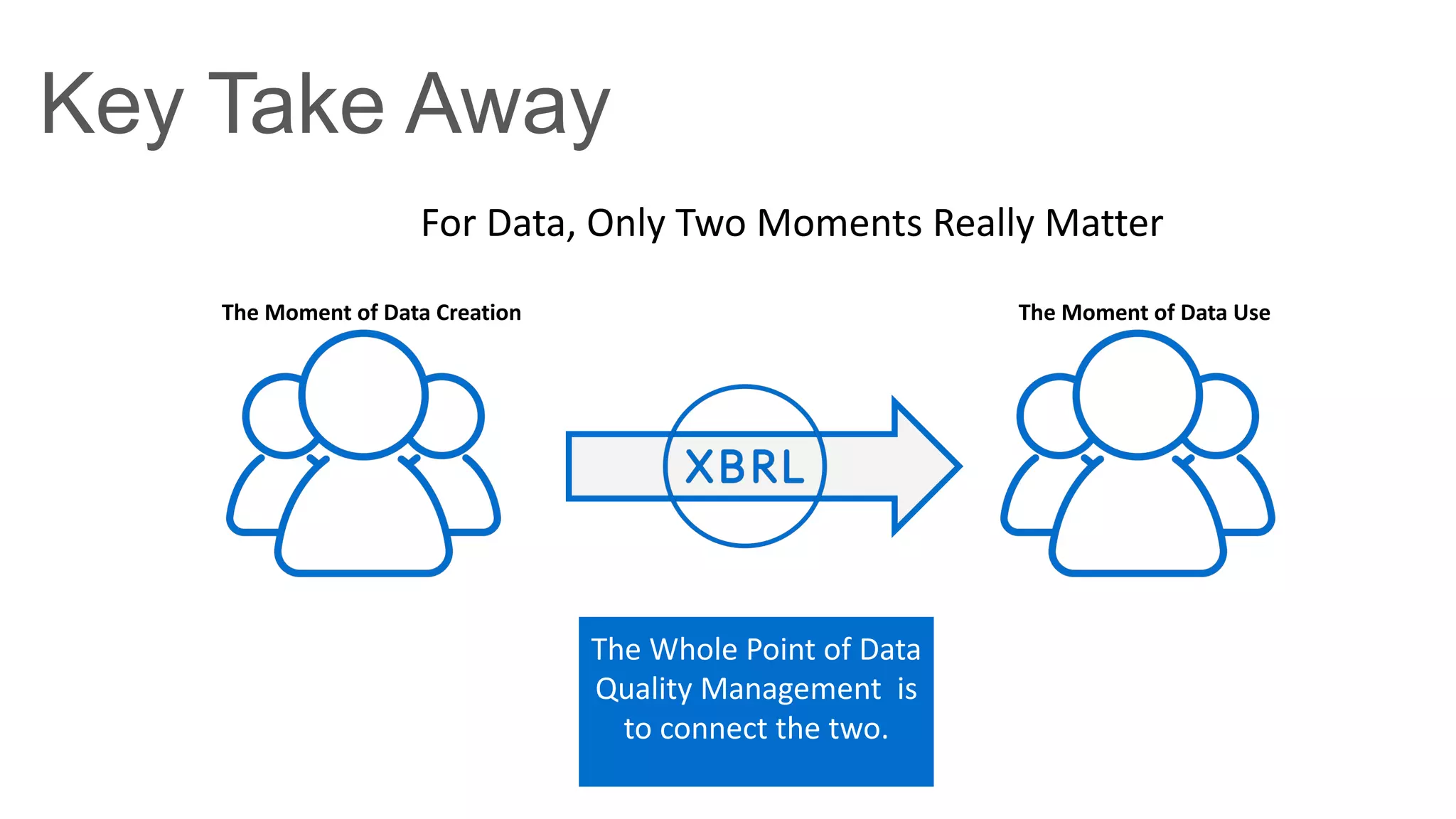

The document presents an overview of XBRL (eXtensible Business Reporting Language), emphasizing its role in improving the generation, validation, and analysis of business and financial information. It outlines the various stakeholders who utilize XBRL, including regulators, companies, and data providers, and highlights key benefits such as enhanced data integrity and reduced costs. The presentation by Liv A. Watson also discusses the importance of digital transformation in financial reporting and XBRL's contributions to global business information exchange.

![12th EARC AM

International Conference

April 25-26, Kyiv, Ukraine

Presentation Title:

XBRL – A Common Language for Data Reporting

Presented By:

Liv A. Watson

Sr. Director of Strategic Customer Initiatives

Workiva, Inc [NYSE: WK]](https://image.slidesharecdn.com/12thearcamandinternationalconferenceapril25-26kyivukraine-190429141939/75/XBRL-A-Common-Language-For-Data-Reporting-Kyiv-25-26-April-2019-1-2048.jpg)