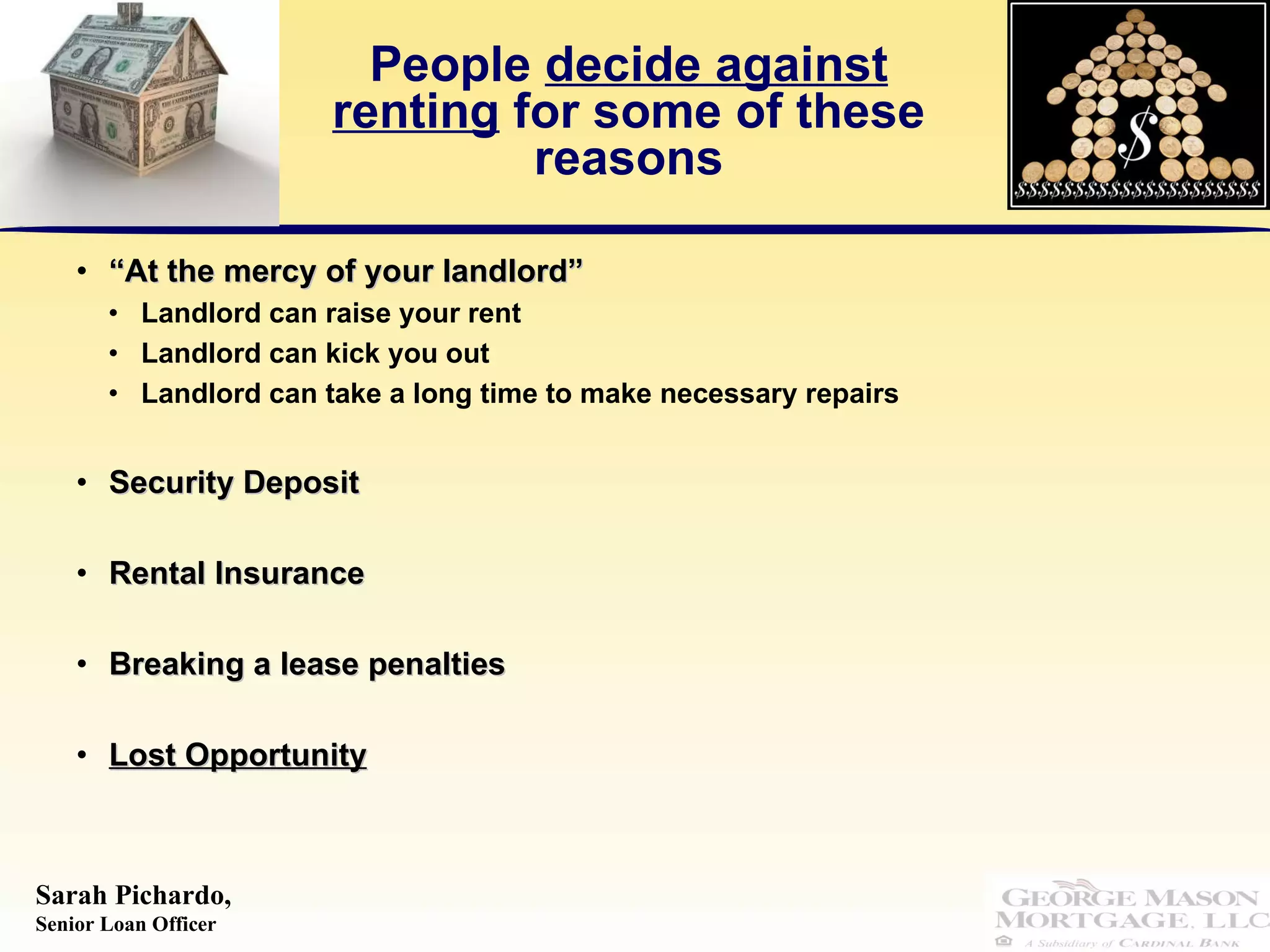

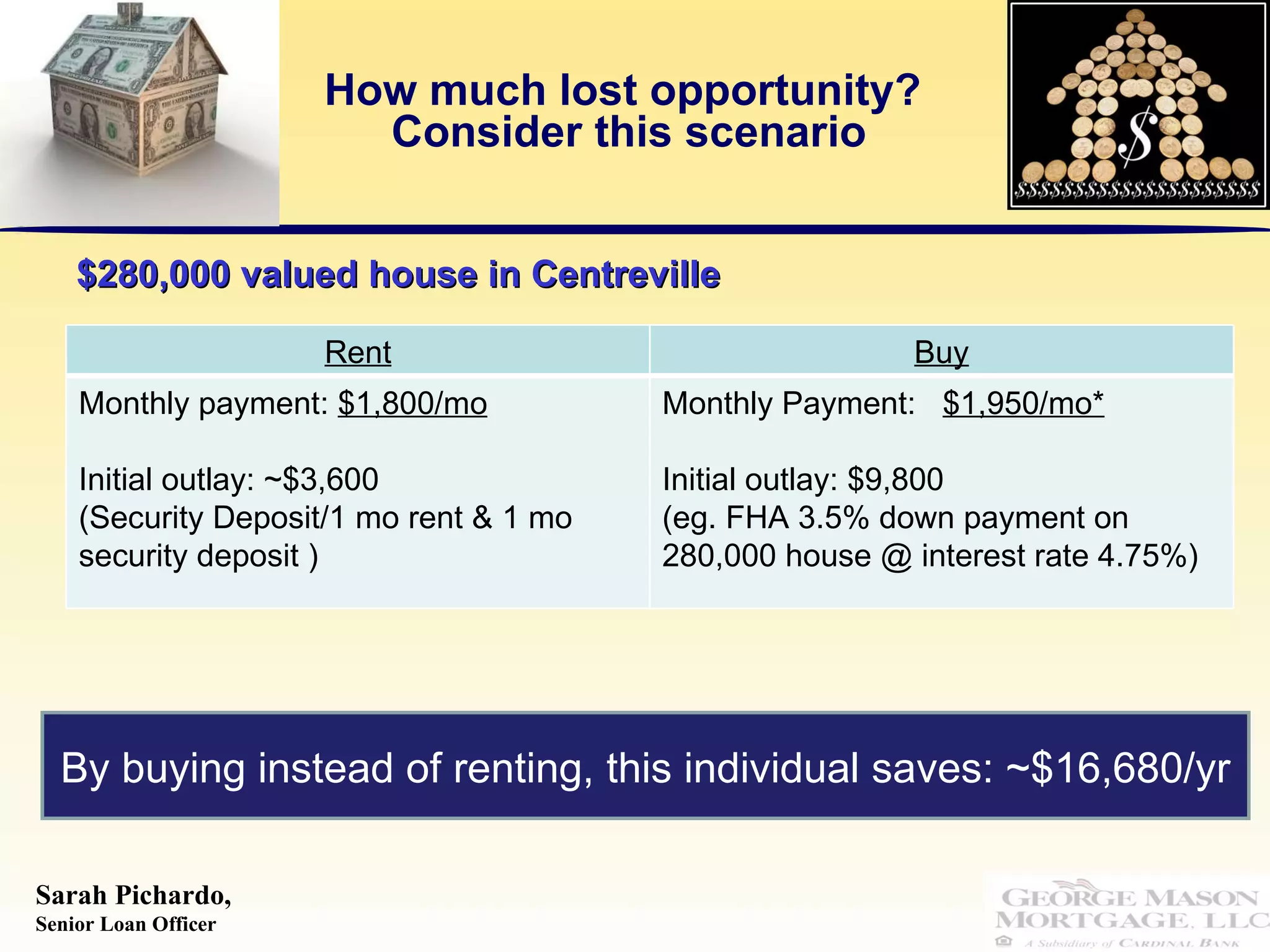

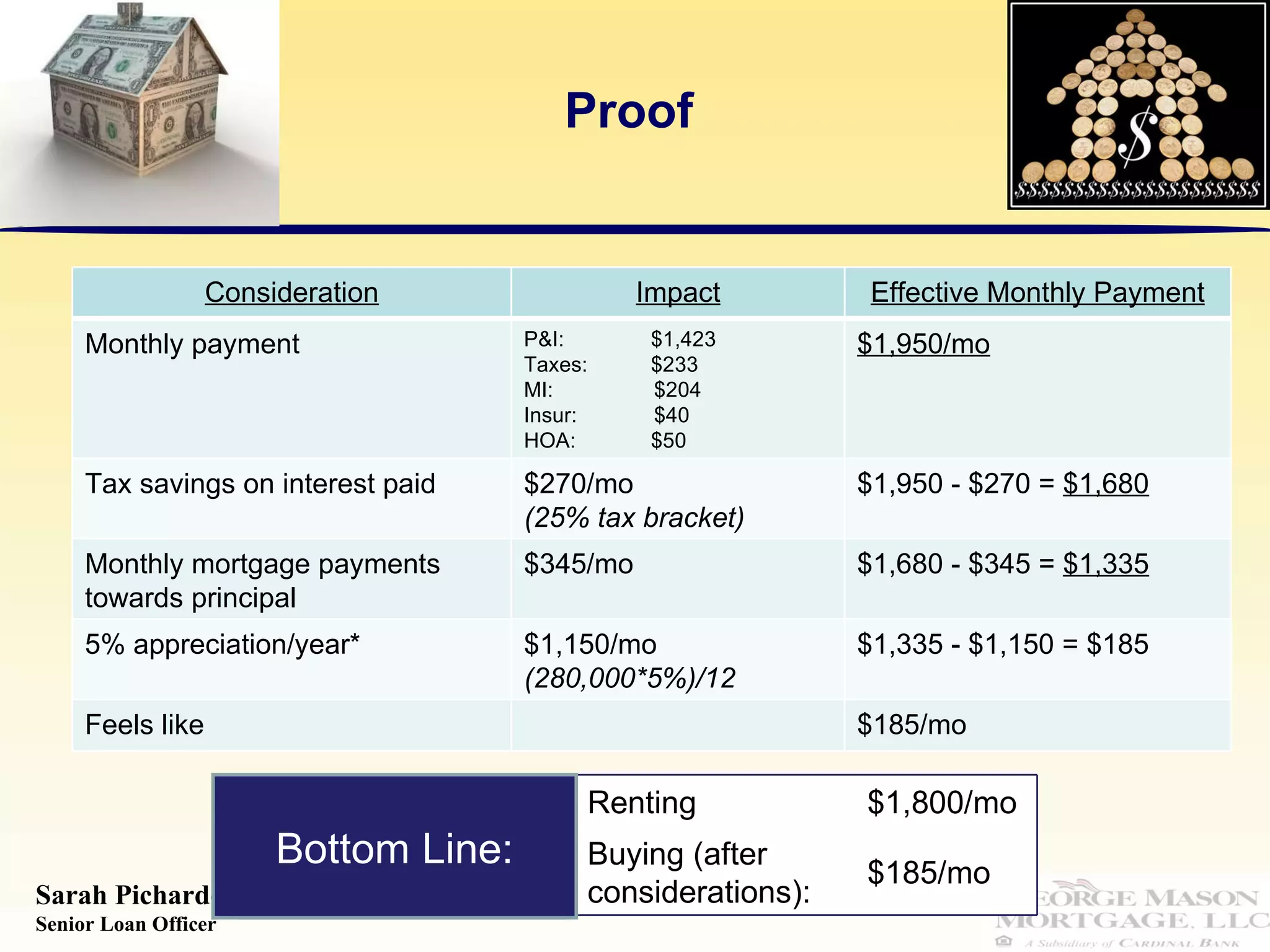

The document compares the financial considerations of renting versus buying a home. Key factors in the decision include location, anticipated length of stay, and budget. Buying a home offers tax benefits like deducting mortgage interest and property taxes. It also allows building equity over time as the home appreciates in value. However, buying requires a larger initial investment for a down payment and closing costs. The document uses an example in Centreville, VA to show how buying could save over $16,000 per year compared to renting after accounting for tax benefits and home appreciation. It provides resources for calculating the rent vs buy analysis and describes various loan programs like FHA that offer lower down payment options.

![Programs FHA - Loan program to assist homebuyers in acquiring property with small down payments from gov’t agency (Federal Housing Administration) [3.5% down payment] VHDA FHA PLUS - designed to help low to moderate income families obtain affordable financing. [up to 101.5% financing] VA - Feature designed to provide housing and assistance for veterans and their families as established by the GI Bill. [100% financing] Conventional - Any mortgage that is not insured or guaranteed by the federal, state, or local gov’ts](https://image.slidesharecdn.com/powerofpower1-110625153422-phpapp01/75/The-power-of-purchase-9-2048.jpg)