The Fiscal Cliff and Housing

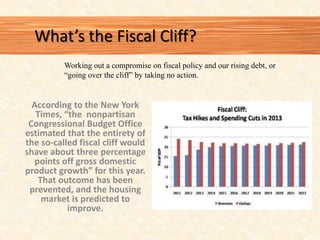

- 1. What’s the Fiscal Cliff? Working out a compromise on fiscal policy and our rising debt, or “going over the cliff” by taking no action. According to the New York Times, “the nonpartisan Congressional Budget Office estimated that the entirety of the so-called fiscal cliff would shave about three percentage points off gross domestic product growth” for this year. That outcome has been prevented, and the housing market is predicted to improve.

- 2. Business Tax Items Permanently extends the 2001 - 2003 tax rates for adjusted gross income levels under $450,000 or $400,000 single Verdict: Thumbs up for small businesses and home builders that are pass through entities paying taxes on the individual side of code. It’s estimated that 80% of builders, contractors, and supplies fall in this category Protects small businesses from tax hikes and keeps 15% rates for capital gains and dividends for income levels under 450,000 ($400,000 single)

- 3. Business Tax Items Permanently extends the Alternative Minimum patch Verdict: Good for small businesses who are at risk for paying AMT. In a typical tax year, it’s estimated that about five million taxpayers are subject to AMT. Prevents many small businesses facing higher tax liability. AND Protects housing deductions and credits such as the real estate tax deduction and the 25C energy efficiency tax credit from shrinking in value.

- 4. Business Tax Items Extends present law section 179 small business expensing through the end of 2013 Verdict: Good for small firms via cash flow and administrative cost benefits. Increases the maximum amount of depreciation and the income phase-out threshold in 2012 and 2013 to levels in effect in 2010 and 2011 (500,000 and $2 million, respectively).

- 5. Business Tax Items Permanently sets the parameters of the estate tax Verdict: Positive for family-owned construction firm, because higher exemption amounts protect many small businesses. Extends the $5 million (indexed to inflation) exemption amount AND Raises the rate of tax to 40% for estate value above the exemption amount.

- 6. Business Tax Items Extends the section 45L new energy-efficient home tax credit through the end of 2013 Verdict: Thumbs up for green builders. Allows a $2,000 tax credit for the construction of for sale and for- lease energy-efficient homes in buildings with fewer than three floors above grade

- 7. Home Owner Tax Items Extends through the end of 2013 mortgage debt tax relief. Verdict: Good for distressed households and the housing market. Prevents tax liability from short sales or mitigation workouts involving deferred or canceled mortgage debt. AND Enables more short sales to move forward and reduce downward pressure on home prices. Without this a homeowner who owes $150,000 on the mortgage and short sells for $100,000 would have been taxed on the $50,000 difference as income, placing them in a higher tax bracket.

- 8. Home Owner Tax Items Deduction for mortgage insurance extended through the end of 2013 Verdict: Helpful for first-time home buyers and the middle class Reduces the cost of buying a home when paying private mortgage insurance as well as insurance provided by the Federal Housing Administration, the Veterans Affairs and the Rural Housing Service. HOWEVER The tax break only applies to those with AGI under $110,000.

- 9. Home Owner Tax Items Extends the section 25C energy-efficient tax credit for existing homes through the end of 2013 Verdict: Important remodeling incentive, particularly helpful for remodelers and households looking to upgrade their home. 10 percent tax credit with a lifetime credit cap at $500. HOWEVER Combined with local tax incentives (check your local energy provider) and energy savings, it can go a long way.

- 10. Home Owner Tax Items Reinstates the Pease/PEP phase outs for deductions. Verdict: The Pease rule will affect only a very small number of households who use the mortgage interest deduction, in which the rule will reduce the value of itemized deductions, such as for charitable giving and mortgage interest. For taxpayers with AGI above $300,000 ($250,000 single) reduces total itemized deductions by 3% per dollar amount above the thresholds. For example, a married couple with a $350,000 AGI would be $50,000 above the limit and must reduce their Schedule A deduction total by $50,000 multiplied by 3%, or $1,500. This would raise their taxes by about $500.

- 11. Multifamily Tax Items Extends the 9% Low Income Housing Tax Credit (LIHTC) rate for allocations through the end of 2013 Verdict: Helpful for low income families. Absent the credit fix, the LIHTC program would suffer a loss of equity investment for affordable housing projects.

- 12. Multifamily Tax Items Extension through the end of 2013 of base housing allowance rules for affordable housing. Verdict: This extension will ensure more equity can go into any one given project and increase the financial viability of Housing Credit deals. The military’s basic housing allowance is not considered income for purposes of calculating whether the individual qualifies as a low- income tenant.

- 13. To be continued… It’s not quite over. Coming in February, decisions over the debt ceiling and the delayed sequester will be determined. But for now, let’s enjoy the housing market’s progress.

- 15. Sources National Association of Home Builders North American Retail Hardware Association Forbes