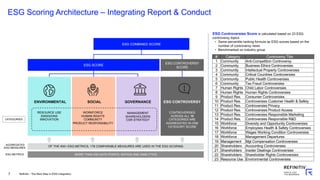

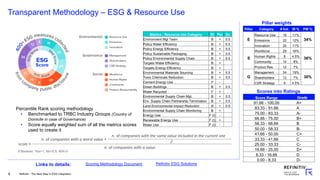

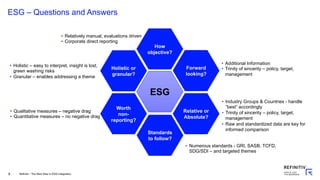

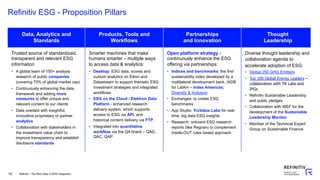

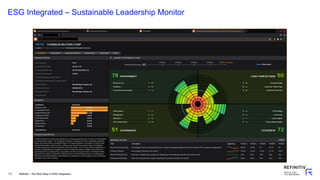

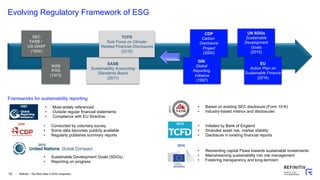

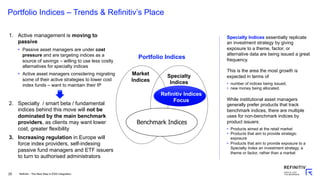

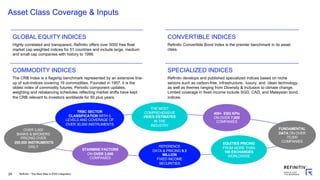

Refinitiv enables tailored integration of ESG into the research, investment vehicle creation, and investment management processes through audible, standardized data across all Environmental, Social and Governance pillars, transparent and customizable rating mechanism, and regularly updating controversies. Refinitiv provides a wide range of concorded historic and forward looking fundamental and pricing data, and value-add index calculation services supporting thematic investments. Refinitiv aims to be the next step in ESG Integration.