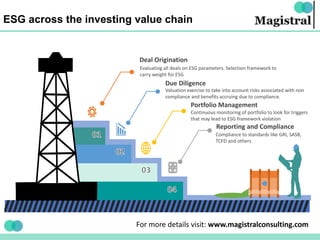

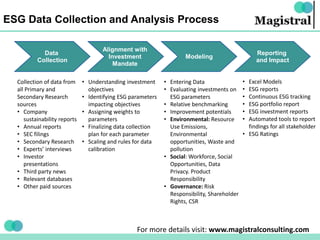

The document outlines the importance of evaluating ESG parameters in investment decision-making, including a structured approach for ESG deal origination and ongoing compliance monitoring. It highlights challenges in ESG data collection, emphasizes the need for customized solutions, and presents various elements involved in effective ESG reporting and analysis. Magistral Consulting offers expertise in investment analytics and consulting services tailored to meet diverse client needs across the financial sector.