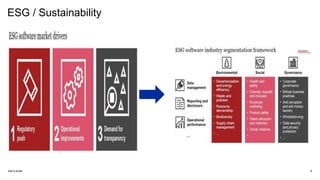

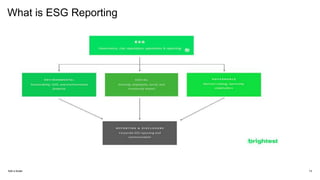

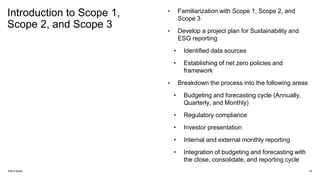

The document provides an overview of sustainability reporting and ESG reporting. It discusses key concepts like scope 1, 2, and 3 emissions reporting and standards like IFRS, FASB, and SASB. It also outlines initial steps organizations can take to implement sustainability and ESG reporting, including developing a data strategy, identifying data sources, and establishing reporting cycles and metrics. Sample software vendors for ESG compliance and reporting are also listed.