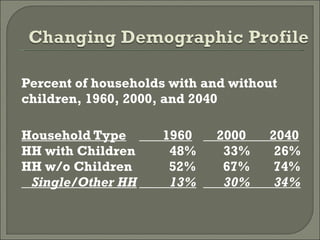

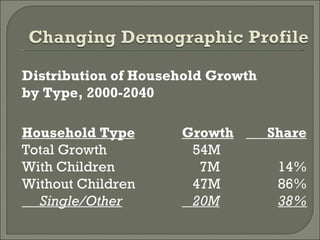

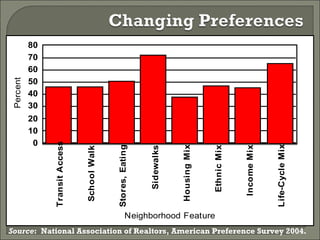

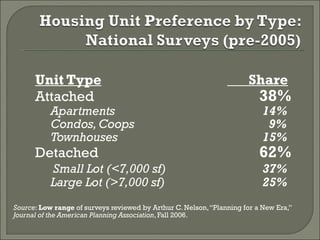

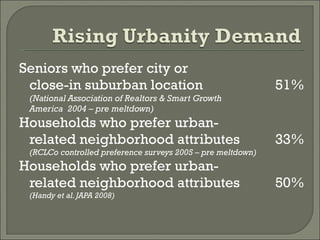

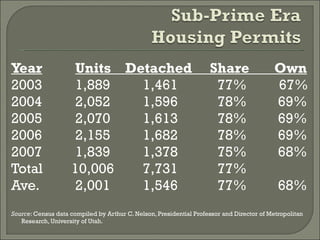

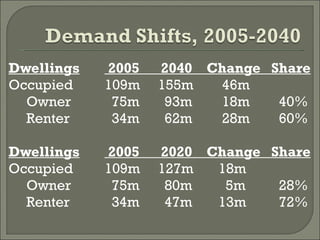

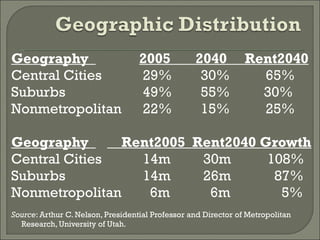

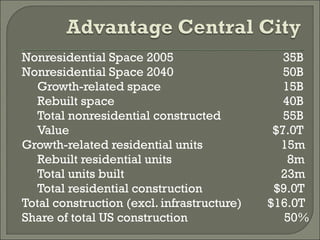

This document summarizes trends in housing, demographics, and development from 1960 to 2040. It finds that the share of households with children will decline while single-person and childless households rise. Most household growth between 2000-2040 will be among those without children. Preferences are also shifting towards more compact urban or attached housing options. Renting is projected to increase, with more renters located in central cities. Total nonresidential and residential construction through 2040 is estimated to reach $16 trillion, accounting for half of all US construction.