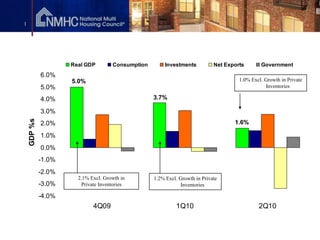

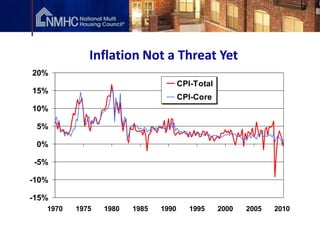

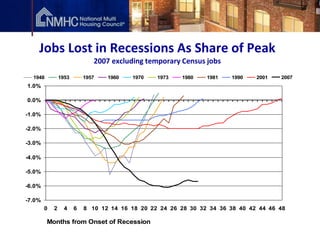

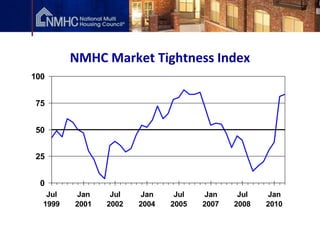

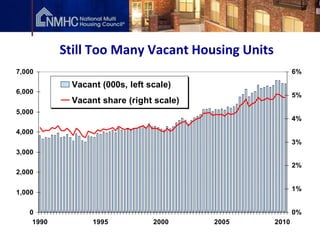

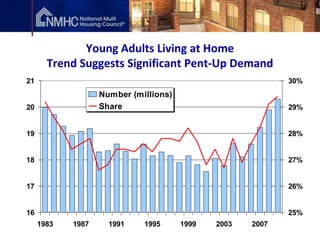

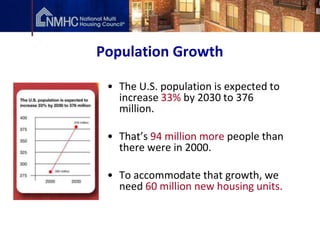

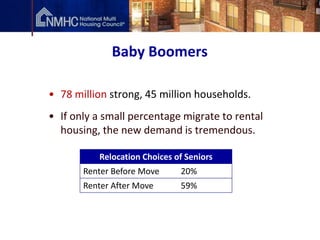

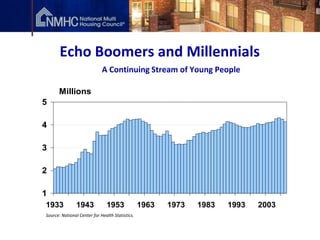

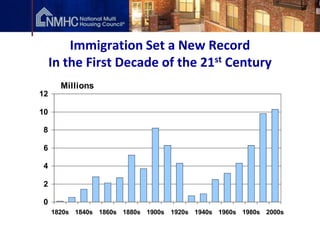

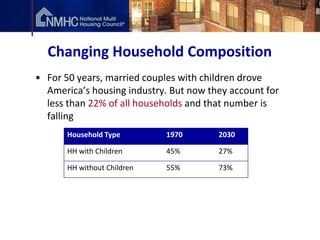

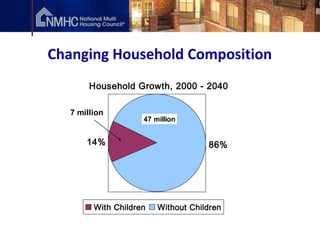

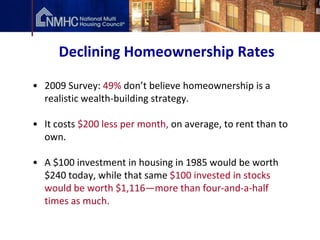

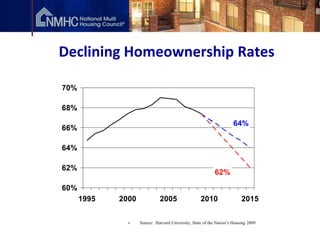

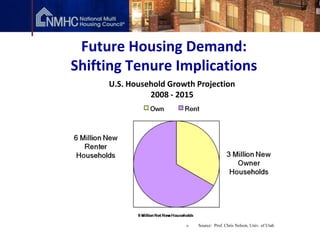

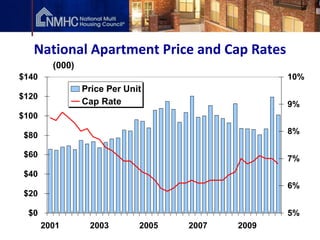

The document provides an overview of the state of the US apartment market in September 2010. It summarizes recent economic indicators and trends affecting supply and demand for rental housing. Key points include slowing GDP growth recovering from recession, low inflation, high unemployment, a large inventory of vacant homes, declining homeownership rates, and positive long-term demographic trends that will increase demand for rental housing such as population growth, aging baby boomers, immigration, and changing household composition. The outlook for the apartment industry remains favorable due to these demand drivers, but construction activity and financing remain below historical levels due to the impacts of the financial crisis and new regulations.