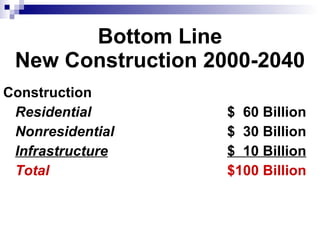

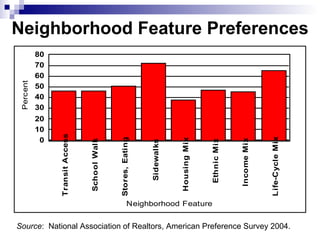

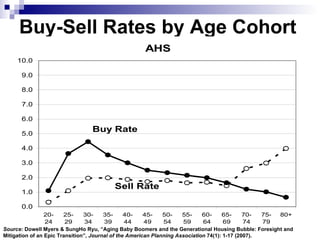

The document discusses population and development projections for Sarasota County, Florida through 2040. It projects that the county's population will grow significantly from 327,000 in 2000 to 664,000 in 2040. To accommodate this growth, most new development will come from redevelopment of existing parking lots and structures rather than greenfield development. The document advocates planning for more dense, walkable, and transit-oriented development to meet changing consumer preferences and make the most efficient use of existing infrastructure.

![People Turning 65 Each Year [Figures in 000s] Source: US Census Bureau – 65+ in the United States: 2005; Wan He, Manisha Sengupta, Victoria A. Velkoff, & Kimberly A DeBarros. December 2005 .](https://image.slidesharecdn.com/nelson-sarasota4-15-08-120107071832-phpapp02/85/Nelson-sarasota-4-15-08-16-320.jpg)

![Sarasota County Parking Lot Building Capacity Calculation Result Commercial Acres Ripe for Redevelopment Acres by 2040 6,600 Average 25 dwellings @ 1,500sq.ft. Average 40 jobs @ 500sq.ft. 1.3FAR [With “smart parking” policies & design] Percent Residential Absorption 100% Percent Employment Absorption 100%](https://image.slidesharecdn.com/nelson-sarasota4-15-08-120107071832-phpapp02/85/Nelson-sarasota-4-15-08-35-320.jpg)