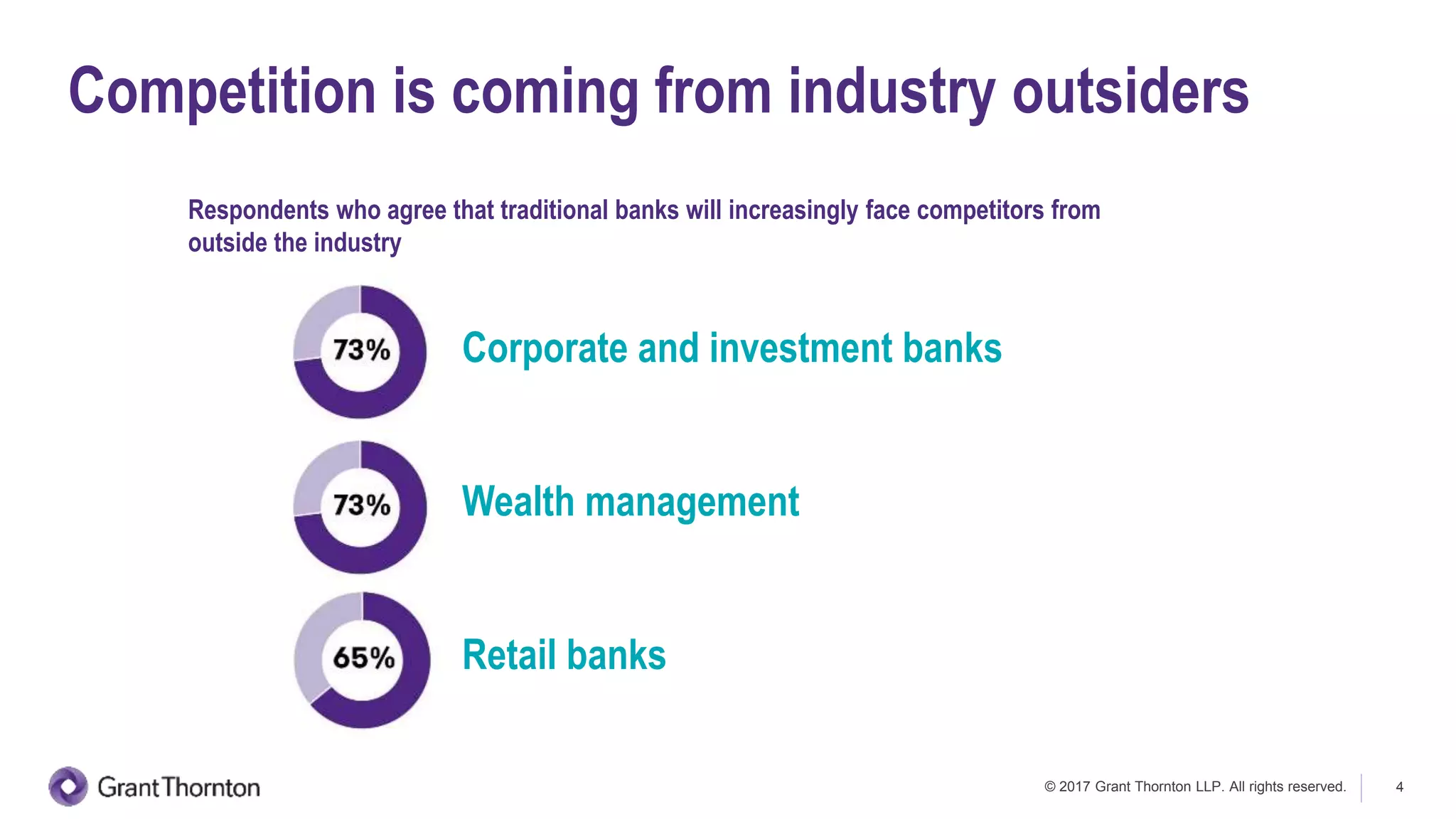

A survey of over 350 banking executives reveals that the focus on customer service will double by 2020, becoming the top priority for value creation. The report emphasizes the importance of technology in enhancing customer service and encourages banks to streamline operations, collaborate with fintechs, and reset risk priorities for better predictive management. Thriving financial institutions will prioritize customer satisfaction through technological innovations and strategic reorientations.