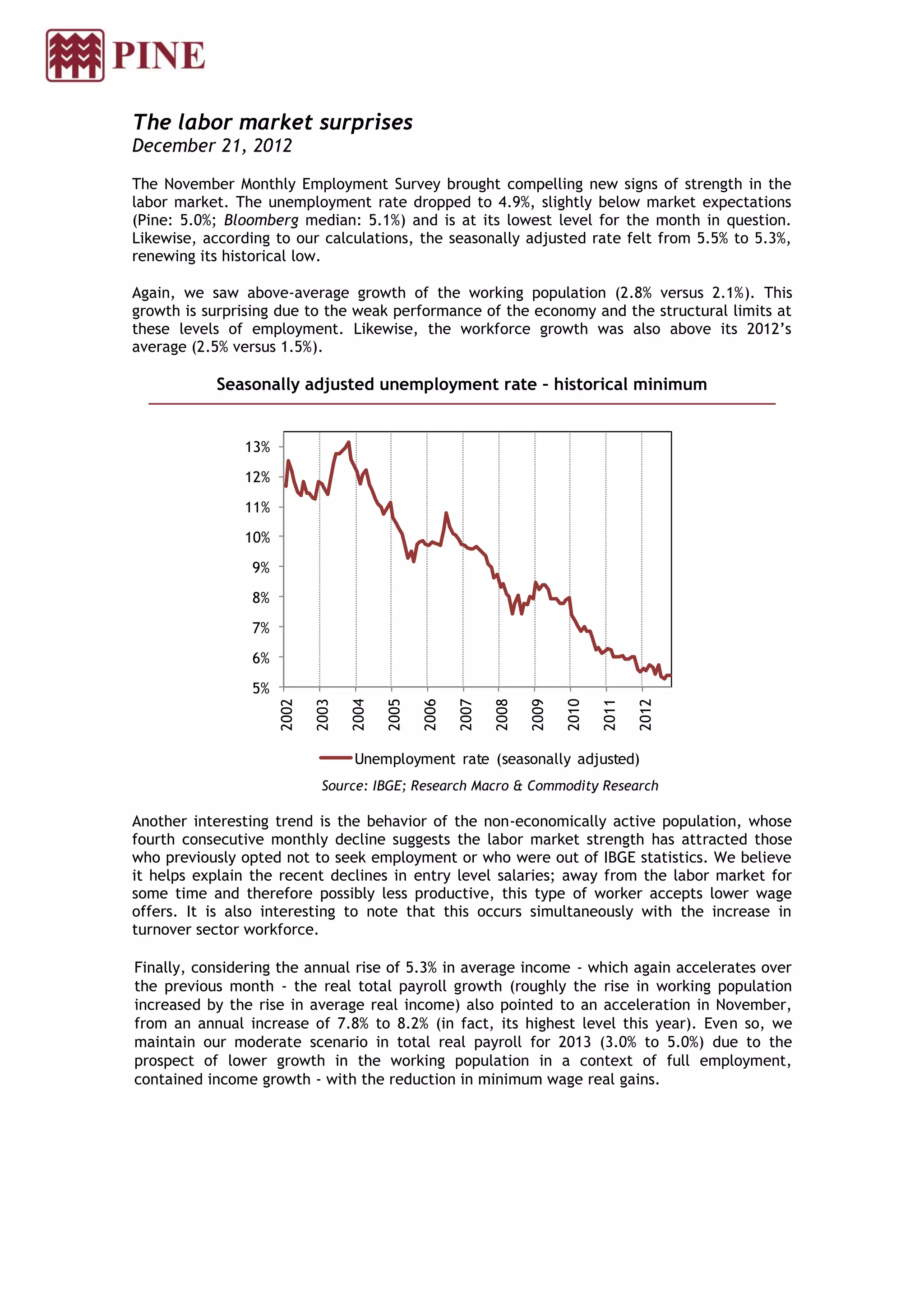

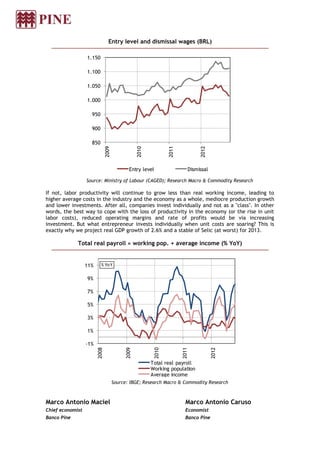

The labor market in Brazil showed unexpected signs of strength in November. The unemployment rate dropped below expectations to 4.9%, its lowest level for November. The working population grew 2.8%, above the yearly average, despite weak economic growth. The number of non-working people declined for the fourth month in a row, suggesting more people are entering the workforce. Average incomes rose 5.3% year-over-year, accelerating the growth in total real payroll. However, the economist maintains a moderate growth forecast for 2013 due to expectations of slower workforce expansion and contained income growth in a context of full employment.