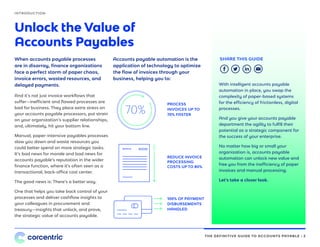

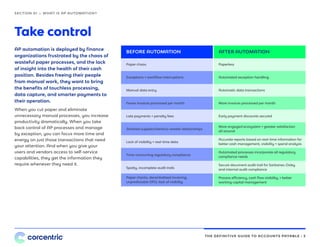

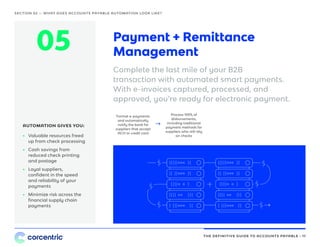

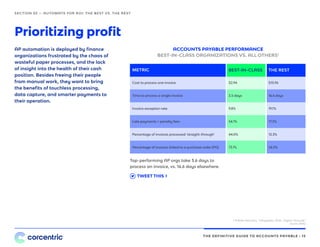

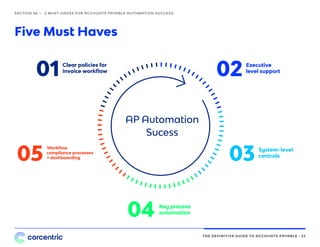

The document serves as a comprehensive guide to accounts payable (AP) automation, highlighting its benefits in streamlining invoice processing, cutting costs, and enhancing operational efficiency. It details the transformation from manual, paper-intensive processes to digital workflows that can save organizations significant time and resources, thereby increasing overall productivity and improving supplier relationships. The guide also includes insights on calculating ROI, the strategic value of AP automation, and reasons why businesses should adopt these systems for better cash flow management.