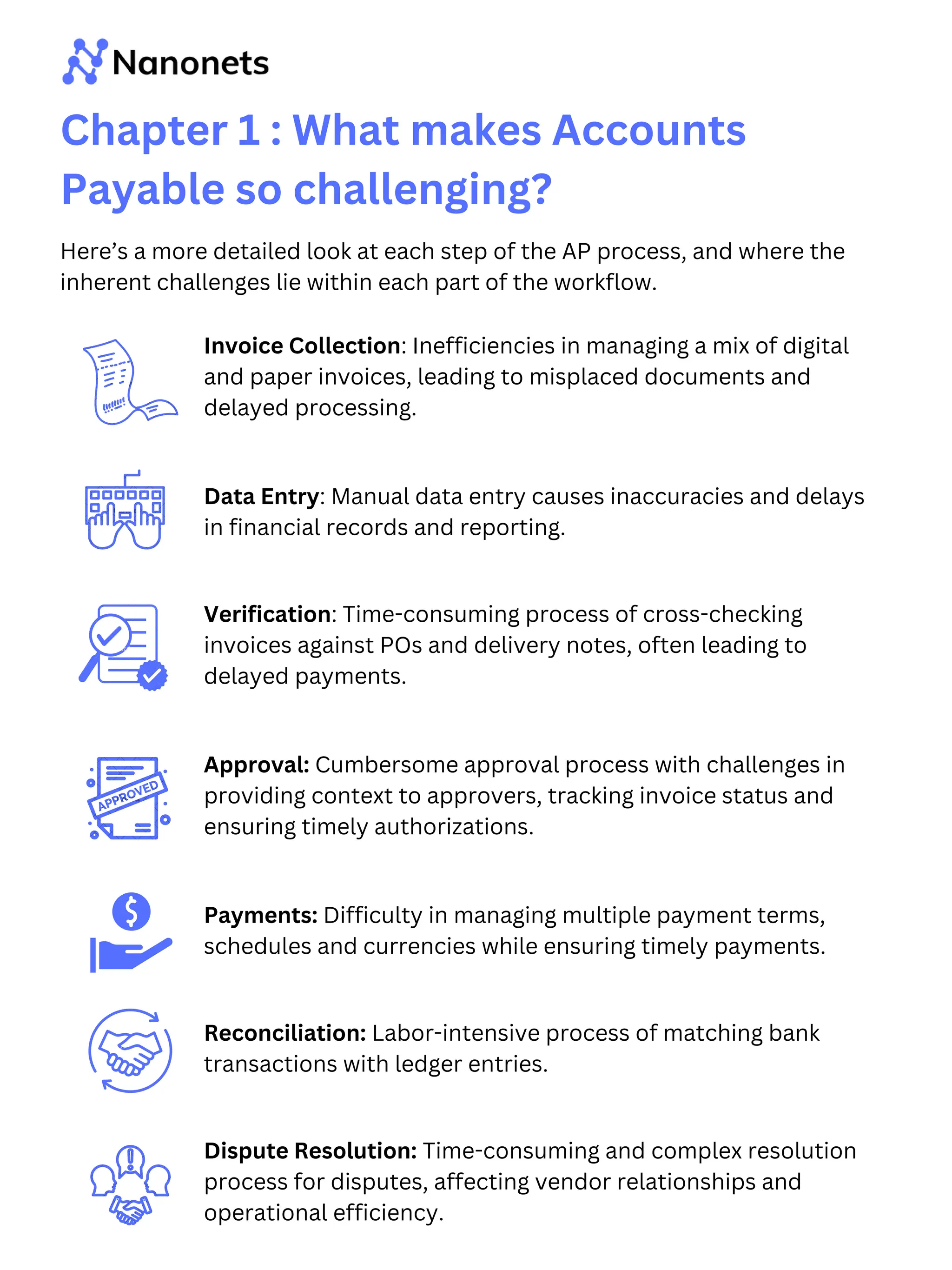

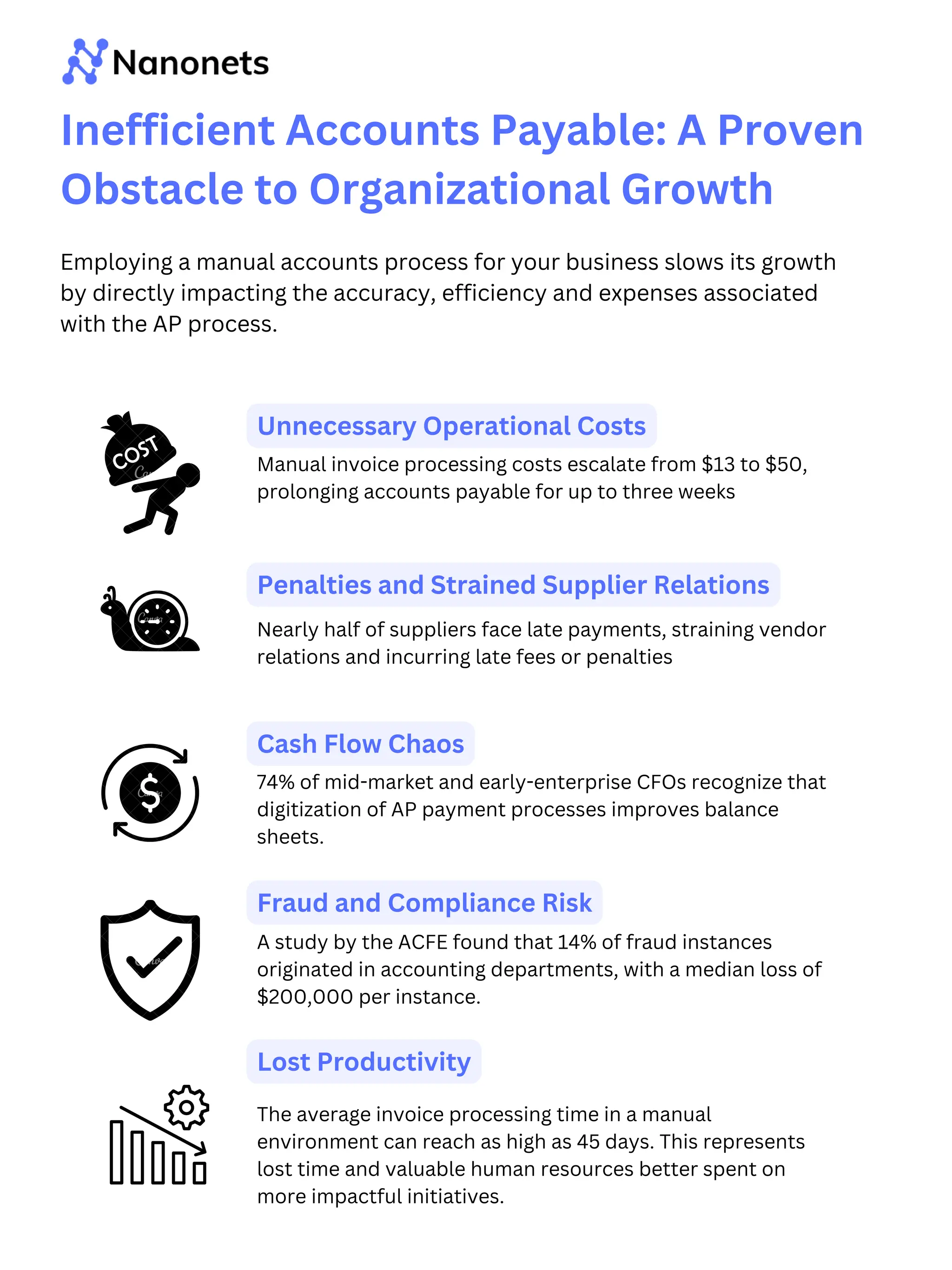

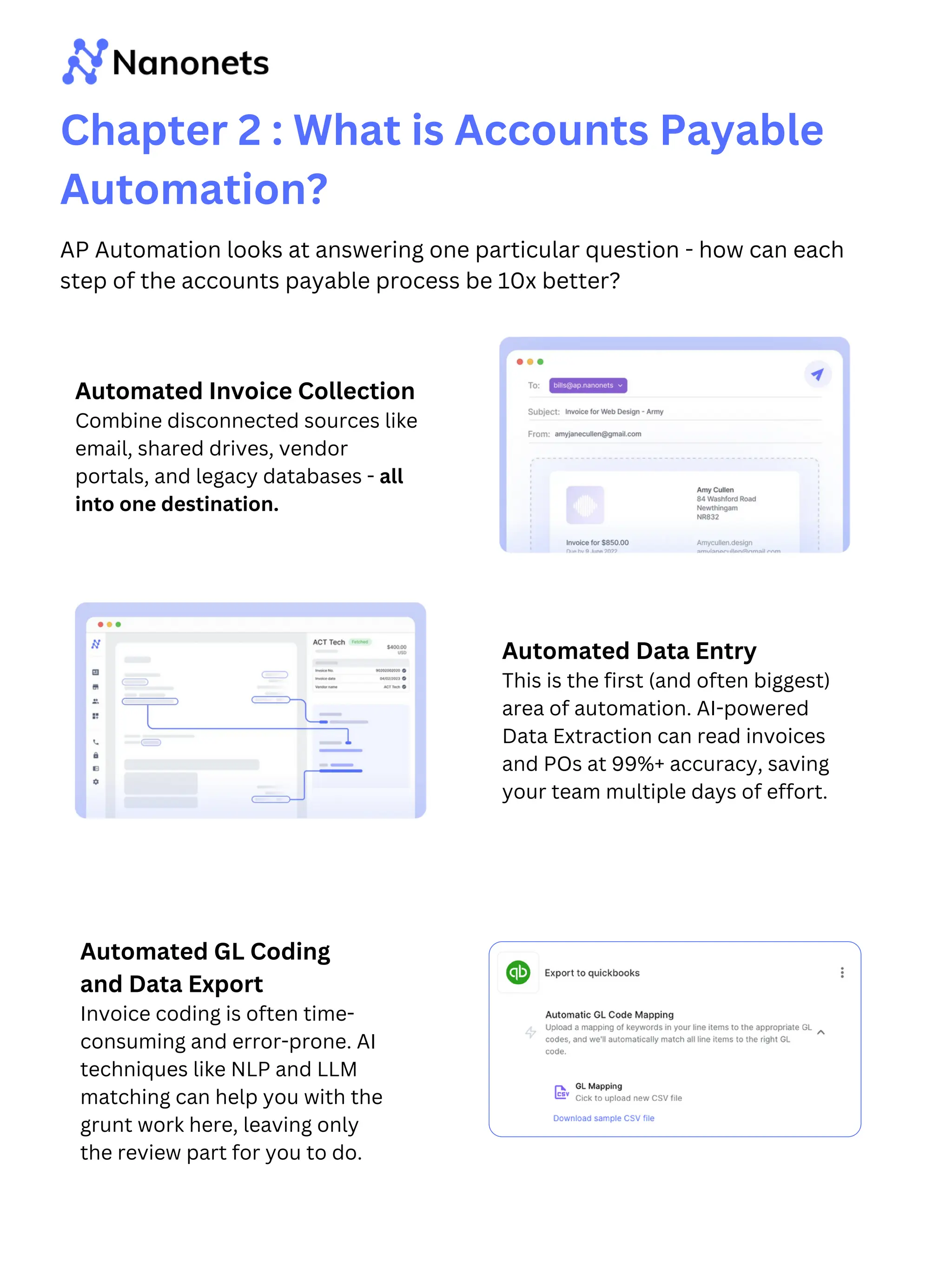

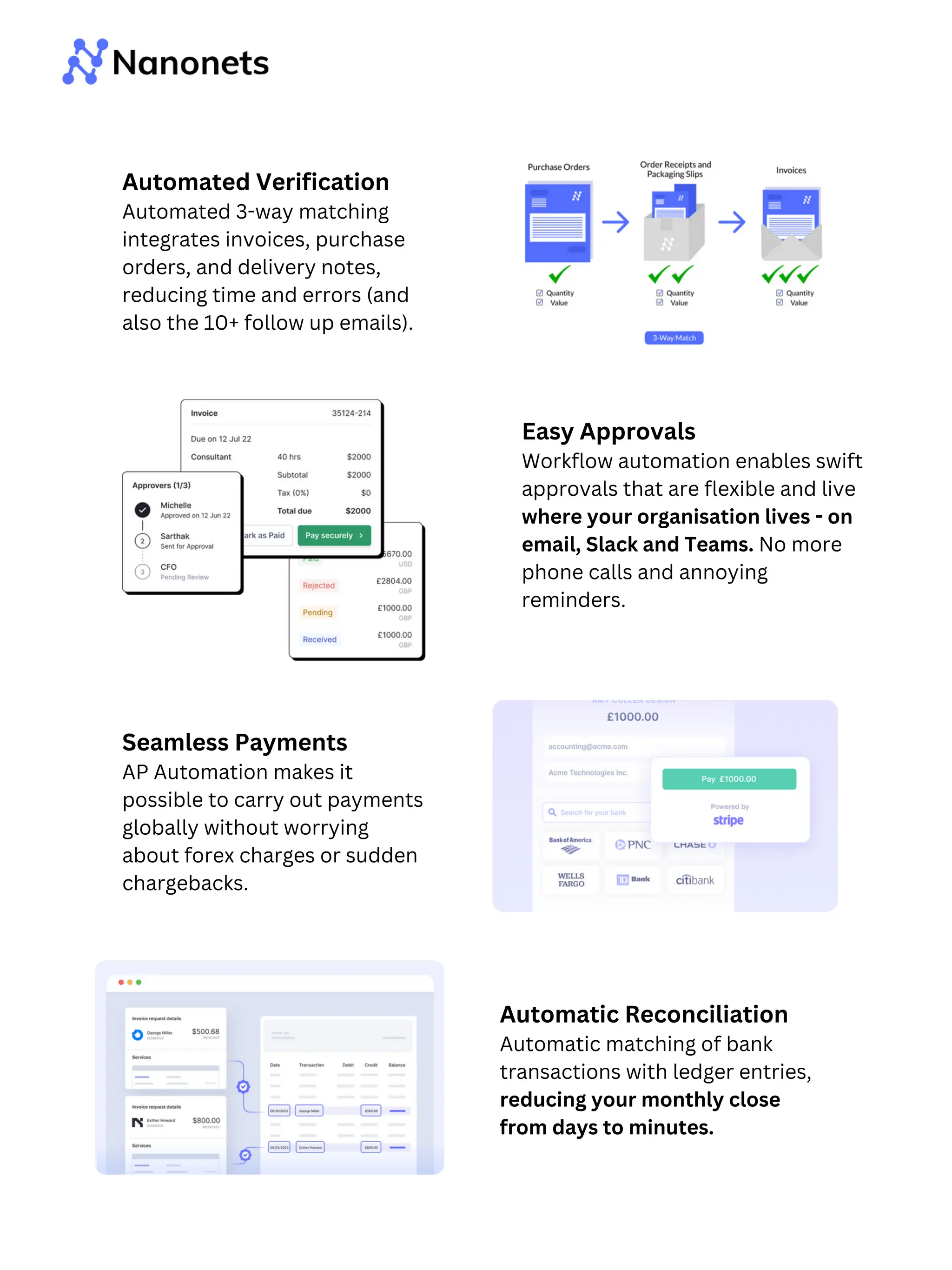

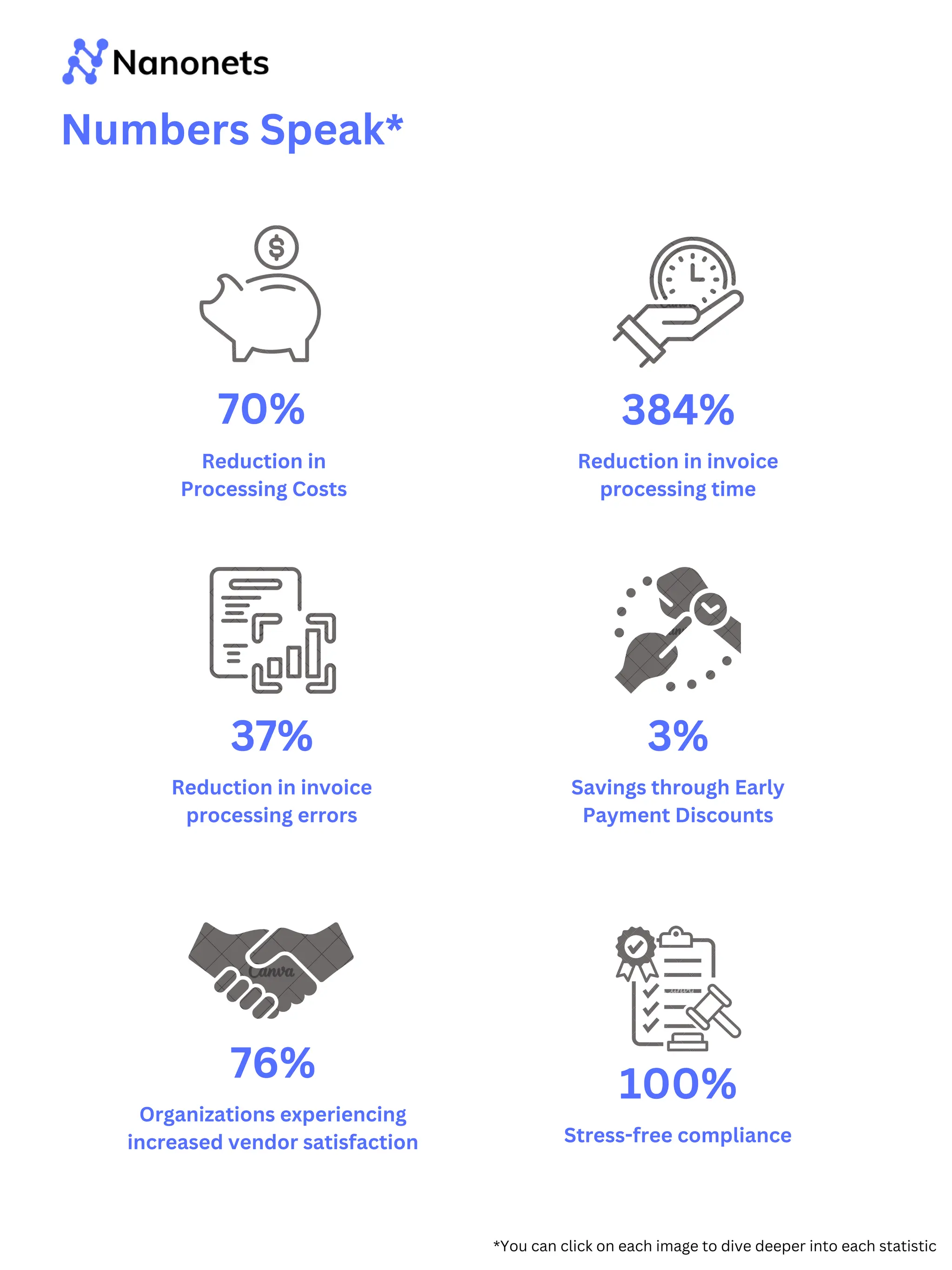

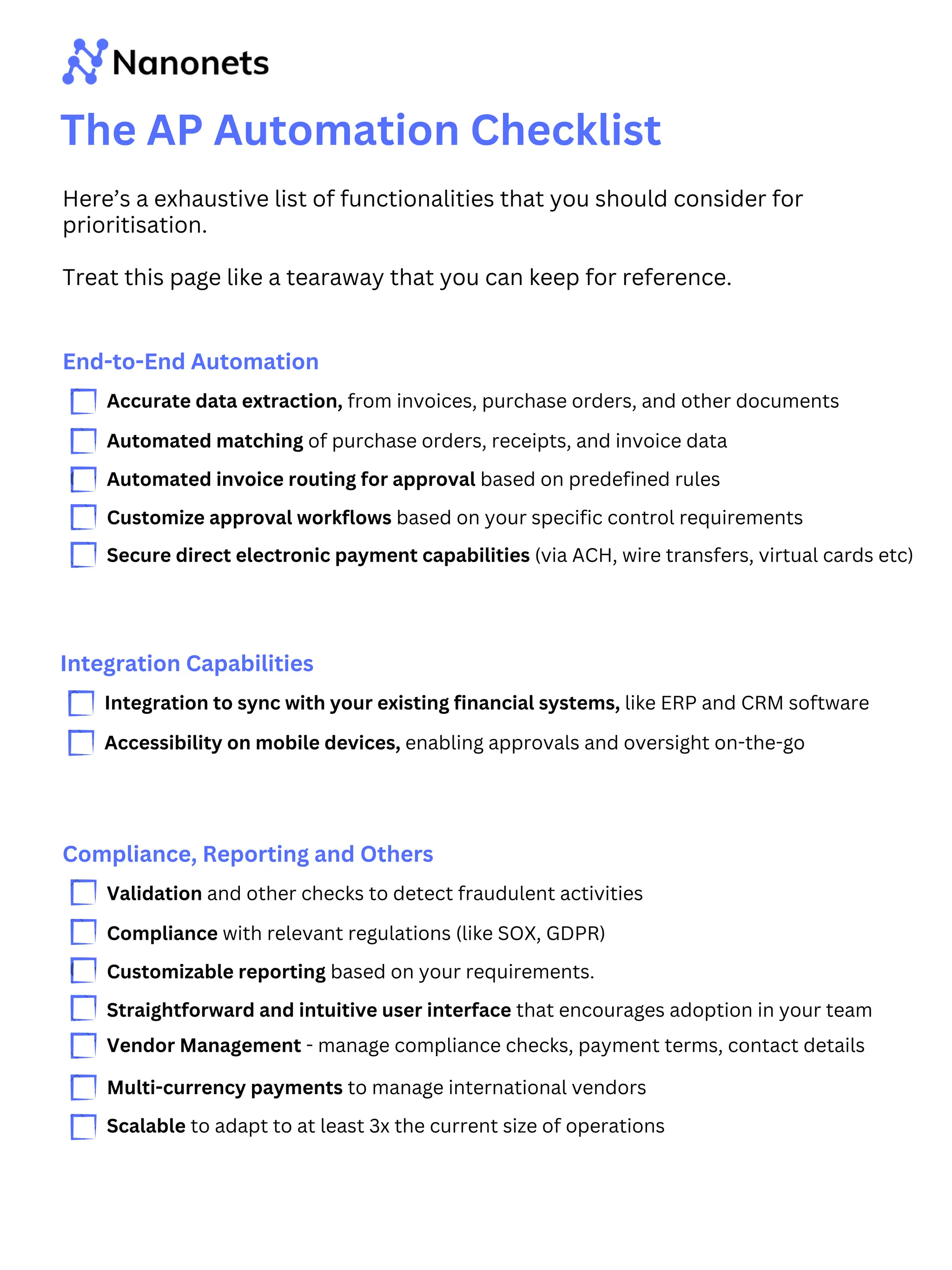

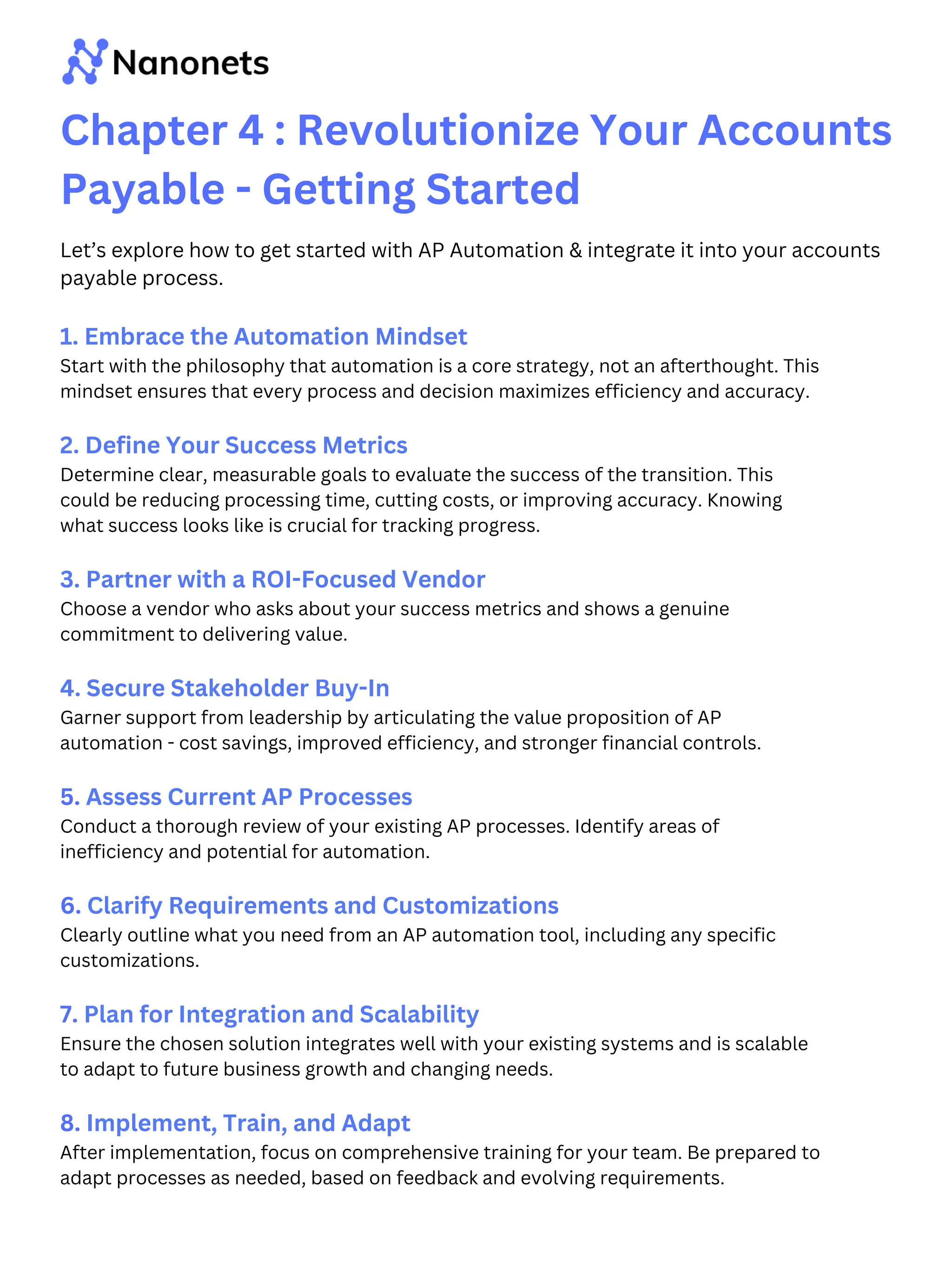

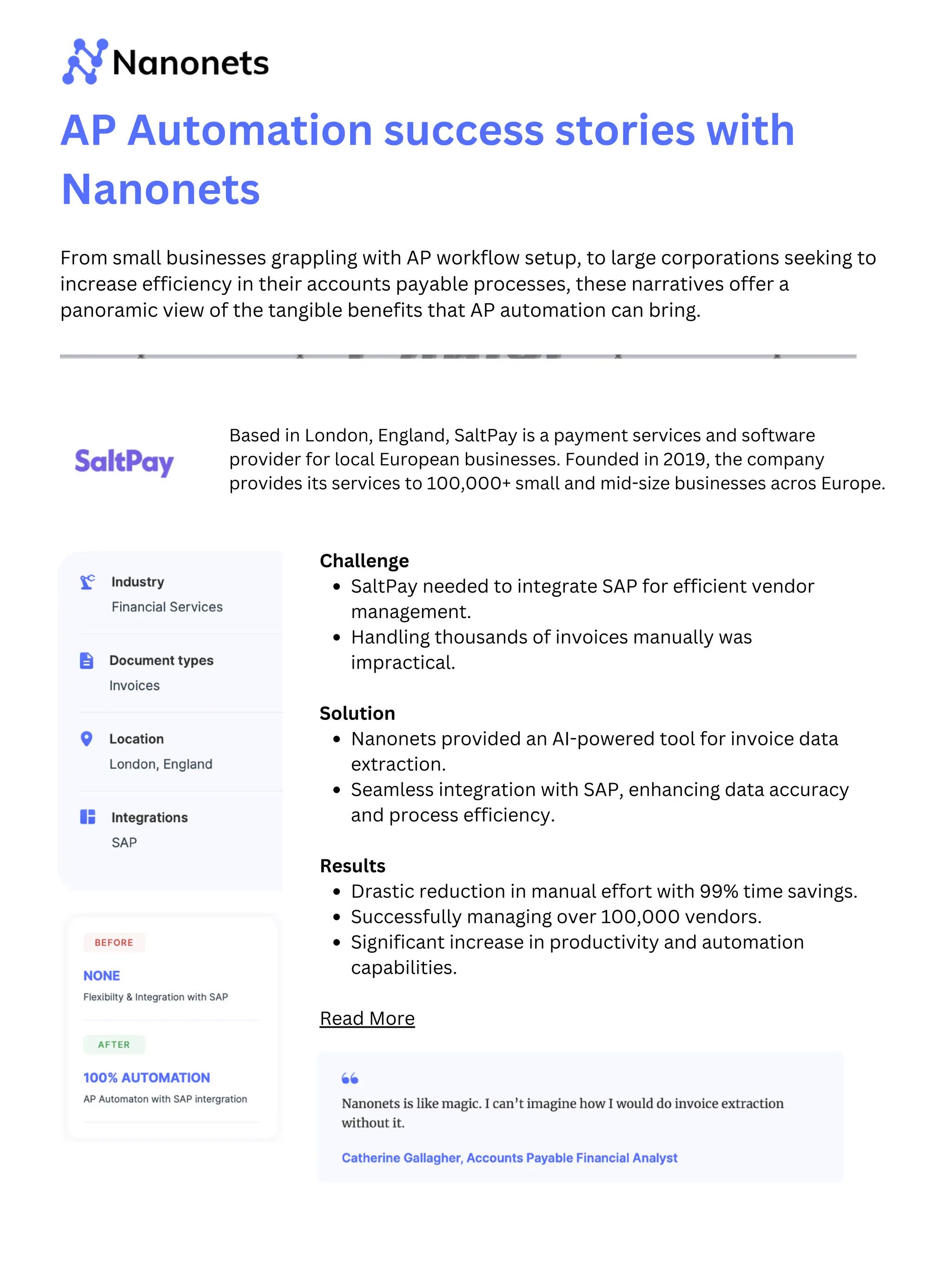

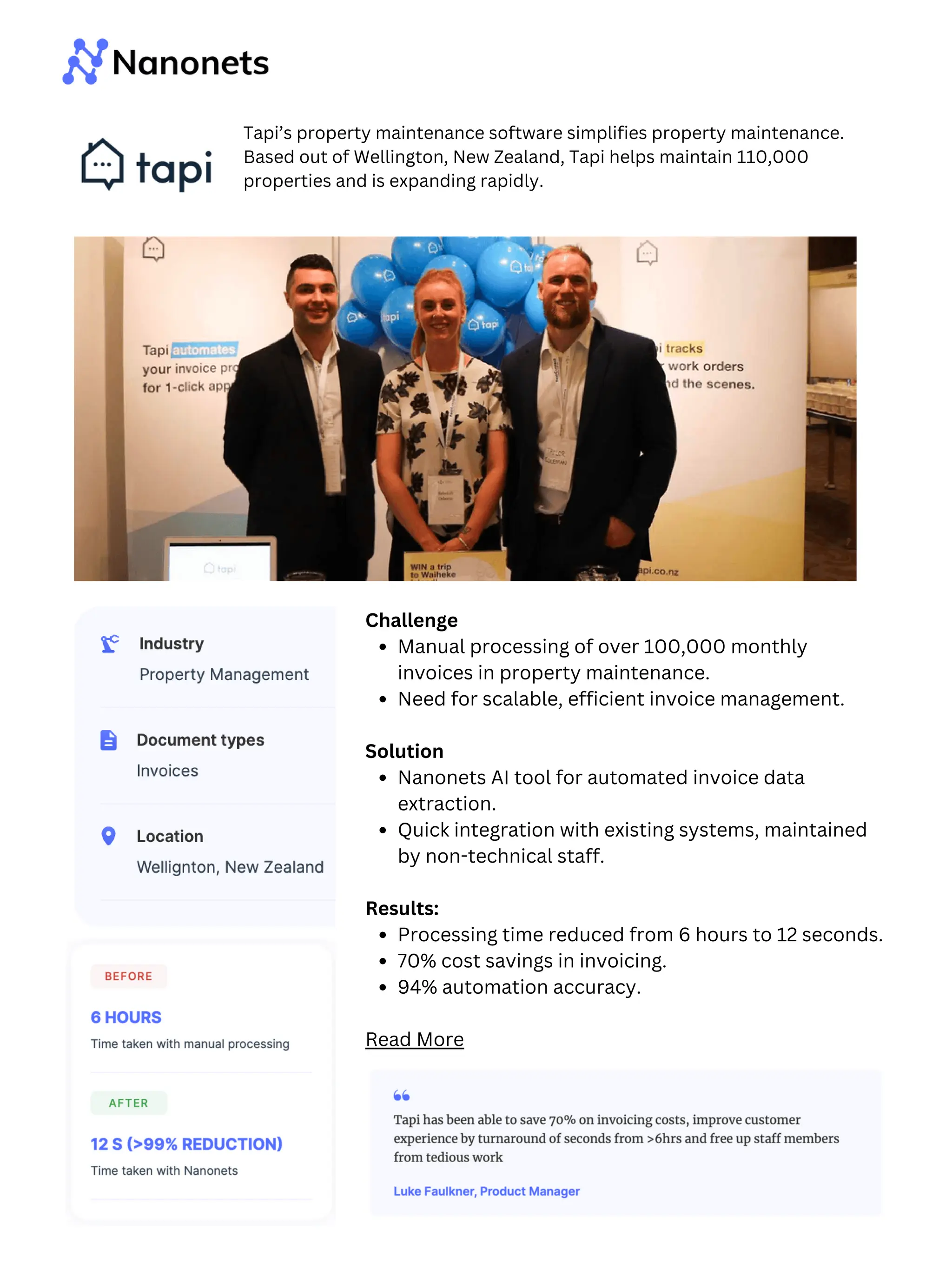

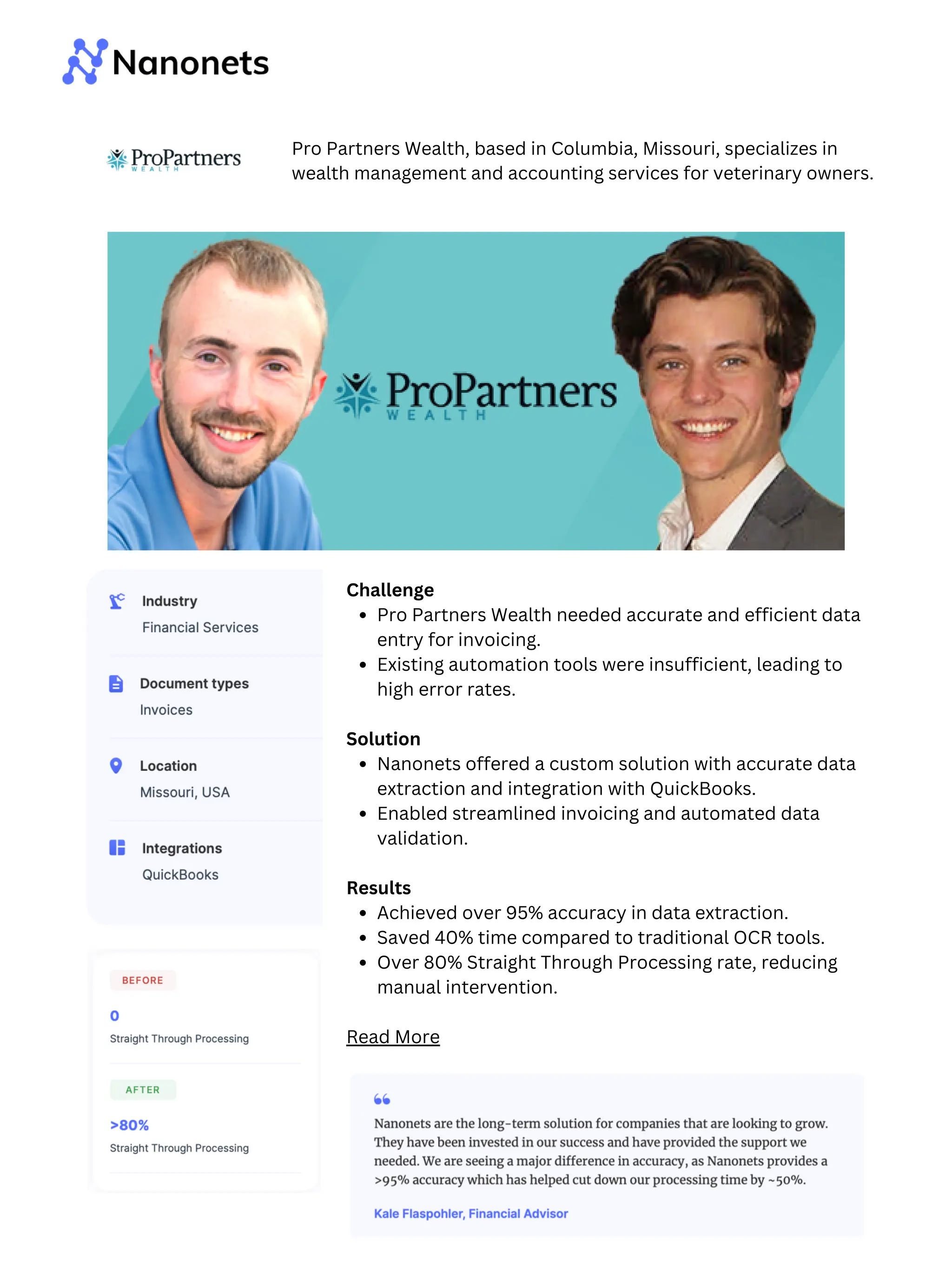

The document is a comprehensive guide on accounts payable (AP) automation, addressing the challenges of traditional AP processes and presenting a transformative approach for finance leaders. It outlines key insights into the automation essentials, benefits, and important steps for implementation, emphasizing efficiency, accuracy, and strategic business impact. The guide also includes real-world successful case studies implementing AP automation solutions.