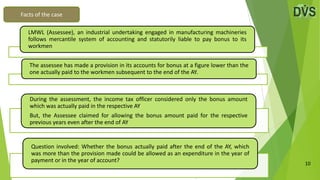

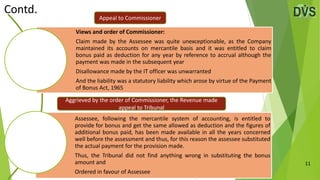

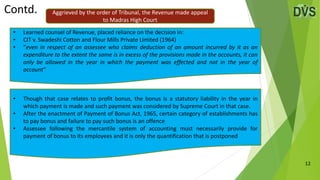

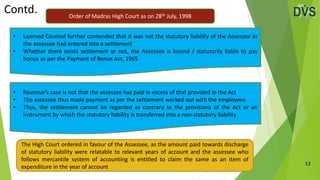

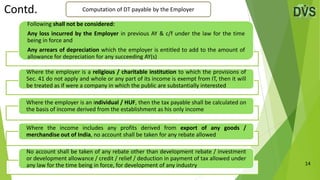

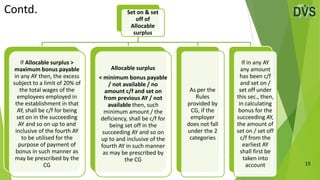

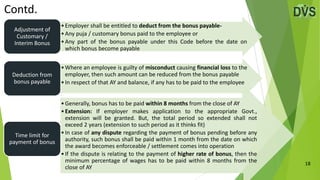

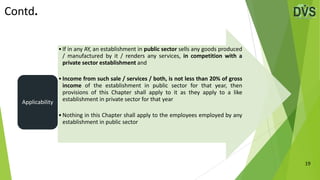

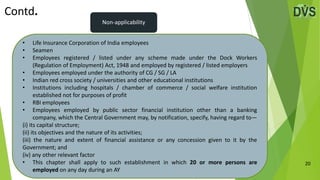

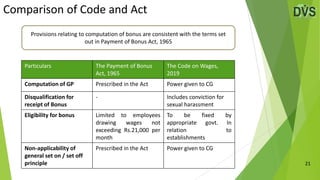

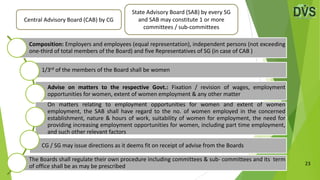

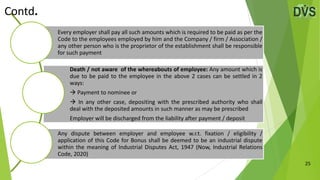

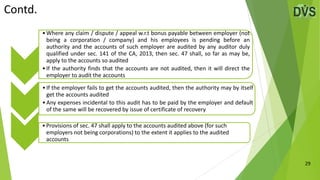

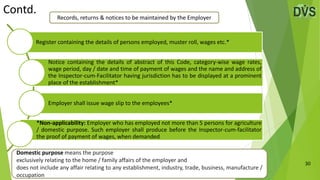

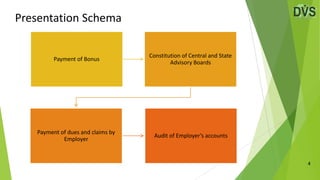

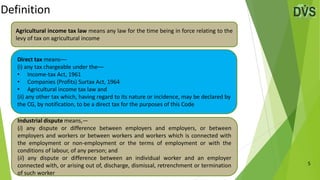

The Code on Wages, 2019 outlines the regulations surrounding the payment of wages, bonuses, and the establishment of advisory boards to ensure fair employment practices. It details the computation of gross profits for bonus calculations, as well as provisions for statutory liabilities regarding bonus payments. Additionally, it addresses the roles and responsibilities of employers, the conditions for claims, and the applicable parties under the law.

![8

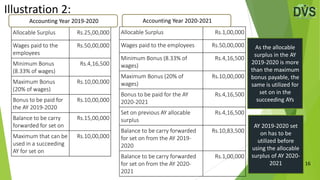

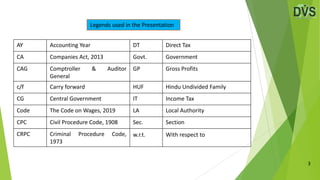

Illustration 1:

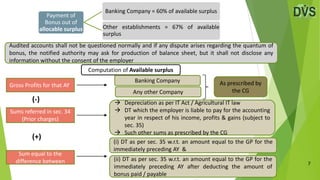

a GP for AY 2019-2020 Rs.20,00,000

b Bonus paid for AY 2019-

2020

Rs.1,10,000

c GP for AY 2020-2021 Rs.25,00,000

d Sums referred in sec. 34 Rs.3,50,000

e DT as per sec. 35 (a *

25%) (assume the

company’s turnover is

less than Rs. 400 Crore

during the previous year

2017-18)

Rs.5,00,000

f DT on GP – bonus paid

( [a – b] * 25% )

Rs.4,72,500

g Difference (e – f) Rs.27,500

(i)

(ii)

(iii)

(i) – (ii) + (iii) = Rs.21,77,500 Available Surplus

Allocable surplus:

Banking Company = 60% of

Rs.21,77,500 = Rs.13,06,500

Other establishments = 67% of

Rs.21,77,500 = Rs.14,58,925

Allocable Surplus forms part of

Available Surplus

Allocable Surplus < Available

Surplus

ABC Company Limited / Bank Limited](https://image.slidesharecdn.com/thecodeonwages2019-partiii-210121120324/85/The-Code-on-Wages-2019-Part-III-8-320.jpg)