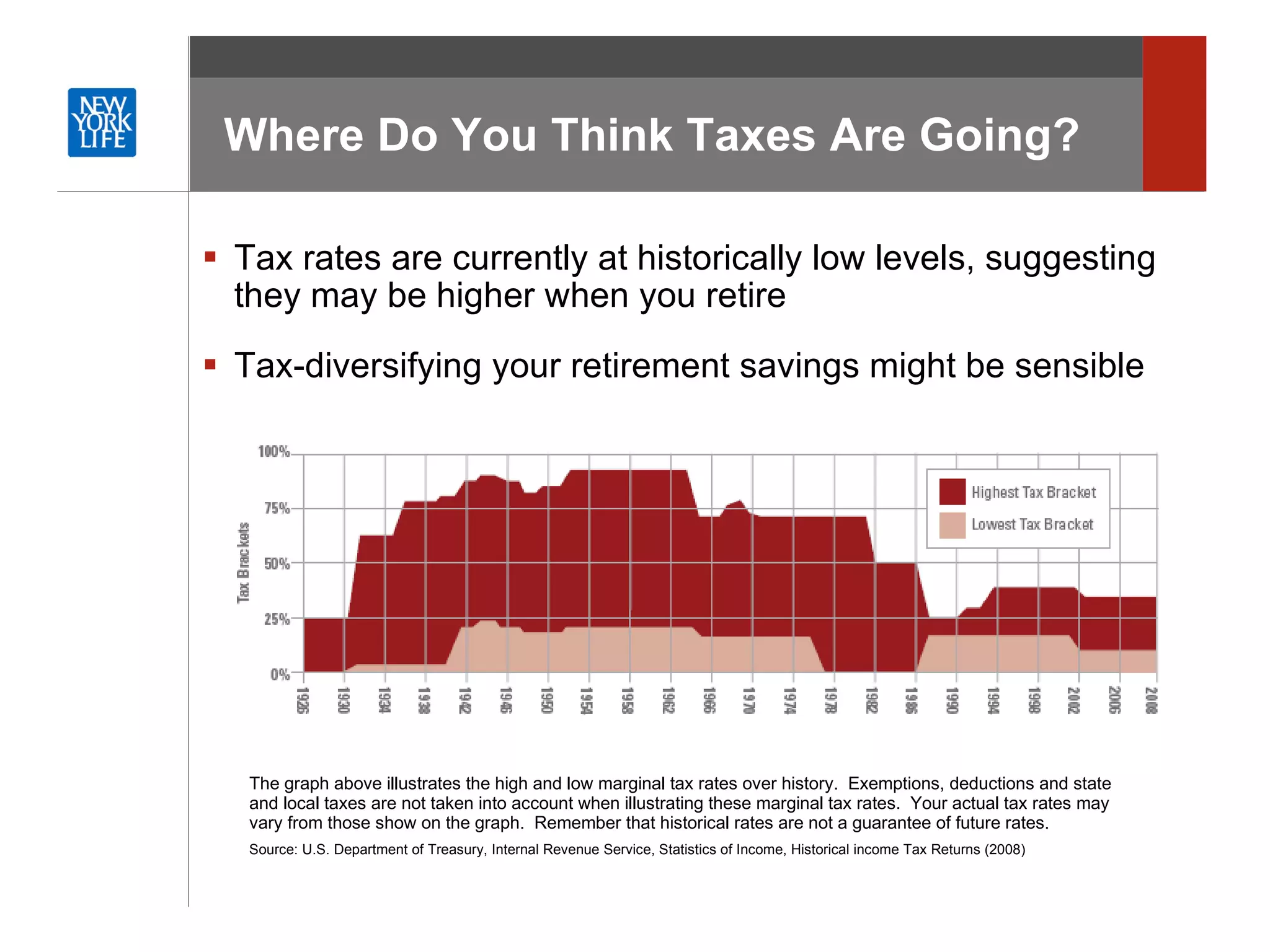

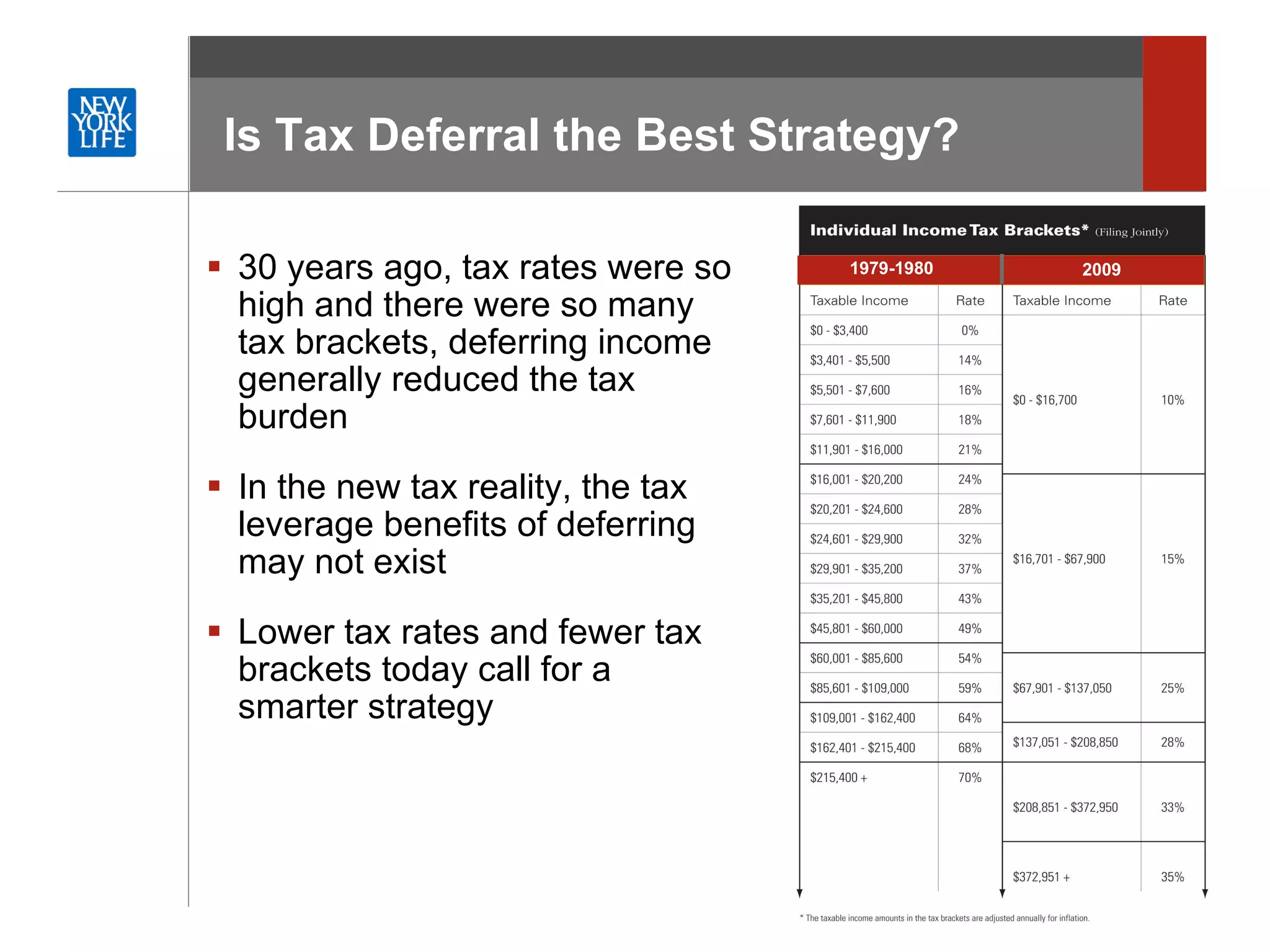

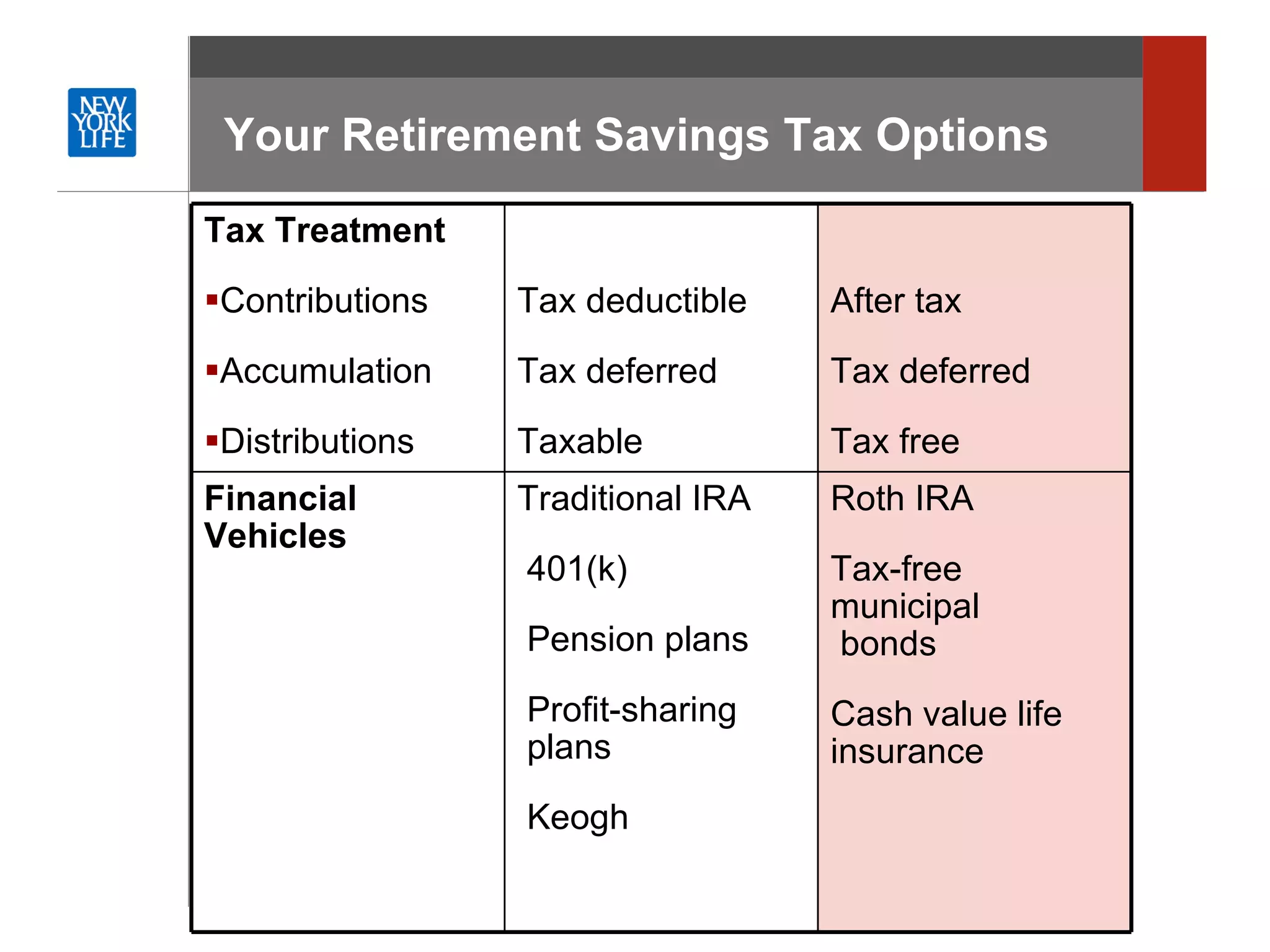

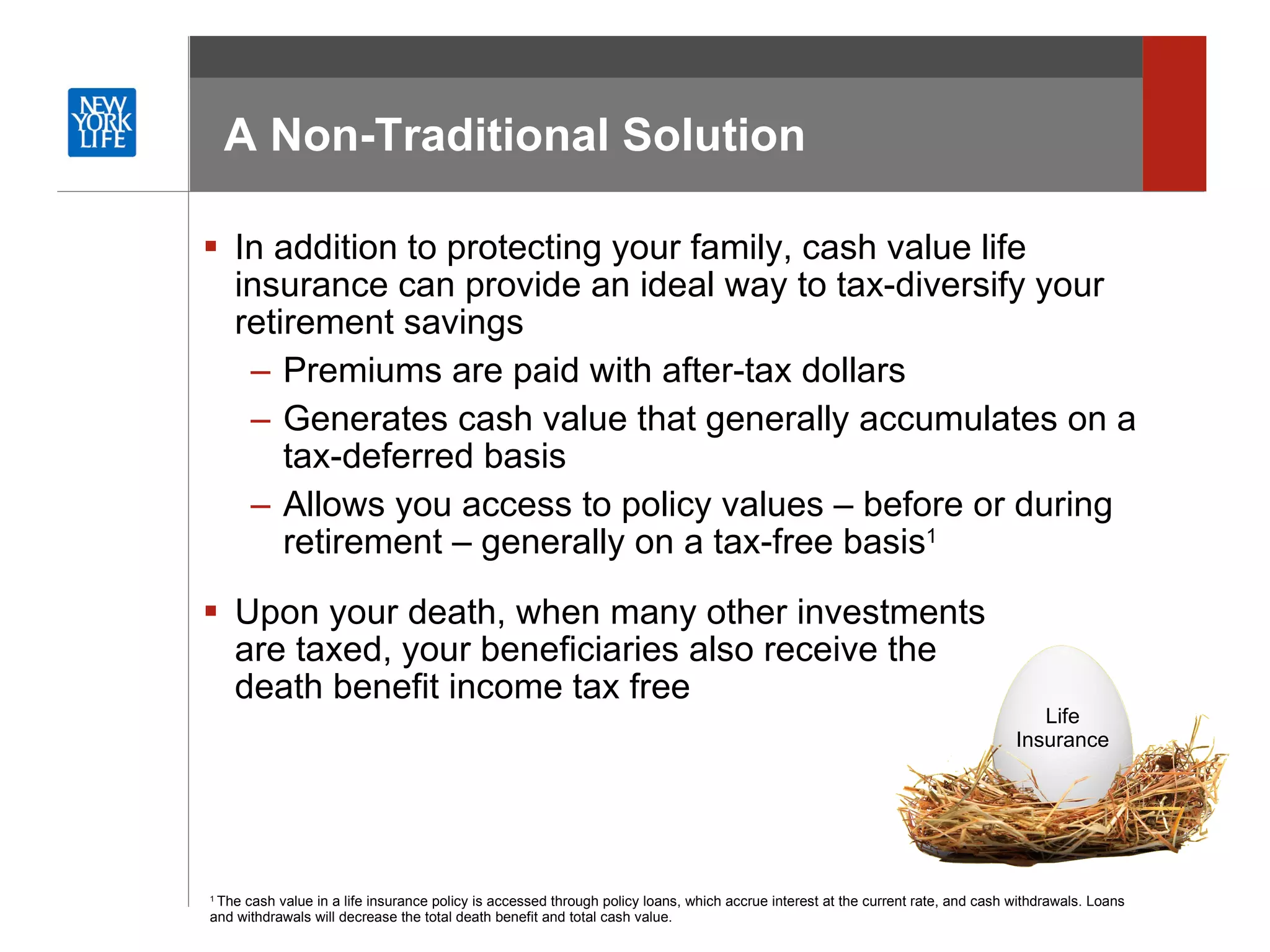

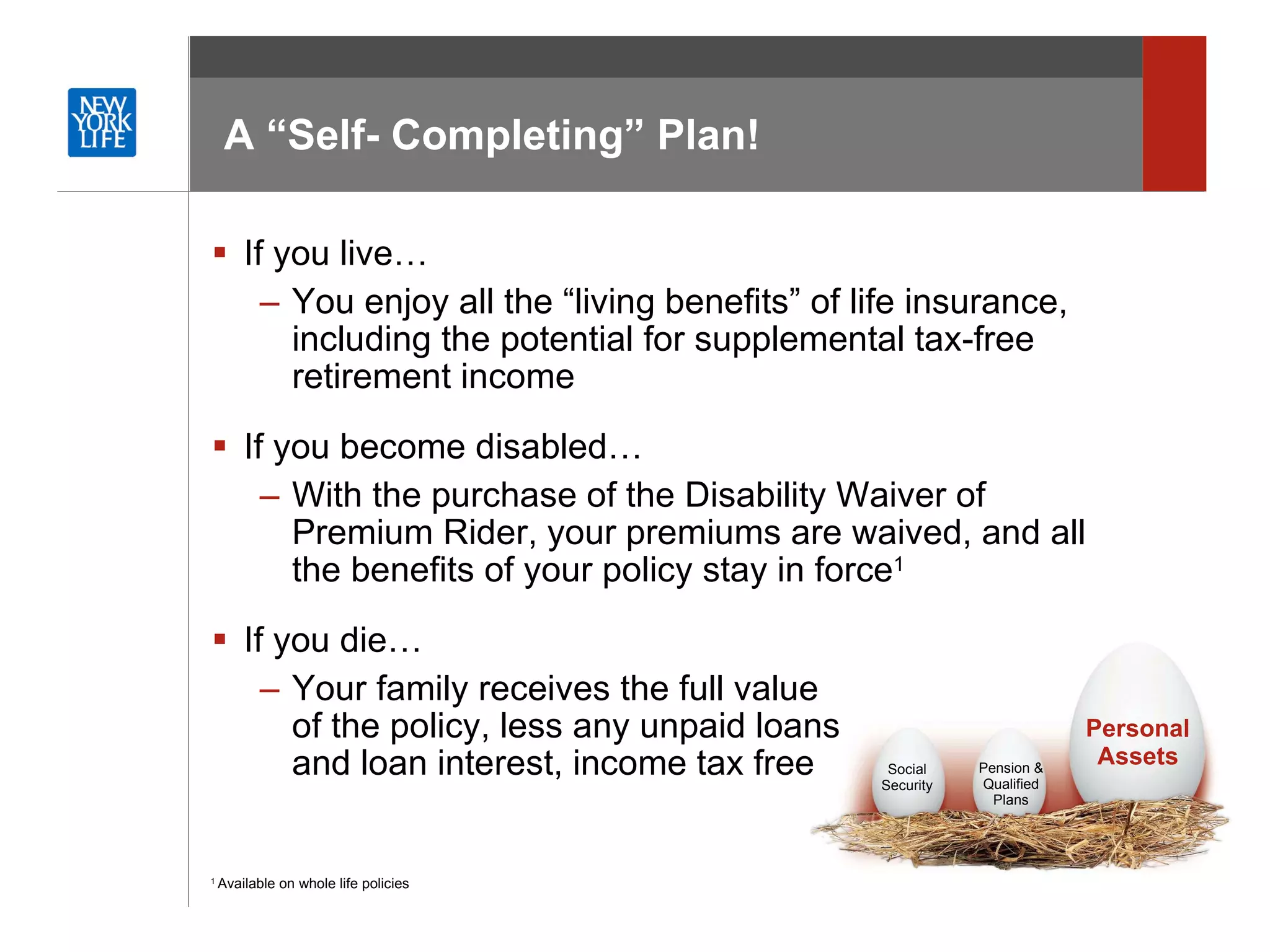

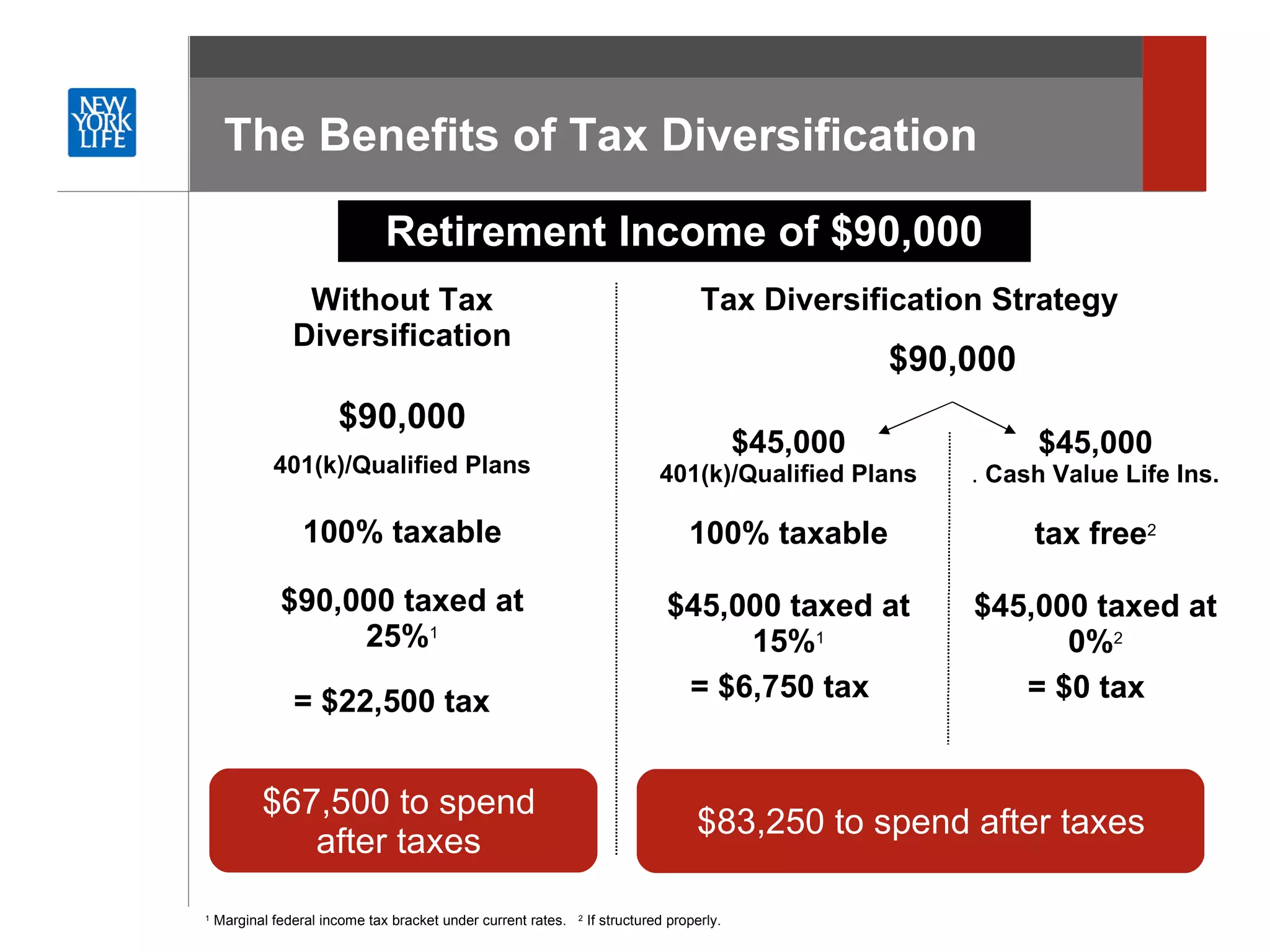

The document discusses strategies for tax diversifying retirement income. It notes that retirement can last longer now while key income sources have been reduced. It recommends placing retirement savings in a variety of tax-advantaged vehicles like Roth IRAs, municipal bonds, cash value life insurance, and traditional IRAs to reduce taxes during accumulation and withdrawal. Cash value life insurance in particular allows tax-free access to policy values before or during retirement.