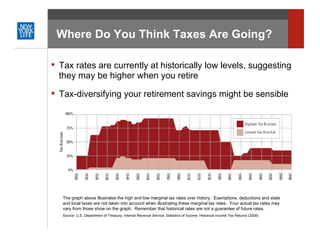

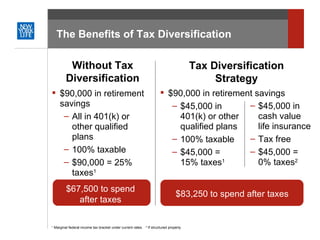

The document discusses tax diversifying retirement income through various financial vehicles like traditional IRAs, 401(k)s, pensions, profit sharing plans, Keoghs, and Roth IRAs. It notes that while a "tax-perfect" retirement plan does not exist, strategies like using cash value life insurance can provide tax-deferred accumulation and tax-free distributions to better diversify retirement savings from a tax perspective. The summary highlights how tax diversification can potentially increase the amount of money available to spend in retirement.