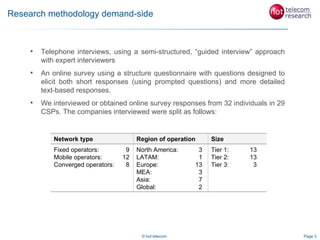

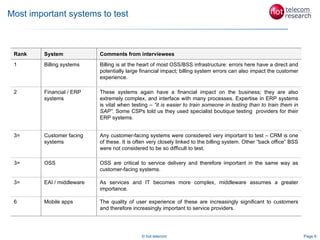

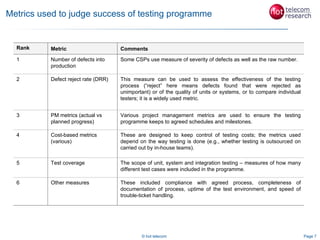

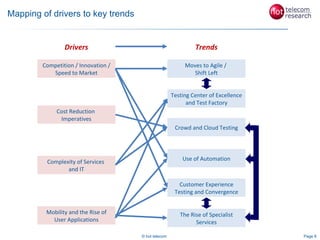

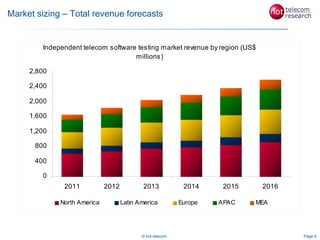

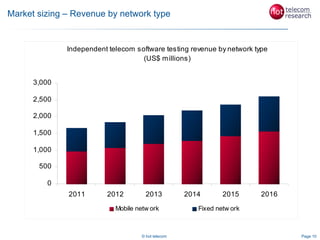

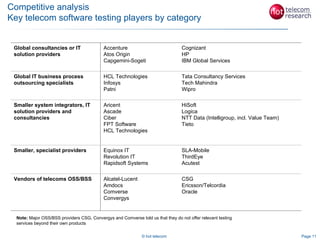

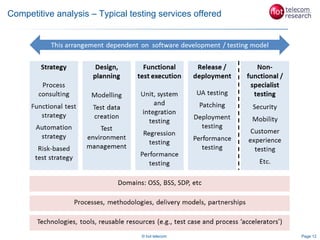

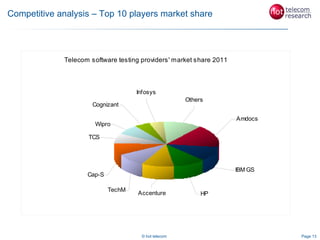

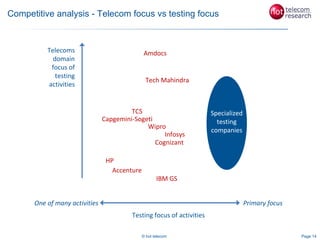

The document presents a market analysis of software testing services for Communication Service Providers (CSPs), detailing research methodologies that include interviews and surveys with industry experts and software testing providers. Key findings highlight the importance of testing billing systems, ERP systems, and customer-facing systems, along with metrics used to assess testing success. The analysis also includes market sizing forecasts and competitive dynamics among key players in the telecom software testing sector.