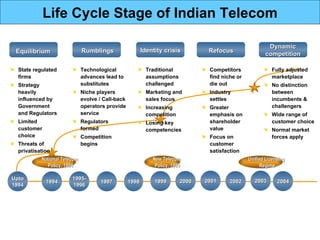

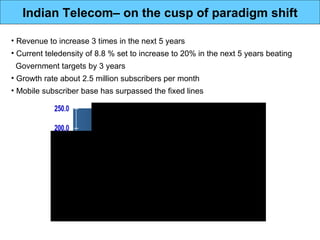

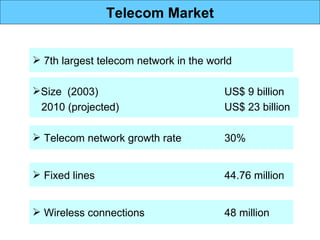

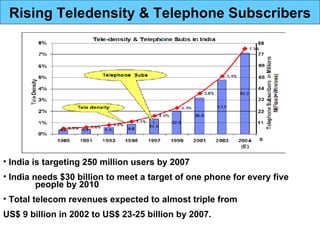

The telecom sector in India has undergone significant changes over the past two decades. In the 1990s, the sector moved from a state-regulated monopoly to increased privatization and competition under new policies. This has led to technological advances, increased customer choice, and a shift to market forces. India now has the 7th largest telecom network in the world, with rapid subscriber growth expected to continue. The mobile market in particular is booming, with over 1.5 million new wireless subscribers added each month. Major players like Bharti Airtel have significant market share but also face threats from new entrants and technology changes. The telecom sector is projected to almost triple in revenue by 2007 as India's teledensity increases