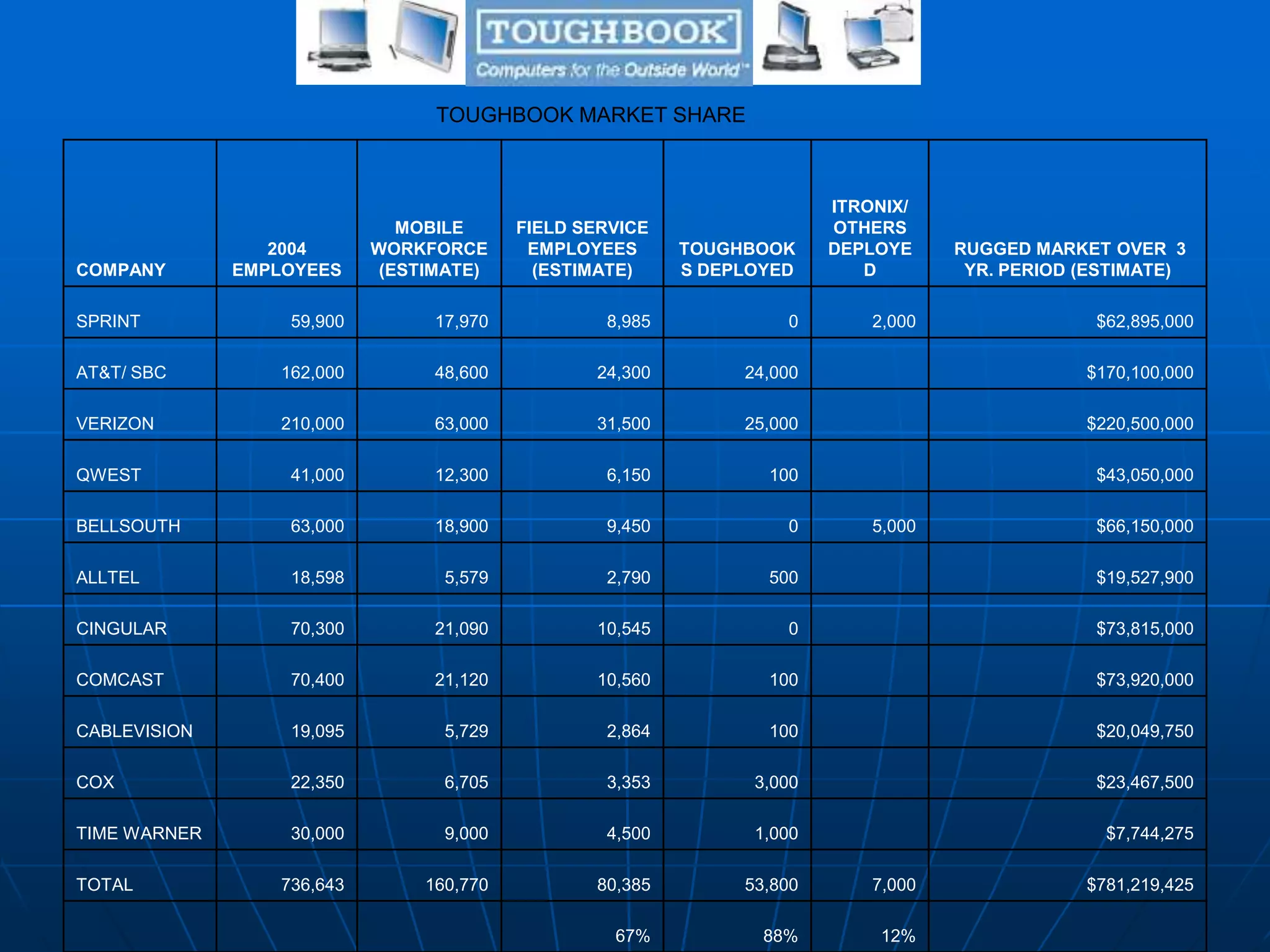

This document provides an overview and action plan for Panasonic's Workforce Automation Team to target the telecommunications vertical market with mobility and field force automation solutions using Panasonic Toughbook laptops. It identifies top telecom companies and their estimated mobile workforces as potential customers. It outlines strategies such as developing reseller partnerships, generating leads from trade shows and campaigns, and providing ROI tools and introductory trials to help capture business from competitors in this growing market.

![WHY TOUGHBOOK & MOBILITY?

• Among large mobility vendors such as Panasonic, which sells its Toughbook laptop line to

mobile field forces, sales have doubled between 2002 and 2005, says Mike McMahon,

director of workforce automation at Panasonic Comput-er Solutions. “The number one

reason [for the sales boom] is the advance of mobility in the workforce management

space. Five to seven years ago, ROI typically was a three-year payback process [based on

loaded labor rates, i.e., $55 to $95/hour for field service technicians in telecoms]. Now the

ROI payback has shrunk to three to five months because the [computer] hardware,

software and wireless technologies have become much more dependable and mission

critical,” McMahon believes.

• Field forces demonstrate a pent-up need for mobile data, according to a 2005 study by the

Aberdeen Group. Such applications as on-demand access to work order details and

scheduling, locating and identifying spare parts and warranties, and quickly obtaining

customer histories are main areas for growth. In 2004, no more than 30 percent of the

companies Aberdeen surveyed could provide real-time data access to their field forces in

any individual data category, while at least half the companies indicated they required it.

- Mobile Enterprise Magazine - May 2006](https://image.slidesharecdn.com/telecompresentation-140417152515-phpapp02/75/Telecom-Market-Presentation-14-2048.jpg)