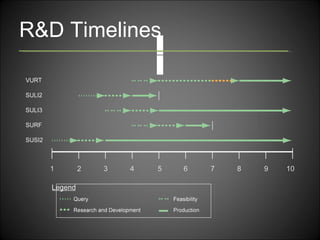

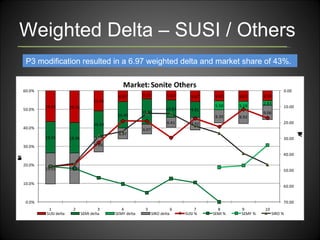

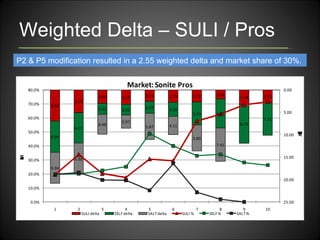

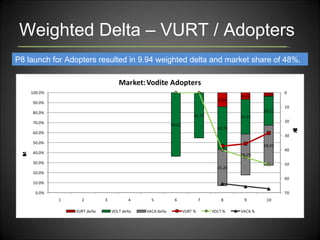

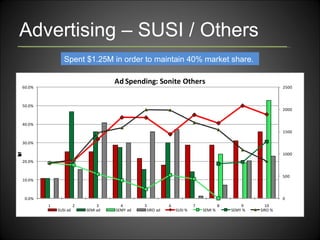

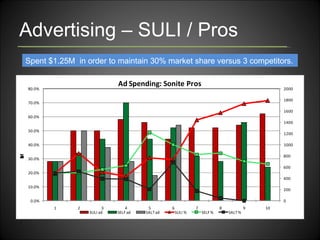

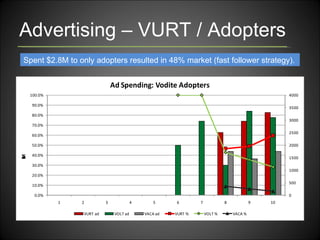

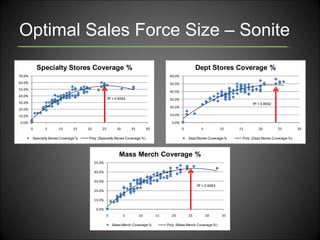

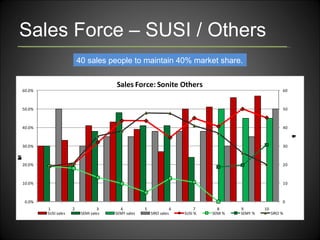

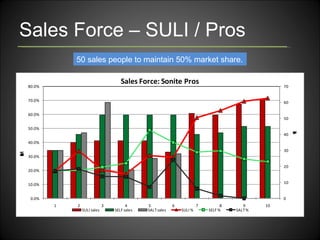

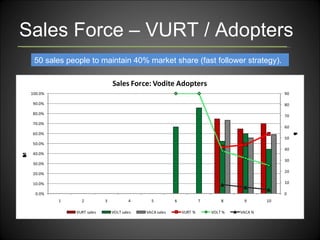

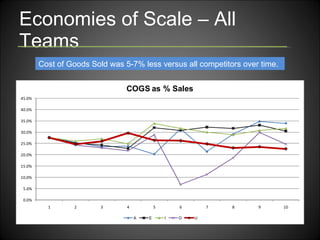

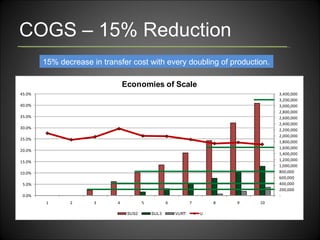

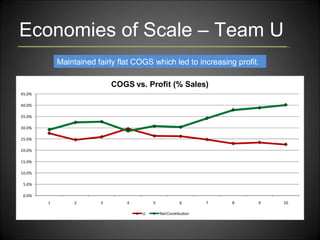

The team achieved the highest cumulative net contribution of $661,056 by focusing on three target segments. They dominated the Others (45%), Pros (72%), and Adopters (60%) segments through tailored R&D timelines and modifications. Economies of scale helped maintain flat costs of goods sold around 15% and increased profits over time.