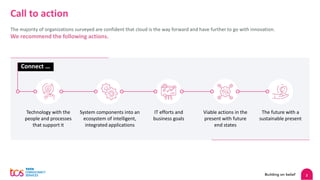

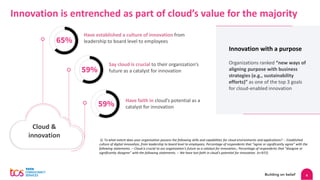

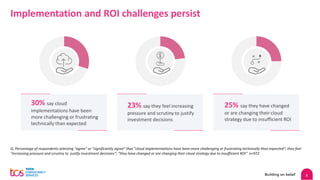

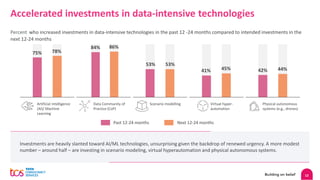

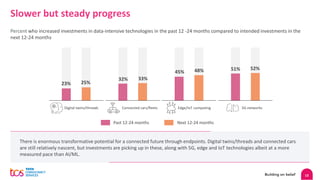

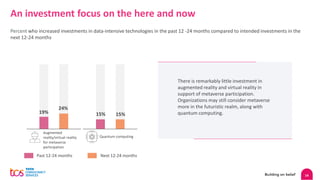

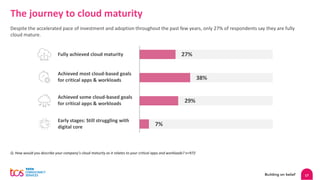

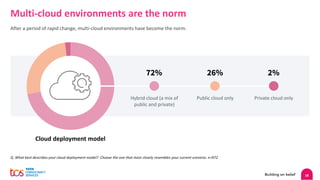

The June 2023 TCS Global Cloud Study indicates that organizations are increasingly confident in cloud technology as a catalyst for innovation, with 65% considering it crucial for their future. Despite challenges such as implementation difficulties and ROI concerns, 70% view cloud as a long-term investment, and organizations are progressing toward digital ecosystem maturity. Additionally, the study highlights that while investments in data-intensive technologies are increasing, many organizations are still evolving their cloud strategies and governance capabilities.