Embed presentation

Download to read offline

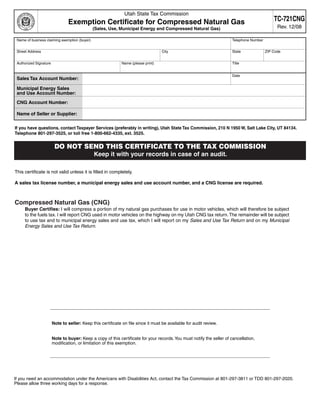

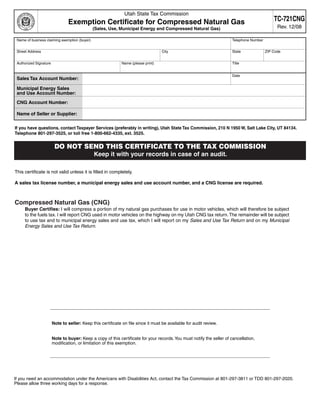

This document is an exemption certificate from the Utah State Tax Commission for compressed natural gas (CNG). It certifies that the buyer will pay fuels tax on the portion of natural gas purchases that are compressed for use in motor vehicles. The remainder will be subject to use tax and municipal energy sales tax, which the buyer will report on tax returns. The certificate provides spaces for the buyer's contact information and signature to validate the exemption. It instructs sellers to keep the certificate on file for audit review and buyers to keep a copy for their records.